FALSE000170305600017030562023-10-022023-10-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | | | | |

| | |

| FORM 8-K | |

| | |

| CURRENT REPORT | |

| | |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported): October 2, 2023 | | | | | | | | |

| | |

| | |

| ADT Inc. | |

| (Exact name of registrant as specified in its charter) |

| | |

| | | | | | | | |

| Delaware | 001-38352 | 47-4116383 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

| 1501 Yamato Road Boca Raton, Florida 33431 | |

| (Address of principal executive offices) | |

(561) 988-3600

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | ADT | | New York Stock Exchange |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.01 Completion of Acquisition or Disposition of Assets.

As previously disclosed on a Current Report on Form 8-K filed with the Securities and Exchange Commission by ADT Inc., a Delaware corporation (“ADT” or the “Company”) on August 8, 2023, ADT entered into an Equity Purchase Agreement (the “Commercial Purchase Agreement”) dated as of August 7, 2023 with Iris Buyer LLC, a Delaware limited liability company and affiliate of GTCR LLC (“GTCR”), and, solely for certain purposes set forth in the Commercial Purchase Agreement, Fire & Security Holdings, LLC (“F&S Holdings”), a Delaware limited liability company and an indirect, wholly owned subsidiary of ADT, pursuant to which GTCR agreed to purchase all of the issued and outstanding equity interests of F&S Holdings (the “Commercial Transaction”), which directly or indirectly held all of the issued and outstanding equity interests in the subsidiaries of ADT that operated ADT’s Commercial business (the “Commercial Business”).

On October 2, 2023, and pursuant to the Commercial Purchase Agreement, GTCR acquired all of the issued and outstanding equity interests of F&S Holdings (the “Commercial Divestiture”). The gross purchase price was $1,612.5 million in cash, subject to certain customary adjustments as set forth in the Commercial Purchase Agreement.

The unaudited pro forma condensed consolidated statements of operations for ADT for the six months ended June 30, 2023, as well as the years ended December 31, 2022, 2021 and 2020, and an unaudited pro forma condensed consolidated balance sheet as of June 30, 2023, in each case giving effect to the Commercial Divestiture, is attached hereto as Exhibit 99.2.

The foregoing description of the Commercial Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Commercial Purchase Agreement, a copy of which was filed as Exhibit 2.1 to the Company's Form 8-K filed on August 8, 2023 and is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Concurrent with the closing of the Commercial Divestiture on October 2, 2023, Mr. Daniel M. Bresingham, Executive Vice President, Commercial, resigned from his position as an executive officer of the Company.

Item 7.01 Regulation FD Disclosure.

On October 2, 2023, ADT issued a press release announcing the completion of the Commercial Divestiture. A copy of the press release is attached hereto as Exhibit 99.1.

The information contained in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(b) Pro forma financial information.

The following unaudited pro forma financial information of ADT, giving effect to the Commercial Divestiture, is attached hereto as Exhibit 99.2:

•Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2023;

•Unaudited Pro Forma Condensed Consolidated Statement of Operations for the Six Months Ended June 30, 2023; and

•Unaudited Pro Forma Condensed Consolidated Statements of Operations for the Years Ended December 31, 2022, 2021, and 2020.

| | | | | |

| Exhibit | Description |

| |

| |

| |

| |

| |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | October 2, 2023 | ADT Inc. |

| | | |

| | By: | /s/ Richard Mattessich |

| | | Richard Mattessich |

| | | Vice President and Deputy General Counsel, Corporate & Securities |

ADT Completes Sale of Commercial Business

BOCA RATON, Fla., Oct. 2, 2023 – ADT Inc. (NYSE: ADT), the most trusted brand in smart home and small business security, today completed the previously announced divestiture of its commercial security, fire, and life safety business unit to GTCR, a leading private equity firm, for a purchase price of $1.6 billion, subject to customary purchase price adjustments.

The net proceeds of approximately $1.5 billion significantly reduced the Company’s net debt and leverage upon today’s closing. All net proceeds will be used for debt redemptions and repayments, expected to occur during the current quarter.

