Filed Pursuant to Rule 424(b)(3)

Registration No. 333-268678

PROSPECTUS

iSUN,

INC.

SHARES

OF COMMON STOCK

This

Prospectus covers up to 5,286,654 shares of our Common Stock that may be offered for resale or otherwise disposed of by the selling

stockholders set forth under the caption “Selling Stockholders” elsewhere in this prospectus, including their pledges, assignees

or successors-in-interest.

The

shares of Common Stock offered for resale consist of shares underlying two Senior Secured Convertible Notes, each issued by us in a private

placement on November 4, 2022.

We

will not receive any proceeds from the sale or other disposition of the shares of Common Stock by the Selling Stockholders.

The

Selling Stockholders identified in this Prospectus, or their respective transferees, pledgees, donees or other successors-in-interest,

may offer the Shares from time to time through public or private transactions at prevailing market prices, at prices related to prevailing

market prices or at privately negotiated prices. For additional information on the methods of sale for the Shares that may be used by

the Selling Stockholders, see the section entitled “Plan of Distribution” on page 10.

We

are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, and, as such, are allowed to provide

more limited disclosures than an issuer that would not so qualify. This Prospectus describes the general manner in which the Shares may

be offered and sold. If necessary, the specific manner in which the Shares may be offered and sold will be described in a supplement

to this Prospectus.

Our

Common Stock is traded on the Nasdaq Capital Market under the symbol “ISUN.”

Investing

in our Common Stock involves risks. See “Risk Factors” beginning on page 4 of this Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this Prospectus. Any representation to the contrary is a criminal offense.

The

date of this Prospectus is January 31, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

Prospectus is part of a Registration Statement filed with the SEC using a “shelf” registration process. Under this shelf

registration process, the Selling Stockholders may, from time to time, offer and sell the shares of Common Stock described in this Prospectus.

This Prospectus provides you with a general description of the securities which may be offered.

You

should rely only on the information contained in this Prospectus, any Prospectus Supplement and the documents incorporated by reference,

or to which we have referred you. Neither we nor the Selling Stockholders have authorized anyone to provide you with different information.

If anyone provides you with different or inconsistent information, you should not rely on it. This Prospectus and any Prospectus Supplement

does not constitute an offer to sell, or a solicitation of an offer to purchase, the Common Stock offered by this Prospectus and any

Prospectus Supplement in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation

of an offer in such jurisdiction. You should not assume that the information contained in this Prospectus, any Prospectus Supplement,

as well as information we have previously filed with the U.S. Securities and Exchange Commission (the “SEC”), is accurate

as of any date other than the date on the front cover of the applicable document.

If

necessary, the specific manner in which the shares of Common Stock may be offered and sold will be described in a Supplement to this

Prospectus, which Supplement may also add, update or change any of the information contained in this Prospectus. To the extent there

is a conflict between the information contained in this Prospectus and the Prospectus Supplement, you should rely on the information

in the Prospectus Supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document

having a later date—for example, a document incorporated by reference in this Prospectus or any Prospectus Supplement—the

statement in the document having the later date modifies or supersedes the earlier statement.

Neither

the delivery of this Prospectus nor any distribution of Common Stock pursuant to this Prospectus shall, under any circumstances, create

any implication that there has been no change in the information set forth or incorporated by reference into this Prospectus or in our

affairs since the date of this Prospectus. Our business, financial condition, results of operations and prospects may have changed since

such date.

When

used herein, unless the context requires otherwise, references to the “Company,” “we,” “our” and

“us” refer to iSun, Inc., a Delaware corporation.

OUR

COMPANY

This

summary highlights information contained in the documents incorporated herein by reference. Before making an investment decision, you

should read the entire Prospectus, and our other filings with the Securities and Exchange Commission, or the SEC, including those filings

incorporated herein by reference, carefully, including the sections entitled “Risk Factors” and “Cautionary Statement

Regarding Forward-Looking Statements.”

