- 2010 Earnings per ADS of 19 cents

- Positive on 2011 outlook with strong growth in small/medium and

non-driver products

- Expects to commence the planned TDR listing in 2011

Himax Technologies, Inc. ("Himax" or "Company") (Nasdaq:HIMX) today

reported financial results for the fourth quarter and full year

ended December 31, 2010.

For the fourth quarter of 2010, Himax reported net revenues of

$141.2 million, representing a 21.0% decrease from $178.7 million

in the fourth quarter of 2009, and a 2.1% increase from $138.3

million in the third quarter of 2010. Gross margin was 21.5% in the

fourth quarter of 2010, up 150 basis points year-over-year and down

140 basis points, sequentially. Operating income in the fourth

quarter was $12.9 million, compared to $13.1 million for the same

period last year and operating loss of $0.7 million in the previous

quarter.

Net income attributable to Himax stockholders for the fourth

quarter of 2010 was $11.7 million or $0.066 per diluted ADS, up

from $11.0 million or $0.061 per diluted ADS in the fourth quarter

of 2009, and up from $0.4 million or $0.003 per diluted ADS in the

third quarter of 2010.

Excluding share-based compensation and acquisition-related

charges, non-GAAP operating income for the fourth quarter of 2010

was $14.5 million, down from $15.4 million in the same period last

year, and up from $7.3 million in the previous quarter.

Non-GAAP net income attributable to Himax stockholders for the

fourth quarter of 2010 was $13.0 million or $0.073 per diluted ADS,

up from $12.6 million or $0.069 per diluted ADS in the fourth

quarter of 2009, and up from $7.0 million or $0.040 per diluted ADS

in the third quarter of 2010.

Reconciliation of gross margin, operating margin (loss), net

margin and diluted EPS excluding share-based compensation and

acquisition-related charges, a non-GAAP financial measure, to GAAP

gross margin, GAAP operating margin (loss), GAAP net margin and

diluted GAAP EPS, most comparable GAAP figure, is set out in the

attached reconciliation schedule.

Jordan Wu, President and Chief Executive Officer of Himax,

commented, "2010 was a year full of both challenges and excitement.

While we lost share in large panel drivers, we also gained a lot of

ground in small and medium size panels. Also, we picked up strong

momentum in 2010 across all of our non-driver businesses, which we

have cultivated for a long time. We believe the strong momentum

will continue into this year and beyond."

Mr. Wu continued, "Our revenues totaled $642.7 million in 2010,

representing a 7.2% decline year-over-year. The decline was caused

by the 25.7% year over year reduction of large-panel drivers, which

represented 57.0% of 2010 revenue, as compared to 71.3% in 2009. We

don't expect further loss of market share for large-sized drivers

with our existing major customers for this year. Moreover, we are

confident that we will gain share in China where there are

aggressive panel capacity expansion plans offering attractive new

driver business opportunities in the near term, especially in the

large panel segment.

Small- and medium-sized drivers, on the other hand, grew 46.5%

year over year, representing 34.8% of our total revenue, as

compared to 22.0% a year ago. This strong growth momentum in the

small and medium drivers will continue into this year, thanks to

the expanding markets for several emerging product segments,

especially smart phones and tablet PCs.

Non-driver products grew 13.8% year over year, representing 8.2%

of our total sales, as compared to 6.7% a year ago. We achieved

numerous milestones for non-driver products in 2010. Firstly 2010

was the year when we commenced mass production for several new

product areas, including CMOS image sensors, wafer-level optics,

wafer-level camera modules, 2D to 3D conversion solutions and touch

controller ICs. These milestones are illustrations of our strong

R&D capability and our commitment to a more diversified product

portfolio. It has also paved the way for strong long term growth.

Moreover, our LCOS pico-projector solutions, power management ICs

and WLED drivers all showed significant year-over-year shipment and

revenue growth in 2010. We are confident that the strong momentum

will continue into 2011 and beyond for every non-driver product

segment.

Gross margin in 2010 was 21.0% compared to 20.5% in 2009. Our

net income was $33.2 million, or 19 cents per ADS, compared to

$39.7 million, or 21 cents per ADS in the previous year. We expect

to see contribution from our non-driver products to our gross

profit and bottom line this year, on top of their contributions to

the top line. Other than a short period of ramping time in the

initial stage of mass production, each of our non-driver products

exhibits higher gross margin than our driver products. We believe,

with further ramp-up in non-driver products, we will be able to

improve our gross margin from the current level."