As previously announced, the commercial business unit will be reported as discontinued operations beginning in the third quarter of 2023 for current and historical periods. The Company will provide further information as part of its upcoming third quarter 2023 earnings conference call.

About ADT Inc.

ADT provides safe, smart and sustainable solutions for people, homes and small businesses. Through innovative offerings, unrivaled safety, and a premium customer experience, all delivered by the largest network of smart home security and rooftop solar professionals in the U.S., we empower people to protect and connect to what matters most. For more information, visit www.adt.com.

ADT contacts:

Elizabeth Landers

Investor Relations

elizabethlanders@adt.com

888-238-8525

Paul Wiseman

Media Relations

paulwiseman@adt.com

561-356-6388

Forward-looking statements

ADT has made statements in this press release that are forward-looking and therefore subject to risks and uncertainties, including those described below. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to,

among other things, the transaction between ADT and GTCR, and the benefits and synergies of the transaction; the Company’s ability to reduce debt or improve leverage ratios, or to achieve or maintain its long-term leverage goals; the Company’s financial results and guidance metrics taking into account the impact of the transaction; any stated or implied outcomes with regards to the foregoing; and other matters. Without limiting the generality of the preceding sentences, any time the Company uses the words “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and, in each case, their negative or other various or comparable terminology, and similar expressions, the Company intends to clearly express that the information deals with possible future events and is forward-looking in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. ADT cautions that these statements are subject to risks and uncertainties, many of which are outside of ADT’s control, and could cause future events or results to be materially different from those stated or implied in this document, including among others, factors relating to the effect of the announcement of the transaction on ADT’s ability to retain and hire key personnel and to maintain relationships with customers, suppliers and other business partners; risks related to diverting management’s attention from ADT’s ongoing business operations; uncertainties as to ADT’s ability and the amount of time necessary to realize the expected benefits of the transaction; risks to the Company’s ability to pay down a sufficient amount of debt to achieve a desired leverage ratio and to the Company’s ability to continue its operations without having to increase its debt level in the future; risks to the Company achieving any financial benefit or improved guidance metrics taking into account the impact of the transaction; and risks that are described in the Company’s Amended Annual Report, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the SEC, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. Any forward-looking statement made in this press release speaks only as of the date on which it is made. ADT undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Unaudited Pro Forma Financial Information Overview On October 2, 2023, ADT Inc. (“ADT” or the “Company”) completed the previously announced divestiture of all of the issued and outstanding equity interests of Fire & Security Holdings, LLC (“F&S Holdings”), an indirect, wholly owned subsidiary of ADT which directly or indirectly held all of the issued and outstanding equity interests in the subsidiaries of ADT that operated ADT’s commercial business (the “Commercial Business”), to Iris Buyer LLC, an affiliate of GTCR LLC (the “Commercial Divestiture,” or the “Transaction”), pursuant to the terms and subject to the conditions set forth in the Equity Purchase Agreement, dated August 7, 2023 (the “Commercial Purchase Agreement”), among ADT, Iris Buyer LLC, and, solely for certain purposes set forth therein, F&S Holdings. The Commercial Divestiture represents a strategic shift for the Company, and therefore, the Company will report the results of the Commercial Business as discontinued operations for the current and historical periods in the Company’s consolidated financial statements beginning in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023. The Company intends to use the majority of the net proceeds from the Transaction to partially redeem the Company’s (i) first lien term loan facility due 2026 (the “First Lien Term Loan due 2026”) and (ii) 5.250% First- Priority Senior Secured Notes due 2024 (the “First Lien Notes due 2024”). Unaudited Pro Forma Condensed Consolidated Financial Information The following unaudited pro forma condensed consolidated financial statements were derived from the historical unaudited condensed consolidated financial statements of ADT included in its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, as well as the historical consolidated financial statements of ADT included in its Annual Reports on Form 10-K for the years ended December 31, 2022 (as amended), December 31, 2021, and December 31, 2020, and should be read in conjunction with such reports. In addition, the unaudited pro forma condensed consolidated financial statements presented herein are: • prepared in accordance with Article 11 of Regulation S-X; • presented to give effect to the unaudited pro forma condensed consolidated balance sheet as of June 30, 2023 as if the completion of the Commercial Divestiture occurred as of such date; • presented to give effect to the unaudited pro forma condensed consolidated statements of operations for the six months ended June 30, 2023 and the year ended December 31, 2022 as if the completion of the Commercial Divestiture occurred as of January 1, 2022, including the impact of other transaction adjustments; • presented to give effect to the classification of the Commercial Business as discontinued operations for all periods presented; and • accompanied by notes that further describe the pro forma adjustments which are based upon estimates using available information and assumptions that management believes are reasonable under the circumstances to give effect, on a pro forma basis, to the Commercial Divestiture. These unaudited pro forma condensed consolidated financial statements are for informational purposes only and are not indicative of the Company’s actual financial condition or results of operations had the completion of the Commercial Divestiture occurred as of and for the periods presented. Additionally, these unaudited pro forma condensed consolidated financial statements do not include any autonomous entity adjustments, management adjustments, or adjustments to reflect potential synergies that may be achievable, or dis-synergy costs that may occur, in connection with the Commercial Divestiture. Actual amounts may differ materially from these estimates. Exhibit 99.2 1