Overview

We

are one of the largest commercial solar engineering, procurement and construction (“EPC”) companies in the country and are

expanding across the Northeastern United States. We were a second-generation family business founded under the name Peck Electric Co.

in 1972 as a traditional electrical contractor. Our core values were and still are to align people, purpose, and profitability, and since

taking leadership in 1994, Jeffrey Peck, our Chief Executive Officer, has applied such core values to expand into the solar industry.

Today, we are guided by the mission to facilitate the reduction of carbon emissions through the expansion of clean, renewable energy

and we believe that leveraging such core values to deploy resources toward profitable business is the only sustainable strategy to achieve

these objectives.

The

world recognizes the need to transition to a reliable, renewable energy grid in the next 50 years. Vermont and Hawaii are leading the

way in the U.S. with renewable energy goals of 75% by 2032 and 100% by 2045, respectively. California committed to 100% carbon-free energy

by 2045. The majority of the other states in the U.S. also have renewable energy goals, regardless of current Federal solar policy. We

are a member of Renewable Energy Vermont, an organization that advocates for clean, practical and renewable solar energy. We intend to

use near-term incentives to take advantage of long-term, sustainable energy transformation with a commitment to the environment and to

our shareholders. Our triple bottom line, which is geared towards people, environment, and profit, has always been our guide since we

began installing renewable energy and we intend that it remain our guide over the next 50 years as we construct our energy future.

We

primarily provide EPC services to solar energy customers for projects ranging in size from several kilowatts for residential loads to

multi-megawatt systems for large commercial and utility projects. To date, we have installed over 400 megawatts of solar systems since

inception and are focused on profitable growth opportunities. We believe that we are well-positioned for what we believe to be the coming

transformation to an all renewable energy economy. We are expanding across the Northeastern United States to serve the fast-growing demand

for clean renewable energy. We are open to partnering with others to accelerate our growth process, and we are expanding our portfolio

of company-owned solar arrays to establish recurring revenue streams for many years to come. We have established a leading presence in

the market after five decades of successfully serving our customers, and we are now ready for new opportunities and the next five decades

of success. As part of our business strategy in 2021 we acquired iSun Energy, LLC, the intellectual property of Oakwood Construction

Services, Inc, SolarCommunities, Inc. d/b/a SunCommon and Liberty Electric, Inc in order to provide our full suite of services to the

residential, community, commercial, industrial and utility solar markets.

Corporate

Information

We

were incorporated on October 8, 2014 under the laws of the State of Delaware as Jensyn Acquisition Corp. On June 20, 2019, we changed

our name to The Peck Company Holdings, Inc. On January 19, 2021, we changed our name to iSun, Inc. Our executive offices are located

at 400 Avenue D, Suite 10, Williston, Vermont 05495 and our telephone number is (802) 658-3378. Our website address is www.isunenergy.com.

The information on our website is not part of this Prospectus. We have included our website address as a factual reference and do

not intend it to be active link to our website.

About

This Offering

This

Prospectus relates to the offer and resale by the Selling Stockholders of shares of our Common Stock. All of the shares, when sold, will

be sold by the Selling Stockholders. The Selling Stockholders may sell their shares of Common Stock from time to time at prevailing market

prices or at privately negotiated prices.

| Common

Stock Offered by the Selling Stockholders: |

|

5,286,654

shares of Common Stock. |

| |

|

|

| Common

Stock Outstanding at January 30, 2023: |

|

15,569,741 |

| |

|

|

| Use

of Proceeds: |

|

We

will not receive any proceeds from the sale of the shares of Common Stock offered by this Prospectus. |

| |

|

|

| Risk

Factors: |

|

An

investment in the Common Stock offered under this Prospectus is highly speculative and involves substantial risk. Please carefully

consider the “Risk Factors” section on page 4 and other information in this Prospectus for a discussion of risks.

Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business

and operations. |

| |

|

|

| Nasdaq

Symbol: |

|

ISUN |

RISK

FACTORS

An

investment in our Common Stock involves significant risks. You should carefully consider the risk factors contained in any Prospectus

Supplement and in our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2021 filed on April

15, 2022, and Form 10-K/A on May 2, 2022, our Form 10-Q for the quarterly period ended March 31, 2022 filed on May 16, 2021, our Form

10-Q for the quarterly period ended June 30, 2022 filed on August 15, 2022, our form 10-Q for the quarterly period ended September 30,

2022, filed on November 14, 2022, as well as all of the information contained in this Prospectus, any Prospectus Supplement and the documents

incorporated by reference herein or therein, before you decide to invest in our Common Stock. Our business, prospects, financial condition

and results of operations may be materially and adversely affected as a result of any of such risks. The value of our Common Stock could

decline as a result of any of these risks. You could lose all or part of your investment in our Common Stock. Some of our statements

in sections entitled “Risk Factors” are forward-looking statements. The risks and uncertainties we have described

are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may

also affect our business, prospects, financial condition and results of operations.

A

substantial number of shares of our Common Stock may be issued pursuant to the conversion terms of the Convertible Notes, which could

cause the price of our Common Stock to decline.

The

Convertible Notes are immediately convertible upon issuance into shares of our Common Stock at a conversion price of $2.66 per share,

for an aggregate of approximately 4,699,249 shares (based on $12,500,000 in aggregate principal amount outstanding as of such date) without

taking into account the accumulation of interest or the limitations on the conversion of the Convertible Notes as described elsewhere

in this Prospectus. The issuance of these shares will dilute our other equity holders, which could cause the price of our Common Stock

to decline.

Sales

of substantial amounts of our Common Stock by the Selling Stockholders, or the perception that these sales could occur, could adversely

affect the price of our Common Stock.

The

sale by the Selling Stockholders of a significant number of shares of Common Stock could have a material adverse effect on the market

price of our Common Stock. In addition, the perception in the public markets that the Selling Stockholders may sell all or a portion

of their shares as a result of the registration of such shares for resale pursuant to this Prospectus could also in and of itself have

a material adverse effect on the market price of our Common Stock. We cannot predict the effect, if any, that market sales of those shares

of Common Stock or the availability of those shares of Common Stock for sale will have on the market price of our Common Stock.

The

requirement that we repay the Convertible Notes and interest thereon in cash could adversely affect our business plan, liquidity, financial

condition, and results of operations.

If

not converted, we are required to repay principal amounts outstanding under the Convertible Notes and interest thereon in cash. These

obligations could have important consequences on our business. In particular, they could:

| |

● |

limit

our flexibility in planning for, or reacting to, changes in our businesses and the industries in which we operate; |

| |

● |

increase

our vulnerability to general adverse economic and industry conditions; and |

| |

● |

place

us at a competitive disadvantage compared to our competitors. |

No

assurances can be given that we will be successful in making the required payments under the Convertible Notes.

If

we are unable to make the required cash payments, there could be a default under the Convertible Notes. In such event, or if a default

otherwise occurs under the Convertible Notes, including as a result of our failure to comply with the financial or other covenants contained

therein, the holders of the Convertible Notes could cause the Convertible Notes to accrue interest at the rate of 10% per annum. In addition,

the holders could exercise their remedies as secured creditors as provide in a Security Agreement dated November 4, 2022.

Restricted

covenants under the Convertible Notes could limit our growth and our ability to finance our operations, fund our capital needs, respond

to changing conditions and engage in other business activities that maybe in our best interests.

The

Convertible Notes contain a number of affirmative and negative covenants regarding the payment of dividends, maintenance of its property,

transactions with affiliates, and issue notes and certain securities.

