NETSOL Technologies, Inc.

(Nasdaq: NTWK),

a global business services and enterprise application solutions

provider, reported results for the fiscal fourth quarter and year

ended June 30, 2023.

Fiscal Fourth Quarter 2023 Operational

Highlights

- Launched the Hubex API Library, the

second product offering from the Company’s AppexNow marketplace,

allowing customers to standardize all API integration procedures

across multiple API services through a single integration

- Implemented and went live with NFS

Ascent for a Swedish bank operating across the Nordic and European

regions, to support the bank’s lending business via the Cloud

- Appointed Darryll Lewis as Managing

Director of NETSOL Technologies Europe to drive business growth and

innovation in this market; Hired two key sales personnel to promote

expansion in the United States

- Received numerous designations and

accreditations establishing NETSOL as a premier Amazon Web Services

partner committed to designing, building, and maintaining secure,

reliable, and efficient cloud architectures

Fiscal Fourth Quarter 2023 Financial

Results

Total net revenues for the fourth quarter of fiscal 2023 were

$13.8 million, compared with $13.5 million in the prior year

period. On a constant currency basis, total net revenues were $14.0

million.

- Total subscription (SaaS and Cloud)

and support revenues were $6.8 million compared with $6.1 million

in the prior year period. Total subscription and support revenues

on a constant currency basis were $6.9 million.

- Total services revenues were $7.0 million compared with $6.5

million in the prior year period. Total services revenues on a

constant currency basis were $7.1 million.

Gross profit for the fourth quarter of fiscal 2023 was $4.8

million (or 35.0% of net revenues), consistent with $4.8 million

(or 35.6% of net revenues) in the fourth quarter of fiscal 2022. On

a constant currency basis, gross profit for the fourth quarter of

fiscal 2023 was $2.4 million (or 17.1% of net revenues as measured

on a constant currency basis).

Operating expenses for the fourth quarter of fiscal 2023 were

$7.7 million (or 56.0% of sales) compared to $6.4 million (or 47.0%

of sales) for the fourth quarter of fiscal 2022. On a constant

currency basis, operating expenses for the fourth quarter of fiscal

2023 increased to $9.0 million (or 63.9% of sales on a constant

currency basis).

GAAP net loss attributable to NETSOL for the fourth quarter of

fiscal 2023 totaled $(5.1 million) or $(0.45) per diluted share,

compared with GAAP net loss of $(2.2 million) or $(0.19) per

diluted share in the fourth quarter of fiscal 2022. On a constant

currency basis, GAAP net loss attributable to NETSOL for the fourth

quarter of fiscal 2023 totaled $(7.8 million) or $(0.69) per

diluted share. Included in GAAP net loss attributable to NETSOL was

a loss of $(610,000) on foreign exchange currency in the fourth

quarter, compared to a gain of approximately $1.6 million in the

prior year period. On a constant currency basis, NETSOL realized a

loss of $(1.2 million) on foreign currency transactions.

Non-GAAP adjusted EBITDA for the fourth quarter of fiscal 2023

was a loss of $(4.2 million) or $(0.37) per diluted share, compared

with non-GAAP adjusted EBITDA loss of $(1.4 million) or $(0.12) per

diluted share in the fourth quarter of fiscal 2022 (see note

regarding “Use of Non-GAAP Financial Measures,” below for further

discussion of this non-GAAP measure).

Fiscal Full Year 2023 Financial Results

Total net revenues for the full year ended June 30, 2023, were

$52.4 million, compared to $57.3 million in the prior year period.

On a constant currency basis, total net revenues were $54.7

million.

- Total subscription (SaaS and Cloud)

and support revenues for the full year 2023 were $26.0 million

compared with $28.3 million in the prior year period. Total

subscription and support revenues on a constant currency basis were

$26.7 million. The decrease in the full year total subscription and

support revenue is related to a one-time catch-up in support

revenue of approximately $3.5 million in fiscal year 2022.