(in millions) June 30, 2023 Historical Commercial Divestiture Note 1 Note Use of Proceeds Note 2 Note Other Transaction Adjustments Note Pro Forma Assets Current assets: Cash and cash equivalents $ 146 $ — $ 45 $ — $ 191 Restricted cash and restricted cash equivalents 114 — — — 114 Accounts receivable, net of allowance for credit losses 622 (266) — — 356 Inventories, net 308 (104) — — 204 Work-in-progress 63 (55) — — 8 Prepaid expenses and other current assets 302 (36) — — 266 Total current assets 1,555 (460) 45 — 1,139 Property and equipment, net 341 (69) — — 272 Subscriber system assets, net 3,103 (137) — — 2,966 Intangible assets, net 5,004 (153) — — 4,851 Goodwill 5,344 (337) — — 5,008 Deferred subscriber acquisition costs, net 1,169 (90) — — 1,079 Other assets 818 (81) — — 737 Total assets $ 17,334 $ (1,327) $ 45 $ — $ 16,052 Liabilities and stockholders' equity Current liabilities: Current maturities of long-term debt $ 836 $ (26) $ (198) $ — $ 612 Accounts payable 375 (63) — — 312 Deferred revenue 386 (110) — — 276 Accrued expenses and other current liabilities 722 (95) — 42 [4, 6] 669 Total current liabilities 2,319 (293) (198) 42 1,870 Long-term debt 8,835 (45) (1,300) — 7,489 Deferred subscriber acquisition revenue 1,826 (64) — — 1,763 Deferred tax liabilities 764 — — 223 [4] 987 Other liabilities 273 — — — 273 Total liabilities 14,016 (402) (1,499) 266 12,381 Total stockholders' equity 3,318 (925) [3] 1,543 [3] (266) [4, 6] 3,671 Total liabilities and stockholders' equity $ 17,334 $ (1,327) $ 45 $ — $ 16,052 Note: Amounts may not sum due to rounding. See Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) ADT Inc. Pro Forma Condensed Consolidated Balance Sheet (Unaudited) 2

