Himax Technologies, Inc. ("Himax" or "Company") (Nasdaq:HIMX) today

reported financial results for the third quarter ended September

30, 2010.

For the third quarter of 2010, Himax reported net revenues of

$138.3 million, representing a 31.9% decrease from $203.1 million

in the third quarter of 2009, and a 26.3% decrease from $187.7

million in the second quarter of 2010. Gross margin was 22.9% in

the third quarter of 2010, up 250 basis points year-over-year and

sequentially. Operating loss in the third quarter was $0.7 million,

compared to operating income of $10.8 million for the same period

last year and $13.0 million in the previous quarter.

Net income attributable to Himax stockholders for the third

quarter of 2010 was $0.4 million or 0.3 cents per diluted ADS, down

from $8.8 million or $0.05 cents per diluted ADS in the third

quarter of 2009, and down from $12.0 million or $0.07 cents per

diluted ADS in the second quarter of 2010.

Excluding share-based compensation and acquisition-related

charges, non-GAAP operating income for the third quarter of 2010

was $7.3 million, down from $20.0 million in the same period last

year, and down from $15.4 million in the previous quarter.

Non-GAAP net income attributable to Himax stockholders for the

third quarter of 2010 was $7.0 million or $0.04 per diluted ADS,

down from $16.2 million or $0.09 per diluted ADS in the third

quarter of 2009, and down from $14.0 million or $0.08 per diluted

ADS in the second quarter of 2010.

Reconciliation of gross margin, operating margin (loss), net

margin and diluted EPS excluding share-based compensation and

acquisition-related charges, a non-GAAP financial measure, to GAAP

gross margin, GAAP operating margin (loss), GAAP net margin and

diluted GAAP EPS, most comparable GAAP figure, is set out in the

attached reconciliation schedule.

Jordan Wu, President and Chief Executive Officer of Himax,

commented, "We believe we are bottoming out from the current trough

and our global driver IC market share is in a good position to grow

again next year. Our core competence in display drivers remains

strong as demonstrated by the steady year-over-year revenue growth

of our small and medium- sized panel drivers. Large-sized display

drivers remains a business we are fully committed to. Looking

ahead, China's aggressive capacity expansion plans have made it the

market segment with the highest growth potential over the next few

years. We are confident that we are in a strong position to capture

a major driver IC market share during this time of fast

expansion."

Mr. Wu continued, "The third quarter non-driver sales,

especially those from our LCOS product line, were lower than our

expectation. Many of our LCOS customers built significant inventory

during the second quarter, anticipating strong market demand over

certain new product designs. However, at the end of second quarter

2010, the Chinese government took measures to crack down on the

white-box handset market, which, at this stage, is a major end

market for our LCOS products. Facing a high inventory level, our

customers have slowed down placing new orders to us starting in the

third quarter and toward the beginning of the fourth quarter. We

are now seeing order flows returning towards normal levels as those

overbuilt inventories are gradually being consumed."

Mr. Wu continued, "An area to highlight is our 2D to 3D

conversion solutions, which have been embedded into a number of

worldwide first-tier TV brands particularly in Japan and China. We

continue to see enthusiastic adoption of our solutions from many

other customers covering TV and other applications. Capped by the

availability of 3D panels, however, our shipment this year has been

insignificant. Today 3D panels are offered only by a small number

of panel makers with a limited number of models. However, we are

seeing more display makers offering a wide variety of 3D panels to

the market, using different technologies. We expect our world

leading 2D to 3D conversion products to benefit strongly next year

with the increasing shipment and penetration of 3D panels."

Mr. Wu continued, "Revenues from CMOS image sensors and WLED

drivers each experienced over 100% quarter-over-quarter growth in

the third quarter. We expect both segments to carry strong momentum

into the fourth quarter and next year. Our new generation sensors,

in particular, are very competitive in cost and performance and are

being adopted by numerous handset, notebook and web camera

customers. We anticipate an explosive growth of our sensor sales

next year."

