Product revenue growth of 13% and security-led

solutions continue to drive growth; Company re-affirms full-year

outlook, raises dividend and announces new $50 million buyback

A10 Networks (NYSE: ATEN), a leading provider of cybersecurity

and infrastructure solutions, today announced financial results for

its third quarter and nine-month period ended September 30,

2022.

Third Quarter 2022 Financial

Summary

- Revenue of $72.1 million, up 10.2% year-over-year.

- Revenue growth was broad-based, with increases in North

America, APJ, EMEA and Latin America, and from both Enterprise and

Service Provider customers. Enterprise sales grew 17%, and Service

Provider sales grew 6%, demonstrating strong revenue

diversification.

- GAAP gross margin of 79.5%; non-GAAP gross margin of 80.2% as a

result of better product mix and continued successful navigation of

short-term input cost pressures.

- GAAP net income of $12.1 million, or $0.16 per diluted share,

compared with GAAP net income (inclusive of a non-recurring $65.4

million income tax benefit related to sustained profitability) of

$74.9 million, or $0.94 per diluted share in the third quarter of

2021.

- Non-GAAP net income of $15.9 million, or $0.20 per diluted

share, compared with non-GAAP net income of $13.7 million, or $0.17

per diluted share in the third quarter of 2021.

- Adjusted EBITDA of $21.3 million, representing 29.5% of

revenue, in line with stated business model goals.

- A10 repurchased approximately 3.7 million shares during the

quarter at an average price of $12.77 for a total of $47.5 million

and issued $3.8 million in cash dividends.

- The Board of Directors approved a 20% increase in its quarterly

cash dividend to $0.06 per share, payable on December 1, 2022 to

stockholders of record at the close of business on November 15,

2022.

A reconciliation between GAAP and non-GAAP information is

contained in the financial statements below.

“A10 is consistently achieving revenue and EPS targets despite a

variety of macro headwinds in all regions,” said Dhrupad Trivedi,

President and Chief Executive Officer of A10 Networks. “This

demonstrates robust demand for our proprietary security-led

solutions, disciplined execution, and a focus on diversification

that drives sustainability. We have positioned our business to

avoid concentration in any single geography, any specific customer

type, or any isolated product offering, and this diversification

enables consistent execution despite economic, supply chain, and

geopolitical challenges. Customer-centric technical innovation,

global commercial execution and focus on driving the business model

are bolstering our sustainability and driving continued

success.”

“From a profitability standpoint, we maintained gross margins of

approximately 80%, and we delivered record non-GAAP operating

income and EBITDA margin, reflecting strong execution and an

ability to navigate supply chain challenges and input cost

pressures,” added Mr. Trivedi. “This performance enabled us to

repurchase more than $47.5 million of our stock, in both negotiated

and open-market transactions, materially reducing our

capitalization. Additionally, ongoing strength in our business

positioned us to increase the quarterly dividend by 20% and

authorize a new $50 million stock repurchase plan. Simultaneously,

we are strategically investing in technology, furthering our

ability to capture market share and reinforcing our differentiators

and driving durability for our business model despite macroeconomic

conditions. We again reiterate our full year targets of top line

growth of 10 – 12% and Adjusted EBITDA margins in the range of 26 –

28% of revenue.”

Conference Call

Management will host a call at 1:30 p.m. Pacific time (4:30 p.m.

Eastern time) today, November 1, 2022, to discuss these results.

Interested parties may access the conference call by dialing (833)

927-1758 (toll-free) or (929) 526-1599 and referencing access code:

059416.

A live audio webcast of the conference call will be accessible

from the “Investor Relations” section of A10 Network’s website at

investors.a10networks.com. The webcast will be archived for at

least 90 days. A telephonic replay of the conference call will be

available two hours after the conclusion of the live call and will

run for seven days and may be accessed by dialing (866) 813-9403

(toll-free) or (929) 458-6194 and entering the passcode 030371.