Mr. Wu continued, "Entering into 2011, we are seeing encouraging

signs in literally all aspects of our businesses, including large

panel driver business where we suffered last year. We are therefore

optimistic that our business is bottoming out and we are on track

again to see top line and bottom line growth starting this year,

following three years of decline. Equally important, looking ahead,

we foresee a more balanced business portfolio with the large panel

driver business accounting for a smaller percentage of our total

sales. We also anticipate small panel drivers and non-drivers,

which do not rely on a small number of large customers, to

contribute significantly to our total sales.

2011 will be marked as a year of transition for us. Seeing the

exciting upside potential, we continue to invest heavily on

R&D, which will result in less than satisfactory first quarter

profitability, as will be provided by the guidance below.

Nevertheless, we believe we will be able to grow both our top and

bottom lines each quarter during 2011."

Mr. Wu continued, "Another important task for this year is the

listing of our planned Taiwan Depositary Receipts, or TDR. The

filing, however, can only be made after the publication of the 2010

full year US GAAP audited financial reports, which is scheduled for

the end of April. Prior year audited financial report is one of the

essential documents required for official TDR application with the

Taiwan Stock Exchange. We expect the issuance of TDR will provide a

more convenient platform for our Asia-based investors and would

help better reflect our corporate value through increased

liquidity. We will provide application updates along the way."

Mr. Wu added, "Moving to our first quarter 2011 guidance, we

expect revenues to remain flat or go up slightly, with our

non-driver products to account for over 10% of the total sales, the

first time in our history. However, we expect gross margin to

decline within 1 percentage point. The decline in gross margin is

primarily due to certain ramping-up expenses involved in non-driver

products in their early stage of mass production. With further

shipment ramp-up, we do expect non-driver products to contribute

positively to our overall gross margin soon after this quarter. As

mentioned earlier, R&D expenses are projected to increase from

last quarter. Finally, our GAAP earnings per ADS is expected to be

in the range of 1-2 cents."

Investor Conference Call / Webcast Details

The Company's management will review detailed fourth quarter

2010 results on Wednesday, February 9, 2011 at 6:00 PM NYC (7:00

AM, Thursday, February 10, Taiwan time). The conference dial-in

numbers are +1-201-689-8471 (international) and +1-877-407-4018

(U.S. domestic). A live webcast of the conference call will be

available on the Company's website at www.himax.com.tw. The

playback will be available beginning two hours after the call

through 1:00 PM Taiwan time on Wednesday, February 16, 2011

(midnight U.S. Eastern Standard Time) at www.himax.com.tw and by

telephone at +1-858-384-5517 (international) or +1-877-870-5176

(U.S. domestic). The conference ID number is 364670.

About Himax Technologies, Inc.

Himax Technologies, Inc. designs, develops, and markets

semiconductors that are critical components of flat panel displays.

The Company's principal products are display drivers for

large-sized TFT-LCD panels, which are used in desktop monitors,

notebook computers and televisions, and display drivers for small-

and medium-sized TFT-LCD panels, which are used in mobile handsets

and consumer electronics products such as netbook computers,

digital cameras, mobile gaming devices, portable DVD players,

digital photo frame and car navigation displays. In addition, the

Company is expanding its product offerings to include timing

controllers, touch controller ICs, LCD TV and monitor chipset

solutions, LCOS projector solutions, power management ICs, CMOS

Image Sensors, Infinitely Color Technology and 2D to 3D conversion

solutions. Based in Tainan, Taiwan, the Company has regional

offices in Hsinchu and Taipei, Taiwan; Ninbo, Foshan, Fuqing,

Beijing, Shanghai, Suzhou and Shenzhen, China; Yokohama and

Matsusaka, Japan; Cheonan-si, Chungcheongnam-do, South Korea; and

Irvine, California, USA.