Mr. Wu added, "Looking forward to the fourth quarter of 2010, we

expect revenues to be approximately flat, gross margin to down by 1

to 2 percentage points, sequentially, and GAAP earnings per ADS to

be in the range of $0.04 to $0.06 cents."

Investor Conference Call / Webcast Details

The Company's management will review detailed third quarter 2010

results on Monday, November 8, 2010 at 6:00 PM NYC (7:00 AM,

Tuesday, November 9, Taiwan time). The conference dial-in numbers

are +1-201-689-8471 (international) and +1-877-407-4018 (U.S.

domestic). A live webcast of the conference call will be available

on the Company's website at www.himax.com.tw. The playback will be

available beginning two hours after the call through 1:00 PM Taiwan

time on Tuesday, November 16, 2010 (midnight U.S. Eastern Standard

Time) at www.himax.com.tw and by telephone at +1 858-384-5517

(international) or +1-877-870-5176 (U.S. domestic). The conference

ID number is 358070.

About Himax Technologies, Inc.

Himax Technologies, Inc. designs, develops, and markets

semiconductors that are critical components of flat panel displays.

The Company's principal products are display drivers for

large-sized TFT-LCD panels, which are used in desktop monitors,

notebook computers and televisions, and display drivers for small-

and medium-sized TFT-LCD panels, which are used in mobile handsets

and consumer electronics products such as netbook computers,

digital cameras, mobile gaming devices, portable DVD players,

digital photo frame and car navigation displays. In addition, the

Company is expanding its product offerings to include timing

controllers, LCD TV and monitor chipset solutions, LCOS projector

solutions, power management ICs, CMOS Image Sensors, Infinitely

Color Technology and 2D to 3D conversion solutions. Based in

Tainan, Taiwan, the Company has regional offices in Hsinchu and

Taipei, Taiwan; Ninbo, Foshan, Fuqing, Beijing, Shanghai, Suzhou

and Shenzhen, China; Yokohama and Matsusaka, Japan; Cheonan-si,

Chungcheongnam-do, South Korea; and Irvine California, USA.

Forward-Looking Statements:

Factors that could cause actual events or results to differ

materially include, but not limited to, general business and

economic conditions and the state of the semiconductor industry;

market acceptance and competitiveness of the driver and non-driver

products developed by the Company; demand for end-use applications

products; reliance on a small group of principal customers; the

uncertainty of continued success in technological innovations; our

ability to develop and protect our intellectual property; pricing

pressures including declines in average selling prices; changes in

customer order patterns; changes in estimated full-year effective

tax rate; shortages in supply of key components; changes in

environmental laws and regulations; exchange rate fluctuations;

regulatory approvals for further investments in our subsidiaries;

our ability to collect accounts receivable and manage inventory;

the uncertainty of success in our Taiwan listing plan which is

still under review by Taiwan regulatory authorities and subject to

change due to, among other things, changes in either Taiwan or U.S.

authorities' policies and Taiwan regulatory authorities' acceptance

of the Company's Taiwan listing application and other risks

described from time to time in the Company's SEC filings, including

those risks identified in the section entitled "Risk Factors" in

its Form 20-F for the year ended December 31, 2009 filed with SEC

on dated June 3, 2010, as amended.

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Income |

| (These interim

financials do not fully comply with U.S. GAAP because they omit all

interim disclosure required by U.S. GAAP) |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

|

|

|

| |

Three Months Ended

September 30, |

Three Months Ended June

30, |

| |

2010 |

2009 |

2010 |

| Revenues |

|

|

|

| Revenues from

third parties, net |

$ 71,064 |

$ 77,933 |

$ 94,939 |

| Revenues from

related parties, net |

67,217 |

125,189 |

92,768 |

| |

138,281 |

203,122 |

187,707 |

| |

|

|

|

| Costs and expenses: |

|

|

|

| Cost of revenues |

106,602 |

161,687 |

149,388 |

| Research and development |

23,267 |

21,772 |

18,341 |

| General and administrative |

4,948 |

4,985 |

4,197 |

| Sales and marketing |

4,139 |

3,856 |

2,752 |

| Total costs and

expenses |

138,956 |

192,300 |

174,678 |

| |

|

|

|

| Operating income

(loss) |

(675) |

10,822 |

13,029 |

| |

|

|

|

| Non operating income

(loss): |

|

|

|

| Interest income |

193 |

110 |

169 |

| Equity in losses of equity method

investees |

(99) |

(41) |

(106) |

| Foreign exchange gains (losses), net |

(345) |

7 |

53 |

| Interest expense |

(71) |

(3) |

(5) |

| Other income, net |

173 |

66 |

72 |

| |

(149) |

139 |

183 |

| Earnings (loss)