- Total services revenues for the full year 2023 were $24.1

million compared with $24.4 million in the prior year period. Total

services revenues on a constant currency basis were $25.6 million.

The increase in services revenues on a constant currency basis is

primarily due to the increase in change requests, enhancements, and

reimbursable costs.

Gross profit for the full year 2023 was $16.9 million (or 32.3%

of net revenues), compared with $23.7 million (or 41.5% of net

revenues) in full year 2022. On a constant currency basis, gross

profit for the full year 2023 was $9.2 million (or 16.8% of net

revenues as measured on a constant currency basis).

Operating expenses for the full year 2023 were $25.7 million (or

49.0% of sales) compared to $24.8 million (or 43.3% of sales) for

full year 2022. On a constant currency basis, operating expenses

for the full year 2023 were $30.4 million (or 55.7% of sales on a

constant currency basis).

GAAP net loss attributable to NETSOL for the full year ended

June 30, 2023 totaled $(5.2 million) or $(0.46) per diluted share,

compared with GAAP net loss of $(851,000) or $(0.08) per diluted

share for the full year ended June 30, 2022. On a constant currency

basis, GAAP net loss attributable to NETSOL for the full year 2023

totaled $(12.3 million) or $(1.09) per diluted share. Included in

GAAP net loss attributable to NETSOL was a gain of $6.7 million on

foreign exchange currency, compared to a gain of approximately $4.3

million in the prior year period. On a constant currency basis,

NETSOL realized a gain of $9.4 million on foreign currency

transactions for the full year 2023.

Non-GAAP adjusted EBITDA for the full year 2023 was a loss of

$(2.3 million) or $(0.20) per diluted share, compared with non-GAAP

adjusted EBITDA of $1.8 million or $0.16 per diluted share in the

full year 2022 (see note regarding “Use of Non-GAAP Financial

Measures,” below for further discussion of this non-GAAP

measure).

At June 30, 2023, cash and cash equivalents were $15.5 million.

Total NETSOL stockholders’ equity at June 30, 2023 was $36.8

million, or $3.24 per share.

Management Commentary

NETSOL Co-Founder, Chairman and Chief Executive Officer Najeeb

Ghauri stated, “From a financial perspective, our fourth quarter

results fell short of our goals and expectations. However, this

past quarter and full fiscal year was characterized by progress

advancing our three core growth drivers that we believe will give

current and prospective shareholders reason to be optimistic about

what’s on the horizon for NETSOL. We continue to drive our

transition to SaaS-based, recurring revenue and we’re seeing

positive sequential and year-over-year growth, highlighted by our

full-year subscription and support revenues exceeding our stated

target of $25 million. As we seek interest from existing customers

in converting to SaaS pricing and with new clients purchasing SaaS

and cloud-based solutions, we expect our subscription and support

revenues to be positioned for continued growth.

“Our ongoing transition to SaaS based pricing has also allowed

us to implement significant cost reduction strategies across our

business including the reduction of our head count by what we

expect to be approximately 300 after a period of severance required

by local laws that extend into the first and second quarters of

fiscal 2024. As we continue to drive these initiatives, we expect

to be able to better allocate capital to the growing, higher margin

part of our business to drive profitability. Additionally, we

continue to make strides on our expansion strategy into the North

American markets. As previously mentioned, we have established a

facility in Austin, Texas to support our United States operations,

and we’re taking the time to staff it with the most qualified

individuals to efficiently grow our business in this region.

“Our established markets throughout the Asia-Pacific region and

Europe remain strong, and our pipeline continues to be active with

several potential licensing deals in the works. We believe that we

have the pieces in place to generate long-term growth for our

business, and given our healthy pipeline, we are targeting $61

million to $63 million in revenue for the full fiscal year 2024, or

16% to 20% revenue growth. We are not satisfied with our current

results, but we have a strategy in place that we are focusing our

time, energy, and patience on executing, and we believe that this

will yield long-term, sustainable growth and positive results for

NETSOL.”

