UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of October 2023

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

São Paulo, October 30, 2023

– Assaí Atacadista announces its results for the 3rd quarter of 2023. All comments on adjusted EBITDA exclude

other operating expenses and income in the periods. Figures also include the effects of IFRS 16/CPC 06 (R2) – Leases, which eliminates

the distinction between operating and financial leases, except where stated otherwise.

|

ASSAÍ REGISTERS HIGHEST

PENETRATION IN BRAZILIAN HOMES, NOW PRESENT IN 1 IN EVERY 4 HOUSEHOLDS (1)

IN LESS THAN A YEAR, CONVERSIONS

DELIVERED SALES UPLIFT OF OVER 2.7x AND EBITDA MARGIN (POST-IFRS16) IN LINE WITH COMPANY’S AVERAGE, REFLECTING ITS UNIQUE VALUE

PROPOSITION |

We proved the strength of our brand during

one more quarter. According to a NielsenIQ Homescan survey, we are the most widely present food chain in Brazilian homes: 1 in 4 households

shop at Assaí. Our customers’ preference was also confirmed by the Marcas Mais Study published by Estadão newspaper,

in which we were elected the most admired Cash and Carry player in Brazil.

Our unique model continues to reap successes:

in the quarter, we registered sales growth of over 20% and relevant gains in market share. Despite the context of high investments, the

Company’s operating cash generation totaled R$ 9.4bn since 2021, which reflects the quality of our expansion and the rapid maturation

of converted stores – one of the biggest projects in the history of Brazilian retail. We have reached the final phase of the project:

90% of the converted stores are already operational, with sales uplift and margin evolution.

The Company continues to seek a prominent position

in the cash and carry segment, reaching R$ 70bn of sales in the last 12 months. Given the intense cycle of investments related to the

conversions project nearing completion, and with the maturation of new stores, we should move forward with our deleveraging process. Thank

you for being with us!

Belmiro Gomes, CEO of

Assaí

SALES GROW 23%, DRIVEN

BY 25% GROWTH IN CUSTOMER TRAFFIC, REACHING 73 MILLION TICKETS

Net sales in the quarter increased R$3.2 billion

(23%) from 3Q22 to reach R$17.0 billion, up 59% from 3Q21. The continued growth pace of over 20%, despite the scenario of deflation in

commodities and high levels of household debt, is mainly due to:

| (i) | the significant contribution from the expansion project (+23.7%), with 52

stores opened in the last 12 months; |

| (ii) | the commercial actions, notably the “Festa em Dobro” campaign

to mark Assaí’s 49th anniversary; and |

| (iii) | the continuous improvement in the shopping experience, with rapid adaptation

of assortment and services to meet the customers’ needs of each region, which is reflected in continued customer growth

(73 million tickets in 3Q23, +25% vs. 3Q22). |

Same-store sales (-0.9%) continued to improve (-2.0%

in 2Q23) gradually during the quarter. The quarterly performance was affected by food deflation, mainly caused by agricultural commodities,

and the closure of hypermarkets in 2022, which resulted in a strong comparison base. Same-store sales increased during the period to become

positive in September, resulting from the recovery of volumes, which grew in August and September.

The Company’s attractive value proposition

was underscored by a recent survey published by Nielsen. Assaí was the brand with the highest penetration in Brazilian homes, being

present in 1 in every 4 households. Additionally, significant market share gains were achieved in the quarter on both total (+2.7 p.p.)

and same-store bases. The constant market share expansion in diverse regions prove the strength of the Assaí’s brand and

its unique differentials, which continues to attract new customers by continuously improving the shopping experience.

In 9M23, net sales totaled R$48.1 billion, up R$9.5

billion (25%) from 9M22, driven by the expansion in the last 12 months (24%), mainly by the strong performance of hypermarket conversions

and same-store sales growth (0.9%).

EXPANSION MOVES AHEAD

AND CONVERSIONS CONTINUE ACCELERATED MATURATION

Assaí ended 3Q23 with 276 stores

in operation and total sales area of around 1.4 million square meters. In the last 12 months, 52 new stores were opened, representing

growth of 29% in sales area.

During the quarter, 4 hypermarket conversions

were inaugurated in the Southeast (Rio de Janeiro, São Paulo and Minas Gerais) and Northeast (Ceará) regions. The conversion

process is in the final phase: 59 of the 66 acquired stores have been converted so far.