before income taxes |

(824) |

10,961 |

13,212 |

| Income tax expense (benefit) |

(149) |

2,933 |

2,174 |

| Net income (loss) |

(675) |

8,028 |

11,038 |

| Net loss attributable to

noncontrolling interests |

1,122 |

793 |

930 |

| Net income

attributable to Himax stockholders |

$ 447 |

$ 8,821 |

$ 11,968 |

| |

|

|

|

| Basic earnings per ordinary share

attributable to Himax stockholders |

$ 0.001 |

$ 0.024 |

$ 0.034 |

| Diluted earnings per

ordinary share attributable to Himax

stockholders |

$ 0.001 |

$ 0.024 |

$ 0.033 |

| Basic earnings per ADS attributable

to Himax stockholders |

$ 0.003 |

$ 0.048 |

$ 0.067 |

| Diluted earnings per

ADS attributable to Himax

stockholders |

$ 0.003 |

$ 0.048 |

$ 0.067 |

| |

|

|

|

| Basic Weighted Average

Outstanding Ordinary

Shares |

352,589 |

367,026 |

355,426 |

| Diluted Weighted Average

Outstanding Ordinary

Shares |

353,767 |

368,905 |

358,011 |

| |

| Himax Technologies,

Inc. |

| Unaudited Condensed

Consolidated Statements of Income |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