Our

ability to comply with these covenants may be adversely affected by events beyond our control, and we cannot assure you that we can maintain

compliance with these covenants. The financial covenants could limit our ability to make needed expenditures or otherwise conduct necessary

or desirable business activities.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

Prospectus, any Prospectus Supplement and the documents that we incorporate by reference contain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, regarding our business, financial

condition, expenditures, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,”

“plans,” “planned expenditures,” “believes,” “seeks,” “estimates” and similar

expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive

means of identifying forward-looking statements as denoted in this Prospectus, any Prospectus Supplement and the documents that we incorporate

by reference. Additionally, statements concerning future matters are forward-looking statements.

Although

forward-looking statements in this Prospectus, any Prospectus Supplement and the documents that we incorporate by reference reflect the

good faith judgment of our management, such statements can only be based on facts and factors known by us as of such date. Consequently,

forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from

the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such

differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risk Factors”

herein and in the documents we incorporate by reference, as well as those discussed elsewhere in this prospectus and any prospectus

supplement. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this

Prospectus, any Prospectus Supplement or the respective documents incorporated by reference, as applicable. Except as required by law,

we undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may

arise after the date of such forward-looking statements. Readers are urged to carefully review and consider the various disclosures made

throughout the entirety of this Prospectus, any Prospectus Supplement and the documents incorporated by reference, which attempt to advise

interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

PRIVATE

PLACEMENT OF THE CONVERTIBLE NOTES

On

November 4, 2022, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with Anson Investments Master

Fund LP and Anson East Master Fund LP (the “Investors”) and consummated the sale to the Investors of the Senior Secured Convertible

Notes (the “Convertible Notes”) with an aggregate initial principal amount of $12,500,000. The Notes were sold with an original

issue discount of $750,000. The Investors paid for the Notes to be issued by delivering $11,750,000 in cash consideration.

Upon

(i) the effectiveness of this Registration Statement covering the Registrable Securities, (ii) the Stockholder Approval (as defined in

the Purchase Agreement), (iii) the Company’s achievement of certain revenue and EBITDA targets, (iv) the Company having sufficient

authorized shares of Common Stock, (v) the Company’s maintenance of certain balance sheet requirements, and (vi) certain other

conditions, the Company and the Investors will consummate a second closing in which the Company will issue and sell to each Investor

a second Note for an aggregate principal amount of $12,500,000 having identical terms and conditions as the first Note, including a six

percent (6%) original issue discount, for an aggregate principal amount of $25,000,000 in Notes that may be issued and sold pursuant

to the Purchase Agreement.

Alliance

Global Partners / A.G.P. (“AGP”) was engaged as the sole placement agent for the offering of the Convertible Notes. AGP received

a placement agent fee of $718,750 at the closing of the Private Placement, representing 6.1% of the gross cash proceeds at the closing.

After deducting the placement agent fee, the Company’s estimated expenses associated with the Private Placement and the repayment

of certain indebtedness of the Company, the Company’s estimated net cash proceeds at the closing were approximately $632,461.61.

Purchase

Agreement

The

Purchase Agreement contains certain representations and warranties, covenants and indemnities customary for similar transactions.

Convertible

Notes

The

Notes were issued to the Investors on November 4, 2022 and mature on May 4, 2025 (the “Maturity Date”). Interest shall accrue

under the Notes at the rate of 5% per annum, payable in cash or, at the Company’s option, in duly authorized, validly issued, fully

paid and non-assessable shares of the Company’s Common Stock, or a combination thereof. The Notes are convertible into shares of

Common Stock at the election of the holder at any time at an initial conversion price of $2.66 (the “Conversion Price”).

The Conversion Price is subject to customary adjustments for stock dividends, stock splits, reclassifications and the like, and subject

to price-based adjustment in the event of any issuances of Common Stock, or securities convertible, exercisable or exchangeable for,

Common Stock at a price below the then-applicable Conversion Price (subject to certain exceptions). Beginning on March 1, 2023 and on

the first day of each month thereafter, the Company will be required to redeem 1/26th of the original principal amount of each Note,

plus accrued but unpaid interest, until the maturity date of May 4, 2025, on which date all amounts that remain outstanding will be due

and payable in full. Subject to certain conditions, including certain equity conditions, the Company may pay the amount due on each monthly

redemption date, and the final amount due at maturity, either in cash, shares of Common Stock or a combination thereof. The number of

shares used to pay any portion of the Notes in such event would be calculated as 90% of the lowest daily volume weighted average price

of the Common Stock during the five (5) trading days immediately prior to the payment date. The Notes may not be prepaid by the Company,

other than as specifically permitted by the Notes.