Forward-Looking

Statements:

Factors that could cause actual events or results to differ

materially include, but not limited to, general business and

economic conditions and the state of the semiconductor industry;

market acceptance and competitiveness of the driver and non-driver

products developed by the Company; demand for end-use applications

products; reliance on a small group of principal customers; the

uncertainty of continued success in technological innovations; our

ability to develop and protect our intellectual property; pricing

pressures including declines in average selling prices; changes in

customer order patterns; changes in estimated full-year effective

tax rate; shortages in supply of key components; changes in

environmental laws and regulations; exchange rate fluctuations;

regulatory approvals for further investments in our subsidiaries;

our ability to collect accounts receivable and manage inventory;

the uncertainty of success in our Taiwan listing plan which is

still under review by Taiwan regulatory authorities and subject to

change due to, among other things, changes in either Taiwan or US

authorities' policies and Taiwan regulatory authorities' acceptance

of the Company's Taiwan listing application and other risks

described from time to time in the Company's SEC filings, including

those risks identified in the section entitled "Risk Factors" in

its Form 20-F for the year ended December 31, 2009 filed with SEC

on dated June 3, 2010, as amended.

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Income |

| (These interim

financials do not fully comply with US GAAP because they omit all

interim disclosure required by US GAAP) |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

|

|

|

| |

Three Months Ended

December 31, |

Three Months Ended September

30, |

| |

2010 |

2009 |

2010 |

| Revenues |

|

|

|

| Revenues

from third parties, net |

$ 67,125 |

$ 59,421 |

$ 71,064 |

| Revenues

from related parties, net |

74,081 |

119,255 |

67,217 |

| |

141,206 |

178,676 |

138,281 |

| |

|

|

|

| Costs and expenses: |

|

|

|

| Cost of revenues |

110,884 |

142,889 |

106,602 |

| Research and

development |

17,010 |

16,767 |

23,267 |

| General and

administrative |

5,582 |

3,882 |

4,948 |

| Sales and marketing |

(5,149) |

2,047 |

4,139 |

| Total costs and

expenses |

128,327 |

165,585 |

138,956 |

| |

|

|

|

| Operating income

(loss) |

12,879 |

13,091 |

(675) |

| |

|

|

|

| Non operating income

(loss): |

|

|

|

| Interest income |

141 |

90 |

193 |

| Equity in losses of equity method

investees |

(146) |

(48) |

(99) |

| Foreign exchange losses, net |

(433) |

(108) |

(345) |

| Interest expense |

(106) |

-- |

(71) |

| Other income, net |

487 |

79 |

173 |

| |

(57) |

13 |

(149) |

| Earnings (loss)

before income taxes |

12,822 |

13,104 |

(824) |

| Income tax expense

(benefit) |

2,317 |

3,016 |

(149) |

| Net income (loss) |

10,505 |

10,088 |

(675) |

| Net loss attributable to

noncontrolling interests |

1,148 |

949 |

1,122 |

| Net income

attributable to Himax stockholders |

$ 11,653 |

$ 11,037 |

$ 447 |

| |

|

|

|

| Basic earnings per ordinary share

attributable to Himax stockholders |

$ 0.033 |

$ 0.030 |

$ 0.001 |

| Diluted earnings per

ordinary share attributable to Himax

stockholders |

$ 0.033 |

$ 0.030 |

$ 0.001 |

| Basic earnings per ADS attributable

to Himax stockholders |

$ 0.066 |

$ 0.061 |

$ 0.003 |

| Diluted earnings per

ADS attributable to Himax

stockholders |

$ 0.066 |

$ 0.061 |

$ 0.003 |

| |

|

|

|

| Basic Weighted Average

Outstanding Ordinary

Shares |

354,633 |

362,034 |

352,589 |

| Diluted Weighted Average

Outstanding Ordinary

Shares |

355,061 |

362,579 |

353,767 |

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Income |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

