Form 8-K/A date of report 09-06-24

true

0001069530

0001069530

2024-09-06

2024-09-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 6, 2024

Cassava Sciences, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-41905

|

91-1911336

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification Number)

|

6801 N Capital of Texas Highway, Building 1; Suite 300

Austin, Texas 78731

(Address of principal executive offices, including zip code)

(512) 501-2444

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

|

SAVA

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Amendment No. 1 to Current Report on Form 8-K (this “Amendment”) amends the Current Report on Form 8-K filed by Cassava Sciences, Inc. (“Cassava” or the “Company”) on September 9, 2024 (the “Original Form 8-K”), which disclosed, among other things, the appointment of Richard (Rick) Barry as the Company’s Chief Executive Officer (“CEO”), effective September 6, 2024 (the “Transition Date”). At the time of the filing of the Original Form 8-K, the Compensation Committee of the Company’s Board of Directors (the “Board”) had not yet determined the terms of Mr. Barry’s compensation in connection with his appointment as the Company’s CEO. The Company is filing this Amendment to disclose the terms of Mr. Barry’s compensation for his service as the Company’s CEO. No other changes have been made to the Original Form 8-K.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 30, 2024, the Board approved an executive employment agreement, dated as of and subsequently executed on October 1, 2024, between the Company and Mr. Barry (the “Employment Agreement”) that provides for, among other things, (i) an initial base salary to $675,000, retroactive to July 15, 2024, (ii) an annual bonus at target of 60% of base salary, prorated for partial years of service, (iii) the grant of a stock option award to purchase 600,000 shares of the Company’s common stock (the “Options”) and (iv) other customary covenants, terms and conditions during the Employment Agreement’s term.

The Options were issued with an exercise price of $27.42 per common share, which represents the closing price of the Company’s common stock on the date of grant of the Options, pursuant to the 2018 Omnibus Equity Incentive Plan with cliff vesting in four equal annual installments (25% each year) beginning on July 15, 2025 and 25% each full year thereafter, subject to Mr. Barry’s continued employment with the Company.

Pursuant to the Employment Agreement, if Mr. Barry is terminated without cause or resigns for good reason, he will be entitled to (i) continued payment of his base salary as then in effect through the effective date of his termination from employment, (ii) continued payment of his base salary as then in effect for a period of twelve (12) months following the date of termination and (iii) continued employment benefits through the Company’s medical plan, with premiums paid by the Company, until the earlier of twelve (12) months after termination or the time that he becomes covered under another employer-sponsored medical plan. In the event that Mr. Barry is terminated in connection with a “Change in Control” (as defined in the Employment Agreement), he will be entitled to benefits as if he had been terminated without cause under the Employment Agreement. The foregoing termination benefits are conditioned upon Mr. Barry signing and not revoking an employment separation and release agreement in a form acceptable to the Company.

The foregoing description of the Employment Agreement is only a summary and is qualified in its entirety by reference to the full text of the Employment Agreement, which is attached as Exhibit 10.1 hereto and incorporated into this Item 5.02 by reference.

9.01: Financial Statements and Exhibits

|

Exhibit No.

|

|

Description

|

| |

|

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

CASSAVA SCIENCES, INC.

|

|

| |

a Delaware corporation

|

|

| |

|

|

|

|

Date: October 1, 2024

|

|

|

|

| |

By:

|

/s/ ERIC J. SCHOEN

|

|

| |

|

Eric J. Schoen

|

|

| |

|

Chief Financial Officer

|

|

Exhibit 10.1

EXECUTIVE EMPLOYMENT AGREEMENT

This EXECUTIVE EMPLOYMENT AGREEMENT (the “Agreement”) is made this 1st day of October, 2024, by and between CASSAVA SCIENCES, INC., 6801 N. Capital of Texas Highway, Building 1, Suite 300, Austin, TX 78731 (“Cassava” or “Company”), and RICHARD J. BARRY, an individual (“Barry” or “Executive”).

a. Position. Executive has been appointed by the Company’s Board of Directors (the “Board”) to serve as President and Chief Executive Officer of Cassava and shall perform the usual and customary duties of President and Chief Executive Officer under the direction of the Board.

