Blackstone Real Estate Completes Privatization of AIR Communities for Approximately $10 Billion

28 Juni 2024 - 4:47PM

Business Wire

Blackstone (NYSE: BX) and Apartment Income REIT Corp. (“AIR

Communities” or the “Company”) today announced that Blackstone Real

Estate Partners X (“Blackstone”) has completed its previously

announced acquisition of all outstanding common shares of AIR

Communities for $39.12 per share in an all-cash transaction valued

at approximately $10 billion, including the assumption of debt.

BofA Securities, Barclays, BMO Capital Markets Corp., Deutsche

Bank Securities Inc., Goldman Sachs & Co. LLC, J.P. Morgan

Securities LLC, Morgan Stanley & Co. LLC, SG Americas

Securities, LLC and Wells Fargo acted as Blackstone’s financial

advisors, and Simpson Thacher & Bartlett LLP served as

Blackstone’s legal counsel.

Citigroup Global Markets Inc. acted as AIR Communities’

financial advisor, and Skadden, Arps, Slate, Meagher & Flom LLP

served as AIR Communities’ legal counsel.

The transaction was announced on April 8, 2024.

About Apartment Income REIT Corp. (AIR Communities)

Apartment Income REIT Corp’s portfolio comprises 77 communities

totaling 27,385 apartment homes located in 10 states and the

District of Columbia. AIR offers a simple, predictable business

model with focus on what we call the AIR Edge, the cumulative

result of our focus on resident selection, satisfaction, and

retention, as well as relentless innovation in delivering

best-in-class property management. The AIR Edge is a durable

operating advantage in driving organic growth, as well as making

possible the opportunity for excess returns for properties new to

AIR’s platform. For additional information, please visit

aircommunities.com.

About Blackstone Real Estate

Blackstone is a global leader in real estate investing.

Blackstone’s real estate business was founded in 1991 and has US

$339 billion of investor capital under management. Blackstone is

the largest owner of commercial real estate globally, owning and

operating assets across every major geography and sector, including

logistics, residential, office, hospitality and retail. Our

opportunistic funds seek to acquire undermanaged, well-located

assets across the world. Blackstone’s Core+ business invests in

substantially stabilized real estate assets globally, through both

institutional strategies and strategies tailored for income-focused

individual investors including Blackstone Real Estate Income Trust,

Inc. (BREIT), a U.S. non-listed REIT. Blackstone Real Estate also

operates one of the leading global real estate debt businesses,

providing comprehensive financing solutions across the capital

structure and risk spectrum, including management of Blackstone

Mortgage Trust (NYSE: BXMT).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240627119554/en/

Media Contacts AIR Communities: Matthew O’Grady,

Executive Vice President, Capital Markets (303) 691-4566

matthew.ogrady@aircommunities.com Blackstone: Jeffrey Kauth

Jeffrey.Kauth@Blackstone.com

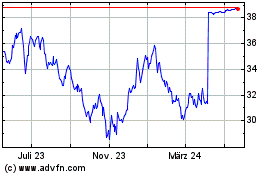

Apartment Income REIT (NYSE:AIRC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

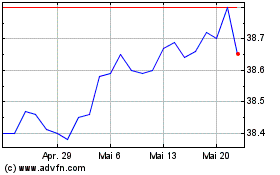

Apartment Income REIT (NYSE:AIRC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025