|

|

| |

Twelve

Months Ended |

| |

December

31, |

| |

2010 |

2009 |

| Revenues |

|

|

| Revenues

from third parties, net |

$ 304,068 |

$ 245,075 |

| Revenues

from related parties, net |

338,624 |

447,306 |

| |

642,692 |

692,381 |

| |

|

|

| Costs and expenses: |

|

|

| Cost of revenues |

507,647 |

550,556 |

| Research and

development |

76,426 |

71,364 |

| General and

administrative |

18,770 |

16,346 |

| Sales and marketing |

4,491 |

10,578 |

| Total costs and

expenses |

607,334 |

648,844 |

| |

|

|

| Operating income |

35,358 |

43,537 |

| |

|

|

| Non operating income

(loss): |

|

|

| Interest income |

607 |

766 |

| Equity in losses of equity method

investees |

(410) |

(89) |

| Foreign exchange losses, net |

(736) |

(510) |

| Interest expense |

(182) |

(3) |

| Other income, net |

820 |

24 |

| |

99 |

188 |

| Earnings before

income taxes |

35,457 |

43,725 |

| Income tax expense |

6,391 |

7,915 |

| Net income |

29,066 |

35,810 |

| Net loss attributable to the

noncontrolling interests |

4,140 |

3,840 |

| Net income

attributable to Himax stockholders |

$ 33,206 |

$ 39,650 |

| |

|

|

| Basic earnings per ordinary share

attributable to Himax stockholders |

$0.094 |

$0.107 |

| Diluted earnings per

ordinary share attributable to Himax

stockholders |

$0.093 |

$0.107 |

| Basic earnings per ADS attributable

to Himax stockholders |

$0.187 |

$0.215 |

| Diluted earnings per

ADS attributable to Himax

stockholders |

$0.187 |

$0.214 |

| |

|

|

| Basic Weighted Average Outstanding

Shares |

355,037 |

369,652 |

| Diluted Weighted Average Outstanding

Shares |

355,690 |

370,229 |

| Himax Technologies,

Inc. |

| Unaudited Supplemental

Financial Information |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

|

| |

| The amount of share-based

compensation included in applicable statements of

income categories is summarized as

follows: |

|

|

|

| |

|

|

|

| |

Three Months Ended

December 31, |

Three Months Ended September

30, |

| |

2010 |

2009 |

2010 |

| Share-based compensation |

|

|

|

| Cost of revenues |

$ 23 |

$ 22 |

$ 174 |

| Research and

development |

779 |

1,306 |

5,275 |

| General and

administrative |

131 |

228 |

937 |

| Sales and marketing |

137 |

219 |

1,040 |

|

Income tax benefit |

(177) |

(233) |

(1,108) |

| Total |

$ 893 |

$ 1,542 |

$ 6,318 |

| |

|

|

|

| The amount of

acquisition-related charges included in

applicable statements of income

categories is summarized as follows: |

|

|

|

| |

|

|

|

| Acquisition-related charges |

|

|

|

| Research and

development |

$ 259 |

$ 259 |

$ 259 |

| Sales

and marketing |

289 |

289 |

289 |

| Income

tax benefit |

(125) |

(546) |

(264) |

| Total |

$ 423 |

$ 2 |

$ 284 |

| |

|

|

|

| Himax Technologies,

Inc. |

| Unaudited Supplemental

Financial Information |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

| The amount of share-based

compensation included in applicable statements of

income categories is summarized as

follows: |

|

|

| |

|

|

| |

Twelve

Months Ended

December

31, |

| |

2010 |

2009 |

| Share-based compensation |

|

|

| Cost of revenues |

$ 240 |

$ 264 |

| Research and

development |

8,803 |

10,936 |

| General and

administrative |

1,525 |

1,959 |

| Sales and marketing |

1,613 |

1,902 |

| Income tax benefit |

(1,603) |

(2,260) |

| Total |

$ 10,578 |

$ 12,801 |

| |

|

|

| The amount of

acquisition-related charges included in

applicable statements of income

categories is summarized as follows: |

|

|

| |

|

|

| Research and

development |

$ 1,035 |

$ 1,035 |

| Sales

and marketing |

1,157 |

1,157 |

| Income

tax benefit |

(728) |

(1,032) |

| Total |

$ 1,464 |

$ 1,160 |

| |

|

|

| |

|

|

| |

|

|

|

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Balance Sheets |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