b. Duties. As President and Chief Executive Officer, Executive will be primarily responsible for leading the Company and making major decisions for the Company consistent with the role as the highest-ranking executive officer of Cassava. Examples of such duties include: (i) managing the Company’s executive team and overall operations; (ii) determining the Company’s organizational structure; (iii) developing and cultivating the Company’s culture and mission/vision; (iv) establishing and implementing the Company’s strategic objectives; (v) leading the development of the Company’s long- and short-term business strategies; (vi) assessing and minimizing legal and business risks to the Company; (viii) identifying and addressing company-wide issues and concerns; (vii) negotiating and/or approving contracts on behalf of the Company; (viii) communicating with stockholders, government entities and the general public on behalf of the Company; (ix) attending Board meetings and regularly communicating with the Board; and (x) and other duties and responsibilities, as assigned to you by the Board. Executive agrees to devote his full business time and best efforts, business judgment, skill and knowledge exclusively to the advancement of the business and interests of the Company and to the discharge of his duties and responsibilities; provided, however, that Executive may serve on outside boards (with prior written notice to and written approval by the Board), participate in charitable and civic organizations, and manage personal investments to the extent such activities do not interfere with the performance of Executive’s our duties and responsibilities to the Company.

c. Director. As long as Executive serves as President and Chief Executive Officer, Executive shall be nominated to serve on the Company’s Board of Directors. Executive agrees to submit his resignation immediately as a director if Executive ceases to be President and Chief Executive Officer.

| |

2.

|

Compensation and Benefits.

|

a. Base Salary. The Company will pay Executive as compensation for his services a base salary at the annualized rate of Six Hundred Seventy-Five Thousand Dollars and no Cents ($675,000) (“Base Salary”), paid semi-monthly, retroactive to July 15, 2024. Base Salary is subject to customary payroll deductions and withholdings authorized or required by applicable law. Executive’s Base Salary will be subject to review from time to time. Periodic adjustments in Base Salary may be approved and implemented by the Board.

b. Bonuses. Executive will be eligible to receive an annual bonus (target bonus amount will be sixty percent (60%) of Base Salary, prorated for partial years of service) based upon performance-related criteria to be agreed upon by and between Executive and the Board.

c. Stock Options. Executive will be granted options to purchase six hundred thousand (600,000) shares of Common Stock (“Options”). Options vest in four equal annual installments (25% each year) commencing on July 15, 2025. The exercise price of such Options will be priced on the closing price of the execution date of this Agreement, subject to approval of the stock option grant by the Board of Directors. Options will be issued pursuant to the 2018 Omnibus Equity Incentive Plan and will be subject to all terms and conditions set forth in the agreement covering your stock option. From time to time, the Company may grant, in its sole discretion, additional stock options or other types of equity-based compensation.

d. Benefits. Executive will be eligible to participate in the employee benefit plans maintained by the Company applicable to other key executives of the Company, including (without limitation) retirement plans, savings or profit-sharing plans, deferred compensation plans, supplemental retirement or excess benefit plans, disability, health, accident and other insurance programs, and similar plans or programs, subject in each case to the generally applicable terms and conditions of the plan or program in question and to the determination of any committee administering such plan or program.

e. Paid Time Off. As an Officer of Cassava Sciences, Executive will not accrue, and the Company will not record, any specific amount of vacation or paid time off. The ability to take paid time off is not intended to be a form of additional wages for services performed. Instead, Executive may utilize paid time off as his work responsibilities allow.

f. Expenses. The Company will reimburse Executive for all reasonable business, entertainment and travel expenses actually incurred or paid by the Executive in the performance of his services on behalf of the Company, in accordance with the Company’s expense reimbursement policy in effect from time to time.

3. Term of Employment. Executive’s employment with the Company pursuant to this Agreement will commence on the Effective Date and continue for thirty-six (36) consecutive months (the “Initial Term”); provided, however, that such term will automatically renew for successive twelve (12) month terms at the end of such Initial Term (each a “Renewal Term”), unless sixty (60) days prior to expiration of the Initial Term or any Renewal Term, either party provides written notice of non-renewal to the other party. In such event, this Agreement and Executive’s employment with the Company will terminate at the expiration of the Initial Term or Renewal Term.