Operating for approximately 10 months

on average, the conversions already register average monthly revenue of R$25 million in the quarter, 13% higher than registered by mature

organic stores (R$22 million), with a sales uplift of over 2.7x (vs. 2.5x in 2Q23). Profitability continues its trajectory of natural

and sustainable maturation: Post-IFRS16 EBITDA margin from the 47 conversions inaugurated in 2022 is above 7%, while Pre-IFRS16 margin

reached 5.4%.

The performance of converted stores continues

to improve in line with the project’s expectations, despite a more challenging macroeconomic scenario than expected, given the exceptional

location of commercial points, which demonstrates the highly attractive business model and the strength of the Assaí brand.

Organic expansion also advanced in 3Q23,

with 3 new units opened, including one in Espírito Santo, marking Assaí’s entry in the state and expanding the Company’s

nationwide footprint, with Assaí stores now present in 24 of the 26 Brazilian states, as well as in the Federal District.

Also,

in October, 3 organic stores were inaugurated to bring the total new units in 2023 to 18 (including 12 conversions and 6 organic stores).

Currently, about 20 stores are under construction, which should be opened in 4Q23 and 2024.

COMMERCIAL GALLERIES

Commercial galleries drive customer traffic

at stores, contributing significantly to the maturation of conversions, and the dilution of rent and occupancy costs. At the end of 3Q23,

66% of total available gross leasable area was in operation, generating revenues of R$23 million, an increase of 64% from 3Q22. In 9M23,

revenue from galleries totaled R$67 million, up 86% year on year.

EVOLVING “PHYGITAL”

STRATEGY

The “Meu Assaí” app,

which provides greater knowledge of the consumption habits of customers and greater integration in the shopping experience between physical

and online stores, continues its growth trend. In just five months of operation, the app already has 10.1 million registered users, up

23% from 2Q23 and 44% since its launch.

Moreover, online sales via last mile operators,

an important tool to offer greater convenience to Assaí customers, continue to grow, increasing 63% in relation to 3Q22.

EFFICIENT COMMERCIAL

STRATEGY DELIVERS CONSISTENT RESULTS

Gross profit in the quarter reached R$2.8 billion, up 22%, with margin of 16.2%, similar to in 3Q22 (16.3%). The

result was mainly driven by:

Equity income from Assaí's interest of

approximately 18% in the capital of FIC came to R$12 million in the quarter. The number of Passaí cards issued exceeded 2.5 million,

now accounting for more than 4% of gross sales.

Other Operating Income and Expenses recorded

a positive (non-cash) accounting effect of R$65 million in the quarter, mainly due to the write-off of the terminated rental agreements.

With the exit of the former controlling shareholder (Casino Group) and given the existence of a clause that establishes the possibility

of early termination of rental agreements of 28 stores pertaining to the Península fund, it was necessary to negotiate new rental

agreements. Detailed information is available in the section “Impacts of exit of controlling shareholder” on page 11 of this

document.

Post-IFRS16 Adjusted EBITDA in the quarter was

R$1.2 billion, up R$201 million (20%) from 3Q22. Post-IFRS16 EBITDA margin reached 7.1%, the highest in the year. Despite the 0.2 p.p.

decline year on year, this is the lowest level of pressure since the launch of the conversion project. Pre-IFRS16 EBITDA margin was 5.4%

at the end of the quarter, 0.3 p.p. higher than in 2Q23 and stable compared to 3Q22, which attests to the quality of expansion, despite

the large number of stores in maturation.

FINANCIAL RESULT AFFECTED

BY HIGH INTEREST RATES

The financial result, including interest on

lease liabilities, totaled R$737 million in the quarter, corresponding to 4.3% of net sales.

Excluding the effect of interest on lease liabilities,

financial expense in the quarter was R$506 million, equivalent to 3.0% of sales. Compared to the previous year, this result mainly reflects

higher gross debt during the period (R$1.8 billion) and the lower impact of capitalized interest considering the progress of conversion

project (R$53 million in 3Q23 vs. R$247 million in 3Q22).