Conference Call

NETSOL Technologies management will hold a conference call today

(September 22, 2023) at 9:00 a.m. Eastern time (6:00 a.m. Pacific

time) to discuss these financial results. A question-and-answer

session will follow management's presentation.

U.S. dial-in: 877-407-0789International dial-in:

201-689-8562

Please call the conference telephone number 5-10 minutes prior

to the start time or use this link for telephone access to the call

via your web browser. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Investor Relations at

818-222-9195.

The conference call will be broadcasted live and available for

replay here and via the Company Information section of NETSOL’s

website.

A telephone replay of the conference call will be available

approximately three hours after the call concludes through Friday,

October 6, 2023.

Toll-free replay number: 844-512-2921International replay

number: 412-317-6671Replay ID: 13741014

About NETSOL TechnologiesNETSOL Technologies,

Inc. (Nasdaq: NTWK) is a worldwide provider of IT and enterprise

software solutions primarily serving the global leasing and finance

industry. The Company’s suite of applications is backed by 40 years

of domain expertise and supported by a committed team in eight

strategically located support and delivery centers throughout the

world. NFS, LeasePak, LeaseSoft or NFS Ascent® – help companies

transform their Finance and Leasing operations, providing a fully

automated asset-based finance solution covering the complete

finance and leasing lifecycle.

Forward-Looking StatementsThis press release

may contain forward-looking statements relating to the development

of the Company's products and services and future operating

results, including statements regarding the Company that are

subject to certain risks and uncertainties that could cause actual

results to differ materially from those projected. The words

“expects,” “anticipates,” variations of such words, and similar

expressions, identify forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, but their

absence does not mean that the statement is not forward-looking.

These statements are not guarantees of future performance and are

subject to certain risks, uncertainties, and assumptions that are

difficult to predict. Factors that could affect the Company's

actual results include the progress and costs of the development of

products and services and the timing of the market acceptance, as

well as the delay in recovery or a prolonged economic downturn that

effects our Company, our customers and the world economy. The

subject Companies expressly disclaim any obligation or undertaking

to update or revise any forward looking statement contained herein

to reflect any change in the company's expectations with regard

thereto or any change in events, conditions or circumstances upon

which any statement is based.

Use of Non-GAAP Financial MeasuresThe

reconciliation of Adjusted EBITDA to net income, the most

comparable financial measure based upon GAAP, as well as a further

explanation of adjusted EBITDA, is included in the financial tables

in Schedule 4 of this press release.

Investor Relations Contact:

