Filed by AltC Acquisition Corp.

pursuant to Rule 425 under the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: AltC Acquisition Corp.

Commission File No. 001-40583

Date: July 11, 2023

On Tuesday, July 11, 2023, AltC Acquisition Corp. (“AltC”)

entered into an agreement for a business combination with Oklo Inc. (“Oklo”). Following the announcement of the transaction,

Sam Altman, who serves as a member of the board of AltC and as its chief executive officer, and who serves as chairman of the board of

directors of Oklo, made the following communications available on Twitter:

IMPORTANT LEGAL INFORMATION

Additional Information About the Proposed Transaction and Where

to Find It

The proposed transaction will be submitted to shareholders of AltC

for their consideration. AltC intends to file a registration statement on Form S-4 (the “Registration Statement”) with

the U.S. Securities and Exchange Comission (“SEC”), which will include preliminary and definitive proxy statements

to be distributed to AltC’s shareholders in connection with AltC’s solicitation for proxies for the vote by AltC’s shareholders

in connection with the proposed transaction and other matters to be described in the Registration Statement, as well as the prospectus

relating to the offer of the securities to be issued to Oklo’s shareholders in connection with the completion of the proposed transaction.

After the Registration Statement has been filed and declared effective, AltC will mail a definitive proxy statement/prospectus/consent

solicitation statement and other relevant documents to its shareholders as of the record date established for voting on the proposed transaction.

AltC’s shareholders and other interested persons are advised to read, once available, the preliminary proxy statement/prospectus/consent

solicitation statement and any amendments thereto and, once available, the definitive proxy statement/prospectus/consent solicitation

statement, in connection with AltC’s solicitation of proxies for its special meeting of shareholders to be held to approve, among

other things, the proposed transaction, as well as other documents filed with the SEC by AltC in connection with the proposed transaction,

as these documents will contain important information about AltC, Oklo and the proposed transaction. Shareholders may obtain a copy of

the preliminary or definitive proxy statement/prospectus/consent solicitation statement, once available, as well as other documents filed

by AltC with the SEC, without charge, at the SEC’s website located at www.sec.gov or by directing a written request to AltC Acquisition

Corp., 640 Fifth Avenue, 12th Floor, New York, NY 10019.

Participants in the Solicitation

AltC, Oklo and certain of their respective directors, executive officers

and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitation of proxies from AltC’s

shareholders in connection with the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants

in the solicitation of AltC’s shareholders in connection with the proposed transaction will be set forth in AltC’s proxy statement/prospectus/consent

solicitation statement when it is filed with the SEC. You can find more information about AltC’s directors and executive officers

in AltC’s final prospectus filed with the SEC on July 7, 2021 and in the Annual Reports filed by AltC with the SEC on Form 10-K.

Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests will

be included in the proxy statement/prospectus/consent solicitation statement when it becomes available. Shareholders, potential investors

and other interested persons should read the proxy statement/prospectus/consent solicitation statement carefully when it becomes available

before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. This communication is not, and under no circumstances is to be construed as, a prospectus, an advertisement or a public

offering of the securities described herein in the United States or any other jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or exemptions therefrom. INVESTMENT

IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON

OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY

IS A CRIMINAL OFFENSE.

Forward-Looking Statements

This communication includes “forward-looking statements”

within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,”

“forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,”

“seek,” “target,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict” or other similar expressions that predict or indicate future events or trends or that

are not statements of historical matters. We have based these forward-looking statements on our current expectations and projections

about future events. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of

financial and operational metrics; estimates and projections regarding future manufacturing capacity and plant performance; estimates

and projections of market opportunity and market share; estimates and projections of adjacent energy sector opportunities; Oklo’s

projected commercialization timeline; Oklo’s ability to demonstrate scientific and engineering feasibility of its technologies;