The cost of debt includes a negative impact

of R$ 6 million in the 3Q23 (R$ 9 million on 9M23) related to the waiver negotiations on the debt contracts. Detailed information is available

in the section “Impacts of exit of controlling shareholder” on page 11 of this document.

NET INCOME GROWTH UNDERSCORES

RESILIENCE OF ASSAÍ’S BUSINESS MODEL

Net income totaled R$185 million in 3Q23, with

margin of 1.1%. In the year, net income reached R$413 million, with margin of 0.9%. The large number of stores under maturation and high

interest rates continue to significantly affect the Company’s profits and net margin.

The net income reported includes (i) the positive

(non-cash) impact of around R$41 million related to the write-off of rental agreements terminated and (ii) negative impact of R$ 4 million

in the 3Q23 (R$ 6 million in 9M23) related to waiver negotiations on the debt contracts. Detailed information is available in the section

“Impacts of exit of controlling shareholder” on page 11 of this document.

GROWING NATIONWIDE FOOTPRINT

THROUGH CONTINUED EXPANSION

Investments in the quarter totaled R$598

million due to the progress of expansion, with the opening of seven stores, including four conversions and three organic. With the entry

in a new state (Espírito Santo), the 3rd quarter marks the expansion of nationwide presence of Assaí, which is

now present in 24 of the 26 Brazilian states, plus the Federal District.

Investments in 9M23 reached R$1.7 billion

with the opening of 15 stores in the period and around 20 stores under construction, with inaugurations expected for 4Q23 and 2024.

LEVERAGE REFLECTS

INVESTMENTS IN EXPANSION

At the end of 3Q23, Pre-IFRS16 net debt/adjusted

EBITDA was 2.71x, as shown in the table above. It is a recurring level, mainly due to the intense cycle of investments, with 52 stores

opened in the last 12 months and around 20 stores currently under construction.

Moreover, the receivables discount is an operation

typical to the retail sector and the Brazilian market. Discounted receivables on September 30, 2023 totaled R$2.6 billion, with an average

term of 14 days, which added to the receivables not discounted (R$839 million) totaled R$3.4 billion.

The net debt added to the receivables discounted

and the remaining installments on the acquisition of hypermarket commercial points divided by the Pre-IFRS16 Adjusted EBITDA reached 4.44x,

down 0.2x from the same period the previous year. This reduction was supported by the operating cash generation of R$4.9 billion in the

last 12 months, which represents 54% growth.

{0>

The Company emphasizes that, in accordance with

financial agreements, its leverage ratio is 1.96x, which is below the limits established in covenants (3.00x).

Since 2021, Assaí has increased gross

sales by R$ 31 billion and has intensified the pace of expansion with the opening of 103 stores, which resulted in investments totaling

R$10.3 billion (including the acquisition of 66 hypermarket commercial points). During the period, the Company’s operating cash

flow totaled R$9.4 billion which supported 91% of the total investments.

The current leverage level reflects the largest

expansion project carried out by the Company, which is in the completion phase. The completion of this project, with the end of payments

in 1Q24, will allow the Company to reduce its leverage.

This deleveraging process will be mainly supported

by a growing cash generation with the maturation and quality of the expansion, readjustment in the level of investment in new stores,

and the expectation of a reduction in interest rate leading to a lower cost of debt.

FORFAIT OPERATIONS

The sale of receivables to a financial institution

is a common practice in the retail and the Brazilian market.

In such an operation the Company provides its

suppliers the option to be paid in advance through agreements with financial institutions. These agreements aim to provide suppliers with

earlier liquidity than they would get if they were paid directly by the Company. The decision of suppliers to enter into such arrangements,

referred to as “forfait” or “risco sacado" in Portuguese, is at the sole discretion of the supplier.

If a supplier enters into such an arrangement

the financial institution becomes the creditor, and the Company pays the financial institution (instead of the supplier) under the original

terms agreed with the supplier. The Company receives a commission from the financial institution for this intermediation, which is recorded

as financial revenue. The Supplier accepts to be paid at a discount to the invoiced amount by the financial institution. There is no obligation

resulting in additional expenses for the Company, and the liability to the Financial Institution is not considered net debt.

