AEye, Inc. (“AEye” or the “Company”) (Nasdaq: LIDR), a global

leader in adaptive, high performance lidar solutions, today

announced that the Company’s Board of Directors (“Board”) has

approved a 1-for-30 reverse stock split (the “Reverse Stock Split”)

of its common stock, par value $0.0001 per share (the “Common

Stock”), that is expected to become effective on Tuesday, December

26, 2023 at 5:00 p.m. Eastern Time (the “Effective Time”). The

Common Stock will continue to trade on the Nasdaq Stock Market

(“Nasdaq”) under the symbol “LIDR” and will begin trading on a

split-adjusted basis commencing upon market open on December 27,

2023. The new CUSIP number for the Common Stock following the

Reverse Stock Split will be 008183204. The Company’s publicly

traded warrants will continue to be traded on the Nasdaq under the

symbol “LIDRW.” However, under the terms of the applicable warrant

agreement, the number of shares of Common Stock issuable on

exercise of each warrant will be proportionately decreased.

The Reverse Stock Split was approved by the Company’s

stockholders at the special meeting of stockholders held on

December 12, 2023, where the Company’s stockholders approved the

amendments to the Company’s Second Amended and Restated Certificate

of Incorporation, as amended (the “Charter”), to effect the Reverse

Stock Split at such reverse stock split ratio (in multiples of five

to one ratio between and including five and fifty) and granted the

Board the authority to determine the final reverse stock split

ratio and when to proceed with the Reverse Stock Split.

Subsequently, the Board approved the Reverse Stock Split and filing

of the amendment to the Charter to effect the Reverse Stock Split,

at the ratio of 1-for-30, as of the Effective Time. As a result of

the Reverse Stock Split, every 30 shares of Common Stock issued and

outstanding will be automatically combined into one share of Common

Stock and proportionate adjustments will be made to the number of

shares of Common Stock underlying the Company’s outstanding equity

awards, the public warrants trading on Nasdaq under the existing

symbol “LIDRW,” private warrants and the number of shares issuable

under its equity incentive plans and other existing agreements, as

well as the exercise or conversion price, as applicable. There will

be no change to the number of authorized shares or the par value

per share.

No fractional shares of common stock will be issued as a result

of the Reverse Stock Split. Instead, any stockholders who would

have been entitled to receive a fractional share as a result of the

Reverse Stock Split will receive cash payments in lieu of such

fractional shares.

“After evaluating alternatives, we determined that a reverse

stock split was the best course of action to bring the Company in

compliance with Nasdaq’s minimum bid price requirements, and our

stockholders agreed,” said Matt Fisch, AEye CEO. “We believe

remaining listed on Nasdaq gives us the liquidity and visibility

necessary to attract a broader segment of the investment community.

This strategic move is intended to remove the ambiguity around our

listing and put us in a stronger position to enhance stockholder

value as we execute against our automotive-first strategy.”

INFORMATION FOR LIDR STOCKHOLDERS

The Company has chosen its transfer agent, Broadridge Financial

Solutions, Inc., to act as exchange agent for the Reverse Stock

Split. Registered stockholders holding pre-split shares of Common

Stock electronically in book-entry form are not required to take

any action to receive post-split shares and/or any cash in lieu of

fractional shares (if applicable). Such stockholders will

automatically receive, either via email or at your address of

record, a transaction statement from our transfer agent indicating

the number of post-Reverse Stock Split shares held following the

implementation of the Reverse Stock Split.

Those stockholders who hold their shares in brokerage accounts

or in “street name” will have their positions automatically

adjusted to reflect the Reverse Stock Split and any cash in lieu of

fractional shares (as applicable) will be automatically issued to

such stockholders through their broker, subject to each brokers’

particular processes, and will not be required to take any action

in connection with the Reverse Stock Split.

Additional information about the Reverse Stock Split and the

related Charter amendment can be found in the Company’s definitive

proxy statement filed by the Company with the United States

Securities and Exchange Commission (the “SEC”) on October 31, 2023.

This document is publicly accessible on the SEC’s website at

www.sec.gov.

About AEye

AEye’s unique software-defined lidar solution enables advanced

driver-assistance, vehicle autonomy, smart infrastructure, and

logistics applications that save lives and propel the future of

transportation and mobility. AEye’s 4Sight™ Intelligent Sensing

Platform, with its adaptive sensor-based operating system, focuses

on what matters most: delivering faster, more accurate, and

reliable information. AEye’s 4Sight™ products, built on this

platform, are ideal for dynamic applications which require precise

measurement imaging to ensure safety and performance.

Forward-Looking

Statements

Certain statements included in this press release that are not

historical facts are forward-looking statements within the meaning

of the federal securities laws, including “forward looking

statements” within the meaning of the safe harbor provisions under

the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements are sometimes accompanied by words such

as “believe,” “continue,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “future,” “opportunity,”

“predict,” “plan,” “may,” “should,” “will,” “would,” “potential,”

“seem,” “seek,” “outlook,” and similar expressions that predict or

indicate future events or trends, or that are not statements of

historical matters. Forward-looking statements are predictions,

projections, and other statements about future events that are

based on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. Forward-looking statements

included in this press release include statements about the future

effective date and intended effects of the Reverse Stock Split,

including whether the Reverse Stock Split will increase the price,

marketability, liquidity, and investor appeal of the Company’s

Common Stock and the Company’s ability to maintain the listing of

its Common Stock on Nasdaq, among others. These statements are

based on various assumptions, whether or not identified in this

press release. These forward-looking statements are provided for

illustrative purposes only and are not intended to serve as and

must not be relied on by an investor as a guarantee, an assurance,

a prediction, or a definitive statement of fact or probability.

Actual events and circumstances are very difficult or impossible to

predict and will differ from the assumptions. Many actual events

and circumstances are beyond the control of AEye. Many factors

could cause actual future events to differ from the forward-looking

statements in this press release. You should carefully consider the

risks and uncertainties described in the “Risk Factors” section of

the periodic report that AEye has most recently filed with the SEC,

and other documents filed by us or that will be filed by us from

time to time with the SEC. These filings identify and address

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made.

Readers are cautioned not to put undue reliance on

forward-looking statements; AEye assumes no obligation and does not

intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or

otherwise. AEye gives no assurance that AEye will achieve any of

its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231222043610/en/

Jennifer Deitsch AEye, Inc. jennifer@aeye.ai 925-400-4366 Evan

Niu, CFA Financial Profiles, Inc. eniu@finprofiles.com

310-622-8243

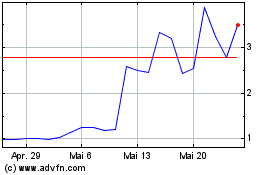

AEye (NASDAQ:LIDR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

AEye (NASDAQ:LIDR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025