Oklo’s ability to attract, retain, and expand its future customer base; Oklo’s ability to timely and effectively meet construction

timelines and scale its production and manufacturing processes; Oklo’s ability to develop products and services and bring them

to market in a timely manner; Oklo’s ability to achieve a competitive levelized cost of electricity; Oklo’s ability to compete

successfully with fission energy products and solutions offered by other companies, including fusion, as well as with other sources of

clean energy; Oklo’s expectations concerning relationships with strategic partners, suppliers, governments, regulatory bodies and

other third parties; Oklo’s ability to maintain, protect, and enhance its intellectual property; future acquisitions, ventures

or investments in companies or products, services, or technologies; Oklo’s ability to attract and retain qualified employees; development

of favorable regulations and government incentives affecting the markets in which Oklo operates; Oklo’s expectations regarding

regulatory framework development; the potential for and timing of receipt of a license to operate nuclear facilities from the U.S. Nuclear

Regulatory Commission; the ability to achieve the results illustrated in the unit economics and the potential benefits of the proposed

transaction and expectations related to the terms and timing of the proposed transaction. These statements are based on various assumptions,

whether or not identified in this communication, and on the current expectations of Oklo’s and AltC’s management and are

not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended

to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events

and circumstances are beyond the control of Oklo and AltC. These forward-looking statements are subject to known and unknown risks, uncertainties

and assumptions about us that may cause our actual results, levels of activity, performance or achievements to be materially different

from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Such

risks and uncertainties include changes in domestic and foreign business, market, financial, political and legal conditions; the inability

of the parties to successfully or timely consummate the proposed transaction, including the risk that any required regulatory approvals

are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected

benefits of the proposed transaction or that the approval of the shareholders of AltC or Oklo is not obtained; the outcome of any legal

proceedings that may be instituted against Oklo or AltC following announcement of the proposed transaction; failure to realize the anticipated

benefits of the proposed transaction; risks relating to the uncertainty of the projected financial information with respect to Oklo;

the effects of competition; changes in applicable laws or regulations; the ability of Oklo to manage expenses and recruit and retain

key employees; the ability of AltC or the combined company to issue equity or equity-linked securities in connection with the proposed

transaction or in the future; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries;

and the impact of the global COVID-19 pandemic on Oklo, AltC, the combined company’s projected results of operations, financial

performance or other financial metrics, or on any of the foregoing risks; those factors discussed in AltC’s Quarterly Reports filed

by AltC with the SEC on Form 10-Q and the Annual Reports filed by AltC with the SEC on Form 10-K, in each case, under the heading “Risk

Factors,” as well as the factors summarized in this communication under “Risk Factors” and other documents filed, or

to be filed, with the SEC by AltC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ

materially from the results implied by these forward-looking statements. There may be additional risks that neither Oklo nor AltC presently

know or that Oklo and AltC currently believe are immaterial that could also cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements reflect Oklo’s and AltC’s expectations, plans or forecasts

of future events and views as of the date of this communication. Oklo and AltC anticipate that subsequent events and developments will

cause Oklo’s and AltC’s assessments to change. However, while Oklo and AltC may elect to update these forward- looking statements

at some point in the future, Oklo and AltC specifically disclaim any obligation to do so. These forward-looking statements should not

be relied upon as representing Oklo’s and AltC’s assessments as of any date subsequent to the date of this communication.

Accordingly, undue reliance should not be placed upon the forward-looking statements. An investment in AltC is not an investment in any

of our founders' or sponsors' past investments or companies or any funds affiliated with any of the foregoing. The historical results

of these investments are not indicative of future performance of AltC, which may differ materially from the performance of the founders

or sponsors past investments, companies or affiliated funds.

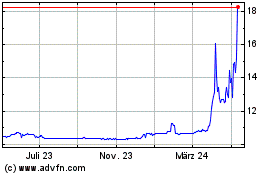

AltC Acquisition (NYSE:ALCC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

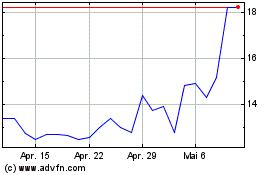

AltC Acquisition (NYSE:ALCC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024