The

Notes rank senior to all outstanding and future indebtedness of the Company and its Subsidiaries (as defined in the Purchase Agreement),

subject to certain exclusions including (i) existing debt relating to bank loans to the Company’s subsidiary Peck Electric, Co.,

a Vermont corporation, secured by certain solar arrays, and (ii) existing vehicle and equipment loans to the Company’s subsidiaries,

Peck Electric Co., a Vermont corporation and SolarCommunities, Inc., a Vermont benefit corporation, secured by those vehicles and equipment,

and is secured by a first priority perfected security interest in all of the existing and future assets of the Company and each Guarantor

(as defined in the Security Agreement), as evidenced by (i) a Security Agreement entered into at the Closing (the “Security Agreement”),

(ii) a Trademark Security Agreement entered into at the Closing (the “Trademark Security Agreement”), and (iii) a Guaranty

executed by all direct and indirect subsidiaries of the Company (the “Guaranty”) pursuant to which each of them has agreed

to guaranty the obligations of the Company under the Notes and the other Transaction Documents (as defined in the Purchase Agreement).

Conversion

Limitation

The

Investors will not have the right to convert any portion of a Convertible Notes, to the extent that, after giving effect to such conversion,

the Investor (and other certain related parties) would beneficially own in excess of 4.99% of the shares of Common Stock outstanding

immediately after giving effect to such conversion. This limit may, from time to time, be increased, up to 9.99%, or decreased; provided

that any such increase will not be effective until the 61st day after delivery of a notice to the Company of such increase.

Events

of Default

The

Convertible Notes include certain customary and other Events of Default. In connection with an Event of Default, the Investor may require

the Company to redeem in cash any or all of the Convertible Notes. The redemption price will be at a premium to the amount due under

the Convertible Notes as described therein.

Covenants

The

Company will be subject to certain customary affirmative and negative covenants including those regarding the payment of dividends, maintenance

of its property, transactions with affiliates, and issue notes and certain securities.

Company

Optional Redemption Rights

The

Company may redeem the Convertible Notes at the redemption price described in the Convertible Notes.

Registration

Rights Agreement

The

Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Investors. Pursuant to

the terms of the Registration Rights Agreement, the Company has agreed to prepare and file with the SEC within 20 days following the

Closing a Registration Statement covering the resale of the shares of Common Stock issuable upon conversion of the Notes (the “Registrable

Securities”), and to use its best efforts to cause such Registration Statement to be declared effective under the Securities Act

of 1933, as amended (the “Securities Act”), as promptly as possible, but in any event no later than 60 days following the

Closing. If the Registration Statement is not filed within 20 days after the Closing (extended by the Company and the Investors to December

5, 2022) or is not declared effective by the applicable deadline set forth in the Registration Rights Agreement, or under certain other

circumstances described in the Registration Rights Agreement, then the Company shall be obligated to pay, as partial liquidated damages,

to each Investor an amount in cash equal to 2% of the original principal amount of the Notes each month until the applicable event giving

rise to such payments is cured. If the Company fails to pay any partial liquidated damages in full within seven days after the date payable,

the Company will pay interest thereon at a rate of 10% per annum.

Additional

Information

The

foregoing is only a summary of the material terms of the Purchase Agreement, the Convertible Notes, the Registration Rights Agreement

and the other ancillary transaction documents (collectively, the “Transaction Documents”), and does not purport to be a complete

description of the rights and obligations of the parties thereunder.

