0001034670false00010346702024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2024

Autoliv, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-12933 |

|

51-0378542 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

Klarabergsviadukten 70, Section B, 7th Floor,

Box 70381,

SE-107 24, Stockholm, Sweden

(Address and Zip Code of principal executive offices)

+46 8 587 20 600

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $1.00 par value |

|

ALV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

The information contained in Item 2.03 of this Current Report on Form 8-K is incorporated by reference into this Item 1.01.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On February 7, 2024, Autoliv, Inc. (the “Issuer”) issued EUR 500,000,000 of notes due August 7, 2029 (the “Notes”). The Notes have a coupon rate of 3.625% per annum, and the issue price of the Notes was 99.854% of the aggregate nominal amount of the Notes. The Notes were offered to third parties in denominations of EUR 100,000 and increments of EUR 1,000 above that. Autoliv ASP, Inc. (the “Guarantor”) is guarantor of all payments due in respect of the Notes. An amount equivalent to the net proceeds from the offering of the Notes will be allocated to new or existing Eligible Projects which fall within the following Eligible Categories: Clean Transportation, Renewable Energy, Energy Efficiency or De-carbonization of Operations and Products.

The Notes were issued pursuant to the Pricing Supplement, dated February 5, 2024 (the “Pricing Supplement”), which supplements the base listing particulars (the “Base Listing Particulars”) of the Issuer’s EUR 3,000,000,000 guaranteed medium term note programme dated February 17, 2023 (the “EMTN Programme”). Copies of the Pricing Supplement and the Base Listing Particulars are filed as Exhibit 1.1 and 4.1 to this Form 8-K and is incorporated herein by reference.

Application has been made to The Irish Stock Exchange plc trading as Euronext Dublin for the Notes to be admitted to the official list of Euronext Dublin and to trading on the Global Exchange Market of Euronext Dublin.

The Notes were issued pursuant to Regulation S under the United States Securities Act of 1933, as amended (the “Securities Act”), and have not been and will not be registered under the Securities Act. The Notes may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from the registration requirements under the Securities Act. This Current Report on Form 8-K shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities, including the Notes or any other securities of the Issuer or the Guarantor.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

Exhibit No. |

|

Description |

1.1* |

|

Pricing Supplement, dated February 5, 2024, of the EUR 500,000,000 of notes due August 7, 2029 issued by Autoliv, Inc. |

4.1 |

|

Base Listing Particulars, dated February 17, 2023, among Autoliv, Inc., Autoliv ASP, Inc. and the dealers named therein, incorporated herein by reference to Exhibit 4.1 to the Current Report on Form 8-K (File No. 001-12933, filing date March 16, 2023. |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

|

|

(*) filed herewith |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

AUTOLIV, INC. |

By: |

|

/s/ Anthony J. Nellis |

Name: |

|

Anthony J. Nellis |

Title: |

|

Executive Vice President, Legal Affairs, General Counsel and Secretary |

Date: February 7, 2024

PROHIBITION OF SALES TO EEA RETAIL INVESTORS – The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”) or (ii) a customer within the meaning of Directive (EU) 2016/97 (the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II. Consequently no key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

PROHIBITION OF SALES TO UK RETAIL INVESTORS – The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom (“UK”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”); (ii) a customer within the meaning of the provisions of the Financial Services Market Act 2000 (“FSMA”) and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law of the United Kingdom by virtue of the EUWA. Consequently no key information document required by Regulation (EU) No 1286/2014 as it forms part of domestic law of the United Kingdom by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

MIFID II product governance / Professional investors and ECPs only target market – Solely for the purposes of the manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is eligible counterparties and professional clients only, each as defined in MiFID II; and (ii) all channels for distribution of the Notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the Notes (a “distributor”) should take into consideration the manufacturer’s target market assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the Notes (by either adopting or refining the manufacturer’s target market assessment) and determining appropriate distribution channels.

UK MIFIR product governance / Professional investors and ECPs only target market – Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is only eligible counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook (“COBS”), and professional clients, as defined in Regulation (EU) No 600/2014 as it forms part of domestic law of the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (“UK MiFIR”); and (ii) all channels for distribution of the Notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the Notes (a “distributor”) should take into consideration the manufacturers’ target market assessment; however, a distributor subject to the FCA Handbook Product Intervention and Product Governance Sourcebook (the “UK MiFIR Product Governance Rules”) is responsible for undertaking its own target market assessment in respect of the Notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

NO PROSPECTUS IS REQUIRED IN ACCORDANCE WITH REGULATION (EU) 2017/1129 FOR THE ISSUE OF NOTES DESCRIBED BELOW.