Forward-Looking

Statements

This press release contains “forward-looking statements,”

including statements regarding our anticipated future financial

results, quarterly dividend payments, drivers of growth, demand,

supply chain challenges, positioning, growth and EBITDA

expectations. Forward-looking statements are subject to known and

unknown risks and uncertainties and are based on assumptions that

may prove to be incorrect, which could cause actual results to

differ materially from those expected or implied by the

forward-looking statements. Factors that may cause actual results

to differ include the impact of the COVID-19 pandemic on our

business and the business of our customers; a significant decline

in global macroeconomic or political conditions that have an

adverse impact on our business and financial results; business

interruptions related to our supply chain; our ability to manage

our business and expenses if customers cancel or delay orders;

execution risks related to closing key deals and improving our

execution; the continued market adoption of our products; our

ability to successfully anticipate market needs and opportunities;

our timely development of new products and features; our ability to

achieve or maintain profitability; any loss or delay of expected

purchases by our largest end-customers; our ability to maintain or

improve our competitive position; competitive and execution risks

related to cloud-based computing trends; our ability to attract and

retain new end-customers and our largest end-consumers; our ability

to maintain and enhance our brand and reputation, changes demanded

by our customers in the deployment and payment model for our

products; continued growth in markets relating to network security;

the success of any future acquisitions or investments in

complementary companies, products, services or technologies; the

ability of our sales team to execute well; our ability to shorten

our close cycles; the ability of our channel partners to sell our

products; variations in product mix or geographic locations of our

sales; risks associated with our presence in international markets;

weaknesses or deficiencies in our internal control over financial

reporting; our ability to timely file periodic reports required to

be filed under the Securities Exchange Act of 1934; and other risks

that are described in “Risk Factors” in our periodic filings with

the Securities and Exchange Commission, including our Form 10-K

filed with the Securities and Exchange Commission on March 8, 2022.

We do not intend to update or alter our forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by applicable law.

Non-GAAP Financial

Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), this press release and the accompanying tables and Exhibit

99.2 to our Current Report on Form 8-K filed with the Securities

and Exchange Commission on the date of this release contain certain

non-GAAP financial measures, including non-GAAP net income,

non-GAAP net income per basic and diluted share, non-GAAP gross

profit and gross margin, non-GAAP operating income and operating

margin, non-GAAP operating expenses, and Adjusted EBITDA. Non-GAAP

financial measures do not have any standardized meaning and are

therefore unlikely to be comparable to similarly titled measures

presented by other companies.

A10 Networks considers these non-GAAP financial measures to be

important because they provide useful measures of the operating

performance of the company, exclusive of unusual events or factors

that do not directly affect what we consider to be our core

operating performance and are used by the company's management for

that purpose.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP.

We define non-GAAP net income as our GAAP net income excluding:

(i) stock-based compensation and related payroll tax, (ii)

amortization expense related to acquisition, (iii) global

distribution center transition expense and (iv) release of deferred

tax asset valuation allowance. We define non-GAAP net income per

basic and diluted share as our non-GAAP net income divided by our

basic and diluted weighted-average shares outstanding. We define

non-GAAP gross profit as our GAAP gross profit excluding (i)

stock-based compensation and related payroll tax, and (ii) global

distribution center transition expense. We define non-GAAP gross

margin as our non-GAAP gross profit divided by our GAAP revenue. We

define non-GAAP operating income as our GAAP income from operations

excluding (i) stock-based compensation and related payroll tax,

(ii) amortization expense related to acquisition and (iii) global

distribution center transition expense. We define non-GAAP

operating margin as our non-GAAP operating income divided by our

GAAP revenue. We define non-GAAP operating expenses as our GAAP

operating expenses excluding (i) stock-based compensation and

related payroll tax, (ii) amortization expense related to

acquisition and (iii) global distribution center transition

expense. We define Adjusted EBITDA as our GAAP net income excluding

(i) interest expense (if any), (ii) interest income and other

(income) expense, net, (iii) depreciation and amortization expense,

(iv) benefit from (provision for) income taxes, (v) stock-based

compensation and related payroll tax and (vi) global distribution

center transition expense.

We have included our non-GAAP net income, non-GAAP gross profit

and gross margin, non-GAAP operating income and operating margin,

non-GAAP operating expenses and Adjusted EBITDA in this press

release. Non-GAAP financial measures are presented for supplemental

informational purposes only for understanding the company's

operating results.

