Additional Proxy Soliciting Materials (definitive) (defa14a)

30 März 2023 - 11:29PM

Edgar (US Regulatory)

____________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

____________________________________________________________________________

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

| | | | | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

☐ | Definitive Proxy Statement |

| | | | | |

☒ | Definitive Additional Materials |

| | | | | |

☐ | Soliciting Material Pursuant to §240.14a-12 |

A10 NETWORKS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

☐ | Fee paid previously with preliminary materials. |

| | | | | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SUPPLEMENT TO PROXY STATEMENT DATED MARCH 1, 2023

FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 26, 2023

This supplement (this “Supplement”) supplements the definitive proxy statement filed by A10 Networks, Inc. (“we” or the “Company”) with the U.S. Securities and Exchange Commission (“SEC”) on March 15, 2023 (the “2023 Proxy Statement”) and made available to the Company’s stockholders in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”) for use at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”), on Wednesday, April 26, 2023 at 10:00 a.m. Pacific Time, at 2300 Orchard Parkway, San Jose, California 95131 (the “Annual Meeting”). This Supplement is being filed with the SEC and made available to stockholders on or about March 30, 2023.

This Supplement updates the disclosure in the 2023 Proxy Statement in the section titled “Proposal 4. Approval of the A10 Networks, Inc. 2023 Stock Incentive Plan––Grant Practices and Key Data” with the following:

Overhang is a commonly used measure to assess the dilutive impact of equity programs such as the A10 Networks, Inc. 2023 Stock Incentive Plan (the “2023 Plan”). Overhang shows how much existing shareholder ownership would be diluted if all outstanding equity-based awards plus all remaining shares available for equity-based awards were introduced into the market. Overhang is equal to the number of equity-award shares currently outstanding plus the number of equity-award shares available to be granted, divided by the total diluted shares of common stock outstanding at the end of the year. The table below provides updated overhang data as of March 29, 2023:

| | | | | |

| (a) New shares proposed under the 2023 Plan | 5,600,000 |

(b) Shares underlying outstanding awards(1) | 3,475,099 |

(c) Shares remaining available under the 2014 Plan(2) | 8,905,713 |

| (d) Total shares authorized for or outstanding under awards (a+b) | 9,075,099 |

| (e) Total shares outstanding | 74,096,407 |

| (f) Overhang (d/e) | 12.25% |

| |

| (1) Of such shares, 110,438 are option awards with a weighted average exercise price of $4.39 and an average remaining term of 1.73 years. This (i) does not include 90,568 shares underlying options outstanding under our 2008 Stock Plan, which will not recycle to the 2023 Plan and (ii) includes an aggregate of 877,794 shares subject to performance contingent awards, of which 368,407 have been earned and remain subject to time-based vesting and 509,377 of which have not yet been earned. |

| (2) Does not include 1,111,702 shares reserved under the Employee Stock Purchase Plan. These shares will not roll over to 2023 Plan. No new awards will be available for issuance under the 2014 Plan once the 2023 Plan becomes effective. |

We have not and do not intend to issue any additional equity under the A10 Networks, Inc. 2014 Equity Incentive Plan (the “2014 Plan”) between March 29, 2023 and the Annual Meeting. To the degree any awards are granted under the 2014 Plan between March 29, 2023 and the Annual Meeting, we will correspondingly reduce the share reserve under the proposed the 2023 Plan. If the 2023 Plan is approved at the Annual Meeting, no additional shares will be issuable under the 2014 Plan.

Except as described in this Supplement, none of the items or information presented in the 2023 Proxy Statement is affected by this Supplement. This Supplement does not change the proposals to be acted upon at the Annual Meeting, which are described in the 2023 Proxy Statement. This Supplement does not provide all of the information that is important to your voting decisions at the Annual Meeting, and the 2023 Proxy Statement contains other important additional information. This Supplement should be read in conjunction with the 2023 Proxy Statement.

If you have already returned your proxy or voting instruction card or provided voting instructions, you do not need to take any action unless you wish to change your vote. If you desire to change or revoke your vote, you may do so

by (1) giving written notice of revocation to the Secretary of A10 Networks, Inc. in writing at the address listed above anytime time before the Annual Meeting; (2) voting again by telephone or over the Internet prior to 11:59 p.m. Eastern Time on April 25, 2023; (3) submitting a later-dated vote or another properly executed proxy of a later date prior to the Annual Meeting or (4) completing a written ballot at the Annual Meeting. For those stockholders who submit a proxy by telephone or the Internet, the date on which the proxy is submitted in accordance with the instructions listed on the proxy card is deemed to be the date of the proxy. Any written notice of revocation or subsequent proxy should be sent to our Secretary at A10 Networks, Inc., 2300 Orchard Parkway, San Jose, California 95131.

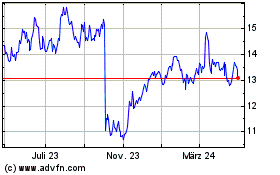

A10 Networks (NYSE:ATEN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

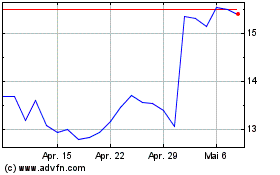

A10 Networks (NYSE:ATEN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024