0001393584false00013935842024-10-252024-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 25, 2024 |

American Well Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39515 |

20-5009396 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

75 State Street 26th Floor |

|

Boston, Massachusetts |

|

02109 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 617 204-3500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock, $0.01 Par Value |

|

AMWL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Adoption of Inducement Plan

On October 25, 2024, American Well Corporation’s (“Company”) Board of Directors (the “Board”) approved and adopted the American Well Corporation 2024 Inducement Plan (the “Inducement Plan”), to be effective November 4, 2024. The Inducement Plan provides for the grant of equity or equity-based awards in the form of non-qualified stock options, restricted stock units (“RSUs”), and other stock-based awards. The Inducement Plan’s terms are substantially similar to the terms of the Company’s 2020 Equity Incentive Plan, with the addition of certain terms and conditions intended to comply with the New York Stock Exchange (“NYSE”) inducement award exemption from stockholder approval requirements for equity compensation plans. The Board has reserved 1,222,960 shares of the Company’s Class A common stock for issuance pursuant to awards granted under the Inducement Plan. In accordance with the NYSE Listed Company Manual Rule 303A.08, awards under the Inducement Plan may only be made to individuals not previously employed by the Company or individuals being rehired following a bona fide period of interruption of employment, as an inducement material to such individuals’ entering into employment with the Company. The foregoing description of the Inducement Plan is qualified in its entirety by reference to the full text of the Inducement Plan, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Awards under Inducement Plan

Effective November 4, 2024, the Company will grant awards to its new Chief Financial Officer, Mark Hirschhorn, under the Inducement Plan. The awards will be made pursuant to the Company’s previously announced Employment Agreement with Mr. Hirschhorn, and as a material inducement to his joining the Company as its Chief Financial Officer. The material terms of the awards are as follows:

•An award of RSUs having a grant date value of $2,500,000 which will become vested as follows, subject to Mr. Hirschhorn’s continued employment through each vesting date, except as noted below: 25% of the RSUs vesting on the grant date, and the remaining 75% of the RSUs vesting in substantially equal quarterly installments over a three-year period, starting on the one-year anniversary of the grant date, with the first vesting date for the remaining 75% portion occurring on the first day of the first month following the 15-month anniversary of the grant date and with subsequent vesting dates occurring on each three-month anniversary thereof until such RSUs are fully vested on the four-year anniversary of the grant date. The number of shares underlying the RSUs will be determined based on the volume weighted average closing price per share of the Company’s Class A common stock over the 30-day period preceding the grant date.

•An additional long-term incentive award (the “Additional Award”) under which a total value of $5,000,000 may be earned. The Additional Award will be eligible to vest in substantially equal annual installments on each of the first four anniversaries of Mr. Hirschhorn’s employment start date, provided that (i) Mr. Hirschhorn remains employed by the Company through the applicable vesting date; and (ii) applicable EBITDA targets and appreciation of Company valuation targets, in each case, as determined by the Board or the Board’s Compensation Committee (the “Committee”) in its sole discretion, are achieved. The Additional Award, to the extent it becomes vested, will be settled in cash, unless and to the extent the Board or the Committee determines in its sole discretion that it will be settled in shares of the Company’s Class A common stock or other property (in which case it will be settled in such shares or other property, as applicable).

•If Mr. Hirschhorn’s employment is terminated by the Company without Cause (as defined in his Employment Agreement) or by Mr. Hirschhorn with Good Reason (as defined in the Employment Agreement)), conditioned on Mr. Hirschhorn’s execution and non-revocation of a release of claims, the awards will vest as to the portion that would have vested had Mr. Hirschhorn remained employed by the Company through the first anniversary of his termination date. In addition, if the involuntary termination of employment occurs one month before or within 24 months following a Change in Control (as defined in the Employment Agreement), the awards will fully vest at the time of termination.

The foregoing description of the awards is qualified in its entirety by reference to the full text of the Employment Agreement, a copy of which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on October 15, 2024, and the award agreements governing the awards, copies of which will be filed with the Company’s Annual Report on Form 10-K filed for the fiscal year ending December 31, 2024, and each is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

10.1 American Well Corporation Inducement Plan

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

AMERICAN WELL CORPORATION |

|

|

|

|

Date: |

October 31, 2024 |

By: |

/s/ Bradford Gay |

|

|

|

Bradford Gay

Senior Vice President, General Counsel |

AMERICAN WELL CORPORATION

2024 INDUCEMENT PLAN

ARTICLE I

effective date and PURPOSE

1.1Effective Date. The Plan was established effective as of November 4, 2024, the date of its original approval by the Independent Compensation Committee (the “Effective Date”).

1.2Purposes. The Plan, through the granting of Awards, is intended to provide a material inducement for certain individuals to enter into employment with the Company within the meaning of Section 303A.08 of the New York Stock Exchange Listed Company Manual and to focus on the Company’s performance and link such individuals’ interests with those of the Company’s stockholders through increased stock ownership.

2.1“Administrator” means the Independent Compensation Committee or other administrator determined in accordance with Article III.

2.2“Applicable Law” means any applicable law, including the requirements relating to the administration of equity-based awards under U.S. state corporate laws, U.S. federal and state securities laws, the Code, any stock exchange or quotation system on which the Common Stock is listed or quoted and the applicable laws of any foreign country or jurisdiction where Awards are, or will be, granted under the Plan.

2.3“Award” means, individually or collectively, a grant under the Plan of Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, or other stock or cash based Award.

2.4“Award Agreement” means the written or electronic agreement, terms and conditions, contract or other instrument or document setting forth the terms and provisions applicable to each Award granted under the Plan. The Award Agreement is subject to the terms and conditions of the Plan.

2.5“Board” means the Board of Directors of the Company.