|

|

|

| |

December 31, |

September 30, |

December 31, |

| |

2010 |

2010 |

2009 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$96,842 |

$80,139 |

$110,924 |

| Investments in marketable securities

available-for-sale |

8,632 |

2,470 |

10,730 |

| Restricted cash equivalents |

58,500 |

44,000 |

-- |

| Accounts receivable, less allowance for

doubtful accounts, sales returns and discounts |

80,212 |

84,803 |

64,496 |

| Accounts receivable from related parties,

less allowance for sales returns and discounts |

95,964 |

97,597 |

138,172 |

| Inventories |

117,988 |

111,664 |

67,768 |

| Deferred income taxes |

4,348 |

17,900 |

17,491 |

| Prepaid expenses and other current

assets |

15,810 |

11,749 |

14,216 |

| Total current

assets |

$478,296 |

$450,322 |

$423,797 |

| |

|

|

|

| Investment securities, including

securities measured at fair value |

25,626 |

19,135 |

11,619 |

| Equity method

investments |

869 |

1,231 |

586 |

| Property, plant and equipment,

net |

47,561 |

48,708 |

51,586 |

| Deferred income

taxes |

30,227 |

25,121 |

24,548 |

| Goodwill |

26,846 |

26,846 |

26,846 |

| Intangible assets, net |

6,674 |

7,223 |

8,872 |

| Other assets |

1,391 |

2,460 |

2,594 |

| |

139,194 |

130,724 |

126,651 |

| Total assets |

$617,490 |

$581,046 |

$550,448 |

| |

|

|

|

| Liabilities and Equity |

|

|

|

| Current liabilities: |

|

|

|

| Short-term debt |

$57,000 |

$44,000 |

$ -- |

| Accounts payable |

115,922 |

106,350 |

88,079 |

| Income taxes payable |

6,560 |

11,681 |

14,147 |

| Other accrued expenses and other current

liabilities |

23,605 |

20,041 |

18,425 |

| Total current

liabilities |

$203,087 |

$182,072 |

$120,651 |

| Other liabilities |

7,427 |

4,514 |

5,725 |

| Total liabilities |

$210,514 |

$186,586 |

$126,376 |

| |

|

|

|

| Equity |

|

|

|

| Himax stockholders'

equity: |

|

|

|

| Ordinary shares, US$0.3 par value,

1,000,000,000 shares authorized; 353,842,764 shares, 353,842,764

shares, and 358,012,184 shares issued and outstanding at December

31, 2010, September 30, 2010, and December 31, 2009,

respectively |

$106,153 |

$106,153 |

$107,404 |

| Additional paid-in capital |

100,291 |

99,154 |

102,924 |

| Accumulated other comprehensive

income |

1,204 |

454 |

4 |

| Unappropriated retained earnings |

198,230 |

186,577 |

209,121 |

| Himax stockholders'