|

| |

Nine

Months Ended |

| |

September

30, |

| |

2010 |

2009 |

| Revenues |

|

|

| Revenues from

third parties, net |

$ 236,943 |

$ 185,654 |

| Revenues from

related parties, net |

264,543 |

328,051 |

| |

501,486 |

513,705 |

| |

|

|

| Costs and expenses: |

|

|

| Cost of revenues |

396,763 |

407,667 |

| Research and development |

59,416 |

54,597 |

| General and administrative |

13,188 |

12,464 |

| Sales and marketing |

9,640 |

8,531 |

| Total costs and

expenses |

479,007 |

483,259 |

| |

|

|

| Operating income |

22,479 |

30,446 |

| |

|

|

| Non operating income

(loss): |

|

|

| Interest income |

466 |

676 |

| Equity in losses of equity method

investees |

(264) |

(41) |

| Foreign exchange losses, net |

(303) |

(402) |

| Interest expense |

(76) |

(3) |

| Other income (loss), net |

333 |

(55) |

| |

156 |

175 |

| Earnings before

income taxes |

22,635 |

30,621 |

| Income tax expense |

4,074 |

4,899 |

| Net income |

18,561 |

25,722 |

| Net loss attributable to the

noncontrolling interests |

2,992 |

2,891 |

| Net income

attributable to Himax stockholders |

$ 21,553 |

$ 28,613 |

| |

|

|

| Basic earnings per ordinary share

attributable to Himax stockholders |

$0.061 |

$0.077 |

| Diluted earnings per

ordinary share attributable to Himax

stockholders |

$0.061 |

$0.077 |

| Basic earnings per ADS attributable

to Himax stockholders |

$0.121 |

$0.154 |

| Diluted earnings per

ADS attributable to Himax

stockholders |

$0.121 |

$0.154 |

| |

|

|

| Basic Weighted Average Outstanding

Shares |

355,172 |

372,219 |

| Diluted Weighted Average Outstanding

Shares |

355,775 |

372,588 |

| |

| Himax Technologies,

Inc. |

| Unaudited Supplemental

Financial Information |

| (Amounts in Thousands

of U.S. Dollars) |

| |

| The amount of share-based

compensation included in applicable statements of

income categories is summarized as

follows: |

Three Months Ended

September 30, |

Three Months Ended June

30, |

| |

2010 |

2009 |

2010 |

| Share-based compensation |

|

|

|

| Cost of revenues |

$ 174 |

$ 216 |

$ 21 |

| Research and development |

5,275 |

6,040 |

1,375 |

| General and administrative |

937 |

1,188 |

228 |

| Sales and marketing |

1,040 |

1,149 |

218 |

| Income tax benefit |

(1,108) |

(1,631) |

(131) |

| Total |

$ 6,318 |

$ 6,962 |

$ 1,711 |

| |

|

|

|

| The amount of

acquisition-related charges included in

applicable statements of income

categories is summarized as follows: |

|

|

|

| |

|

|

|

| Acquisition-related charges |

|

|

|

| Research and development |

$ 259 |

$ 260 |

$ 258 |

| Sales and marketing |

289 |

288 |

290 |

| Income tax benefit |

(264) |

(162) |

(200) |

| Total |

$ 284 |

$ 386 |

$ 348 |

| |

| Himax Technologies,

Inc. |

| Unaudited Supplemental

Financial Information |

| (Amounts in Thousands

of U.S. Dollars) |

| |

| The amount of share-based

compensation included in applicable statements of

income categories is summarized as

follows: |

Nine Months

Ended September

30, |

| |

2010 |

2009 |

| Share-based compensation |

|

|

| Cost of revenues |

$ 217 |

$ 242 |

| Research and development |

8,024 |

9,630 |

| General and administrative |

1,394 |

1,731 |

| Sales and marketing |

1,476 |

1,683 |

| Income tax benefit |

(1,426) |

(2,027) |

| Total |

$ 9,685 |

$ 11,259 |

| |

|

|

| The amount of

acquisition-related charges included in

applicable statements of income

categories is summarized as follows: |

|

|

| |

|

|

| Research and development |

$ 776 |

$ 776 |

| Sales and marketing |

868 |

868 |

| Income tax benefit |

(603) |

(486) |

| Total |

$ 1,041 |

$ 1,158 |

| |

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Balance

Sheets |

| (Amounts in Thousands

of U.S. Dollars, Except Per Share Data) |

| |

|

|

|

| |

September

30, |

June

30, |

December

31, |

| |

2010 |

2010 |

2009 |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ 80,139 |

$ 153,967 |

$ 110,924 |

| Investments in marketable securities

available-for-sale |

2,470 |

3,900 |

10,730 |

| Restricted cash equivalents |

44,000 |

-- |

-- |

| Accounts receivable, less allowance for

doubtful accounts, sales returns and discounts |

84,803 |

97,499 |

64,496 |

| Accounts receivable from related parties,

less allowance for sales returns and discounts |

97,597 |

118,746 |

138,172 |

| Inventories |

111,664 |

79,261 |

67,768 |

| Deferred income taxes |

17,900 |

15,873 |

17,491 |

| Prepaid expenses and other current

assets |

11,749 |

12,657 |

14,216 |

| Total current

assets |

$ 450,322 |

$ 481,903 |

$ 423,797 |

| |

|

|

|

| Investment securities, including

securities measured at fair value |

19,135 |

12,643 |

11,619 |

| Equity method

investments |

1,231 |

1,318 |

586 |

| Property,

plant and equipment, net |

48,708 |

50,544 |

51,586 |

| Deferred income taxes |

25,121 |

23,426 |

24,548 |

| Goodwill |

26,846 |

26,846 |

26,846 |

| Intangible assets, net |

7,223 |

7,773 |

8,872 |

| Other assets |

2,460 |

2,440 |

2,594 |

| |

130,724 |

124,990 |

126,651 |

| Total assets |

$ 581,046 |

$ 606,893 |

$ 550,448 |

| |

|

|

|

| Liabilities and

Equity |

|

|

|

| Current liabilities: |

|

|

|

| Short-term debt |

$ 44,000 |

$ -- |

$ -- |

| Accounts payable |

106,350 |

134,266 |

88,079 |

| Income taxes payable |

11,681 |

7,661 |

14,147 |

| Dividend payable |

-- |

44,188 |

-- |

| Other accrued expenses and other current

liabilities |

20,041 |

19,413 |

18,425 |

| Total current

liabilities |

$ 182,072 |

$ 205,528 |

$ 120,651 |

| Other liabilities |

4,514 |

4,642 |

5,725 |

| Total liabilities |

$ 186,586 |

$ 210,170 |

$ 126,376 |

| |

|

|

|

| Equity |

|

|

|

| Himax stockholders'