(in millions, except per share data) Six Months Ended June 30, 2023 Historical Commercial Divestiture Note 1 Use of Proceeds Note Other Transaction Adjustments Note Pro Forma Revenue: Monitoring and related services $ 2,360 $ (288) $ — $ — $ 2,072 Security installation, product, and other 623 (394) — — 229 Solar installation, product, and other 222 — — — 222 Total revenue 3,205 (683) — — 2,523 Cost of revenue (exclusive of depreciation and amortization shown separately below): Monitoring and related services 471 (167) — — 304 Security installation, product, and other 363 (288) — — 75 Solar installation, product, and other 163 — — — 163 Total cost of revenue 998 (455) — — 543 Selling, general, and administrative expenses 904 (141) — — 763 Depreciation and intangible asset amortization 729 (41) — — 688 Merger, restructuring, integration, and other 36 (10) — — 26 Goodwill impairment 423 — — — 423 Operating income (loss) 116 (36) — — 80 Interest expense, net (256) 1 57 [8] — (198) Other income (expense) (1) — — 18 [7] 17 Income (loss) before income taxes and equity in net earnings (losses) of equity method investee (140) (36) 57 18 (101) Income tax benefit (expense) 118 (46) (15) [5] (5) [5] 53 Income (loss) before equity in net earnings (losses) of equity method investee (22) (82) 42 13 (48) Equity in net earnings (losses) of equity method investee (4) — — — (4) Net income (loss) $ (27) $ (82) $ 42 $ 13 $ (53) Net income (loss) per share - basic: Common Stock $ (0.03) $ (0.06) Class B Common Stock $ (0.03) $ (0.06) Weighted-average shares outstanding - basic: Common Stock 856 856 Class B Common Stock 55 55 Net income (loss) per share - diluted: Common Stock $ (0.03) $ (0.06) Class B Common Stock $ (0.03) $ (0.06) Weighted-average shares outstanding - diluted: Common Stock 856 856 Class B Common Stock 55 55 Note: Amounts may not sum due to rounding. See Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) ADT Inc. Pro Forma Condensed Consolidated Statement of Operations (Unaudited) 3

(in millions, except per share data) Year Ended December 31, 2022 Historical Commercial Divestiture Note 1 Use of Proceeds Note Other Transaction Adjustments Note Pro Forma Revenue: Monitoring and related services $ 4,589 $ (536) $ — $ — $ 4,053 Security installation, product, and other 1,020 (691) — — 329 Solar installation, product, and other 786 — — — 786 Total revenue 6,395 (1,227) — — 5,168 Cost of revenue (exclusive of depreciation and amortization shown separately below): Monitoring and related services 918 (321) — — 597 Security installation, product, and other 620 (518) — — 102 Solar installation, product, and other 502 — — — 502 Total cost of revenue 2,040 (839) — — 1,200 Selling, general, and administrative expenses 1,930 (267) — 1,663 Depreciation and intangible asset amortization 1,694 (78) — — 1,616 Merger, restructuring, integration, and other 22 (5) — 8 [6] 25 Goodwill impairment 201 — — — 201 Operating income (loss) 509 (38) — (8) 463 Interest expense, net (265) 1 76 [8] (34) [8] (222) Loss on extinguishment of debt — — (19) [2] — (19) Other income (expense) (58) — — 46 [7] (11) Income (loss) before income taxes and equity in net earnings (losses) of equity method investee 186 (37) 57 4 210 Income tax benefit (expense) (49) 11 (15) [5] (1) [5] (53) Income (loss) before equity in net earnings (losses) of equity method investee 137 (26) 42 3 157 Equity in net earnings (losses) of equity method investee (5) — — — (5) Net income (loss) $ 133 $ (26) $ 42 $ 3 $ 152 Net income (loss) per share - basic: Common Stock $ 0.15 $ 0.17 Class B Common Stock $ 0.15 $ 0.17 Weighted-average shares outstanding - basic: Common Stock 848 848 Class B Common Stock 55 55 Net income (loss) per share - diluted: Common Stock $ 0.15 $ 0.17 Class B Common Stock $ 0.15 $ 0.17 Weighted-average shares outstanding - diluted: Common Stock 915 915 Class B Common Stock 55 55 Note: Amounts may not sum due to rounding. See Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) ADT Inc. Pro Forma Condensed Consolidated Statement of Operations (Unaudited) 4