equity |

$405,878 |

$392,338 |

$419,453 |

| Noncontrolling

interests |

1,098 |

2,122 |

4,619 |

| Total equity |

$406,976 |

$394,460 |

$424,072 |

| Total liabilities and

equity |

$617,490 |

$581,046 |

$550,448 |

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in

Thousands of

U.S.Dollars) |

| |

|

|

|

| |

Three Months

Ended December 31, |

Three Months Ended

September 30, |

| |

2010 |

2009 |

2010 |

| |

|

|

|

| Cash flows from operating

activities: |

|

|

|

| Net income (loss) |

$ 10,505 |

$ 10,088 |

$ (675) |

| Adjustments to reconcile net income (loss) to

net cash provided by (used in) operating activities: |

|

|

|

| Depreciation and

amortization |

3,275 |

3,617 |

3,366 |

| Bad debt expenses |

-- |

(575) |

-- |

| Share-based compensation

expenses |

1,071 |

1,775 |

1,555 |

| Equity in losses of equity

method investees |

146 |

48 |

99 |

| Loss on disposal of property

and equipment |

-- |

2 |

34 |

| Gain on disposal of marketable

securities, net |

(197) |

(17) |

(21) |

| Valuation gain on investment

securities |

(258) |

-- |

(62) |

| Amortization of discount on

investment securities |

(34) |

-- |

(18) |

| Deferred income tax expense

(benefit) |

8,198 |

2,022 |

(3,850) |

| Inventories write downs |

4,112 |

3,774 |

2,210 |

| Changes in operating assets and

liabilities: |

|

|

|

| Accounts receivable |

4,591 |

12,110 |

12,696 |

| Accounts receivable from

related parties |

1,645 |

10,700 |

21,178 |

| Inventories |

(10,436) |

33,746 |

(34,613) |

| Prepaid expenses and other current

assets |

(4,059) |

(1,131) |

908 |

| Accounts payable |

9,572 |

(62,060) |

(27,918) |

| Income taxes payable |

(5,478) |

1,068 |

4,045 |

| Other accrued expenses and other current

liabilities |

3,673 |

2,159 |

829 |

| Other liabilities |

3,476 |

(697) |

(34) |

| Net cash

provided by (used in) operating

activities |

29,802 |

16,629 |

(20,271) |

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

| Purchase of property and

equipment |

(1,831) |

(2,260) |

(1,233) |

| Proceeds from disposal of

property and equipment |

-- |

15 |

-- |

| Purchase of available-for-sale

marketable securities |

(15,958) |

(13,653) |

(9,184) |

| Disposal of available-for-sale

marketable securities |

10,399 |

7,946 |

6,340 |

| Purchase of non-marketable

equity securities |

(5,500) |

-- |

(1,000) |

| Purchase of investment

securities |

-- |

-- |

(684) |

| Purchase of Equity method

investments |

(9) |

-- |

-- |

| Pledge of restricted cash

equivalents and marketable securities |

(13,512) |

(2,068) |

(44,004) |

| Decrease in other assets |

88 |

19 |

7 |

| Net cash used in investing

activities |

(26,323) |

(10,001) |

(49,758) |

| |

|

|

|

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in

Thousands of

U.S.Dollars) |

| |

|

|

|

| |

Three Months

Ended December

31, |

Three Months Ended

September

30, |

| |

2010 |

2010 |

2010 |

| Cash flows from financing

activities: |

|

|

|

| Distribution of cash

dividends |

$ -- |

$ -- |

$ (44,097) |

| Proceeds from issuance of new

shares by subsidiaries |

95 |

805 |

117 |

| Payments to acquire ordinary

shares for retirement |

-- |

(11,043) |

(4,210) |

| Proceeds from disposal of

subsidiary shares to noncontrolling interests by Himax Technologies

Limited |

135 |

76 |

364 |

| Purchase of subsidiary shares

from noncontrolling interests |

(60) |

(99) |

-- |

| Proceeds from borrowing of

short-term debt |

13,000 |

-- |

44,000 |

| Net cash

provided by (used in) financing

activities |

13,170 |

(10,261) |

(3,826) |

| Effect of foreign

currency exchange rate changes on

cash and cash equivalents |

54 |

(5) |

27 |

| Net increase

(decrease) in cash and cash

equivalents |

16,703 |

(3,638) |

(73,828) |

| Cash and cash equivalents at

beginning of period |

80,139 |

114,562 |

153,967 |

| Cash and cash equivalents at end of

period |

$ 96,842 |

$ 110,924 |

$ 80,139 |

| |

|

|

|

| Supplemental disclosures of cash flow

information: |

|

|

|

| Cash paid during the

period for: |

|

|

|

| Interest expense |

$ 165 |

$ -- |

$ -- |

| Income taxes |

$ 41 |

$ 13 |

$ 45 |

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in

Thousands of

U.S.Dollars) |

| |

|

|

| |

Twelve

Months Ended December

31, |

| |

2010 |