equity: |

|

|

|

| Ordinary shares, US$0.3 par value,

1,000,000,000 shares authorized; 353,842,764 shares, 353,502,962

shares, and 358,012,184 shares issued and outstanding at September

30, 2010, June 30, 2010, and December 31, 2009, respectively |

$ 106,153 |

$ 106,051 |

$ 107,404 |

| Additional paid-in capital |

99,154 |

101,623 |

102,924 |

| Accumulated other comprehensive income

(loss) |

454 |

(32) |

4 |

| Unappropriated retained earnings |

186,577 |

186,039 |

209,121 |

| Himax

stockholders' equity |

$ 392,338 |

$ 393,681 |

$ 419,453 |

| Noncontrolling

interests |

2,122 |

3,042 |

4,619 |

| Total

equity |

$ 394,460 |

$ 396,723 |

$ 424,072 |

| Total liabilities and

equity |

$ 581,046 |

$ 606,893 |

$ 550,448 |

| |

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in

Thousands of

U.S.Dollars) |

| |

|

|

| |

Three Months

Ended September 30, |

Three Months Ended

June 30, |

| |

2010 |

2009 |

2010 |

| |

|

|

|

| Cash flows from operating

activities: |

|

|

|

| Net income (loss) |

$ (675) |

$ 8,028 |

$ 11,038 |

| Adjustments to reconcile net income (loss) to

net cash provided by (used in) operating activities: |

|

|

|

| Depreciation and amortization |

3,366 |

3,452 |

3,463 |

| Bad debt expenses |

-- |

533 |

-- |

| Share-based compensation expenses |

1,555 |

2,085 |

1,842 |

| Equity in losses of equity method

investees |

99 |

41 |

106 |

| Loss on disposal of property and

equipment |

34 |

34 |

-- |

| Gain on disposal of marketable

securities, net |

(21) |

(52) |

(19) |

| Valuation gain on trading securities |

(62) |

-- |

-- |

| Amortization of discount on investment

securities |

(18) |

-- |

-- |

| Deferred income tax expense

(benefit) |

(3,850) |

(263) |

2,639 |

| Inventories write downs |

2,210 |

2,649 |

1,371 |

| Changes in operating assets and

liabilities: |

|

|

|

| Accounts receivable |

12,696 |

(11,308) |

(25,211) |

| Accounts receivable from related

parties |

21,178 |

(6,797) |

9,827 |

| Inventories |

(34,613) |

(25,612) |

(15,230) |

| Prepaid expenses and other current

assets |

908 |

1,905 |

1,098 |

| Accounts payable |

(27,918) |

13,590 |

18,352 |

| Income taxes payable |

4,045 |

3,333 |

(8,844) |

| Other accrued expenses and other current

liabilities |

829 |

1,363 |

2,464 |

| Other liabilities |

(34) |

-- |

(602) |

| Net cash

provided by (used in) operating

activities |

(20,271) |

(7,019) |

2,294 |

| |

|

|

|

| Cash flows from investing

activities: |

|

|

|

| Purchase of property and equipment |

(1,233) |

(2,365) |

(1,720) |

| Proceeds from disposal of property and

equipment |

-- |

9 |

-- |

| Purchase of available-for-sale marketable

securities |

(9,184) |

(8,896) |

(4,257) |

| Disposal of available-for-sale marketable

securities |

6,340 |

8,454 |

5,514 |

| Purchase of non-marketable equity

securities |

(1,000) |

-- |

(1,024) |

| Purchase of equity method

investments |

-- |

(312) |

-- |

| Purchase of trading securities |

(684) |

-- |

-- |

| Release (pledge) of restricted cash

equivalents and marketable securities |

(44,004) |

2,101 |

(62) |

| Decrease (increase) in other assets |

7 |

(226) |

134 |

| Net cash used in investing

activities |

(49,758) |

(1,235) |

(1,415) |

| |

| Himax Technologies,

Inc. |

| Unaudited

Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in

Thousands of

U.S.Dollars) |

| |

|

|

| |

|

|

| |

Three Months

Ended September

30, |

Three Months Ended

June

30, |

| |

2010 |

2009 |

2010 |

| Cash flows from financing