2.6“Cause” means the use of such term in any written agreement between the Participant and the Company defining such term and, in the absence of such agreement, such term means, with respect to a Participant, the occurrence of any of the following actions or events by such Participant: (i) the Participant’s commission of any felony or any crime involving fraud, dishonesty or moral turpitude; (ii) the Participant’s commission of or attempted commission of, or participation in, a fraud or act of dishonesty against the Company; (iii) the Participant’s material violation of any contract or agreement between the Company and the Participant or of any statutory duty owed to the Company; (iv) the Participant’s material failure to comply with the written polices or rules of the Company; (v) the Participant’s unauthorized use or disclosure of the Company’s confidential information or trade secrets; (vi) the Participant’s material failure or neglect to

perform assigned duties after receiving written notification of the failure; (vii) the Participant’s willful disregard of any material lawful written instruction from the Company; or (viii) the Participant’s willful misconduct or insubordination with respect to the Company or any affiliate of the Company; provided that, in the case of (iii), (iv), (v), (vi), (vii) and (viii) above, if such action or conduct is curable, (A) the Company has provided the Participant written notice within thirty (30) days following the occurrence (or Company’s first knowledge of the occurrence) of any such event; (B) the Participant fails to cure such event within thirty (30) days thereafter; and (C) the Company terminates the Participant’s employment for Cause within thirty (30) days following the end of such cure period.

2.7“Change in Control” means the occurrence of any of the following events:

(i) any “person,” as such term is used in Sections 13(d) and 14(d) of the Exchange Act (other than the Company, any trustee or other fiduciary holding securities under any employee benefit plan of the Company, or any company owned, or immediately after the transaction would be owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions as their ownership of the combined voting power or economic interests of the Company, as applicable, as of immediately prior to such transaction), becoming the beneficial owner (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing more than 50% of the combined voting power or economic interests of the Company’s then outstanding securities; provided that the provisions of this clause (i) are not intended to apply to or include as a Change in Control any transaction that is specifically excepted from the definition of Change in Control under clause (iii) below;

(ii) during any period of 12 months, individuals who at the beginning of such period constitute the Board, and any new director (other than a director designated by a person who has entered into an agreement with the Company to effect a transaction described in paragraph (i), (iii), or (iv) of this definition or a director whose initial assumption of office occurs as a result of either an actual or threatened election contest (as such term is used in Rule 14a-11 of Regulation 14A promulgated under the Exchange Act) or other actual or threatened solicitation of proxies or consents by or on behalf of a person other than the Board) whose election by the Board or nomination for election by the Company’s stockholders was approved by a vote of at least a majority of the directors then still in office who either were directors at the beginning of the 12-month period or whose election or nomination for election was previously so approved, cease for any reason to constitute at least a majority of the Board;

(iii) a merger or consolidation of the Company with any other corporation or other entity, other than a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or parent company thereof) more than 50% of (i) the combined voting power of the voting securities and (ii) the economic interests of the surviving entity or the ultimate parent company thereof (within the meaning of Section 424(e) of the Code); provided, that a merger or consolidation effected to implement an internal recapitalization of the Company (or similar transaction) in which no “person” is or

becomes the beneficial owner, directly or indirectly, of securities of the Company representing more than 50% of either the combined voting power of the Company’s then-outstanding voting securities or the then-outstanding economic interests shall not be considered a Change in Control; or

(iv) a complete liquidation or dissolution of the Company or the consummation of a sale or disposition by the Company of all or substantially all of the Company’s assets in which any “person”, other than a person or persons who beneficially own(s), directly or indirectly, 50% or more of the combined voting power and economic interests of the outstanding voting securities of the Company immediately prior to the sale, acquires (or has acquired during the 12-month period ending on the most recent acquisition by such “person”) assets from the Company that have a total gross fair market value equal to 50% or more of the total gross fair market value of all of the assets of the Company as of immediately prior to such sale or disposition of the Company’s assets.

Notwithstanding the foregoing, if a Change in Control constitutes a payment event with respect to any Award (or any portion of an Award) that provides for the deferral of compensation that is subject to Code Section 409A, to the extent required to avoid the imposition of additional taxes under Code Section 409A, such transaction or event described in subsections (i), (ii) or (iv) with respect to such Award (or portion thereof) will not be deemed a Change in Control unless the transaction qualifies as a “change in control event” within the meaning of Code Section 409A.

Further and for the avoidance of doubt, a transaction will not constitute a Change in Control if: (i) its sole purpose is to change the jurisdiction of the Company’s incorporation, or (ii) its sole purpose is to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities immediately before such transaction.

The Administrator shall have full and final authority, which shall be exercised in its sole discretion, to determine conclusively whether a Change in Control has occurred pursuant to the above definition, the date of the occurrence of such Change in Control and any incidental matters relating thereto; provided that any exercise of authority in conjunction with a determination of whether a Change in Control is a “change in control event” as defined in Treasury Regulation Section 1.409A-3(i)(5) shall be consistent with such regulation.

2.8“Code” means the Internal Revenue Code of 1986, as amended. Any reference to a section of the Code herein will be a reference to any successor or amended section of the Code.

2.9“Common Stock” means each or any (as the context may require) class of the common stock of the Company, par value $0.01 per share.

2.10“Company” means American Well Corporation, a Delaware corporation, or any successor thereto, together with its Subsidiaries.

2.11“Effective Date” shall mean November 4, 2024, the date on which the Plan was approved by the Independent Compensation Committee.

2.12“Eligible Employee” shall have the meaning set forth in Article III.

2.13“Employee” means any officer or employee (as determined in accordance with Code Section 3401(c) and the Treasury Regulations thereunder) of the Company or any parent or Subsidiary of the Company.

2.14“Exchange Act” means the Securities Exchange Act of 1934, as amended.

2.15“Fair Market Value” means, as of any date, the value of a Share determined as follows:

(i) If the applicable class of Common Stock is listed on any established stock exchange, national market system or quoted or traded on any automated quotation system, including without limitation the Nasdaq Global Select Market, the Nasdaq Global Market or the Nasdaq Capital Market of The Nasdaq Stock Market, its Fair Market Value will be the closing sales price for a Share (or the closing bid, if no sales were reported) as quoted on such exchange or system on the trading day immediately preceding the date of determination, as reported in The Wall Street Journal or such other source as the Administrator deems reliable;

(ii) If the applicable class of Common Stock is not listed on an established stock exchange, national market system or automated quotation system, but the Common Stock is regularly quoted by a recognized securities dealer, the Fair Market Value of a Share will be the mean of the high bid and low asked prices for such date or, if no high bids and low asks were reported on such date, the high bid and low asked prices for a Share on the last preceding date such bids and asks were reported, as reported in The Wall Street Journal or such other source as the Administrator deems reliable; or

(iii) In the absence of an established market for the applicable class of Common Stock, the Fair Market Value will be determined in good faith by the Administrator.