About A10 Networks

A10 Networks (NYSE: ATEN) provides secure application services

and solutions for on-premises, multi-cloud and edge-cloud

environments at hyperscale. Our mission is to enable service

providers and enterprises to deliver business-critical applications

that are secure, available and efficient for multi-cloud

transformation and 5G readiness. We deliver better business

outcomes that support investment protection, new business models

and help future-proof infrastructures, empowering our customers to

provide the most secure and available digital experience. Founded

in 2004, A10 Networks is based in San Jose, Calif. and serves

customers globally. For more information, visit

https://www.a10networks.com/ and follow us @A10Networks.

The A10 logo and A10 Networks are trademarks or registered

trademarks of A10 Networks, Inc. in the United States and other

countries. All other trademarks are the property of their

respective owners.

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited, in thousands,

except per share amounts, on a GAAP Basis)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

Revenue:

Products

$

45,104

$

39,815

$

123,624

$

104,718

Services

26,955

25,545

79,080

74,653

Total revenue

72,059

65,360

202,704

179,371

Cost of revenue:

Products

10,191

7,859

28,342

23,160

Services

4,574

5,335

12,747

16,163

Total cost of revenue

14,765

13,194

41,089

39,323

Gross profit

57,294

52,166

161,615

140,048

Operating expenses:

Sales and marketing

21,605

21,354

66,159

60,195

Research and development

14,360

13,578

41,483

41,050

General and administrative

5,661

6,931

17,160

17,260

Total operating expenses

41,626

41,863

124,802

118,505

Income from operations

15,668

10,303

36,813

21,543

Non-operating income (expense), net:

Interest income

432

66

736

306

Other income (expense), net

(871

)

(264

)

(1,204

)

(1,799

)

Non-operating income (expense), net

(439

)

(198

)

(468

)

(1,493

)

Income before provision for (benefit from)

income taxes

15,229

10,105

36,345

20,050

Provision for (benefit from) income

taxes

3,116

(64,781

)

7,467

(64,109

)

Net income

$

12,113

$

74,886

$

28,878

$

84,159

Net income per share:

Basic

$

0.16

$

0.97

$

0.38

$

1.09

Diluted

$

0.16

$

0.94

$

0.37

$

1.05

Weighted-average shares used in computing

net income per share:

Basic

75,881

77,149

76,191

76,885

Diluted

77,679

79,927

78,454

79,803

A10 NETWORKS, INC.

RECONCILIATION OF GAAP NET

INCOME TO NON-GAAP NET INCOME

(unaudited, in thousands,

except per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

GAAP net income

$

12,113

$

74,886

$

28,878

$

84,159

Non-GAAP items:

Stock-based compensation and related

payroll tax

3,798

4,201

10,423

11,433

Amortization expense related to

acquisition

—

—

—

505

Global distribution center transition

expense

—

(1

)

—

2,946

Release of deferred tax asset valuation

allowance

—

(65,417

)

—

(65,417

)

Total non-GAAP items

3,798

(61,217

)

10,423

(50,533

)

Non-GAAP net income

15,911

13,669

39,301

33,626

Income tax effect of non-GAAP items

(1)

(2,831

)

(2,952

)

(5,876

)

(5,876

)

Non-GAAP net income, as adjusted for

income tax effect of non-GAAP items (2)

$

13,080

$

10,717

$

33,425

$

27,750

GAAP net income per share:

Basic

$

0.16

$

0.97

$

0.38

$

1.09

Diluted

$

0.16

$

0.94

$

0.37

$

1.05

Non-GAAP items:

Stock-based compensation and related

payroll tax

0.04

0.05

0.13

0.14

Amortization expense related to

acquisition

—

—

—

0.01

Global distribution center transition

expense

—

—

—

0.04

Release of deferred tax asset valuation

allowance

—

(0.82

)

—

(0.82

)

Total non-GAAP items

0.04

(0.77

)

0.13

(0.63

)

Non-GAAP net income

0.20

0.17

0.50

0.42

Income tax effect of non-GAAP items

(1)

(0.03

)

(0.04

)

(0.07

)

(0.07

)