The

summary of the Transaction Documents is qualified in its entirety by reference to the forms of such agreements, which are filed as exhibits

to the Company’s Current Report on Form 8-K, filed November 8, 2022, and incorporated herein by reference.

The

foregoing summary and the exhibits hereto also are not intended to modify or supplement any disclosures about the Company in the Company’s

reports filed with the SEC. In particular, the agreements and the related summary are not intended to be, and should not be relied upon,

as disclosures regarding any facts and circumstances relating to the Company or any of its subsidiaries or affiliates. The agreements

contain representations and warranties by the Company, which were made only for purposes of that agreements and as of specified dates.

The representations, warranties and covenants in the agreements were made solely for the benefit of the parties to the agreements;

may be subject to limitations agreed upon by the contracting parties, including being subject to confidential disclosures that may modify,

qualify or create exceptions to such representations and warranties; may be made for the purposes of allocating contractual risk

between the parties to the agreements instead of establishing these matters as facts; and may be subject to standards of materiality

applicable to the contracting parties that differ from those applicable to the Investors. In addition, information concerning the subject

matter of the representations, warranties and covenants may change after the date of the agreements, which subsequent information may

or may not be fully reflected in the Company’s public disclosures.

As

of the date of this Prospectus, we believe that we will have the financial ability to make the majority of payments on the Convertible

Notes in cash when due. Accordingly, we do intend, as of the date of this Prospectus, to make such payments in shares of our Common Stock

when operating cash flow is not available to satisfy the amortization of the Convertible Note.

We

have not had any material relationships or arrangements with the Selling Stockholders, their affiliates, or any person with whom the

Selling Stockholders have a contractual relationship regarding this private placement (or any predecessors of those persons).

No

assurances can be given that we will be successful in satisfying the conditions, complying with certain of the terms and conditions in

the issuance of the convertible notes or in arranging further funding, if needed, or if successful to continue the execution of our business

plan including the development and commercialization of new products. Failure to obtain such funding will require management to substantially

curtail, if not cease operations, which will result in a material adverse effect on the financial position and our results of operations.

USE

OF PROCEEDS

The

Selling Stockholders will receive all of the proceeds from the sale of shares of Common Stock under this Prospectus. We will not receive

any proceeds from these sales. The Selling Stockholders will pay any agent’s commissions and expenses they incur for brokerage,

accounting, tax or legal services or any other expenses that they incur in disposing of the shares of Common Stock. We will bear all

other costs, fees and expenses incurred in effecting the registration of the shares of Common Stock covered by this Prospectus and any

Prospectus Supplement. These may include, without limitation, all registration and filing fees, SEC filing fees and expenses of compliance

with state securities or “blue sky” laws.

SELLING

STOCKHOLDERS

The

shares of Common Stock being offered by the Selling Stockholders are those issuable to the Selling Stockholders upon conversion of the

Convertible Notes. For additional information regarding the issuance of the Convertible Notes, see “Private Placement of the Convertible

Notes” above. We are registering the shares of Common Stock in order to permit the Selling Stockholders to offer the shares for

resale from time to time. Except for the ownership of the Convertible Notes issued pursuant to the Securities Purchase Agreement, the

Selling Stockholders have not had any material relationship with us within the past three years.

The

table below lists the selling stockholders and other information regarding the beneficial ownership (as determined under Section 13(d)

of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder) of the shares of Common Stock held by the

Selling Stockholders. The second column lists the number of shares of Common Stock beneficially owned by the Selling Stockholders, as

of November 4, 2022, assuming conversion of the Convertible Notes held by the Selling Stockholders on that date but taking account of

any limitations on conversion set forth therein. The third column lists the shares of Common Stock being offered by this prospectus by

the Selling Stockholders and does not take in account any limitations on conversion of the notes set forth therein.