In assessing this matter, the Company's management

considered the guidance of CVM SNC/SEP Official Letter No. 01/2022. The Company assessed qualitative aspects of its forfait operations,

and concluded that its forfait operations maintain the economic substance of the transaction and do not involve any changes to the originally

agreed conditions with suppliers. On September 30, 2023, the balance payable on these operations was R$903 million, including R$479 million

related to products and R$424 million to property and equipment.

IMPROVED CASH CONVERSION

CYCLE WITH NORMALIZATION OF INVENTORIES

The cash conversion cycle in 3Q23 was 4.1 days, adjusted for discounted receivables, an improvement of 8.9 days from 3Q22 and is mainly

explained by the normalization of inventory levels after the intense pace of store openings in 2022.

CASH

FLOW OF R$4.9 BILLION

SUSTAINS INVESTMENTS OF R$4.7

BILLION

Operating cash flow totaled R$4.9 billion

in the last 12 months, up 54% (R$1.7 billion) from 3Q22. The higher cash flow in the period reflects (i) efficient working capital management

resulting from the normalization of inventory turnover to levels in line with historical levels, since 2022 was marked by an intense pace

of expansion; and (ii) the increase of R$363 million in EBITDA, despite a scenario of deflation of commodities and the large number of

stores under maturation.

Operating cash flow sustained the investments

in expansion (R$4.7 billion) related to the hypermarket conversion project. However, cost of debt (-R$1.6 billion), which increased due

to high interest rates during the period, negatively affected total cash flow in the period.

In the last 12 months, cash disbursement

totaled R$906 million, showing that the maturation of new stores and the conclusion of acquisition payments in 2024 will contribute to

increased cash flows for the Company.

IMPACTS OF EXIT OF

CONTROLLING SHAREHOLDER

With the exit of the former controlling

shareholder (Casino Group) and given the existence of a clause that establishes the possibility of early termination of rental agreements

of 28 stores pertaining to the Península fund, it was necessary to negotiate new rental agreements. The new agreement is valid

through 2045, which is longer than the Company’s average.

The impacts booked in 3Q23 were:

| (i) | Non-cash effect of R$62 million in Other Operating Income and Expenses related

to the write-off of agreements terminated, which had a positive impact on net income from the quarter of around R$41 million; |

| (ii) | Effect on lease liabilities, at present value, of R$414 million and on assets

of R$476 million over the duration of the agreements (22 years); |

| (iii) | Increase in intangible assets of R$95 million, corresponding to the right

of use during the rental period. This amount will be paid in 4Q23; |

| (iv) | The negotiation included a gradual increase in payments until the fifth

year of the agreement. The highest increase will be in 2027, representing between 10bps–20bps of rental expenses as a percentage

of net sales of these stores. After this period, the amounts will be diluted by sales growth. |

Moreover, the exit of the controlling shareholder

resulted in waiver negotiations related to loan agreements, debentures and CRIs, with a total impact of R$93 million, R$44 million of

which in 3Q23. In the Income Statement, the effects will be recognized until the end of the debt contracts. In the 3Q23, the financial

result was negatively impacted by R$ 6 million (R$ 9 million in 9M23) and the net income by R$ 4 million (R$ 6 million in the 9M23). The

negotiations were concluded.

There are no other contracts of any nature

subject to the clause regarding the exit of the former controlling shareholder that could result in future costs for the Company.

IFRS-16 IMPACTS

With the adoption of IFRS 16 in January

2019, a few income statement lines are affected. The table shows the key changes:

SUCCESS OF ESG STRATEGY PROVEN

BY INCLUSION IN NEW B3 INDEX

Assaí, as an inherent part of its business

model, implements initiatives to foster a more responsible and inclusive society based on five strategic pillars:

1.

Combating climate change: innovating and enhancing environmental management;

2.

Integrated management and transparency: improving ESG practices through ethical and transparent

relations;

3.

Transforming the value chain: co-building value chains committed to the environment and people;

4.

Engaging with society: acting as an agent of change to promote fair and inclusive opportunities;

and

5.

Valuing our people: being a reference in fostering diversity, inclusion and sustainability

through our employees.