IMS Investor

Relationsnetsol@imsinvestorrelations.com+1 203-972-9200

|

NETSOL Technologies, Inc. and

SubsidiariesSchedule 1: Consolidated Balance

Sheets |

| |

|

|

|

|

|

| |

|

|

As of |

|

As of |

|

|

ASSETS |

June 30, 2023 |

|

June 30, 2022 |

| Current

assets: |

|

|

|

| |

Cash and cash

equivalents |

$ |

15,533,254 |

|

|

$ |

23,963,797 |

|

| |

Accounts

receivable, net of allowance of $420,354 and $166,231 |

|

11,714,422 |

|

|

|

8,669,202 |

|

| |

Revenues in excess

of billings, net of allowance of $1,380,141 and $136,976 |

|

12,377,677 |

|

|

|

14,571,776 |

|

| |

Other current

assets |

|

1,978,514 |

|

|

|

2,223,361 |

|

|

|

|

Total current assets |

|

41,603,867 |

|

|

|

49,428,136 |

|

| Revenues in excess

of billings, net - long term |

|

- |

|

|

|

853,601 |

|

| Property and

equipment, net |

|

6,161,186 |

|

|

|

9,382,624 |

|

| Right of use

assets - operating leases |

|

1,151,575 |

|

|

|

969,163 |

|

| Long term

investment |

|

25,396 |

|

|

|

1,059,368 |

|

| Other assets |

|

6,931 |

|

|

|

25,546 |

|

| Intangible assets,

net |

|

127,931 |

|

|

|

1,587,670 |

|

| Goodwill |

|

9,302,524 |

|

|

|

9,302,524 |

|

| |

|

Total

assets |

$ |

58,379,410 |

|

|

$ |

72,608,632 |

|

| |

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

| |

Accounts payable

and accrued expenses |

$ |

6,552,181 |

|

|

$ |

6,813,541 |

|

| |

Current portion of

loans and obligations under finance leases |

|

5,779,510 |

|

|

|

8,567,145 |

|

| |

Current portion of

operating lease obligations |

|

505,237 |

|

|

|

548,678 |

|

| |

Unearned

revenue |

|

7,932,306 |

|

|

|

4,901,562 |

|

| |

|

Total current liabilities |

|

20,769,234 |

|

|

|

20,830,926 |

|

| Loans and

obligations under finance leases; less current maturities |

|

176,229 |

|

|

|

476,223 |

|

| Operating lease

obligations; less current maturities |

|

652,194 |

|

|

|

447,260 |

|

| |

|

Total

liabilities |

|

21,597,657 |

|

|

|

21,754,409 |

|

| |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

| |

Preferred stock,

$.01 par value; 500,000 shares authorized; |

|

- |

|

|

|

- |

|

| |

Common stock, $.01

par value; 14,500,000 shares authorized; |

|

|

|

| |

|

12,284,887 shares issued and

11,345,856 outstanding as of June 30, 2023 |

|

|

|

| |

|

12,196,570 shares issued and

11,257,539 outstanding as of June 30, 2022 |

|

122,850 |

|

|

|

121,966 |

|

| |

Additional

paid-in-capital |

|

128,476,048 |

|

|

|

128,218,247 |

|

| |

Treasury stock (at

cost, 939,031 shares |

|

|

|

| |

as of June 30,

2023 and June 30, 2022) |

|

(3,920,856 |

) |

|

|

(3,920,856 |

) |

| |

Accumulated

deficit |

|

(44,896,186 |

) |

|

|

(39,652,438 |

) |

| |

Other

comprehensive loss |

|

(45,975,156 |

) |

|

|

(39,363,085 |

) |

| |

|

Total NetSol stockholders'

equity |

|

33,806,700 |

|

|

|

45,403,834 |

|

| |

Non-controlling

interest |

|

2,975,053 |

|

|

|

5,450,389 |

|

| |

|

Total stockholders'