Under

the terms of the Convertible Notes, a selling stockholder may not convert the notes to the extent (but only to the extent) such selling

stockholder or any of its affiliates would beneficially own a number of shares of our Common Stock which would exceed 4.99% of the outstanding

shares of the Company. The number of shares in the second column reflects these limitations. The Selling Stockholders may sell all, some

or none of their shares in this offering. See “Plan of Distribution.”

| Name of Selling Stockholder | |

Shares of Common Stock Beneficially Owned Prior to Offering | | |

Number of Shares of Common Stock Being Offered (1) | | |

Shares of Common Stock Beneficially Owned Upon Completion of this Offering (2) | |

| Anson Investments Master Fund LP (3) | |

| 0 | | |

| 4,229,323 | | |

| - | |

| Anson East Master Fund LP (4) | |

| 0 | | |

| 1,057,331 | | |

| - | |

(1)

In accordance with the terms of a Registration Rights Agreement with the holders of the Convertible Notes, this Prospectus generally

covers the resale of 5,286,654 shares of our Common Stock, which is the maximum number of shares of Common Stock issued or issuable pursuant

to the Notes (without regard to any limitations on conversion contained therein solely for the purpose of such calculation) at the Conversion

Price. Because the Conversion Price in connection with Monthly Redemptions (as defined in the Notes) of the Notes may be adjusted, the

number of shares that will actually be issued may be more or less than the number of shares being offered by this Prospectus.

(2)

The ownership of shares after the offering assumes the issuance of all of the shares underlying the Convertible Notes that are offered

for resale hereby, and the sale by the selling stockholders of all of the shares offered for resale hereby.

(3)

Anson Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers of Anson Investments Master Fund LP (“Anson”),

hold voting and dispositive power over the Common Shares held by Anson. Bruce Winson is the managing member of Anson Management GP LLC,

which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Winson,

Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these Common Shares except to the extent of their pecuniary interest

therein. The principal business address of Anson is Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104,

Cayman Islands.

(4)

Anson Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers of Anson East Master Fund LP (“Anson East”),

hold voting and dispositive power over the Common Shares held by Anson East. Bruce Winson is the managing member of Anson Management

GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr.

Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these Common Shares except to the extent of their pecuniary interest

therein. The principal business address of Anson East is Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104,

Cayman Islands

PLAN

OF DISTRIBUTION

The

Selling Stockholders and any of their respective pledgees, assignees and successors-in-interest may, from time to time, sell any or all

of their securities covered hereby on any trading market, stock exchange or other trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. The Selling Stockholders may use any one or more of the

following methods when selling securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

Selling Stockholders may also sell securities under Rule 144 under the Securities Act, if available, rather than under this Prospectus.

Broker-dealers

engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or

markdown in compliance with FINRA IM-2440.

In

connection with the sale of the securities covered hereby, the Selling Stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each Selling Stockholder has informed us that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the securities. We have agreed to indemnify

the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

Because

the Selling Stockholders may be deemed to be an “underwriter” within the meaning of the Securities Act, they will be subject

to the prospectus delivery requirements of the Securities Act, including Rule 172 thereunder. In addition, any securities covered by

this Prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this

Prospectus. Each Selling Stockholder has advised us that there is no underwriter or coordinating broker acting in connection with the

proposed sale of the resale securities by the Selling Stockholder.

We

agreed to keep this Prospectus effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders

without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for

us to be in compliance with the current public information requirement under Rule 144 under the Securities Act or any other rule of similar

effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule

of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable

state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered

or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is

complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the

Common Stock by the Selling Stockholders or any other person. We will make copies of this Prospectus available to the Selling Stockholders

and have informed the Selling Stockholders of the need to deliver a copy of this prospectus to each purchaser at or prior to the time

of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL

MATTERS

The

validity of the Common Stock offered by this Prospectus will passed upon by Merritt & Merritt, Burlington, Vermont.