2009 |

| |

|

|

| Cash flows from operating

activities: |

|

|

| |

|

|

| Net income |

$ 29,066 |

$ 35,810 |

| Adjustments to reconcile net income to net

cash provided by operating activities: |

|

|

| Depreciation and

amortization |

13,626 |

13,795 |

| Bad debt expenses |

-- |

218 |

| Share-based compensation

expenses |

6,311 |

8,553 |

| Equity in losses of equity

method investees |

410 |

89 |

| Loss on disposal of

property and equipment |

34 |

43 |

| Loss (gain) on sale of

marketable securities, net |

(296) |

87 |

| Valuation gain on investment

securities |

(320) |

-- |

| Amortization of discount on

investment securities |

(52) |

-- |

| Deferred income taxes

expense |

6,612 |

1,447 |

| Inventories write

downs |

10,557 |

13,622 |

| Changes in operating assets and

liabilities: |

|

|

| Accounts receivable |

(14,782) |

(13,686) |

| Accounts receivable from

related parties |

41,306 |

(33,685) |

| Inventories |

(60,777) |

14,401 |

| Prepaid expenses and

other current assets |

(1,591) |

(2,299) |

| Accounts payable |

27,843 |

34,360 |

| Income tax payable |

(7,923) |

(880) |

| Other accrued expenses

and other current liabilities |

4,767 |

2,452 |

| Other liabilities |

2,840 |

(697) |

| Net cash

provided by operating

activities |

57,631 |

73,630 |

| |

|

|

| Cash flows from investing

activities: |

|

|

| Purchase of property and

equipment |

(7,172) |

(10,592) |

| Proceeds from sale of property,

plant and equipment |

-- |

25 |

| Purchase of available-for-sales

marketable securities |

(34,976) |

(34,248) |

| Disposal of available-for-sale

marketable securities |

33,443 |

39,263 |

| Purchase of financial assets

carried at cost |

(7,524) |

-- |

| Purchase of equity-method

investments |

(906) |

(663) |

| Purchase of investment

securities |

(684) |

-- |

| Decrease (increase) in

refundable deposits |

298 |

(217) |

| Pledge of restricted cash

equivalents and marketable securities |

(57,578) |

(1,002) |

| Increase in other assets |

-- |

(107) |

| Net cash used in

investing activities |

(75,099) |

(7,541) |

| |

|

|

| |

|

|

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Statements of Cash

Flows |

| (Figures in

Thousands of

U.S.Dollars) |

| |

|

|

| |

Twelve

Months Ended December

31, |

| |

|

|

| |

2010 |

2009 |

| |

|

|

| Cash flows from financing

activities: |

|

|

| Distribution of cash

dividends |

$ (44,097) |

$ (55,496) |

| Proceeds from issuance of new

shares by subsidiaries |

353 |

1,027 |

| Payments to acquire ordinary

shares for retirement |

(10,755) |

(36,596) |

| Proceeds from disposal of

subsidiary shares by Himax Technologies Limited |

1,011 |

529 |

| Purchase of subsidiary shares

from noncontrolling interest |

(207) |

(243) |

| Proceeds from short-term

debt |

217,000 |

80,000 |

| Repayment of short-term

debt |

(160,000) |

(80,000) |

| Net cash

provided by (used in) financing

activities |

3,305 |

(90,779) |

| Effect of exchange rate

change on cash and cash equivalents |

81 |

414 |

| Net

decrease in cash and cash

equivalents |

(14,082) |

(24,276) |

| Cash and cash equivalents at

beginning of year |

110,924 |

135,200 |

| Cash and cash equivalents at end of

year |

$ 96,842 |

$ 110,924 |

| |

|

|

| Supplemental disclosures of cash flow

information: |

|

|

| Cash paid during

the period for: |

|

|

| Interest |

$ 170 |

$ 3 |

|

Income taxes |

$ 8,329 |

$ 7,652 |

| |

|

|

|

|

|

| Himax Technologies,

Inc. Unaudited Supplemental Data – Reconciliation

Schedule |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

|

| Gross Margin, Operating

Margin and Net Margin Excluding Share-based Compensation and

Acquisition-Related Charges: |

| |

|

|

|

| |

Three Months Ended

December 31, |

Three Months Ended September

30, |

| |

2010 |

2009 |

2010 |

| |

|

|

|

| Revenues |

$ 141,206 |

$ 178,676 |

$ 138,281 |

| |

|

|

|

| Gross profit |

30,322 |

35,787 |

31,679 |

| Add: Share-based compensation – Cost of

revenues |

23 |

22 |

174 |

| Gross profit excluding share-based

compensation |

30,345 |

35,809 |

31,853 |

| Gross margin excluding share-based

compensation |

21.5% |

20.0% |

23.0% |

| |

|

|

|

| Operating income (loss) |

12,879 |

13,091 |

(675) |

| Add: Share-based compensation |

1,070 |

1,775 |

