0001865107FALSE12/3100018651072023-09-252023-09-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2023

a.k.a. Brands Holding Corp.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 001-40828 | 87-0970919 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

100 Montgomery Street, Suite 1600

San Francisco, California 94104

(Address of Principal Executive Offices, including Zip Code)

415-295-6085

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s): | | Name of each exchange on which registered: |

| Common Stock, par value $0.001 per share | | AKA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

| | | | | |

Item 3.03 | Material Modification to Rights of Security Holders. |

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

| | | | | |

Item 5.03 | Amendment to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On September 25, 2023, a.k.a. Brands Holding Corp. (the “Company”) filed a Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Company with the Secretary of State of the State of Delaware (the “Certificate of Amendment”) to affect a one-for-12 reverse stock split (the “Reverse Split”) of the shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”). The Certificate of Amendment will not decrease the number of authorized shares of Common Stock. No fractional shares of Common Stock will be issued as a result of the Reverse Split. Instead, in lieu of any fractional shares to which a stockholder of record would otherwise be entitled as a result of the Reverse Split, we will pay cash (without interest) equal to such fraction multiplied by the average of the closing sales prices of the Common Stock on the New York Stock Exchange (“NYSE”) during regular trading hours for the five consecutive trading days immediately preceding the effective date of the Reverse Split (with such average closing sales prices being adjusted to give effect to the Reverse Split).The number of any outstanding awards, the exercise price per share of outstanding stock options and other terms of outstanding awards issued are automatically adjusted to reflect the effects of the Reverse Split. The Reverse Split impacts all holders of the Common Stock proportionally and does not impact any stockholder’s percentage ownership of Common Stock (except to the extent the Reverse Split results in any stockholder owning fractional shares).

The Reverse Split will become effective at 5:01 PM Eastern Time on September 29, 2023, after the close of trading on the NYSE. The Common Stock will begin trading on a Reverse Split-adjusted basis on the NYSE when the market opens on October 2, 2023. The trading symbol for the Common Stock will remain “AKA.” The Common Stock was assigned a new CUSIP number (00152K200) following the Reverse Split.

The foregoing description of the Certificate of Amendment does not purport to be complete and is qualified in its entirety by reference to the Certificate of Amendment, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| | | | | |

Item 7.01 | Regulation FD Disclosure. |

On September 29, 2023, the Company issued a press release announcing the effectiveness of the Reverse Split. The press release is attached as Exhibit 99.1 hereto and is hereby incorporated herein by reference.

The information furnished with this report under this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such a filing.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 3.1 | |

| 99.1 | |

| 104 | Cover page interactive data file (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | a.k.a. Brands Holding Corp. |

| | | |

| Date: September 29, 2023 | By: | /s/ Ciaran Long |

| | Name: | Ciaran Long |

| | Title: | Interim Chief Executive Officer and Chief Financial Officer |

CERTIFICATE OF AMENDMENT TO THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF A.K.A. BRANDS HOLDING CORP.

a.k.a. Brands Holding Corp. (the “Corporation”), a corporation organized and existing under the General Corporation Law of the State of Delaware (the “General Corporation Law”), DOES HEREBY CERTIFY:

First: The name of the corporation is a.k.a. Brands Holding Corp.

Second: The date on which the Certificate of Incorporation of the Corporation was originally filed with the Secretary of State of the State of Delaware is May 19, 2021, under the name of a.k.a. Brands Holding Corp.

Third: That Article Four of the Amended and Restated Certificate of the Corporation (the “Certificate of Incorporation”), is hereby amended by deleting Section 1 in its entirety and inserting the following in lieu thereof:

The total number of shares of all classes of stock that the Corporation is authorized to issue is five hundred and fifty million (550,000,000), consisting of (i) five hundred million (500,000,000) shares of Common Stock, with a par value of $0.001 per share; and (iii) fifty million (50,000,000) shares of preferred stock, with a par value of $0.001 per share (the “Preferred Stock”). Upon this Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Corporation (this “Certificate of Amendment”) becoming effective pursuant to the General Corporation Law (the “Effective Time”), the shares of Common Stock issued and outstanding or held in treasury immediately prior to the Effective Time (the “Existing Common Stock”) shall be reclassified and combined into a different number of shares of Common Stock (the “New Common Stock”) such that each five (5) to fifty (50) shares of Existing Common Stock shall, at the Effective Time, be automatically reclassified and combined into one share of New Common Stock, with the exact ratio within the foregoing ranges to be determined by the Board of Directors in its sole discretion and publicly announced by the Corporation prior to the Effective Time (such reclassification and combination of shares, the “Reverse Split”). The par value of the Common Stock following the Reverse Split shall remain at $0.001 per share for the Common Stock. No fractional shares of Common Stock shall be issued as a result of the Reverse Split and, in lieu thereof, upon receipt after the Effective Time by the exchange agent selected by the Corporation of a properly completed and duly executed transmittal letter, any stockholder who would otherwise be entitled to a fractional share of New Common Stock as a result of the Reverse Split, following the Effective Time (after taking into account all fractional shares of New Common Stock otherwise issuable to such stockholder), shall be entitled to receive a cash payment (without interest) equal to the fractional share of New Common Stock to which such stockholder would otherwise be entitled multiplied by the average of the closing sales price of a share of the Common Stock (as adjusted to give effect to the Reverse Split) on the New York Stock Exchange during regular trading hours for the five (5) consecutive trading days immediately preceding the Effective Time. The Reverse Split shall be effected on a record holder-record holder basis, such that any fractional shares of New Common Stock resulting from the Reverse Split and held by a single record holder shall be aggregated.