Non-GAAP net income per share, as adjusted

for income tax effect of non-GAAP items: (2)

Basic

$

0.17

$

0.14

$

0.44

$

0.36

Diluted

$

0.17

$

0.13

$

0.43

$

0.35

Weighted average shares used in computing

net income per share:

Basic

75,881

77,149

76,191

76,885

Diluted

77,679

79,927

78,454

79,803

(1)

For the three and nine months ended September 30, 2022 this

represents the tax impact using estimated tax rates of 17.8% and

15.0%, respectively. For the three and nine months ended September

30, 2021 this represents the tax impact using estimated tax rates

of 21.6% and 17.5%, respectively.

(2)

Net income and earnings per share excluding adjustments are

non-GAAP financial measures presented as supplemental financial

measures to enable a user of the financial information to

understand the impact of these adjustments on reported results.

These financial measures should not be considered an alternative to

net income, operating income, cash flows provided by operating

activities, or any other measure of financial performance or

liquidity presented in accordance with U.S. GAAP. Our adjusted net

income and earnings per share may not be comparable to similarly

titled measures of another company because all companies may not

calculate adjusted net income and earnings per share in the same

manner.

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited, in thousands,

except par value, on a GAAP Basis)

September 30,

2022

December 31,

2021

ASSETS

Current assets:

Cash and cash equivalents

$

32,131

$

78,925

Marketable securities

95,642

106,117

Accounts receivable, net of allowances of

$319 and $543, respectively

73,500

61,795

Inventory

21,289

22,462

Prepaid expenses and other current

assets

15,023

14,720

Total current assets

237,585

284,019

Property and equipment, net

17,958

10,692

Goodwill

1,307

1,307

Deferred tax assets, net

65,557

65,773

Other non-current assets

30,254

31,294

Total assets

$

352,661

$

393,085

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

6,045

$

6,852

Accrued liabilities

41,472

36,101

Deferred revenue

74,762

73,132

Total current liabilities

122,279

116,085

Deferred revenue, non-current

51,405

48,499

Other non-current liabilities

18,243

19,613

Total liabilities

191,927

184,197

Stockholders' equity:

Common stock, $0.00001 par value: 500,000

shares authorized; 86,790 and 84,717 shares issued and 73,406 and

77,423 shares outstanding, respectively

1

1

Treasury stock, at cost: 13,384 and 7,294

shares, respectively

(134,934

)

(55,677

)

Additional paid-in-capital

460,884

446,035

Dividends paid

(15,392

)

(3,880

)

Accumulated other comprehensive income

(1,341

)

(229

)

Accumulated deficit

(148,484

)

(177,362

)

Total stockholders' equity

160,734

208,888

Total liabilities and stockholders'

equity

$

352,661

$

393,085

A10 NETWORKS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited, in thousands, on a

GAAP Basis)

Nine Months Ended September

30,

2022

2021

Cash flows from operating activities:

Net income

$

28,878

$

84,159

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

5,539

7,044

Stock-based compensation

9,818

10,848

Release of deferred tax asset valuation

allowance

—

(65,417

)

Other non-cash items

49

786

Changes in operating assets and

liabilities:

Accounts receivable

(11,090

)

4,418

Inventory

530

1,438

Prepaid expenses and other assets

(2,574

)

1,905

Accounts payable

(914

)

(1,086

)

Accrued liabilities

4,001

(11,309

)

Deferred revenue

4,536

8,417

Net cash provided by operating

activities

38,773

41,203

Cash flows from investing activities:

Proceeds from sales of marketable

securities

6,252

5,865

Proceeds from maturities of marketable

securities

48,248

70,870

Purchases of marketable securities

(45,699

)

(104,732

)

Purchases of property and equipment

(8,261

)

(3,387

)

Net cash provided by (used in) investing

activities

540

(31,384

)

Cash flows from financing activities:

Proceeds from issuance of common stock

under employee equity incentive plans

4,662

3,750

Repurchase of common stock

(79,257

)

(11,213

)

Payments for dividends

(11,512

)

—

Net cash used in financing activities

(86,107

)

(7,463

)

Net increase (decrease) in cash and cash

equivalents

(46,794

)

2,356

Cash and cash equivalents—beginning of

period

78,925

83,281

Cash and cash equivalents—end of

period

$

32,131

$

85,637

Non-cash investing and financing

activities:

Transfers between inventory and property

and equipment

$

642

$

122

Purchases of property and equipment

included in accounts payable

$

108

$

9

A10 NETWORKS, INC.