(in millions, except per share data) Year Ended December 31, 2021 Historical Commercial Divestiture Note 1 Pro Forma Revenue: Monitoring and related services $ 4,348 $ (465) $ 3,882 Security installation, product, and other 912 (639) 273 Solar installation, product, and other 47 — 47 Total revenue 5,307 (1,104) 4,203 Cost of revenue (exclusive of depreciation and amortization shown separately below): Monitoring and related services 913 (284) 629 Security installation, product, and other 602 (494) 109 Solar installation, product, and other 35 — 35 Total cost of revenue 1,550 (777) 773 Selling, general, and administrative expenses 1,789 (248) 1,541 Depreciation and intangible asset amortization 1,915 (75) 1,840 Merger, restructuring, integration, and other 38 1 39 Operating income (loss) 15 (5) 10 Interest expense, net (458) 1 (457) Loss on extinguishment of debt (37) — (37) Other income (expense) 8 — 8 Income (loss) before income taxes (471) (5) (476) Income tax benefit (expense) 130 1 132 Net income (loss) $ (341) $ (3) $ (344) Net income (loss) per share - basic: Common Stock $ (0.41) $ (0.42) Class B Common Stock $ (0.41) $ (0.42) Weighted-average shares outstanding - basic: Common Stock 771 771 Class B Common Stock 55 55 Net income (loss) per share - diluted: Common Stock $ (0.41) $ (0.42) Class B Common Stock $ (0.41) $ (0.42) Weighted-average shares outstanding - diluted: Common Stock 771 771 Class B Common Stock 55 55 Note: Amounts may not sum due to rounding. See Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) ADT Inc. Pro Forma Condensed Consolidated Statement of Operations (Unaudited) 5

(in millions, except per share data) Year Ended December 31, 2020 Historical Commercial Divestiture Note 1 Pro Forma Revenue: Monitoring and related services $ 4,187 $ (419) $ 3,768 Security installation, product, and other 1,128 (563) 565 Total revenue 5,315 (982) 4,333 Cost of revenue (exclusive of depreciation and amortization shown separately below): Monitoring and related services 790 (246) 544 Security installation, product, and other 727 (447) 280 Total cost of revenue 1,517 (693) 824 Selling, general, and administrative expenses 1,724 (255) 1,468 Depreciation and intangible asset amortization 1,914 (68) 1,846 Merger, restructuring, integration, and other 120 (3) 117 Operating income (loss) 41 38 78 Interest expense, net (708) 1 (708) Loss on extinguishment of debt (120) — (120) Other income (expense) 8 — 8 Income (loss) before income taxes (779) 38 (741) Income tax benefit (expense) 147 (9) 138 Net income (loss) $ (632) $ 29 $ (603) Net income (loss) per share - basic: Common Stock $ (0.82) $ (0.78) Class B Common Stock $ (0.72) $ (0.68) Weighted-average shares outstanding - basic: Common Stock 760 760 Class B Common Stock 16 16 Net income (loss) per share - diluted: Common Stock $ (0.82) $ (0.78) Class B Common Stock $ (0.74) $ (0.70) Weighted-average shares outstanding - diluted: Common Stock 760 760 Class B Common Stock 18 18 Note: Amounts may not sum due to rounding. See Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) ADT Inc. Pro Forma Condensed Consolidated Statement of Operations (Unaudited) 6

