Current Report Filing (8-k)

22 November 2022 - 1:06PM

Edgar (US Regulatory)

0000825313false00008253132022-11-222022-11-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 22, 2022

ALLIANCEBERNSTEIN HOLDING L.P.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-09818 | 13-3434400 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

501 Commerce Street, Nashville, TN 37023

(Address of principal executive offices)

(Zip Code)

(615) 622-0000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on which Registered |

| Units rep. assignments of beneficial ownership of limited partnership interests in AB Holding | AB | NYSE |

Item 8.01. Other Events.

On November 22, 2022, AllianceBernstein Holding L.P. (NYSE: AB), AllianceBernstein L.P., a leading global investment management and research firm, and Société Générale (EURONEXT: SCGLY, “SocGen”), a leading European bank, announced plans to form a joint venture combining their respective cash equities and research businesses (the “Transaction”).

The closing is expected to occur before the end of 2023. The Transaction is subject to customary closing conditions, and to workers council consultation in several countries. AllianceBernstein and SocGen will work closely together to ensure a smooth transition for their staff, clients and partners.

As AllianceBernstein will own less than 50% of the joint venture, AllianceBernstein anticipates deconsolidating Bernstein Research Services from its financial statements following the close of the Transaction. The deconsolidation is expected to have a modestly positive impact on AllianceBernstein’s operating margins. The planned joint venture is not expected to have an impact on AllianceBernstein’s asset management business or Bernstein Private Wealth Management’s business.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | ALLIANCEBERNSTEIN HOLDING L.P. |

| Dated: November 22, 2022 | | By: | /s/ David M. Lesser |

| | | David M. Lesser

Corporate Secretary |

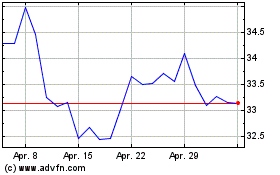

AllianceBernstein (NYSE:AB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

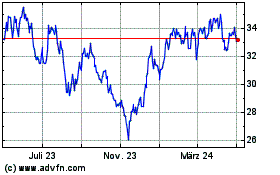

AllianceBernstein (NYSE:AB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024