2.16“Independent Compensation Committee” shall have the meaning set forth in Article III.

2.17“Independent Director” shall have the meaning set forth in Article III.

2.18“Inducement Award Rules” shall have the meaning set forth in Article III.

2.19“Nonstatutory Stock Option” means an Option that by its terms does not qualify or is not intended to qualify as an incentive stock option within the meaning of Code Section 422 and the regulations promulgated thereunder.

2.20“Option” means a right to purchase Shares of a specified class and at a specified exercise price, granted under Article V. An Option shall be a Nonstatutory Stock Option.

2.21“Parent” means any entity (other than the Company) in an unbroken chain of entities ending with the Company if, at the time of determination, each of the entities other than

the Company owns securities or interests possessing fifty percent (50%) or more of the total combined voting power of all classes of stock in one of the other entities in such chain.

2.22 “Participant” means the holder of an outstanding Award.

2.23“Performance Goals” shall mean, for a performance period, one or more goals established in writing by the Administrator for the performance period based upon one or more performance metrics. Depending on the performance metrics used to establish such Performance Goals, the Performance Goals may be expressed in terms of overall Company performance or the performance of a Subsidiary, division, business unit, or an individual.

2.24“Plan” means this 2024 Inducement Plan.

2.25“Restricted Stock” means Shares of a specified class issued pursuant to Article VII that are subject to certain restrictions and may be subject to risk of forfeiture or repurchase.

2.26“Restricted Stock Unit” means a bookkeeping entry representing an amount equal to the Fair Market Value of one Share of a specified class, granted pursuant to Article VIII. Each Restricted Stock Unit represents an unfunded and unsecured obligation of the Company.

2.27“Section 409A” shall mean Code Section 409A and the Department of Treasury regulations and other interpretive guidance issued thereunder, including, without limitation, any such regulations or other guidance that may be issued after the Effective Date.

2.28“Share” means a share of Common Stock.

2.29“Stock Appreciation Right” or “SAR” means an Award, granted alone or in connection with an Option, that pursuant to Article VI is designated as a Stock Appreciation Right.

2.30“Subsidiary” means any entity (other than the Company), whether domestic or foreign, in an unbroken chain of entities beginning with the Company if each of the entities other than the last entity in the unbroken chain beneficially owns, at the time of the determination, securities or interests representing at least fifty percent (50%) of the total combined voting power of all classes of securities or interests in one of the other entities in such chain, provided, however, that a limited liability company or partnership may be treated as a Subsidiary to the extent either (a) such entity is treated as a disregarded entity under Treasury Regulation Section 301.7701-3(a) by reason of the Company or any other Subsidiary that is a corporation being the sole owner of such entity, or (b) such entity elects to be classified as a corporation under Treasury Regulation Section 301.7701-3(a) and such entity would otherwise qualify as a Subsidiary.

2.31“Termination of Service” shall mean the date the Participant ceases to be a service provider to the Company or its affiliates. The Administrator, in its sole discretion, shall determine the effect of all matters and questions relating to any Termination of Service for purposes of the Plan. For the avoidance of doubt, unless the Administrator determines otherwise, the cessation of employee status but the continuation of the performance of services for the Company or a Subsidiary as a director or consultant, or vice versa, shall not be deemed a cessation of service that would constitute a Termination of Service.

ARTICLE III

eligibility and Administration

3.1Eligible Award Recipients. The only persons eligible to receive grants of Awards under this Plan are individuals who satisfy the standards for inducement grants under Section 303A.08 of the New York Stock Exchange Listed Company Manual and any related guidance, or any successor provisions thereof in connection with the applicable grant of an Award. A person who previously served as an Employee will not be eligible to receive Awards under the Plan, other than following a bona fide period of non-employment. Persons eligible to receive grants of Awards under this Plan are referred to in this Plan as “Eligible Employees.” All Awards must be approved by either a majority of the Company's “Independent Directors” (as such term is defined in Section 303A.08 of the New York Stock Exchange Listed Company Manual), or the Company’s compensation committee, provided such committee is comprised solely of Independent Directors (the “Independent Compensation Committee”) in order to comply with the exemption from the stockholder approval requirement for “inducement grants” provided under Section 303A.08 of the New York Stock Exchange Listed Company Manual, or any successor provisions thereof. Section 303A.08 of the New York Stock Exchange Listed Company Manual and any related guidance, or any successor provisions thereof, are referred to in this Plan as the “Inducement Award Rules.”

3.2Administrator. The Independent Compensation Committee will serve as Administrator of the Plan; provided, however, that Awards may be granted by either (i) a majority of the Company's Independent Directors or (ii) the Independent Compensation Committee.

3.3Administrator Responsibilities. The Administrator shall, consistent with the Inducement Award Rules (a) select the Eligible Employees who are to receive Awards under the Plan, (b) determine the type, number, vesting requirements, exercisability, acceleration in the event of a grantee’s death, disability or retirement, or a Change in Control, and other features and conditions of such Awards, (c) interpret the Plan and the terms of the Awards, and (d) make all other decisions relating to the operation of the Plan. Subject to the Inducement Award Rules, the Administrator may adopt such rules or guidelines as it deems appropriate to implement the Plan and amend any Award, subject to the consent of the holder of such Award to the extent required by applicable law. The Administrator’s determinations under the Plan shall be final and binding on all persons.

3.4No Repricing. The Administrator may not reduce the exercise price for an Option or SAR, other than pursuant to Article IX. This shall include, without limitation, a repricing of the Option or SAR as well as an Option or SAR exchange program whereby the Participant agrees to cancel an existing Option in exchange for an Option, SAR, cash or other Award.

3.5Other Stock or Cash Based Awards. The Administrator is authorized to grant stock or cash-based Awards other than Options, SARs, Restricted Stock or Restricted Stock Units, including awards entitling a Participant to receive Shares or cash to be delivered immediately or in the future. Such Awards may be paid in cash, Shares, or a combination of cash and Shares, as determined by the Administrator, and may be available as a form of payment in the settlement of other Awards granted under the Plan, as stand-alone payments, as a part of a bonus, deferred bonus, deferred compensation or other arrangement, or as payment in lieu of compensation to which a Participant is otherwise entitled.

