ADR REPORT: Shares Mostly Up Despite Greek Debt Concerns

20 Juni 2011 - 11:37PM

Dow Jones News

International companies trading in New York closed mostly higher

Monday, as the broader markets also gained, despite Greek debt

concerns looming over Europe.

The Bank of New York index of ADRs ended up 0.02% at 137.02.

The Asian index edged up 0.03% to 131.27.

Panasonic Corp. (PC, 6752.TO) said Monday it expects its net

profit to fall 59% in the current fiscal year through March 2012,

as the Japanese electronics giant continues to cope with the impact

of the March 11 disaster on the country's supply chain. Panasonic

expects to post a net profit of Y30 billion this fiscal year, down

from Y74.02 billion in the last fiscal year ended March 31. But the

outlook signals a strong recovery expected in the fiscal second

half starting Oct. 1. Shares rose 0.9% to $11.61.

Meanwhile, Sony Corp.'s (SNE, 6758.TO) shares fell 2.6% to

$24.28 amid growing concerns over its outlook.

The Latin American index rose 0.3% to 391.39.

Brazilian mining giant Vale SA (VALE, VALE5.BR) finished 1.1%

higher at $30.19 as the Brazilian Steel Institute reported crude

steel output in the country recovered in May after a dip in April

as mills won back more market share from imports.

The emerging markets index increased 0.2% to 320.21.

Taiwan's Himax Technologies Inc. (HIMX) was one of the day's

biggest gainers. The company authorized the repurchase of up to $25

million of its American depository shares, joining a growing list

of companies seeking to reward shareholders by tapping into cash

stockpiles for which they have less need in an improving economy.

Shares surged 15% to $2.01.

The European index dipped 0.1% to 127.16.

A Greek parliamentary vote Tuesday will determine whether

debt-stricken Greece's new cabinet will be able to push through

austerity measures. Additional financial aid from the International

Monetary Fund and fellow euro-zone members is contingent on Greece

passing these fiscal reforms.

The situation in Greece weighed on European bank stocks, as

Lloyds Banking Group PLC (LYG, LLOY.LN) fell 2.3% to $3.01 and

Royal Bank of Scotland Group PLC (RBS, RBS.LN) shares fell 3.5% to

$12.56. Royal Bank of Scotland employees cashed out a swath of

stock awarded for bonuses, adding to pressure from the Greece

woes.

-By Matt Jarzemsky, Dow Jones Newswires; 212-416-2240;

matthew.jarzemsky@dowjones.com

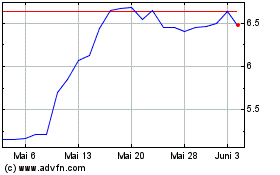

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

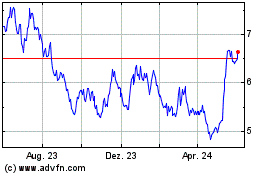

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jul 2023 bis Jul 2024