4. Termination of Employment.

a. Death. Executive’s employment with the Company will terminate automatically upon the death of the Executive. In such event, the Company shall pay to Executive’s beneficiaries or his estate, as the case may be, any accrued Base Salary and any unreimbursed business expenses incurred by Executive in connection with his duties through the date of his death. Nothing in this Section shall affect any entitlement of the Executive’s heirs to the benefits of any life insurance provided by the Company.

b. Disability. If Executive is unable to perform his duties for a period of sixty (60) consecutive days as a result of any physical or mental impairment, then, to the extent permitted by law, the Company may terminate this Agreement on or after the sixtieth (60th) day of Executive’s inability to perform his job duties. In such event, the Company will pay to Executive his Base Salary until such time as Executive shall become entitled to receive disability benefit under the long-term disability insurance policy maintained by the Company (but not more than ninety (90) days following termination of employment), but no other compensation or reimbursement of any kind, including without limitation, severance compensation. Nothing in this Section shall affect Executive’s rights to benefits under any disability plan in which he is a participant.

c. Voluntary Resignation without Good Reason or Termination By Company for Cause. If Executive’s employment with the Company terminates due to his voluntary resignation without Good Reason (as defined below), or if the Company involuntarily terminates Executive’s employment for Cause (as defined below), the Company will pay Executive all accrued Base Salary though the termination date but no other compensation or reimbursement of any kind, including without limitation, severance compensation. If Executive resigns from employment with the Company without Good Reason, Executive agrees to provide a minimum of ninety (90) days’ advance notice of such resignation.

i. For purposes of this Agreement, Termination for “Cause” means: (a) any intentional action or intentional failure to act that was performed in bad faith and to the detriment of the Company; (b) any intentional refusal or intentional failure to act in accordance with any lawful and proper directive or order of the Board; (c) willful and habitual neglect of the duties assigned by the Board; (d) any action or omission that materially and negatively affects the business and/or reputation of the Company; (e) violation of any federal, state or local laws in connection with the performance of his job duties (including without limitation laws prohibiting employment discrimination and workplace harassment), or (f) any conviction for, or plea of guilty or nolo contendere to, a felony or misdemeanor involving moral turpitude under any applicable federal, state or local law; provided, however, that, in the event that any of the foregoing Cause events is capable of being cured, the Company will provide written notice to Executive describing the nature of such Cause event, and Executive will have five (5) business days to cure such event.

ii. For purposes of this Agreement, “Good Reason” means the occurrence of any of the following events without the Executive's prior consent: (a) material reduction in Executive's Base Salary; (b) relocation of Executive's principal place of employment by more than 100 miles; (c) material breach by the Company of any provision of this Agreement; (d) material, adverse change in Executive's duties or responsibilities (other than temporarily while Executive is physically or mentally disabled or as required by applicable law); or (e) material adverse change in the management reporting structure applicable to Executive.

d. Termination By Company Without Cause or Resignation by Executive for Good Reason. If Executive’s employment with the Company is involuntarily terminated for any reason other than Cause, or if Executive resigns from his position for Good Reason, Executive will be entitled to receive: (i) Base Salary through the effective date of his termination from employment (the “Termination Date”); (ii) severance compensation equal to Executive’s Base Salary, immediately prior to the Termination Date for twelve (12) months after the date of termination; (iii) continued participation in the Company medical plan, at the Company’s expense, until the earlier of (a) the date Executive becomes covered under another employer-sponsored medical plan, or (b) twelve (12) months after the Termination Date. Payment of the separation benefits outlined in this paragraph 4(d) is expressly conditioned on Executive’s entering into and not revoking an employment separation and release agreement in a form acceptable to the Company.

e. No Duty to Mitigate. The Executive shall not be required to mitigate the amount of any payment contemplated by Section 4(d) (whether by seeking new employment or in any other manner).

f. 409A Compliance.

i. Notwithstanding anything to the contrary in this Agreement, no severance or other benefits payable upon termination from employment pursuant to this Agreement, when considered together with any other payments or benefits that are considered deferred compensation (together, the “Deferred Payments”) under Section 409A, will be payable until the Executive has a “separation from service” within the meaning of Section 409A.