ARTICLE IV

SHARES AVAILABLE FOR GRANTS

4.1Basic Limitation. Shares issued pursuant to the Plan may be authorized but unissued shares or treasury shares. The aggregate number of Shares issued under the Plan shall not exceed 1,222,960. The limitations of this Section 4.1 shall be subject to adjustment pursuant to Article IX.

4.2Shares Returned to Reserve. The Shares underlying any Awards under the Plan that are forfeited, canceled, held back upon exercise of an Option or settlement of an Award to cover the exercise price or tax withholding, reacquired by the Company prior to vesting, satisfied without the issuance of Shares or otherwise terminated (other than by exercise or settlement) shall be added back to the Shares available for issuance under the Plan. In the event the Company repurchases shares on the open market, such shares shall not be added to the Shares available for issuance under the Plan. To the extent an Award under the Plan is paid out in cash rather than Stock, such cash payment shall not reduce the number of Shares available for issuance under the Plan.

5.1Option Agreement. Each grant of an Option under the Plan shall be evidenced by an Option agreement between the Participant and the Company. Such Option shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various Option agreements entered into under the Plan need not be identical.

5.2Number of Shares. Each Option agreement shall specify the number of shares of Stock subject to the Option and shall provide for the adjustment of such number in accordance with Article IX.

5.3Exercise Price. Each Option agreement shall specify the exercise price; provided that the exercise price under an Option shall in no event be less than 100% of the Fair Market Value of a Share on the date of grant.

5.4Exercisability and Term. Each Option agreement shall specify the date or event when all or any installment of the Option is to become exercisable and vested, and such other terms and conditions as the Administrator, in its sole discretion, will determine. The Option agreement shall also specify the term of the Option; provided that the term of an Option shall in no event exceed ten (10) years from the date of grant. An Option agreement may provide for accelerated exercisability in the event of the Participant’s death, disability or retirement or other events and may provide for expiration prior to the end of its term in the event of the Participant’s Termination of Service. A recipient of Options under the Plan shall have the rights of a stockholder only as to shares acquired upon the exercise of an Option and not as to unexercised Options.

5.5Exercise of Options. Options may be exercised in whole or in part, by giving written or electronic notice of exercise to the Company, specifying the number of Shares to be purchased. The entire exercise price of shares of Stock issued upon exercise of Options shall be

payable in cash or cash equivalents at the time when such shares of Stock are purchased, except that the Administrator at its sole discretion may accept payment of the exercise price in any other form(s) described in this Section 5.5. However, if the Participant is an executive officer of the Company, he or she may pay the exercise price in a form other than cash or cash equivalents only to the extent permitted by section 13(k) of the Exchange Act.

(a)With the Administrator’s consent, all or any part of the exercise price may be paid by surrendering, or attesting to the ownership of, shares of Stock that are already owned by the Participant. Such shares of Stock shall be valued at their Fair Market Value on the date when the new shares of Stock are purchased under the Plan.

(b)With the Administrator’s consent, all or any part of the exercise price and any withholding taxes may be paid by delivering (on a form prescribed by the Company) an irrevocable direction to a securities broker approved by the Company to sell all or part of the shares of Stock being purchased under the Plan and to deliver all or part of the sales proceeds to the Company.

(c)With the Administrator’s consent (to the extent permitted by section 13(k) of the Exchange Act) all or any part of the exercise price and any withholding taxes may be paid by delivering (on a form prescribed by the Company) a full- or partial-recourse promissory note.

(d)With the Administrator’s consent, by a “net exercise” arrangement pursuant to which the Company will reduce the number of Shares issuable upon exercise by the largest whole number of shares with a Fair Market Value that does not exceed the aggregate exercise price.

(e)With the Administrator’s consent, all or any part of the exercise price and any withholding taxes may be paid in any other form that is consistent with applicable laws, regulations and rules.

5.6Automatic Exercise. If, on the date when an Option expires, the exercise price under such Option is less than the Fair Market Value on such date but any portion of such Option has not been exercised or surrendered, then such Option shall automatically be deemed to be exercised as of such date with respect to such portion, provided that there is compliance with any applicable trading policy restrictions. An Option agreement may also provide for an automatic exercise of the Option on an earlier date.

ARTICLE VI

stock appreciation rights

6.1SAR Agreement. Each grant of a SAR under the Plan shall be evidenced by a SAR agreement between the Participant and the Company. Such SAR shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various SAR agreements entered into under the Plan need not be identical.

6.2Number of Shares. Each SAR agreement shall specify the number of shares of Stock to which the SAR pertains and shall provide for the adjustment of such number in accordance with Article IX.

6.3Exercise Price. Each SAR agreement shall specify the exercise price; provided that the exercise price under an SAR shall in no event be less than 100% of the Fair Market Value of a Share on the date of grant.

6.4 Exercisability and Term. Each SAR agreement shall specify the date or event when all or any installment of the SAR is to become exercisable and vested, and such other terms and conditions as the Administrator, in its sole discretion, will determine. The SAR agreement shall also specify the term of the SAR; provided that the term of the SAR shall in no event exceed ten (10) years from the date of grant. A SAR agreement may provide for accelerated exercisability in the event of the Participant’s death, disability or retirement or other events and may provide for expiration prior to the end of its term in the event of the Participant’s Termination of Service. SARs may be awarded in combination with Options, and such an Award may provide that the SARs will not be exercisable unless the related Options are forfeited. A SAR granted under the Plan may provide that it will be exercisable only in the event of a Change in Control. A recipient of SARs under the Plan shall have the rights of a stockholder only as to shares acquired upon the exercise of a SAR and not as to unexercised SARs.

6.5Exercise of SARs. SARs may be exercised in whole or in part, by giving written or electronic notice of exercise to the Company, specifying the number of SARs to be exercised. Upon exercise of a SAR, the Participant (or any person having the right to exercise the SAR after his or her death) shall receive from the Company (a) shares of Stock, (b) cash or (c) a combination of shares of Stock and cash, as the Administrator shall determine. The amount of cash and/or the Fair Market Value of shares of Stock received upon exercise of SARs shall, in the aggregate, not exceed the amount by which the Fair Market Value (on the date of surrender) of the shares of Stock subject to the SARs exceeds the exercise price of the shares. If, on the date when a SAR expires, the exercise price under such SAR is less than the Fair Market Value on such date but any portion of such SAR has not been exercised or surrendered, then such SAR shall automatically be deemed to be exercised as of such date with respect to such portion. A SAR agreement may also provide for an automatic exercise of the SAR on an earlier date.