RECONCILIATION OF GAAP GROSS

PROFIT TO NON-GAAP GROSS PROFIT

(unaudited, in thousands,

except percentages)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

GAAP gross profit

$

57,294

$

52,166

$

161,615

$

140,048

GAAP gross margin

79.5

%

79.8

%

79.7

%

78.1

%

Non-GAAP adjustments:

Stock-based compensation and related

payroll tax

489

391

1,248

1,335

Global distribution center transition

expense

—

13

—

538

Non-GAAP gross profit

$

57,783

$

52,570

$

162,863

$

141,921

Non-GAAP gross margin

80.2

%

80.4

%

80.3

%

79.1

%

A10 NETWORKS, INC.

RECONCILIATION OF GAAP TOTAL

OPERATING EXPENSES

TO NON-GAAP TOTAL OPERATING

EXPENSES

(unaudited, in

thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

GAAP total operating expenses

$

41,626

$

41,863

$

124,802

$

118,505

Non-GAAP adjustments:

Stock-based compensation and related

payroll tax

(3,309

)

(3,810

)

(9,175

)

(10,098

)

Amortization expense related to

acquisition

—

—

—

(505

)

Global distribution center transition

expense

—

14

—

(2,408

)

Non-GAAP total operating expenses

$

38,317

$

38,067

$

115,627

$

105,494

A10 NETWORKS, INC.

RECONCILIATION OF GAAP INCOME

FROM OPERATIONS

TO NON-GAAP OPERATING

INCOME

(unaudited, in thousands,

except percentages)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

GAAP income from operations

$

15,668

$

10,303

$

36,813

$

21,543

GAAP operating margin

21.7

%

15.8

%

18.2

%

12.0

%

Non-GAAP adjustments:

Stock-based compensation and related

payroll tax

3,798

4,201

10,423

11,433

Amortization expense related to

acquisition

—

—

—

505

Global distribution center transition

expense

—

(1

)

—

2,946

Non-GAAP operating income

$

19,466

$

14,503

$

47,236

$

36,427

Non-GAAP operating margin

27.0

%

22.2

%

23.3

%

20.3

%

A10 NETWORKS, INC.

RECONCILIATION OF GAAP NET

INCOME TO

EBITDA AND ADJUSTED EBITDA

(NON-GAAP)

(unaudited, in

thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

GAAP net income

$

12,113

$

74,886

$

28,878

$

84,159

GAAP net income margin

16.8

%

114.6

%

14.2

%

46.9

%

Exclude: Interest and other (income)

expense, net

439

198

468

1,493

Exclude: Depreciation and amortization

1,827

2,291

5,539

7,044

Exclude: Provision for income taxes

3,116

(64,781

)

7,467

(64,109

)

EBITDA

17,495

12,594

42,352

28,587

Exclude: Stock-based compensation and

related payroll tax

3,798

4,201

10,423

11,433

Exclude: Global distribution center

transition expense

—

(1

)

—

2,946

Adjusted EBITDA

$

21,293

$

16,794

$

52,775

$

42,966

Adjusted EBITDA margin

29.5

%

25.7

%

26.0

%

24.0

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221101006126/en/

Investor Contact: Rob Fink / Tom Baumann FNK IR

646.809.4048 / 646.349.6641 aten@fnkir.com

Brian Becker Chief Financial Officer

investors@a10networks.com

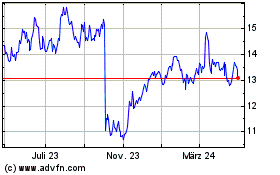

A10 Networks (NYSE:ATEN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

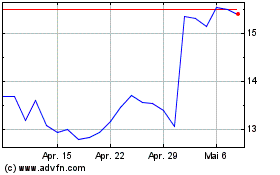

A10 Networks (NYSE:ATEN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024