Commercial Business Discontinued Operations Note 1. The Commercial Divestiture reflects the Company’s current best estimate of the assets, liabilities, stockholders’ equity, revenue, and expenses of the Commercial Business prepared in accordance with discontinued operations guidance set forth in Accounting Standards Codification (“ASC”) 205. Furthermore, an allocated portion of historical income tax expense has been attributed to the Commercial Divestiture discontinued operations for each of the periods. The amounts are considered preliminary, and as such, actual results could materially differ from these estimates. Use of Proceeds and Other Transaction Adjustments Note 2. This adjustment reflects the estimated impact on the Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2023, of the portion of the $1,563 million net cash proceeds from the Commercial Divestiture to be used for the partial redemptions of (i) $1,318 million of the Company’s First Lien Term Loan due 2026 and (ii) $200 million of the Company’s First Lien Notes due 2024. As a result of these debt repayments, the Company reflected a loss on extinguishment of debt of $19 million related to the write-off of debt discounts and debt issuance costs in the Unaudited Pro Forma Condensed Consolidated Statement of Operations for the year ended December 31, 2022. In accordance with the Commercial Purchase Agreement, the purchase price to be paid to ADT in connection with the Transaction is subject to certain customary adjustments following the closing of the Transaction. Note 3. This adjustment reflects the estimated pre-tax gain of $661 million which is included in total stockholders’ equity on the Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2023, as a result of the completion of the Transaction. The gain is the result of the difference between the net estimated proceeds of $1,563 million and the historical net carrying value of the Commercial Business of $925 million, less excluded liabilities of $23 million. The estimated pre-tax gain reflected herein is based on the net carrying value of the Commercial Business as of June 30, 2023. As a result, these estimates may materially differ from the actual pre-tax gain on the Transaction recorded as of the closing date of the Transaction. Note 4. The Commercial Divestiture is structured as an asset sale for income tax purposes. Accordingly, an estimated $21 million of an adjustment to the net deferred tax liabilities associated with the Commercial Business will reverse through the gain on the Transaction for the Company. The gain on the Transaction will result in an estimated $236 million of tax expense. The Company estimates that a federally tax effected gain of $182 million will be offset by net operating and capital loss carryforwards, which is reflected as an increase to net deferred tax liabilities. In addition, the Company estimates a state tax effected gain of approximately $54 million resulting from the Transaction. This gain is partially offset by state net operating loss carryforwards of approximately $20 million, which is reflected as an increase to net deferred tax liabilities, resulting in a state income tax payable of approximately $34 million, which is reflected as an adjustment to accrued expenses and other current liabilities in the Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2023. ADT Inc. Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) 7

Note 5. This adjustment reflects the income tax effects of the adjustments described herein using enacted statutory rates applicable in each period in which pre-tax adjustments were made. Note 6. This adjustment reflects approximately $8 million as an adjustment to accrued expenses and other current liabilities in the Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2023 related to the estimated impact of transaction costs such as legal and accounting fees incurred to effect the Transaction that are not already reflected in historical results. Total transaction costs incurred as of the close of the Transaction were approximately $16 million. These costs are primarily related to legal, tax, accounting, and other professional services incurred to effect the Transaction that are not expected to recur. As of June 30, 2023, approximately $8 million of such costs were already incurred and included as part of historical results. Note 7. In connection with the Transaction, the Company entered into a Transition Services Agreement (the “TSA”), pursuant to which the Company will provide certain transitional services such as information technology, supply chain, and other administrative and customer care support functions to the Commercial Business for a transitional period of up to 24 months after the closing of the Transaction. This adjustment reflects the estimated TSA income during the initial TSA period as if the Transaction occurred on January 1, 2022. Such amounts are calculated based on management’s best estimates of hours worked on a monthly basis as well as certain third-party costs identified in connection with providing such services. Note 8. The adjustment for the use of proceeds reflects the reversal of the historical interest expense incurred associated with the partial redemptions of the First Lien Term Loan due 2026 and First Lien Notes due 2024, as discussed in Note 2. In addition, the Unaudited Pro Forma Condensed Consolidated Statement of Operations for the year ended December 31, 2022, includes approximately $34 million related to the accelerated write-off to interest expense of accumulated other comprehensive income associated with historical losses related to certain interest rate swaps when the Company previously applied hedge accounting for which the cash flows are probable of not occurring as a result of the partial redemption of the Company’s First Lien Term Loan due 2026. ADT Inc. Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) 8

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

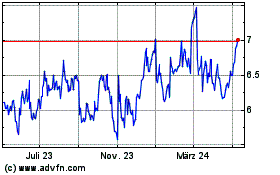

ADT (NYSE:ADT)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

ADT (NYSE:ADT)

Historical Stock Chart

Von Mai 2023 bis Mai 2024