ii. Notwithstanding anything to the contrary in this Agreement, if the Executive is a “specified employee” within the meaning of Section 409A at the time of Executive’s termination from employment, then, if required, the Deferred Payments, which are otherwise due to Executive on or within the six (6) month period following Executive’s termination from employment will accrue, to the extent required, during such six (6) month period and will become payable in a lump sum payment on the date six (6) months and 1 day following the date of Executive’s termination of employment or the date of the Executive’s death, if earlier. All subsequent Deferred Payments, if any, will be payable in accordance with the payment schedule applicable to each payment or benefit. Each payment and benefit payable under this Agreement is intended to constitute a separate payment for purposes of Section 1.409A-2(b)(2) of the Treasury Regulations.

iii. The foregoing provision is intended to comply with the requirements of Section 409A so that none of the payments and benefits to be provided under this Agreement will be subject to the additional tax imposed under Section 409A, and any ambiguities herein will be interpreted to so comply. Executive and the Company agree to work together in good faith to consider amendments to this Agreement and to take such reasonable actions which are necessary, appropriate or desirable to avoid imposition of any additional tax or income recognition prior to actual payment to Executive under Section 409A.

g. Non-Assumption of Agreement. In the event of the Change in Control (as defined below) in which this Agreement and the obligations of the Company are not assumed by the successor entity either by operation of law or by assignment, Executive’s employment with the Company shall be deemed to be terminated for Other than Cause, and Executive shall be entitled to the benefits sect forth in Section 4(d) above. For purposes of this Agreement, “Change in Control” means the acquisition of fifty-one percent (51%) or more of the Company’s then outstanding shares at the time of a Change-in-Control transaction; provided, however, that Executive signs and does not revoke an employment separation and release agreement. For purposes of this paragraph 4(g), raising capital through the issuance of equity by the Company shall not constitute a Change-in-Control.

5. Indemnification. Subject to and in accordance with the terms of his December 21, 2021 Indemnification Agreement (attached), in the event that Executive is made a party or threatened to be made a party to any action, suit, or proceeding, whether civil, criminal, administrative, or investigative (a “Proceeding”), other than any Proceeding initiated by the Executive or the Company related to any contest or dispute between the Executive and the Company or any of its affiliates with respect to this Agreement or the Executive's employment, by reason of the fact that the Executive is or was a director or officer of the Company, or any affiliate of the Company, Executive shall be indemnified and held harmless by the Company to the fullest extent applicable to any other officer or director of the Company/to the maximum extent permitted under applicable law and the Company's bylaws from and against any liabilities, costs, claims, and expenses, including all costs and expenses incurred in defense of any Proceeding (including attorneys' fees).

6. Confidential Information.

a. Confidentiality Agreement. Executive agrees at all times during the term of his employment and thereafter to hold in strictest confidence and not to use, except for the benefit of the Company, or to disclose to any person, firm or corporation without written authorization of the Board, any Confidential Information or trade secrets belonging to the Company. As a condition of employment, Executive will be required to enter into a “Confidential Information and Invention Assignment Agreement” (attached).

i. Pursuant to the Defend Trade Secrets Act, 28 U.S.C. § 1833, Executive will not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that is: (i) made in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law, or (ii) made in a complaint or other document filed in a lawsuit or other proceeding if such a filing is made under seal. Executive further understands that any individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose a trade secret to his/her attorney and use the trade secret information in the court proceeding so long as the individual: (i) files any document containing the trade secret under seal, and (ii) does not disclose the trade secret, except pursuant to court order.

ii. Nothing in this Agreement prevents Executive from providing, without prior notice to the Company, information to governmental authorities regarding possible legal violations or otherwise testifying or participating in any investigation or proceeding by any governmental authorities regarding possible legal violations.

b. Former Employer Information. Executive agrees that he will not, during his employment with the Company, improperly use or disclose any proprietary information or trade secrets of any former or concurrent employer or other person or entity and that Executive will not bring onto the premises of the Company any unpublished document or proprietary information belonging to any such employer, person or entity unless consented to in writing by such employer, person or entity.

c. Third Party Information. Executive recognizes that the Company has received and in the future will receive from third parties their confidential or proprietary information subject to a duty on the Company’s part to maintain the confidentiality of such information and to use it only for certain limited purposes. Executive agrees to hold all such confidential or proprietary information in the strictest confidence and not to disclose it to any person, firm or corporation or to use it except as necessary in carrying out his work for the Company consistent with the Company’s agreement with such third party.