ARTICLE VII

Restricted stock

7.1Restricted Stock Agreement. Each grant of Restricted Stock under the Plan shall be evidenced by a Restricted Stock agreement between the recipient and the Company. Such Restricted Stock shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various Restricted Stock agreements entered into under the Plan need not be identical.

7.2Payment for Awards. Restricted Stock may be sold or awarded under the Plan for such consideration as the Administrator may determine, including (without limitation) cash, cash equivalents, property, full- or partial-recourse promissory notes (to the extent permitted by section 13(k) of the Exchange Act), and future services.

7.3 Vesting Conditions. Restricted Stock may not be sold, assigned, transferred, pledged or otherwise encumbered or disposed of except as specifically provided herein or in the Restricted Stock Agreement. Except as may otherwise be provided by the Administrator, if a grantee’s employment (or other service relationship) with the Company terminates for any reason, any Restricted Stock that has not vested at the time of termination shall automatically and without any requirement of notice to such grantee from or other action by or on behalf of, the Company be deemed to have been reacquired by the Company at its original purchase price (if any) from such grantee or such grantee’s legal representative simultaneously with such termination of employment (or other service relationship), and thereafter shall cease to represent any ownership of the Company by the grantee or rights of the grantee as a stockholder. Each Award of Restricted Stock may or may not be subject to vesting. Any vesting shall occur, in full or in installments, upon satisfaction of the conditions specified in the Restricted Stock agreement. The Administrator may include among such conditions the requirement that the performance of the Company or a business unit of the Company for a specified period of one or more fiscal years equal or exceed a target determined in advance by the Administrator. Such target shall be based on one or more Performance Goals. A Restricted Stock agreement may provide for accelerated vesting in the event of the Participant’s death, disability or retirement or other events.

7.4Voting and Dividend Rights. The holders of Restricted Stock awarded under the Plan shall have the same voting, dividend and other rights as the Company’s other stockholders, except as otherwise set forth in this section. Prior to vesting or forfeiture, each share of unvested Restricted Stock awarded under the Plan may, at the Administrator’s discretion, carry with it a right to dividend equivalents in lieu of otherwise applicable dividend rights. Such right would entitle the holder to be credited for each Share with an amount equal to all dividends paid on one Share while the Restricted Stock is outstanding, which shall be subject to the terms of the Restricted Stock agreement. Dividend equivalents may be converted into additional shares of Restricted Stock. Settlement of dividend equivalents may be made in the form of cash, in the form of shares of Stock, or in a combination of both. Prior to distribution, any dividend equivalents that are not paid shall be subject to the same conditions and restrictions as the Restricted Stock to which they attach.

ARTICLE VIII

Restricted Stock units

8.1Restricted Stock Unit Agreement. Each grant of Restricted Stock Units under the Plan shall be evidenced by a Restricted Stock Unit agreement between the recipient and the Company. Such Restricted Stock Units shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various Restricted Stock Unit agreements entered into under the Plan need not be identical.

8.2Payment for Awards. To the extent that an Award is granted in the form of Restricted Stock Units, no cash consideration shall be required of the Award recipients.

8.3Vesting Conditions. Each Award of Restricted Stock Units may or may not be subject to vesting. Vesting shall occur, in full or in installments, upon satisfaction of the conditions specified in the Restricted Stock Unit agreement. The Administrator may include among such

conditions the requirement that the performance of the Company or a business unit of the Company for a specified period of one or more fiscal years equal or exceed a target determined in advance by the Administrator. Such target shall be based on one or more Performance Goals. A Restricted Stock Unit agreement may provide for accelerated vesting in the event of the Participant’s death, disability or retirement or other events.

8.4Voting and Dividend Rights. The holders of Restricted Stock Units shall have no voting rights. Prior to settlement or forfeiture, any Restricted Stock Unit awarded under the Plan may, at the Administrator’s discretion, carry with it a right to dividend equivalents. Such right would entitle the holder to be credited with an amount equal to all dividends paid on one Share while the Restricted Stock Unit is outstanding, which shall be subject to the terms of the Restricted Stock Unit agreement. Dividend equivalents may be converted into additional Restricted Stock Units. Settlement of dividend equivalents may be made in the form of cash, in the form of shares of Stock, or in a combination of both. Prior to distribution, any dividend equivalents that are not paid shall be subject to the same conditions and restrictions as the Restricted Stock Units to which they attach.

8.5Form and Time of Settlement of Restricted Stock Units. Settlement of vested Restricted Stock Units may be made in the form of (a) cash, (b) Shares, or (c) any combination of both, as determined by the Administrator. The actual number of Restricted Stock Units eligible for settlement may be larger or smaller than the number included in the original Award, based on predetermined performance factors. Methods of converting Restricted Stock Units into cash may include (without limitation) a method based on the average Fair Market Value of shares of Stock over a series of trading days. Vested Restricted Stock Units may be settled in a lump sum or in installments. The distribution may occur or commence when all vesting conditions applicable to the Restricted Stock Units have been satisfied or have lapsed, or it may be deferred to any later date. The amount of a deferred distribution may be increased by an interest factor or by dividend equivalents. Until an Award of Restricted Stock Units is settled, the number of such Restricted Stock Units shall be subject to adjustment pursuant to Article IX.

8.6Death of Participant; Termination. Any Restricted Stock Units Award that becomes payable after the Participant’s death shall be distributed to the Participant’s beneficiary or beneficiaries. Each recipient of a Restricted Stock Units Award under the Plan shall designate one or more beneficiaries for this purpose by filing the prescribed form with the Company. A beneficiary designation may be changed by filing the prescribed form with the Company at any time before the Award recipient’s death. If no beneficiary was designated or if no designated beneficiary survives the Award recipient, then any Restricted Stock Units Award that becomes payable after the recipient’s death shall be distributed to the recipient’s estate. Except as may otherwise be provided by the Administrator, a grantee’s right in all Restricted Stock Units that have not vested shall automatically terminate upon the grantee’s termination of employment (or cessation of service relationship) with the Company for any reason.

