Crédit Agricole CIB Acted as Joint Bookrunner & Sole Sustainability Agent on Hyundai Capital America’s Inaugural Green Bond Issuance

07 Juli 2023 - 4:00PM

Business Wire

Crédit Agricole CIB assisted Hyundai Capital America on

preparing its Green Finance Framework and inaugural Green Bond

issuance, a $750mm 2-year senior unsecured note as part of a $3bn

multi-tranche offering. The transaction is intended to support

Hyundai Capital America’s zero-emission* vehicle expansion and

actively contribute to Hyundai Motor Group’s commitment to be

carbon neutral across operations by 2045.

The Green Bond issuance provides for an amount equal to the net

proceeds to be allocated to certain eligible green projects,

including:

- Loans and other financial services for customers and dealers

for purchasing, leasing and trading-in the following types of

zero-emission vehicles:

- Battery Electric Vehicles (BEV)

- Fuel Cell Electric Vehicles (FCEV) running on low-carbon fuels

such as hydrogen

- Other future vehicles with zero tailpipe emissions

- Financing and operation of programs that increase consumer

access to zero-emission vehicles listed above, such as Hyundai

Evolve+

- Financing of projects related to the installation of vehicle

charging infrastructure

“Crédit Agricole CIB was proud and honored to have partnered

with Hyundai Capital America on its inaugural Green Bond offering

as a Joint Bookrunner and Sole Sustainability Agent on its Green

Finance Framework. The strong price tension we achieved was a

testament to the investor community’s support for HCA and Hyundai

Motor Group’s vision for a sustainable future,” says Sherry Xu,

Director, Debt Capital Markets at Crédit Agricole CIB.

Hyundai Capital America (“HCA”) is the oldest and largest

automotive finance subsidiary of Hyundai Motor Group (“HMG”).

Founded in 1989 and based in Irvine, CA, HCA is a top 10 U.S. auto

finance company supporting Hyundai, Kia and Genesis vehicle sales

in the United States through a full spectrum of financing solutions

for vehicle customers and dealers. HCA is 80% owned by Hyundai

Motor America (a subsidiary of Hyundai Motor Company “HMC”), and

20% owned by Kia America, Inc. (a subsidiary of Kia Corporation

“KC”).

*as defined in Hyundai Capital America’s Green Finance

Framework

About Crédit Agricole Corporate and Investment Bank (Crédit

Agricole CIB)

Crédit Agricole CIB is the corporate and investment banking arm

of Credit Agricole Group, the 10th largest banking group worldwide

in terms of balance sheet size (The Banker, July 2022). More than

8,900 employees across Europe, the Americas, Asia-Pacific, the

Middle East and Africa support the Bank's clients, meeting their

financial needs throughout the world. Crédit Agricole CIB offers

its large corporate and institutional clients a range of products

and services in capital markets activities, investment banking,

structured finance, commercial banking and international trade. The

Bank is a pioneer in the area of climate finance, and is currently

a market leader in this segment with a complete offer for all its

clients.

For many years Crédit Agricole CIB has been committed to

sustainable development. The Bank was the first French bank to sign

the Equator Principles in 2003. It has also been a pioneer in Green

Bond markets with the arrangement of public transactions from 2012

for a wide array of issuers (supranational banks, corporates, local

authorities, banks) and was one of the co-drafter of Green Bond

Principles and of the Social Bond Guidance. Relying on the

expertise of a dedicated sustainable banking team and on the strong

support of all bankers, Crédit Agricole CIB is one of the most

active banks in the Green Bond market.

For more information, please visit www.ca-cib.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230629343187/en/

Crédit Agricole Corporate and Investment Bank

Jenna Lee Head of Communications for the Americas Email:

jenna.lee@ca-cib.com Tel: +1 212 261 7328

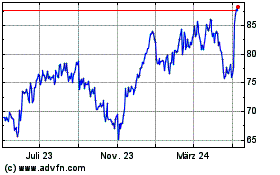

Arcosa (NYSE:ACA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

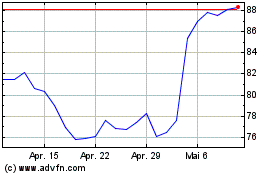

Arcosa (NYSE:ACA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025