7. Dispute Resolution. Executive will attempt in good faith to resolve any dispute with the Company through discussion, evaluation, negotiation and conciliation. If any dispute arising out or relating to this Agreement, or the interpretation, application or enforcement of its terms, cannot be amicably resolved, such dispute will be resolved by final and binding arbitration in accordance with the then existing Employment Arbitration Rules of the American Arbitration Association (“AAA”). This arbitration provision constitutes a waiver by the Parties of any right to a jury trial and relates to the resolution of all claims arising out of, relating to, or in connection with this Agreement, the interpretation, validity, construction, performance, breach or termination of this Agreement.

a. The Parties will agree upon one arbitrator, who shall be an individual skilled in the legal and business aspects of the subject matter of this Agreement and of the dispute. If the Parties cannot agree upon one arbitrator, an arbitrator shall be selected by the Parties through the arbitrator selection procedures established by the AAA. The arbitration proceedings shall take place in Austin, Texas or such other location as the Parties may agree upon. The arbitration proceedings (including any pre-hearing depositions and written discovery responses) will be completely confidential and only the Parties and their authorized representatives, legal counsel and witnesses will be permitted to attend the arbitration hearing.

b. In rendering an award, the arbitrator shall determine the rights and obligations of the Parties according to the substantive law of the State of Texas (or federal law, where applicable) without regard to any principles governing conflicts of laws and the arbitrator’s decision shall be governed by state and federal substantive law, as though the matter were before a court of law. Such decision shall be final, conclusive and binding on the Parties to the arbitration. The decision of the arbitrator shall be made within thirty (30) days following the close of the hearing. The Parties agree that the award shall be enforceable exclusively by any state or federal court of competent jurisdiction.

c. If any part of this arbitration procedure is in conflict with any mandatory requirement or applicable law, the law shall govern, and that part of this arbitration procedure shall be reformed and construed to the maximum extent possible in conformance with the applicable law. The arbitration procedure shall remain otherwise unaffected and enforceable. The Parties agree that any Party shall be entitled to commence legal action in any court of competent jurisdiction to compel any other Party to this Agreement to submit any claim or controversy covered by this paragraph 13 to mandatory and binding arbitration in accordance with the terms and provisions outlined herein and/or for preliminary injunctive relief to preserve the status quo or to prevent any potential or on-going violation of this Agreement pending the outcome of arbitration proceedings under this paragraph.

8. Governing Law and Consent to Jurisdiction. This Agreement shall be deemed to have been made and delivered in the State of Texas, where Executive’s services will be performed, in whole or in part, and shall be governed as to validity, interpretation, construction, effect and in all other respects by the internal laws of the State of Texas and controlling federal law without giving effect to any conflicts of laws provisions. Further, to the extent that any Party is required to initiate legal action to enforce any right or obligation under this Agreement (including arbitration under paragraph 8), the Parties agree that any such litigation shall be filed in the United States District Court for the Western District of Texas or the District Court of Travis County, Texas, and both Parties consent to the exclusive personal jurisdiction of such courts.

9. Assignment. This Agreement, and the rights and obligations of Executive under this Agreement, may not be assigned by Executive without the express written consent of the Company. The rights and obligations of the Company under this Agreement shall be binding upon, and inure to the benefit of, the Company, its successors and assigns. However, this Agreement will be enforceable by and as to the Company and its successors and assigns. Further, in the event of a change in ownership of Cassava, the Company will have the right to assign all rights and obligations under this Agreement to any successor owner without Executive’s consent.

10. Notices. All notices, requests, demands, claims and other communications that are required to be, or which may be, given under this Agreement shall be in writing and (a) delivered in person or by courier; (b) sent by e-mail, telecopy or facsimile transmission; or (c) mailed, certified first class mail, postage prepaid, return receipt requested, to the Parties at the following addresses:

a. If to COMPANY:

CASSAVA SCIENCES, INC.