ARTICLE IX

ADJUSTMENTS, DISSOLUTION OR LIQUIDATION, change in control

9.1Adjustments. In the event that any stock dividend or other distribution (whether in the form of cash, Shares, other securities, or other property), recapitalization, stock split, reverse

stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of Shares or other securities of the Company, or other equity restructuring within the meaning of ASC Topic 718 or change in the corporate structure of the Company affecting Shares occurs, the Administrator, in order to prevent diminution or enlargement of the benefits or potential benefits intended to be made available under the Plan, shall make equitable adjustments to (i) the aggregate number and class of Shares that may be delivered under the Plan as set forth in the limitation in Section 4.1, (ii) the number, class, and grant or exercise price of Shares covered by each outstanding Award, and (iii) the terms and conditions of any outstanding Awards (including, without limitation, any applicable Performance Goals with respect thereto). The adjustment by the Administrator shall be final, binding and conclusive. No fractional shares of Stock shall be issued under the Plan resulting from any such adjustment, but the Administrator in its discretion may make a cash payment in lieu of fractional shares.

9.2Dissolution or Liquidation. In the event of the proposed dissolution or liquidation of the Company, the Administrator will notify each Participant as soon as practicable prior to the effective date of such proposed transaction. To the extent it has not been previously exercised, an Award will terminate immediately prior to the consummation of such proposed action.

9.3Change in Control. In the event of any transaction or event described in Section 9.1, including a Change in Control, each outstanding Award will be treated as the Administrator determines in its sole discretion and on such terms and conditions as the Administrator deems appropriate, including, without limitation, that (i) Awards will be assumed, or substantially equivalent Awards will be substituted, by the acquiring or succeeding corporation (or an affiliate thereof) with appropriate adjustments as to the number and kind of shares and applicable exercise or purchase prices, in all cases, as determined by the Administrator; (ii) upon written notice to a Participant, that the Participant’s Awards will terminate upon or immediately prior to the consummation of such transaction; (iii) outstanding Awards will vest and become exercisable, realizable, or payable, or restrictions applicable to an Award will lapse, in whole or in part, prior to or upon consummation of such transaction or event, notwithstanding anything to the contrary in the Plan or Award Agreement; (iv) (A) the termination of an Award in exchange for an amount of cash and/or property, if any, equal to the amount that would have been attained upon the exercise of such Award or realization of the Participant’s rights as of the date of the occurrence of the transaction (and, for the avoidance of doubt, if as of the date of the occurrence of the transaction the Administrator determines in good faith that no amount would have been attained upon the exercise of such Award or realization of the Participant’s rights, then such Award may be terminated by the Company without payment), or (B) the replacement of such Award with other rights or property selected by the Administrator in its sole discretion; (v) to provide that the Award cannot vest, be exercised or become payable after such event; or (vi) any combination of the foregoing. In taking any of the actions permitted under this Section 9.3, the Administrator will not be obligated to treat all Awards, all Awards held by a Participant, or all Awards of the same type, similarly.

In the event that the successor corporation in a Change in Control does not assume or substitute for the Award (or portion thereof), the Administrator will (i) cause any or all of such Award (or portion thereof) to terminate in exchange for cash, rights or other property pursuant to Section 9.3, or (ii) cause the Participant to fully vest in and have the right to exercise all of his or her outstanding Options and Stock Appreciation Rights, including Shares as to which such Awards would not

otherwise be vested or exercisable, all restrictions on Restricted Stock and Restricted Stock Units will lapse, and, with respect to Awards with Performance Goals, unless otherwise provided in an Award Agreement, all Performance Goals will be deemed achieved at the greater of actual performance or 100% of target levels and all other terms and conditions met.

For the purposes of this Section 9.3, an Award will be considered assumed if, following the Change in Control, the Award confers the right to purchase or receive, for each Share subject to the Award immediately prior to the Change in Control, the consideration (whether stock, cash, or other securities or property) received in the Change in Control by holders of Common Stock for each Share held on the effective date of the transaction (and, if holders were offered a choice of consideration, the type of consideration chosen by the holders of a majority of the outstanding Shares); provided, however, that if such consideration received in the Change in Control is not solely common stock of the successor corporation or its parent, the Administrator may, with the consent of the successor corporation, provide for the consideration to be received upon the exercise of an Option or Stock Appreciation Right or upon the payout of a Restricted Stock Unit, for each Share subject to such Award, to be solely common stock of the successor corporation or its parent equal in fair market value to the per share consideration received by holders of Common Stock in the Change in Control.

Notwithstanding anything in this Section 9.3 to the contrary, an Award that vests, is earned or paid-out upon the satisfaction of one or more Performance Goals will not be considered assumed if the Company or its successor modifies any of such Performance Goals without the Participant’s consent; provided, however, a modification to such Performance Goals only to reflect the successor corporation’s post-Change in Control corporate structure will not be deemed to invalidate an otherwise valid Award assumption.

Notwithstanding anything in this Section 9.3 to the contrary, if a payment under an Award Agreement is subject to Code Section 409A, and if the change in control definition contained in the Award Agreement does not comply with the definition of “change of control” for purposes of a distribution under Code Section 409A, then any payment of an amount that is otherwise accelerated under this Section will be delayed until the earliest time that such payment would be permissible under Code Section 409A without triggering any penalties applicable under Code Section 409A.

9.4Limitations. The Administrator, in its sole discretion, may include such further provisions and limitations in any Award, agreement or certificate as it may deem equitable and in the best interests of the Company that are not inconsistent with the provisions of the Plan. The existence of the Plan, any Award Agreement and/or the Awards granted hereunder shall not affect or restrict in any way the right or power of the Company or the stockholders of the Company to make or authorize any adjustment, recapitalization, reorganization or other change in the Company’s capital structure or its business, any merger or consolidation of the Company, any issue of stock or of options, warrants or rights to purchase stock or of bonds, debentures, preferred or prior preference stocks whose rights are superior to or affect the Common Stock or the rights thereof or which are convertible into or exchangeable for Common Stock, or the dissolution or liquidation of the Company, or any sale or transfer of all or any part of its assets or business, or any other corporate act or proceeding, whether of a similar character or otherwise. In the event of any pending stock dividend, stock split, combination or exchange of shares, merger, consolidation

or other distribution (other than normal cash dividends) of Company assets to stockholders, or any other change affecting the Shares or the share price of Common Stock, for reasons of administrative convenience, the Company, in its sole discretion, may refuse to permit the exercise of any Award during a period of up to thirty (30) days prior to the consummation of any such transaction.