equity |

|

36,781,753 |

|

|

|

50,854,223 |

|

| |

|

Total liabilities and

stockholders' equity |

$ |

58,379,410 |

|

|

$ |

72,608,632 |

|

| |

|

|

|

|

|

|

|

|

|

|

NETSOL Technologies, Inc. and

SubsidiariesSchedule 2: Consolidated Statement of

Operations |

| |

|

|

|

|

|

| |

|

|

For the Three Months |

|

For the Years |

|

|

|

|

Ended June 30, |

|

Ended June 30, |

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Net

Revenues: |

|

|

|

|

|

|

|

| |

License fees |

$ |

20,735 |

|

|

$ |

952,386 |

|

|

$ |

2,269,564 |

|

|

$ |

4,539,260 |

|

| |

Subscription and

support |

|

6,805,076 |

|

|

|

6,124,961 |

|

|

|

25,980,661 |

|

|

|

28,284,759 |

|

| |

Services |

|

6,964,538 |

|

|

|

6,467,083 |

|

|

|

24,142,990 |

|

|

|

24,423,960 |

|

|

|

|

Total net revenues |

|

13,790,349 |

|

|

|

13,544,430 |

|

|

|

52,393,215 |

|

|

|

57,247,979 |

|

| |

|

|

|

|

|

|

|

|

|

| Cost of

revenues |

|

8,974,275 |

|

|

|

8,727,436 |

|

|

|

35,477,652 |

|

|

|

33,510,805 |

|

| Gross

profit |

|

4,816,074 |

|

|

|

4,816,994 |

|

|

|

16,915,563 |

|

|

|

23,737,174 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

| |

Selling, general

and administrative |

|

7,366,072 |

|

|

|

5,789,737 |

|

|

|

24,093,908 |

|

|

|

23,473,343 |

|

| |

Research and

development cost |

|

356,820 |

|

|

|

580,533 |

|

|

|

1,601,613 |

|

|

|

1,342,154 |

|

| |

|

Total operating expenses |

|

7,722,892 |

|

|

|

6,370,270 |

|

|

|

25,695,521 |

|

|

|

24,815,497 |

|

| |

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(2,906,818 |

) |

|

|

(1,553,276 |

) |

|

|

(8,779,958 |

) |

|

|

(1,078,323 |

) |

| |

|

|

|

|

|

|

|

|

|

| Other

income and (expenses) |

|

|

|

|

|

|

|

| |

Interest

expense |

|

(252,920 |

) |

|

|

(92,064 |

) |

|

|

(765,030 |

) |

|

|

(369,801 |

) |

| |

Interest

income |

|

212,293 |

|

|

|

532,336 |

|

|

|

1,217,850 |

|

|

|

1,655,883 |

|

| |

Gain on foreign

currency exchange transactions |

|

(610,481 |

) |

|

|

1,642,910 |

|

|

|

6,748,038 |

|

|

|

4,327,590 |

|

| |

Share of net loss

from equity investment |

|

(1,040,753 |

) |

|

|

(1,703,899 |

) |

|

|

(1,033,243 |

) |

|

|

(2,021,480 |

) |

| |

Other income

(expense) |

|

(662,953 |

) |

|

|

(234,574 |

) |

|

|

(605,570 |

) |

|

|

(424,128 |

) |

| |

|

Total other income

(expenses) |

|

(2,354,814 |

) |

|

|

144,709 |

|

|

|

5,562,045 |

|

|

|

3,168,064 |

|

| |

|

|

|

|

|

|

|

|

|

| Net income

(loss) before income taxes |

|

(5,261,632 |

) |

|

|

(1,408,567 |

) |

|

|

(3,217,913 |

) |

|

|

2,089,741 |

|

| Income tax

provision |

|

(285,438 |

) |

|

|

(462,201 |

) |

|

|

(926,560 |

) |

|

|

(988,938 |

) |

| Net income

(loss) |

|

(5,547,070 |

) |

|

|

(1,870,768 |

) |

|

|

(4,144,473 |

) |

|

|

1,100,803 |

|

| |

Non-controlling interest |

|

472,354 |

|

|

|

(296,672 |

) |

|

|

(1,099,275 |

) |

|

|

(1,951,959 |

) |

| Net income

(loss) attributable to NetSol |

$ |

(5,074,716 |

) |

|

$ |

(2,167,440 |

) |

|

$ |

(5,243,748 |

) |

|

$ |

(851,156 |

) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net income

(loss) per share: |

|

|

|

|

|

|

|

| |

Net income (loss)

per common share |

|

|

|

|

|

|

|

| |

|

Basic |

$ |

(0.45 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.46 |

) |

|

$ |

(0.08 |

) |

| |

|

Diluted |

$ |

(0.45 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.46 |

) |

|

$ |

(0.08 |

) |

| |

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares outstanding |

|

|

|

|

|

|

|

| |

Basic |

|

11,308,571 |

|

|

|

11,252,539 |

|

|

|

11,279,966 |

|

|

|

11,250,219 |

|

| |

Diluted |

|

11,308,571 |

|

|

|

1,252,539 |

|

|

|

11,279,966 |

|

|

|

11,250,219 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NETSOL Technologies, Inc. and