The ESG highlights in 3Q23

were:

| · | Reduction of 1% in scope

1(1) and

2(2) emissions

from the same period in 2022, in line with the Company's

strategy of combating climate change and its target to reduce emissions by 38% by 2030 (base year 2015). |

| · | “Selo Ouro”,

for the second consecutive year, in the Public Emissions Register of the Program Brazilian GHG Protocol, given only to companies

that report their emissions complete and audited by an independent third party. |

| · | Inclusion in B3’s

IDiversa index. Assaí is the only food retail company to join the ranking, which underlines its commitment to creating a diverse

company with equal opportunities for all. |

o

24.5% of women in leadership positions (managers

and above)

o

43.0% of black people in leadership positions (managers

and above)

| · | New launches by Assaí

Institute: |

| o | “Mais Escolha”

Project, which will distribute meal vouchers to more than 2,000 families in Santarém (Pará), Serrinha (Bahia) and São

Paulo (SP); and |

| o | Sports and Citizenship Program,

involving 50 civil society organizations in North and Northeast Brazil and the metropolitan region of São Paulo, with support

in the form of teacher training, institutional structures, financial investment and strengthening of the social sports ecosystem. |

| · | Reuse of 43% (+2.2 p.p. vs. 3Q22) in waste treatment processes by recycling, composting and reducing

food waste. The Destino Certo program has already donated 430 tons of fruits and vegetables. |

(1) Direct emissions from

the company.

(2) Emissions from electricity consumption.

AWARDS AND RECOGNITIONS

For the second year in a row, Assaí was

elected the most admired brand in the Cash and Carry segment by Marcas Mais, a publication of the O Estado de S. Paulo newspaper,

based on a survey in partnership with TroianoBranding.

The Company was also featured in important indices

disclosed this quarter, such as Valor 1000 (21st among the 1,000 biggest companies in terms of gross sales); and Best

and Biggest (2nd among retailers and 24th in the overall ranking, in gross sales).

Finally, the annual ranking published by Institutional

Investor, one of the premier publications in the financial markets, elected Belmiro Gomes the best CEO in the Retail category, Daniela

Sabbag the best CFO in the Retail category and Gabrielle Helú the 3rd best IR professional in the Retail segment.

ABOUT SENDAS DISTRIBUIDORA S.A.

Assaí is a Cash & Carry wholesaler

serving small and midsized merchants as well as consumers in general seeking savings on unit items as well as large volumes. With gross

sales of around R$60 billion in 2022, it is Brazil’s 2nd largest retail company and the most pervasive food retail brand

in Brazilian homes, according to NielsenIQ Homescan. Serving all five regions of the country, Assaí has over 275 stores across

24 states (and the Federal District) and more than 70,000 employees.

Since 2021, Assaí shares have been both

traded on the São Paulo Stock Exchange (B3), under the ticker ASAI3, and the New York Stock Exchange (NYSE), making it the only

company in the sector to be listed on both. It is also a corporation, that is, a Company with no single controlling shareholder. Assaí

is part of the select portfolio of IDIVERSA B3, which recognizes publicly-held companies with the best indicators of racial and gender

diversity.

In 2023, it was considered the most valuable

food retail brand at the annual rankings compiled by Interbrand (20th overall) and by Brand Finance (13th overall)

and, for the second straight year, it was awarded the Great Place To Work (GPTW) seal. In addition, in 2022, Assaí was Top

of Mind in the “Wholesale” category, in a survey carried out by Datafolha Institute.

CONTACTS – INVESTOR

RELATIONS DEPARTMENT

Gabrielle Castelo Branco Helú

Investor Relations Officer

Ana Carolina Silva

Beatris Atilio

Daniel Magalhães

Email: ri.assai@assai.com.br

Website: www.ri.assai.com.br

APPENDICES

OPERATIONAL INFORMATION

I – Number of stores

and sales area

In the last 12 months, six stores were closed: one each in 3Q22,

2Q23 and 3Q23, and three in 4Q22. During the period, the sales area of five stores in operation was expanded through the conversion project.

FINANCIAL INFORMATION

II - Income Statement

III - Balance Sheet

IV – Cash Flow

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 30, 2023

Sendas Distribuidora S.A.

By: /s/ Daniela Sabbag Papa

Name: Daniela Sabbag Papa

Title: Chief Financial Officer

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These

statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates",

"expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking

statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject

to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors.

Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

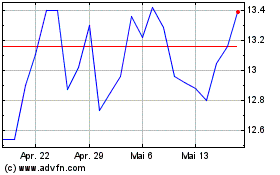

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024