ARTICLE X

LIMITATION ON rights

10.1No Effect on Employment or Service. Neither the Plan nor any Award granted under the Plan shall be deemed to give any individual a right to remain an Employee. The Company and its Parents, Subsidiaries and affiliates reserve the right to terminate the Service of any Employee at any time, with or without cause, subject to applicable laws, the Company’s certificate of incorporation and by-laws and a written employment agreement (if any).

10.2Stockholders’ Rights. Except as otherwise provided in the Plan, a Participant shall have no dividend rights, voting rights or other rights as a stockholder with respect to any shares of Stock covered by his or her Award prior to the time when a stock certificate for such shares of Stock is issued or, if applicable, the time when he or she becomes entitled to receive such shares of Stock by filing any required notice of exercise and paying any required exercise price. No adjustment shall be made for cash dividends or other rights for which the record date is prior to such time, except as expressly provided in the Plan.

10.3Regulatory Requirements. Any other provision of the Plan notwithstanding, the obligation of the Company to issue shares of Stock under the Plan shall be subject to all applicable laws, rules and regulations and such approval by any regulatory body as may be required. The Company reserves the right to restrict, in whole or in part, the delivery of shares of Stock pursuant to any Award prior to the satisfaction of all legal requirements relating to the issuance of such shares of Stock, to their registration, qualification or listing or to an exemption from registration, qualification or listing.

10.4Transferability of Awards. No Awards granted under this Plan may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will, by the laws of descent and distribution, or beneficiary designations under procedures established by the Administrator. All rights with respect to an Award granted to a Participant shall be available during his or her lifetime only to the Participant. Notwithstanding the foregoing, the Administrator may, in its sole discretion, permit transfers of Awards for estate planning and charitable purposes in accordance with procedures it establishes.

ARTICLE XI

Tax WITHHOLDING

11.1Withholding Requirements. Prior to the delivery of any Shares or cash pursuant to an Award (or exercise thereof), the Company will have the power and the right to deduct or withhold, or require a Participant to remit to the Company, an amount sufficient to satisfy federal, state, local, foreign or other taxes (including the Participant’s FICA, employment tax or social

security contribution obligations) required to be withheld with respect to any taxable event concerning a Participant arising as a result of the Plan or any Award.

11.2Withholding Arrangements. The Administrator, in its sole discretion and pursuant to such procedures as it may specify from time to time, may permit a Participant to satisfy such tax withholding obligation, in whole or in part by (without limitation): (i) paying cash, (ii) electing to have the Company withhold otherwise deliverable Shares having a Fair Market Value no greater than the aggregate amount of such obligations based on the maximum statutory withholding rates in such Participant’s applicable jurisdictions for federal, state, local and foreign income tax and payroll tax purposes that are applicable to such taxable income, (iii) delivering to the Company already-owned Shares having a Fair Market Value equal to the statutory amount required to be withheld, provided the delivery of such Shares will not result in any adverse accounting consequences, as the Administrator determines in its sole discretion, (iv) selling a sufficient number of Shares otherwise deliverable to the Participant through such means as the Administrator may determine in its sole discretion (whether through a broker or otherwise) equal to the amount required to be withheld, or (v) any combination of the above permitted forms of payment. The amount of the withholding requirement will be deemed to include any amount which the Administrator agrees may be withheld at the time the election is made, not to exceed the amount determined by using the maximum federal, state or local marginal income tax rates applicable to the Participant with respect to the Award on the date that the amount of tax to be withheld is to be determined. The Fair Market Value of the Shares to be withheld or delivered will be determined as of the date that the taxes are required to be withheld.

ARTICLE XII

general provisions

12.1Term of the Plan. The Plan shall become effective on the Effective Date and shall remain in effect until the date when the Plan is terminated under Section 12.2.

12.2Amendment or Termination. The Board or Independent Compensation Committee may, at any time and for any reason, amend or terminate the Plan. No Awards shall be granted under the Plan after the termination thereof. The termination of the Plan, or any amendment thereof, shall not affect any Award previously granted under the Plan.

12.3Forfeiture and Clawback Provisions. All Awards (including any proceeds, gains or other economic benefit actually or constructively received by a Participant upon any receipt or exercise of any Award or upon the receipt or resale of any Shares underlying the Award and any payments of a portion of an incentive-based bonus pool allocated to a Participant) shall be subject to the provisions of any clawback policy implemented by the Company, including, without limitation, any clawback policy adopted to comply with the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act and any rules or regulations promulgated thereunder, whether or not such clawback policy was in place at the time of grant of an Award, to the extent set forth in such clawback policy and/or in the applicable Award Agreement.

12.4Data Privacy. As a condition of receipt of any Award, each Participant explicitly and unambiguously consents to the collection, use and transfer, in electronic or other form, of personal data as described in this Section 12.4 by and among, as applicable, the Company and its

Subsidiaries for the exclusive purpose of implementing, administering and managing the Participant’s participation in the Plan. The Company and its Subsidiaries may hold certain personal information about a Participant, including but not limited to, the Participant’s name, home address and telephone number, date of birth, social security or insurance number or other identification number, salary, nationality, job title(s), any shares of stock held in the Company or any of its Subsidiaries and details of all Awards, in each case, for the purpose of implementing, managing and administering the Plan and Awards (the “Data”). The Company and its Subsidiaries may transfer the Data amongst themselves as necessary for the purpose of implementation, administration and management of a Participant’s participation in the Plan, and the Company and its Subsidiaries may each further transfer the Data to any third parties assisting the Company and its Subsidiaries in the implementation, administration and management of the Plan. These recipients may be located in the Participant’s country, or elsewhere, and the Participant’s country may have different data privacy laws and protections than the recipients’ country. Through acceptance of an Award, each Participant authorizes such recipients to receive, possess, use, retain and transfer the Data, in electronic or other form, for the purposes of implementing, administering and managing the Participant’s participation in the Plan, including any requisite transfer of such Data as may be required to a broker or other third party with whom the Company or any of its Subsidiaries or the Participant may elect to deposit any Shares. The Data related to a Participant will be held only as long as is necessary to implement, administer, and manage the Participant’s participation in the Plan. A Participant may, at any time, view the Data held by the Company with respect to such Participant, request additional information about the storage and processing of the Data with respect to such Participant, recommend any necessary corrections to the Data with respect to the Participant or refuse or withdraw the consents herein in writing, in any case without cost, by contacting his or her local human resources representative. The Company may cancel the Participant’s ability to participate in the Plan and, in the Administrator’s discretion, the Participant may forfeit any outstanding Awards if the Participant refuses or withdraws his or her consents as described herein. For more information on the consequences of refusal to consent or withdrawal of consent, Participants may contact their local human resources representative.