EXPERTS

The

consolidated financial statements of iSun, Inc. as of December 31, 2021 and December 31, 2020 and for the years then ended, which are

incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2021 have been so incorporated

in reliance on the report of Marcum LLP, an independent registered public accounting firm, given on the authority of said firm as experts

in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the reporting and information requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and

as a result file periodic reports and other information with the SEC. These periodic reports and other information will be available

for inspection and copying at the SEC’s public reference room and the website of the SEC referred to below. We also make available

on our website under “SEC Filings,” free of charge, our Proxy Statements, Annual Reports on Form 10-K, Quarterly Reports

on Form 10-Q, Current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file

such materials with or furnish them to the SEC. Our website address is www.isunenergy.com. This reference to our website

is an inactive textual reference only, and is not a hyperlink. The contents of our website are not part of this Prospectus, and you should

not consider the contents of our website in making an investment decision with respect to the Common Stock offered hereby.

This

Prospectus is part of a Registration Statement on Form S-3 that we filed under the Securities Act with the SEC with respect to the shares

of our Common Stock offered by the Selling Stockholders through this Prospectus. This Prospectus is filed as a part of that Registration

Statement and does not contain all of the information contained in the Registration Statement and Exhibits. We refer you to our Registration

Statement and each Exhibit attached to it for a more complete description of matters involving us, and the statements that we have made

in this Prospectus are qualified in their entirety by reference to these additional materials.

The

SEC maintains a website that contains reports and other information about issuers, like us, who file electronically with the SEC. The

address of that website is http://www.sec.gov. This reference to the SEC’s website is an inactive textual reference only, and is

not a hyperlink.

INCORPORATION

OF DOCUMENTS BY REFERENCE

We

are “incorporating by reference” certain documents that we file with the SEC, which means that we can disclose important

information to you by referring you to those documents. The information in the documents incorporated by reference is considered to be

part of this Prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference in this Prospectus

will automatically update and supersede information contained in this Prospectus, including information in previously filed documents

or reports that have been incorporated by reference in this Prospectus, to the extent the new information differs from or is inconsistent

with the old information.

We

have filed the following documents with the SEC. These documents are incorporated herein by reference as of their respective dates of

filing:

(1)

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as filed with the SEC on April 15, 2022, and Form 10-K/A,

as filed with the SEC on May 2, 2022;

(2)

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, as filed with the SEC on May 16, 2022;

(3)

Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, as filed with the SEC on August 15, 2022.

(4)

Our Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, as filed with the SEC on November 14, 2022.

(4)

Our Current Reports on Form 8-K and 8-K/A, as applicable, as filed with the SEC on January

5, 2022; January

13, 2022; February

2, 2022; March

14, 2022; July

25, 2022; November

8, 2022, and January

25, 2023.

(4)

The description of our Common Stock contained in our Registration Statement on Form 8-A filed with the SEC on March 1, 2016, including

any amendments and reports filed for the purpose of updating such description.

All

documents filed by us pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (1) after the date of the filing of the Registration

Statement of which this Prospectus forms a part and prior to its effectiveness and (2) until all of the Common Stock to which this Prospectus

relates has been sold or the offering is otherwise terminated, except in each case for information contained in any such filing where

we indicate that such information is being furnished and is not to be considered “filed” under the Exchange Act, will be

deemed to be incorporated by reference in this prospectus and any accompanying Prospectus Supplement and to be a part hereof from the

date of filing of such documents.

We

will provide a copy of the documents we incorporate by reference, at no cost, to any person who receives this Prospectus. To request

a copy of any or all of these documents, you should write or telephone us at 400 Avenue D, Suite 10, Williston, VT 05495, Attention:

Mr. John Sullivan, CFO, (802) 658-7738.

Up

to 5,286,654 shares of Common Stock

PROSPECTUS

January

31, 2023

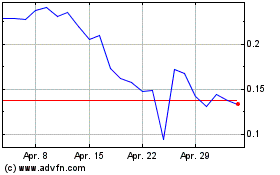

iSun (NASDAQ:ISUN)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

iSun (NASDAQ:ISUN)

Historical Stock Chart

Von Apr 2023 bis Apr 2024