7,426 |

| Operating income excluding share-based

compensation |

13,949 |

14,866 |

6,751 |

| Add: Acquisition-related charges –Intangible

assets amortization |

548 |

548 |

548 |

| Operating income excluding share-based

compensation and acquisition-related charges |

14,497 |

15,414 |

7,299 |

| Operating margin excluding share-based

compensation and acquisition-related charges |

10.3% |

8.6% |

5.3% |

| Net income attributable to Himax

stockholders |

11,653 |

11,037 |

447 |

| Add: Share-based compensation, net of

tax |

893 |

1,542 |

6,318 |

| Add: Acquisition-related charges, net of

tax |

423 |

2 |

284 |

| Net income attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

12,969 |

12,581 |

7,049 |

| Net margin attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

9.2% |

7.0% |

5.1% |

| *Gross margin excluding

share-based compensation equals gross profit excluding share-based

compensation divided by revenues |

| *Operating margin excluding

share-based compensation and acquisition-related charges equals

operating income excluding share-based compensation and

acquisition-related charges divided by revenues |

| *Net margin attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges equals net income attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges divided by revenues |

|

|

| Himax Technologies,

Inc. Unaudited Supplemental Data – Reconciliation

Schedule |

| (Amounts in Thousands

of U.S. Dollars) |

| |

|

|

| Gross Margin, Operating

Margin and Net Margin Excluding Share-based Compensation and

Acquisition-Related Charges: |

| |

|

|

| |

Twelve Months Ended

December 31, |

| |

2010 |

2009 |

| Revenues |

$642,692 |

$692,381 |

| |

|

|

| Gross profit |

135,045 |

141,825 |

| Add: Share-based compensation – Cost of

revenues |

240 |

264 |

| Gross profit excluding share-based

compensation |

135,285 |

142,089 |

| Gross margin excluding share-based

compensation |

21.0% |

20.5% |

| |

|

|

|

|

| Operating income |

35,358 |

43,537 |

| Add: Share-based compensation |

12,181 |

15,061 |

| Operating income excluding share-based

compensation |

47,539 |

58,598 |

| Add: Acquisition-related charges –Intangible

assets amortization |

2,192 |

2,192 |

| Operating income excluding share-based

compensation and acquisition-related charges |

49,731 |

60,790 |

| Operating margin excluding share-based

compensation and acquisition-related charges |

7.7% |

8.8% |

| Net income attributable to Himax

stockholders |

33,206 |

39,650 |

| Add: Share-based compensation, net of

tax |

10,578 |

12,801 |

| Add: Acquisition-related charges, net of

tax |

1,464 |

1,160 |

| Net income attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

45,248 |

53,611 |

| Net margin attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

7.0% |

7.7% |

| *Gross margin excluding

share-based compensation equals gross profit excluding share-based

compensation divided by revenues |

| *Operating margin excluding

share-based compensation and acquisition-related charges equals

operating income excluding share-based compensation and

acquisition-related charges divided by revenues |

| *Net margin attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges equals net income attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges divided by revenues |

| |

|

|

|

|

| Diluted Earnings Per

Ordinary Share Attributable to

Himax stockholders Excluding Share-based Compensation and

Acquisition-Related Charges:

|

| |

|

|

| |

Three Months Ended December

31, |

Twelve Months Ended December

31, |

| |

2010 |

2010 |

| Diluted GAAP EPS attributable to Himax

stockholders |

$0.033 |

$0.093 |

| Add: Share-based compensation per diluted

share |

$0.003 |

$0.030 |

| Add: Acquisition-related charges per diluted

share |

$0.001 |

$0.004 |

| |

|

|

| Diluted non GAAP EPS attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges |

$0.037 |

$0.127 |

| |

|

|

CONTACT: Jessie Wang / Jessica Huang

Investor Relations

Himax Technologies, Inc.

+886-2-2370-3999 Ext. 22618 / 22513

jessie_wang@himax.com.tw

jessica_huang@himax.com.tw

In the U.S.

Joseph Villalta

The Ruth Group

+1-646-536-7003

jvillalta@theruthgroup.com

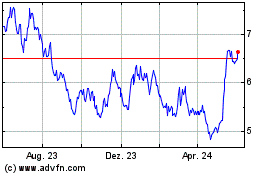

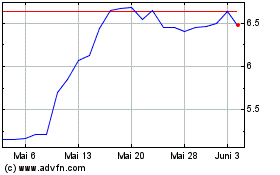

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jul 2023 bis Jul 2024