Ampco-Pittsburgh Corporation Announces Results

05 März 2014 - 10:28PM

Business Wire

Ampco-Pittsburgh Corporation (NYSE:AP) announces sales and

operating income for the three months ended December 31, 2013 of

$77,055,000 and $4,088,000, respectively, against sales and

operating income of $77,154,000 and $5,500,000, respectively, for

the same period of the prior year. During the fourth quarter of

2013, the Corporation recorded a charge of $6,407,000 to recognize

an impairment of its investment in a forged-roll joint venture

company located in China. Net loss for the quarter of $(1,500,000)

or $(0.14) per common share includes the after-tax effect of

$4,165,000 or $0.40 per common share associated with the impairment

charge. Net income for the fourth quarter of 2012 equaled

$3,319,000 or $0.32 per common share.

For 2013, sales approximated $281,050,000 in comparison to sales

of $292,905,000 for 2012. Income from operations for the current

year, which includes a pre-tax credit of $16,340,000 for estimated

additional insurance recoveries through 2022 for asbestos

liabilities resulting from insurance coverage settlement agreements

entered into during the third quarter, was $28,967,000 compared to

$16,293,000 for the prior year. Net income for 2013 of $12,437,000

or $1.20 per common share includes an after-tax credit of

$10,621,000 or $1.03 per common share for the estimated additional

insurance recoveries through 2022 offset by the after-tax charge of

$4,165,000 or $0.40 per common share for the impairment of the

Corporation’s investment in the forged-roll joint venture company

for a net increase to net income of $6,456,000 or $0.63 per common

share. Net income for 2012 equaled $8,355,000 or $0.81 per common

share.

Although sales for the Forged and Cast Rolls segment for the

quarter and year were slightly less than the comparable periods of

the prior year, operating income decreased more significantly

principally due to lower pricing resulting from weaker demand

globally. With respect to the Air and Liquid Processing group,

operating income for the year includes the pre-tax credit of

$16,340,000 for the above-mentioned insurance settlements.

Operating income also benefited from changes in product mix.

The matters discussed herein may contain forward-looking

statements that are subject to risks and uncertainties that could

cause actual results to differ materially from expectations. Some

of these risks are set forth in the Corporation's Annual Report on

Form 10-K as well as the Corporation's other reports filed with the

Securities and Exchange Commission.

AMPCO-PITTSBURGH

CORPORATION

FINANCIAL

SUMMARY

Three Months Ended December 31, Year Ended

December 31, 2013 2012

2013 2012 Sales

$ 77,055,000 $

77,154,000 $

281,050,000 $

292,905,000 Income from operations (1 )

4,088,000 5,500,000 28,967,000 16,293,000 Other expense – net

(118,000 )

(362,000 ) (1,787,000

)

(1,125,000 ) Income before income

taxes 3,970,000 5,138,000 27,180,000 15,168,000 Income tax

benefit (provision) 2,145,000 (1,575,000 ) (5,813,000 ) (5,218,000

) Equity losses in Chinese joint venture

(2

)

(7,615,000

)

(244,000

)

(8,930,000

)

(1,595,000

)

Net (loss) income (3 )

$

(1,500,000 ) $

3,319,000 $

12,437,000 $

8,355,000 Earnings per common share:

Basic (3 )

$ (0.14 )

$ 0.32 $

1.20 $ 0.81

Diluted (3 )

$ (0.14 )

$ 0.32 $

1.20 $ 0.80

Weighted-average number of common shares outstanding: Basic

10,364,206

10,342,973 10,357,524

10,338,401 Diluted

10,412,101 10,394,680

10,406,478

10,389,678 (1) Income from

operations for the year ended December 31, 2013 includes a pre-tax

credit of $16,340,000 representing estimated additional insurance

recoveries through 2022 for asbestos liabilities resulting from

insurance coverage settlement agreements entered into during the

third quarter. (2) Equity losses in Chinese joint venture

for the three and twelve months ended December 31, 2013 includes a

charge of $6,407,000 to recognize an impairment of the

Corporation’s investment in the forged-roll joint venture company.

(3) Net loss for the three months ended December 31, 2013

includes an after-tax charge of $4,165,000 or $0.40 per common

share to recognize an impairment of the Corporation’s investment in

a forged-roll joint venture company located in China. Net income

for 2013 includes an after-tax credit of $10,621,000 or $1.03 per

common share for estimated additional insurance recoveries through

2022 for asbestos liabilities resulting from insurance coverage

settlement agreements entered into during the third quarter, offset

by an after-tax charge of $4,165,000 or $0.40 per common share to

recognize an impairment of the Corporation’s investment in the

forged-roll joint venture for a net increase to net income of

$6,456,000 or $0.63 per common share.

Ampco-Pittsburgh CorporationDee Ann Johnson, 412-456-4410Chief

Financial Officer and Treasurerdajohnson@ampcopgh.com

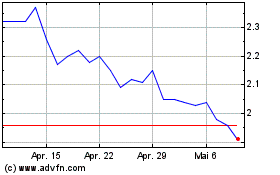

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

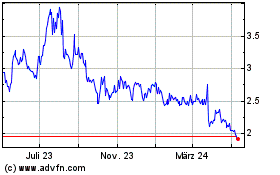

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

Von Jul 2023 bis Jul 2024