5 February 2024

Autoliv, Inc.

Legal entity identifier (LEI): A23RUXWKASG834LTMK28

Issue of €500,000,000 3.625 per cent. Notes due 7 August 2029

Guaranteed by Autoliv ASP, Inc.

under the €3,000,000,000

Euro Medium Term Note Programme

PART A – CONTRACTUAL TERMS

This document constitutes the Pricing Supplement for the Notes described herein. This document must be read in conjunction with the Base Listing Particulars dated 17 February 2023 as supplemented by the supplements dated 21 July 2023, 23 October 2023 and 26 January 2024 (the “Base Listing Particulars”). Full information on the Issuer, the Guarantor and the offer of the Notes is only available on the basis of the combination of this Pricing Supplement and the Base Listing Particulars. Copies of the Base Listing Particulars may be obtained during normal business hours at the Issuer’s registered office at Klarabergsviadukten 70, Section B7, 7th Floor, Box 70381, SE-111 64, Stockholm, Sweden.

|

|

|

3 |

|

1 |

(c)Date on which the Notes will be consolidated and form a single Series: |

Not Applicable |

2.Specified Currency or Currencies: |

Euro (“€”) |

3.Aggregate Nominal Amount: |

|

|

€500,000,000 |

|

€500,000,000 |

|

99.854% of the Aggregate Nominal Amount |

5.(a) Specified Denominations: |

€100,000 and integral multiples of €1,000 in excess thereof |

(b)Calculation Amount (in relation to calculation of interest in global form see Conditions): |

€1,000 |

|

7 February 2024 |

(b)Interest Commencement Date: |

Issue Date |

|

7 August 2029 |

|

3.625% Fixed Rate |

|

|

|

(further particulars specified below) |

9.Redemption/Payment Basis: |

Subject to any purchase and cancellation or early redemption, the Notes will be redeemed on the Maturity Date at 100% of their nominal amount |

10.Change of Interest Basis or Redemption/Payment Basis: |

Not Applicable |

|

Change of Control Put Issuer Call |

|

(further particulars specified below) |

12.Date Board approval for issuance of Notes and Guarantee obtained: |

3 February 2024 and 14 February 2023, respectively |

PROVISIONS RELATING TO INTEREST (IF ANY) PAYABLE |

13.Fixed Rate Note Provisions |

Applicable |

|

3.625% per annum payable in arrear on each Interest Payment Date |

(b)Interest Payment Date(s): |

7 August in each year up to and including the Maturity Date, commencing on 7 August 2024 (short first coupon) |

(c)Fixed Coupon Amount(s) for Notes in definitive form (and in relation to Notes in global form see Conditions): |

€36.25 per Calculation Amount other than in respect of the Interest Payment Date falling on 7 August 2024 |

(d)Broken Amount(s) for Notes in definitive form (and in relation to Notes in global form see Conditions): |

€18.03 per Calculation Amount in respect of the Interest Payment Date falling on 7 August 2024 |

|

Actual/Actual (ICMA) |

(f)Determination Date(s): |

7 August in each year |

(g)Other terms relating to the method of calculating interest for Fixed Rate Notes: |

None |

14.Floating Rate Note Provisions |

Not Applicable |

15.Zero Coupon Note Provisions |

Not Applicable |

16.Index Linked Interest Note |

Not Applicable |

17.Dual Currency Interest Note Provisions |

Not Applicable |

PROVISIONS RELATING TO REDEMPTION |

18.Notice periods for Condition 7.2: |

Minimum period: 30 days |

|

|

|

|

Maximum period: 60 days |

|

Applicable |

(a)Optional Redemption Date(s): |

Any date from and including the Issue Date to but excluding the Maturity Date |

(b)Optional Redemption Amount and method, if any, of calculation of such amount(s): |

From and including the Issue Date to but excluding 7 May 2029: Make-Whole Amount From and including 7 May 2029 to but excluding the Maturity Date: €1,000 per Calculation Amount |

|

0.25% |

|

DBR 0.000% due 15 August 2029 (ISIN: DE0001102473) |

|

11.00 am (CET) |

(c)If redeemable in part: |

|

(i)Minimum Redemption Amount: |

€1,000 |

(ii)Maximum Redemption Amount: |

The then-outstanding aggregate nominal amount of the Notes |

|

Minimum period: 15 days |

|

Maximum period: 30 days |

|

Not Applicable |

21.Change of Control Put: |

Applicable |

22.Final Redemption Amount: |

€1,000 per Calculation Amount |

23.Early Redemption Amount payable on redemption for taxation reasons, redemption following a Change of Control or on event of default and/or the method of calculating the same (if required): |