Attn: Christopher Cook

SVP and General Counsel

6801 N. Capital of Texas Highway

Building 1, Suite 300

Austin, TX 78731

ccook@cassavasciences.com

b. If to EXECUTIVE:

Richard J. Barry

[***]

[***]

or to such other address as the Party to whom notice is being given shall have furnished to the other Party. Such notices shall be effective (i) if delivered in person or by courier, upon actual receipt by the intended recipient, (ii) if sent by e-mail, telecopy or facsimile transmission, when the sender receives confirmation that such notice was received at the e-mail address or telecopier number of the addressee, or (iii) if mailed, upon the earlier of five (5) business days after deposit in the mail or the date of delivery as shown by the return receipt. Any notice delivered in person, by courier or by mail shall also be sent via email to the address listed above.

11. Attorneys’ Fees. In the event that either Party initiates legal action in any court or adjudicative body to enforce any provision of this Agreement, or initiates legal action based upon the breach of any provision of this Agreement by any other Party, or submits any dispute to arbitration under paragraph 8 of this Agreement, each party shall bear its own fees and expenses.

12. Waivers. No claim arising out of a breach of this Agreement can be discharged, in whole or in part, by a waiver of that claim, unless such waiver is in writing and executed by the Party against whom the waiver is asserted. Any waiver by either Party of a breach of any provision of this Agreement by the other Party shall not be construed as a continuing waiver, or as a waiver of any breach of another provision of this Agreement.

13. Severability. In the event that any provision of this Agreement shall be deemed to be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired.

14. Captions. The captions of the paragraphs and provisions of this Agreement are for convenience only and shall not affect in any way the meaning or interpretation of this Agreement or any of its provisions.

15. Entire Agreement. The Parties acknowledge and agree that this Agreement, together with the Release, constitute the entire agreement between the Parties; that the Parties have executed this Agreement based upon the terms set forth herein; that the Parties have not relied on any prior agreement or representation, whether oral or written, which is not set forth in this Agreement; that no prior agreement, whether oral or written, shall have any effect on the terms and provisions of this Agreement; and that, except as otherwise provided in this Agreement, all prior agreements pertaining to the subject matter of this Agreement, whether oral or written, are expressly superseded and/or revoked by this Agreement.

16. Amendment. The Parties further agree that the provisions of this Agreement may not be modified by any subsequent agreement unless the modifying agreement is: (i) in writing; (ii) specifically references this Agreement; (iii) signed by Executive; and (iv) signed and approved by an authorized independent member of the Board of Directors of Cassava.

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the date first above written.

|

|

CASSAVA SCIENCES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ CLAUDE NICAISE

|

|

|

|

|

Claude Nicaise, M.D.

|

|

|

|

|

Chairman of the Board

|

|

| |

|

|

|

| |

|

|

|

| |

RICHARD J. BARRY |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ RICHARD J. BARRY |

|

v3.24.3

Document And Entity Information

|

Sep. 06, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Cassava Sciences, Inc.

|

| Document, Type |

8-K/A

|

| Document, Period End Date |

Sep. 06, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-41905

|

| Entity, Tax Identification Number |

91-1911336

|

| Entity, Address, Address Line One |

6801 N Capital of Texas Highway

|

| Entity, Address, Address Line Two |

Building 1; Suite 300

|

| Entity, Address, City or Town |

Austin

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78731

|

| City Area Code |

512

|

| Local Phone Number |

501-2444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SAVA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Description |

Form 8-K/A date of report 09-06-24

|

| Amendment Flag |

true

|

| Entity, Central Index Key |

0001069530

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

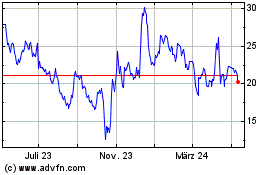

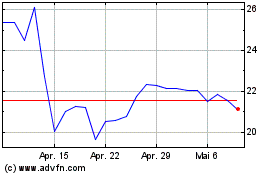

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

Von Nov 2023 bis Nov 2024