The Preferred Stock and the Common Stock shall have the designations, rights, powers and preferences and the qualifications, restrictions and limitations thereof, if any, set forth below.

Fourth: The foregoing amendment was duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

Fifth: That this Certificate of Amendment to the Restated Certificate of Incorporation shall be effective as of 5:01 p.m. New York City time on the 29th day of September 2023.

* * *

IN WITNESS WHEREOF, this Corporation has caused this Certificate of Amendment to Amended and Restated Certificate of Incorporation to be signed by its Interim Chief Executive Officer and Chief Financial Officer this 25th day of September 2023.

| | | | | | | | |

| | a.k.a. Brands Holding Corp. |

| | | |

| By: | /s/ Ciaran Long |

| | Name: | Ciaran Long |

| | Title: | Interim Chief Executive Officer and Chief Financial Officer |

a.k.a. Brands Holding Corp. Announces Effectiveness of Previously Announced Reverse Stock Split

SAN FRANCISCO – September 29, 2023 – a.k.a. Brands Holding Corp. (NYSE: AKA), a brand accelerator of next generation fashion brands, today announced the effectiveness of the reverse stock split contemplated by the certificate of amendment (the “Amendment”) to its amended and restated certificate of incorporation previously filed with the Secretary of State of the State of Delaware that will effect a one-for-12 reverse stock split of its common stock, par value $0.001 per share (“common stock”). The Amendment provides that the reverse stock split will become effective at 5:01 PM Eastern Time today, after the close of trading on the New York Stock Exchange (the “NYSE”). On October 2, 2023, the common stock will begin trading on a post-reverse stock split basis on the NYSE under the existing symbol “AKA.”

About a.k.a. Brands

a.k.a. Brands is a brand accelerator of next generation fashion brands. Each brand in the a.k.a. portfolio targets a distinct Gen Z and millennial audience, creates authentic and inspiring social content and offers quality exclusive merchandise. a.k.a. Brands leverages its next-generation retail platform to help each brand accelerate its growth, scale in new markets and enhance its profitability. Current brands in the a.k.a. Brands portfolio include Princess Polly, Culture Kings, mnml and Petal & Pup.

For additional information, please visit: https://aka-brands.com/.

Forward-Looking Statements

Certain statements made in this release are “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements include statements related to our financial and operational results for the second quarter and long-term expectations, as well as our brands’ omnichannel expansion initiatives.

These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements.

Important factors, among others, that may affect actual results or outcomes include the effects of economic downturns and unstable market conditions; our ability to regain compliance with the NYSE minimum share price requirement within the applicable cure period; our ability in the future to comply with the NYSE listing standards and maintain the listing of our common stock on the NYSE; risks related to doing business in China; our ability to anticipate rapidly-changing consumer preferences in the apparel, footwear and accessories industries; our ability to acquire new customers, retain existing customers or maintain average order value levels; the effectiveness of our marketing and our level of customer traffic; merchandise return rates; our ability to manage our inventory effectively; our success in identifying brands to acquire, integrate and manage on our platform; our ability to expand into new markets; the global nature of our business; interruptions in or increased costs of shipping and distribution, which could affect our ability to deliver our products to the market; our use of social media platforms and influencer sponsorship initiatives, which could adversely affect our reputation or subject us to fines or other penalties; fluctuating operating results; the inherent challenges in measuring certain of our key operating metrics, and the risk that real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business; the potential for tax liabilities that may increase the costs to our consumers; our ability to attract and retain highly qualified personnel, including key members of our leadership team; fluctuations in wage rates and the price, availability and quality of raw materials and

finished goods, which could increase costs; foreign currency fluctuations; and other risks and uncertainties set forth in the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Forward-Looking Statements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, quarterly reports on Form 10-Q and any other periodic reports that the Company may file with the Securities and Exchange Commission (the “SEC”). a.k.a. Brands does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Investor Contact

investors@aka-brands.com

Media Contact

media@aka-brands.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

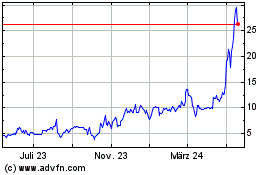

aka Brands (NYSE:AKA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

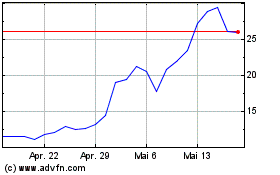

aka Brands (NYSE:AKA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024