activities: |

|

|

|

| Distribution of cash dividends |

$ (44,097) |

$ -- |

$ -- |

| Proceeds from issuance of new shares by

subsidiaries |

117 |

120 |

76 |

| Payments to acquire ordinary shares for

retirement |

(4,210) |

(14,023) |

(2,903) |

| Proceeds from disposal of subsidiary

shares to noncontrolling interests by Himax Technologies

Limited |

364 |

14 |

94 |

| Purchase of subsidiary shares from

noncontrolling interests |

-- |

(61) |

(109) |

| Proceeds from borrowing of short-term

debt |

44,000 |

80,000 |

160,000 |

| Repayment of short-term debt |

-- |

(80,000) |

(160,000) |

| Net cash used

in financing activities |

(3,826) |

(13,950) |

(2,842) |

| Effect of foreign

currency exchange rate changes on

cash and cash equivalents |

27 |

6 |

(2) |

| Net

decrease in cash and cash

equivalents |

(73,828) |

(22,198) |

(1,965) |

| Cash and cash equivalents at

beginning of period |

153,967 |

136,760 |

155,932 |

| Cash and cash equivalents at end of

period |

$ 80,139 |

$ 114,562 |

$ 153,967 |

| |

|

|

|

| Supplemental disclosures of cash flow

information: |

|

|

|

| Cash paid during the period for: |

|

|

|

| Interest expense |

$ -- |

$ 3 |

$ 5 |

| Income taxes |

$ 45 |

$ 5 |

$ 8,196 |

| Supplemental disclosures of non-cash

financing activities: |

|

|

|

| Dividend Payable |

$ -- |

$ -- |

$ 44,188 |

| |

| Himax Technologies,

Inc. |

| Unaudited Supplemental

Data – Reconciliation Schedule |

| (Amounts in Thousands

of U.S. Dollars) |

| |

| Gross Margin, Operating

Margin and Net Margin Excluding Share-based Compensation and

Acquisition-Related Charges: |

| |

Three Months Ended

September 30, |

Three Months Ended June

30, |

| |

2010 |

2009 |

2010 |

| Revenues |

$ 138,281 |

$ 203,122 |

$ 187,707 |

| |

|

|

|

| Gross profit |

31,679 |

41,435 |

38,319 |

| Add: Share-based compensation – Cost of

revenues |

174 |

216 |

21 |

| Gross profit excluding share-based

compensation |

31,853 |

41,651 |

38,340 |

| Gross margin excluding share-based

compensation |

23.0% |

20.5% |

20.4% |

| |

|

|

|

| Operating income (loss) |

(675) |

10,822 |

13,029 |

| Add: Share-based compensation |

7,426 |

8,593 |

1,842 |

| Operating income excluding share-based

compensation |

6,751 |

19,415 |

14,871 |

| Add: Acquisition-related charges –Intangible

assets amortization |

548 |

548 |

548 |

| Operating income excluding share-based

compensation and acquisition-related charges |

7,299 |

19,963 |

15,419 |

| Operating margin excluding share-based

compensation and acquisition-related charges |

5.3% |

9.8% |

8.2% |

| Net income attributable to Himax

stockholders |

447 |

8,821 |

11,968 |

| Add: Share-based compensation, net of

tax |

6,318 |

6,962 |

1,711 |

| Add: Acquisition-related charges, net of

tax |

284 |

386 |

348 |

| Net income attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

7,049 |

16,169 |

14,027 |

| Net margin attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

5.1% |

8.0% |

7.5% |

| |

|

|

|

| *Gross margin excluding

share-based compensation equals gross profit excluding share-based

compensation divided by revenues |

| *Operating margin excluding

share-based compensation and acquisition-related charges equals

operating income excluding share-based compensation and

acquisition-related charges divided by revenues |

| *Net margin attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges equals net income attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges divided by revenues |