SubsidiariesSchedule 3: Consolidated Statement of

Cash Flows |

| |

|

|

|

| |

|

|

For the Years |

| |

|

|

Ended June 30, |

| |

|

|

2023 |

|

2022 |

| Cash flows

from operating activities: |

|

|

|

| |

Net income

(loss) |

$ |

(4,144,473 |

) |

|

$ |

1,100,803 |

|

| |

Adjustments to

reconcile net income (loss) to net cash |

|

|

|

| |

provided by operating activities: |

|

|

|

|

| |

Depreciation and

amortization |

|

3,244,538 |

|

|

|

3,812,273 |

|

|

|

Provision for bad debts |

|

|

1,702,744 |

|

|

|

23,388 |

|

| |

Goodwill

impairment |

|

- |

|

|

|

214,044 |

|

| |

Impairment and

share of net loss from investment under equity method |

|

2,113,430 |

|

|

|

2,021,480 |

|

| |

Loss on sale of assets |

|

|

19,721 |

|

|

|

205,288 |

|

| |

Stock based

compensation |

|

317,451 |

|

|

|

104,347 |

|

| |

Changes in

operating assets and liabilities: |

|

|

|

| |

Accounts receivable |

|

|

(6,860,983 |

) |

|

|

(5,669,262 |

) |

| |

Revenues in excess of billing |

|

|

1,514,305 |

|

|

|

(1,273,693 |

) |

| |

Other current assets |

|

|

(131,108 |

) |

|

|

469,194 |

|

| |

Accounts payable and accrued expenses |

|

|

709,758 |

|

|

|

1,121,308 |

|

| |

Unearned revenue |

|

|

3,524,188 |

|

|

|

931,452 |

|

| |

Net cash

provided by operating activities |

|

2,009,571 |

|

|

|

3,060,622 |

|

| |

|

|

|

|

|

| Cash flows

from investing activities: |

|

|

|

| |

Purchases of

property and equipment |

|

(1,639,438 |

) |

|

|

(2,609,205 |

) |

| |

Sales of property

and equipment |

|

240,207 |

|

|

|

349,058 |

|

| |

Net cash

used in investing activities |

|

(1,399,231 |

) |

|

|

(2,260,147 |

) |

| |

|

|

|

|

|

| Cash flows

from financing activities: |

|

|

|

| |

Purchase of treasury

stock |

|

|

- |

|

|

|

(100,106 |

) |

| |

Purchase of

subsidiary treasury stock |

|

(61,124 |

) |

|

|

(950,352 |

) |

| |

Proceeds from bank

loans |

|

270,292 |

|

|

|

941,841 |

|

| |

Payments on

finance lease obligations and loans - net |

|

(928,160 |

) |

|

|

(1,270,104 |

) |

| |

Net cash

used in financing activities |

|

(718,992 |

) |

|

|

(1,378,721 |

) |

| Effect of

exchange rate changes |

|

(8,321,891 |

) |

|

|

(9,163,111 |

) |

| Net

decrease in cash and cash equivalents |

|

(8,430,543 |

) |

|

|

(9,741,357 |

) |

| Cash and cash

equivalents at beginning of the period |

|

23,963,797 |

|

|

|

33,705,154 |

|

| Cash and

cash equivalents at end of period |

$ |

15,533,254 |

|

|

$ |

23,963,797 |

|

| |

|

|

|

|

|

|

|

|

NETSOL Technologies, Inc. and

SubsidiariesSchedule 4: Reconciliation to

GAAP |

| |

|

|

|

|

| |

|

For the Three Months |

|

For the Years |

|

|

|

Ended June 30, |

|

Ended June 30, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

Net Income (loss) attributable to NetSol |

|

$ |

(5,074,716 |

) |

|

$ |

(2,167,440 |

) |

|

$ |

(5,243,748 |

) |

|

$ |

(851,156 |

) |

|

Non-controlling interest |

|

|

(472,354 |

) |

|

|

296,672 |

|

|

|

1,099,275 |

|

|

|