12.5Paperless Administration. In the event that the Company establishes, for itself or using the services of a third party, an automated system for the documentation, granting or exercise of Awards, such as a system using an internet website or interactive voice response, then the paperless documentation, granting or exercise of Awards by a Participant may be permitted through the use of such an automated system.

12.6Effect of Plan upon Other Compensation Plans. The adoption of the Plan shall not affect any other compensation or incentive plans in effect for the Company or any Subsidiary. Nothing in the Plan shall be construed to limit the right of the Company or any Subsidiary: (a) to establish any other forms of incentives or compensation for Employees, Directors or Consultants of the Company or any Subsidiary, or (b) to grant or assume options or other rights or awards otherwise than under the Plan in connection with any proper corporate purpose including without limitation, the grant or assumption of options in connection with the acquisition by purchase, lease, merger, consolidation or otherwise, of the business, stock or assets of any corporation, partnership, limited liability company, firm or association.

12.7Titles and Headings, References to Sections of the Code or Exchange Act. The titles and headings of the Sections in the Plan are for convenience of reference only and, in the

event of any conflict, the text of the Plan, rather than such titles or headings, shall control. References to sections of the Code or the Exchange Act shall include any amendment or successor thereto.

12.8Governing Law. The Plan and Award Agreements hereunder shall be administered, interpreted and enforced under the internal laws of the State of Delaware without regard to conflicts of laws thereof or of any other jurisdiction.

12.9Code Section 409A. To the extent that the Administrator determines that any Award granted under the Plan is subject to Code Section 409A, the Plan and the Award Agreement evidencing such Award shall incorporate the terms and conditions required by Code Section 409A. In that regard, to the extent any Award under the Plan or any other compensatory plan or arrangement of the Company is subject to Code Section 409A, and such Award or other amount is payable on account of a Participant’s Termination of Service (or any similarly defined term), then (a) such Award or amount shall only be paid to the extent such Termination of Service qualifies as a “separation from service” as defined in Code Section 409A, and (b) if such Award or amount is payable to a “specified employee” as defined in Code Section 409A, then to the extent required in order to avoid a prohibited distribution under Code Section 409A, such Award or other compensatory payment shall not be payable prior to the earlier of (i) the expiration of the six-month period measured from the date of the Participant’s Termination of Service, or (ii) the date of the Participant’s death. To the extent applicable, the Plan and any Award Agreements shall be interpreted in accordance with Code Section 409A. Notwithstanding any provision of the Plan to the contrary, in the event that following the Effective Date, the Administrator determines that any Award may be subject to Code Section 409A, the Administrator may (but is not obligated to), without a Participant’s consent, adopt such amendments to the Plan and Award Agreement or adopt other policies and procedures (including amendments, policies and procedures with retroactive effect), or take any other actions, that the Administrator determines are necessary or appropriate to (A) exempt the Award from Code Section 409A and/or preserve the intended tax treatment of the benefits provided with respect to the Award, or (B) comply with the requirements of Code Section 409A and thereby avoid the application of any penalty taxes under Section Code 409A. The Company makes no representations or warranties as to the tax treatment of any Award under Code Section 409A or otherwise. The Company shall have no obligation under this Section 12.9 or otherwise to take any action (whether or not described herein) to avoid the imposition of taxes, penalties or interest under Code Section 409A with respect to any Award, and shall have no liability to any Participant or any other person if any Award, compensation or other benefits under the Plan are determined to constitute non-compliant, “nonqualified deferred compensation” subject to the imposition of taxes, penalties and/or interest under Code Section 409A.

12.10Unfunded Status of Awards. The Plan is intended to be an “unfunded” plan for incentive compensation. With respect to any payments not yet made to a Participant pursuant to an Award, nothing contained in the Plan or Award Agreement shall give the Participant any rights that are greater than those of a general creditor of the Company or any Subsidiary.

12.11Indemnification. To the extent permitted under applicable law, each member of the Administrator shall be indemnified and held harmless by the Company from any loss, cost, liability, or expense that may be imposed upon or reasonably incurred by such member in connection with or resulting from any claim, action, suit, or proceeding to which he or she may be

a party or in which he or she may be involved by reason of any action or failure to act pursuant to the Plan or any Award Agreement, and against and from any and all amounts paid by him or her, with the Board’s approval, in satisfaction of judgment in such action, suit, or proceeding against him or her; provided he or she gives the Company an opportunity, at its own expense, to handle and defend the same before he or she undertakes to handle and defend it on his or her own behalf and, once the Company gives notice of its intent to assume such defense, the Company shall have sole control over such defense with counsel of the Company’s choosing. The foregoing right of indemnification shall not be available to the extent that a court of competent jurisdiction in a final judgment or other final adjudication, in either case not subject to further appeal, determines that the acts or omissions of the person seeking indemnity giving rise to the indemnification claim resulted from such person’s bad faith, fraud or willful criminal act or omission. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which such persons may be entitled as a matter of law, or otherwise, or any power that the Company may have to indemnify them or hold them harmless.

12.12Relationship to Other Benefits. No payment pursuant to the Plan shall be taken into account in determining any benefits under any pension, retirement, savings, profit sharing, group insurance, welfare or other benefit plan of the Company or any Subsidiary, except to the extent otherwise expressly provided in writing in such other plan or an agreement thereunder.

12.13Expenses. The expenses of administering the Plan shall be borne by the Company and its Subsidiaries.

12.14Trading Policy Restrictions. Option exercises and other Awards under the Plan shall be subject to the Company’s insider trading policies and procedures, as in effect from time to time.

* * * * *

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

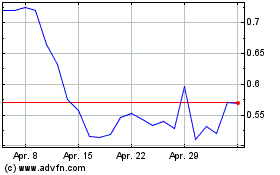

American Well (NYSE:AMWL)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

American Well (NYSE:AMWL)

Historical Stock Chart

Von Dez 2023 bis Dez 2024