| |

| Himax Technologies,

Inc. |

| Unaudited Supplemental

Data – Reconciliation Schedule |

| (Amounts in Thousands

of U.S. Dollars) |

| |

| Gross Margin, Operating

Margin and Net Margin Excluding Share-based Compensation and

Acquisition-Related Charges: |

| |

Nine Months Ended

September 30, |

| |

2010 |

2009 |

| Revenues |

$501,486 |

$513,705 |

| |

|

|

| Gross profit |

104,723 |

106,038 |

| Add: Share-based compensation – Cost of

revenues |

217 |

242 |

| Gross profit excluding share-based

compensation |

104,940 |

106,280 |

| Gross margin excluding share-based

compensation |

20.9% |

20.7% |

| |

|

|

|

|

| Operating income |

22,479 |

30,446 |

| Add: Share-based compensation |

11,111 |

13,286 |

| Operating income excluding share-based

compensation |

33,590 |

43,732 |

| Add: Acquisition-related charges –Intangible

assets amortization |

1,644 |

1,644 |

| Operating income excluding share-based

compensation and acquisition-related charges |

35,234 |

45,376 |

| Operating margin excluding share-based

compensation and acquisition-related charges |

7.0% |

8.8% |

| Net income attributable to Himax

stockholders |

21,553 |

28,613 |

| Add: Share-based compensation, net of

tax |

9,685 |

11,259 |

| Add: Acquisition-related charges, net of

tax |

1,041 |

1,158 |

| Net income attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

32,279 |

41,030 |

| Net margin attributable to Himax stockholders

excluding share-based compensation and acquisition-related

charges |

6.4% |

8.0% |

| |

| *Gross margin excluding

share-based compensation equals gross profit excluding share-based

compensation divided by revenues |

| *Operating margin excluding

share-based compensation and acquisition-related charges equals

operating income excluding share-based compensation and

acquisition-related charges divided by revenues |

| *Net margin attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges equals net income attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges divided by revenues |

| Diluted Earnings Per

Ordinary Share Attributable to

Himax stockholders Excluding Share-based Compensation and

Acquisition-Related Charges: |

|

|

Three Months Ended September

30, |

Nine Months Ended September

30, |

| |

2010 |

2010 |

| Diluted GAAP EPS attributable to Himax

stockholders |

$0.001 |

$0.061 |

| Add: Share-based compensation per diluted

share |

$0.018 |

$0.027 |

| Add: Acquisition-related charges per diluted

share |

$0.001 |

$0.003 |

| |

|

|

| Diluted non GAAP EPS attributable to Himax

stockholders excluding share-based compensation and

acquisition-related charges |

$0.020 |

$0.091 |

| |

|

|

| Numbers do not add up due to

rounding |

CONTACT: Himax Technologies, Inc.

Investor Relations

Jessie Wang, Ext. 22618

jessie_wang@himax.com.tw

Jessica Huang, Ext. 22513

jessica_huang@himax.com.tw

+886-2-2370-3999

The Ruth Group

In the U.S.

Joseph Villalta

+1-646-536-7003

jvillalta@theruthgroup.com

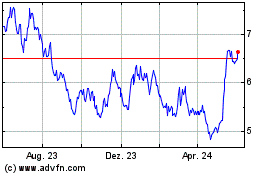

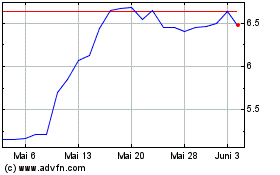

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

Von Jul 2023 bis Jul 2024