1,951,959 |

|

|

Income taxes |

|

|

285,438 |

|

|

|

462,201 |

|

|

|

926,560 |

|

|

|

988,938 |

|

|

Depreciation and amortization |

|

|

725,069 |

|

|

|

942,602 |

|

|

|

3,244,538 |

|

|

|

3,812,273 |

|

|

Interest expense |

|

|

252,920 |

|

|

|

92,064 |

|

|

|

765,030 |

|

|

|

369,801 |

|

|

Interest (income) |

|

|

(212,293 |

) |

|

|

(532,336 |

) |

|

|

(1,217,850 |

) |

|

|

(1,655,883 |

) |

| EBITDA |

|

$ |

(4,495,936 |

) |

|

$ |

(906,237 |

) |

|

$ |

(426,195 |

) |

|

$ |

4,615,932 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

Non-cash stock-based compensation |

|

|

118,892 |

|

|

|

26,122 |

|

|

|

317,451 |

|

|

|

104,347 |

|

| Adjusted EBITDA, gross |

|

$ |

(4,377,044 |

) |

|

$ |

(880,115 |

) |

|

$ |

(108,744 |

) |

|

$ |

4,720,279 |

|

| Less non-controlling interest

(a) |

|

|

208,924 |

|

|

|

(520,736 |

) |

|

|

(2,154,850 |

) |

|

|

(2,903,457 |

) |

| Adjusted EBITDA, net |

|

$ |

(4,168,120 |

) |

|

$ |

(1,400,851 |

) |

|

$ |

(2,263,594 |

) |

|

$ |

1,816,822 |

|

| |

|

|

|

|

|

|

|

|

| Weighted Average number of

shares outstanding |

|

|

|

|

|

|

|

|

| Basic |

|

|

11,308,571 |

|

|

|

11,252,539 |

|

|

|

11,279,966 |

|

|

|

11,250,219 |

|

| Diluted |

|

|

11,308,571 |

|

|

|

11,252,539 |

|

|

|

11,279,966 |

|

|

|

11,250,219 |

|

| |

|

|

|

|

|

|

|

|

| Basic adjusted EBITDA |

|

$ |

(0.37 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.20 |

) |

|

$ |

0.16 |

|

| Diluted adjusted EBITDA |

|

$ |

(0.37 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.20 |

) |

|

$ |

0.16 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| (a)The reconciliation of

adjusted EBITDA of non-controlling interest |

|

|

|

|

|

|

|

|

| to net income attributable to

non-controlling interest is as follows |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net Income (loss) attributable

to non-controlling interest |

|

$ |

(472,354 |

) |

|

$ |

296,672 |

|

|

$ |

1,099,275 |

|

|

$ |

1,951,959 |

|

|

Income Taxes |

|

|

54,809 |

|

|

|

98,614 |

|

|

|

253,158 |

|

|

|

258,468 |

|

|

Depreciation and amortization |

|

|

191,326 |

|

|

|

256,201 |

|

|

|

905,002 |

|

|

|

1,096,709 |

|

|

Interest expense |

|

|

79,233 |

|

|

|

27,515 |

|

|

|

237,162 |

|

|

|

109,361 |

|

|

Interest (income) |

|

|

(65,708 |

) |

|

|

(164,421 |

) |

|

|

(369,197 |

) |

|

|

(526,567 |

) |

| EBITDA |

|

$ |

(212,694 |

) |

|

$ |

514,581 |

|

|

$ |

2,125,400 |

|

|

$ |

2,889,930 |

|

| Add back: |

|

|

|

|

|

|

|

|

|

Non-cash stock-based compensation |

|

|

3,770 |

|

|

|

6,155 |

|

|

|

29,450 |

|

|

|

13,527 |

|

| Adjusted EBITDA of

non-controlling interest |

|

$ |

(208,924 |

) |

|

$ |

520,736 |

|

|

$ |

2,154,850 |

|

|

$ |

2,903,457 |

|

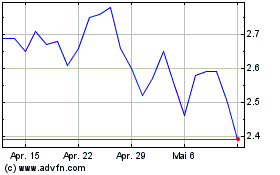

NetSol Technologies (NASDAQ:NTWK)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

NetSol Technologies (NASDAQ:NTWK)

Historical Stock Chart

Von Dez 2023 bis Dez 2024