€1,000 per Calculation Amount |

GENERAL PROVISIONS APPLICABLE TO THE NOTES |

|

Registered Notes |

|

Global Note registered in the name of a nominee for a common safekeeper for Euroclear and Clearstream, Luxembourg (that is held under the NSS) |

25.Additional Financial Centre(s): |

Not Applicable |

26.Details relating to Partly Paid Notes: amount of each payment comprising the Issue Price and date on which each payment is to be made and |

Not Applicable |

|

|

consequences (if any) of failure to pay, including any right of the Issuer to forfeit the Notes and interest due on late payment. |

|

27.Details relating to Instalment Notes: |

Not Applicable |

28.Other terms or special conditions: |

Not Applicable |

RESPONSIBILITY

The Issuer and the Guarantor accept responsibility for the information contained in this Pricing Supplement.

|

|

Signed on behalf of Autoliv, Inc.: |

Signed on behalf of Autoliv ASP, Inc.: |

By: /s/ Fredrik Westin |

By: /s/ Anthony J. Nellis |

Fredrik Westin, EVP Finance and CFO |

Anthony J. Nellis, Vice President |

PART B – OTHER INFORMATION

|

|

|

Application has been made by the Issuer (or on its behalf) to The Irish Stock Exchange plc trading as Euronext Dublin (“Euronext Dublin”) for the Notes to be admitted to the official list and to trading on the Global Exchange Market of Euronext Dublin with effect from 7 February 2024. |

|

|

Ratings: |

The Notes to be issued are expected to be rated BBB by S&P Global Ratings Europe Limited. |

3.INTERESTS OF NATURAL AND LEGAL PERSONS INVOLVED IN THE ISSUE |

Save for any fees payable to the Managers, so far as the Issuer is aware, no person involved in the issue of the Notes has an interest material to the offer. The Managers and their affiliates have engaged, and may in the future engage, in investment banking and/or commercial banking transactions with, and may perform other services for, the Issuer and the Guarantor and their affiliates in the ordinary course of business |

|

Green Bonds - An amount equivalent to the net proceeds from the Notes will be allocated to new or existing Eligible Projects which fall within the following Eligible Categories: Clean Transportation, Renewable Energy, Energy Efficiency or De-carbonization of Operations and Products. Existing projects, being projects financed up to 24 months prior to the date of issuance of the Notes, may be Eligible Projects. |

5.OPERATIONAL INFORMATION |

|

XS2759982577 |

|

275998257 |

|

DTFNFR, as updated, as set out on the website of the Association of National Numbering Agencies (ANNA) or alternatively sourced from the responsible National Numbering Agency that assigned the ISIN |

|

AUTOLIV, INC./EMTN 20290807, as updated, as set out on the website of the Association of National Numbering Agencies (ANNA) or alternatively sourced from the responsible National Numbering Agency that assigned the ISIN |

(v)Any clearing system(s) other than Euroclear and Clearstream, Luxembourg and the relevant identification number(s): |

Not Applicable |

|

Delivery against payment |

|

|

(vii)Names and addresses of additional Paying Agent(s) (if any): |

Not Applicable |

(viii)Intended to be held in a manner which would allow Eurosystem eligibility: |

Yes. Note that the designation “yes” simply means that the Notes are intended upon issue to be deposited with one of the ICSDs as common safekeeper, and registered in the name of a nominee of one of the ICSDs acting as common safekeeper and does not necessarily mean that the Notes will be recognised as eligible collateral for Eurosystem monetary policy and intra day credit operations by the Eurosystem either upon issue or at any or all times during their life. Such recognition will depend upon the ECB being satisfied that Eurosystem eligibility criteria have been met. |

|

(i)Method of distribution: |

Syndicated |

(ii)If syndicated, names of Managers: |

Citigroup Global Markets Limited J.P. Morgan Securities plc MUFG Securities (Europe) N.V. Wells Fargo Securities International Limited |

(iii)Stabilisation Manager(s) (if any): |

Not Applicable |

(iv)If non-syndicated, name of relevant Dealer: |

Not Applicable |

(v)U.S. Selling Restrictions: |

Reg. S Compliance Category 2 |

(vi)Additional selling restrictions: |

Not Applicable |

(vii)Prohibition of Sales to EEA Retail Investors: (viii)Prohibition of Sales to UK Retail Investors: |

Applicable Applicable |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

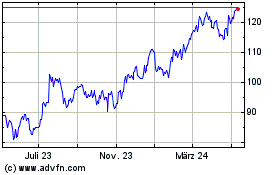

Autoliv (NYSE:ALV)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Autoliv (NYSE:ALV)

Historical Stock Chart

Von Mai 2023 bis Mai 2024