false

0001346830

0001346830

2024-12-17

2024-12-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December

17, 2024

CARA THERAPEUTICS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36279 |

|

75-3175693 |

(state or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

|

|

|

400 Atlantic Street

Suite 500

Stamford, CT |

|

|

|

06901 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

| |

|

|

|

|

| Registrant's telephone number, including area code: (203) 406-3700 |

Not applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange

on which registered |

| Common Stock, $0.001 par value per share |

|

CARA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

This Amendment No. 1 to the

Form 8-K (this “Amendment”) amends the Form 8-K (the “Original Form 8-K”) of Cara Therapeutics, Inc. (the “Company”),

which was filed with the Securities and Exchange Commission (the “SEC”) on December 18, 2024. This Amendment is being filed

solely to correct formatting errors and omitted text resulting from the conversion to the Electronic Data Gathering, Analysis, and Retrieval

system (“EDGAR”), of the investor presentation attached as Exhibit 99.2 to the Original Form 8-K.

Except as described above,

this Amendment does not update or modify any other information presented in the Original Form 8-K and does not reflect events occurring

after the Original Form 8-K’s filing date of December 18, 2024.

Cautionary Statement Regarding Forward-Looking

Statements

Certain statements contained

in this Current Report on Form 8-K regarding matters that are not historical facts are "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995. Examples of these forward-looking statements include statements concerning

the anticipated completion and effects of the proposed Merger and Asset Disposition and related timing, Tvardi’s and the combined

company’s planned clinical programs, including planned clinical trials and the timing for anticipated trial results, the potential

of Tvardi’s product candidates, the expected trading of the combined company’s stock on the Nasdaq Capital Market, management

of the combined company and other statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the

future, and, therefore, you are cautioned not to place undue reliance on them.

Because such statements are

subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements.

These forward-looking statements are subject to a number of risks, including, among other things: the risk that the conditions to the

closing of the Merger are not satisfied, including that the approval of the stockholders of Cara is not obtained on the timeline expected,

if at all; uncertainties as to the timing of the closing of the Merger and the ability of each of Tvardi and Cara to consummate the Merger;

risks related to the ability of Tvardi and Cara to correctly estimate and manage their respective operating expenses and expenses associated

with the Merger pending the closing of the Merger; risks associated with the possible failure to realize certain anticipated benefits

of the Merger, including with respect to future financial and operating results; the potential for the occurrence of any event, change

or other circumstance or condition that could give rise to the termination of the Merger and any agreements entered into in connection

therewith; the possible effect of the announcement, pendency or completion of the Merger on Tvardi’s or Cara’s business relationships,

operating results and business generally; the risk that as a result of adjustments to the exchange ratio, Tvardi stockholders and Cara

stockholders could own more or less of the combined company than is currently anticipated; risks related to the market price of Cara’s

common stock relative to the value suggested by the exchange ratio; unexpected costs, charges or expenses resulting from the Merger; the

uncertainties associated with Tvardi’s product candidates, as well as risks associated with the clinical development and regulatory

approval of product candidates, including potential delays in the completion of clinical trials; the significant net losses each of Cara

and Tvardi has incurred since inception; the combined company’s ability to initiate and complete ongoing and planned preclinical

studies and clinical trials and advance its product candidates through clinical development; the timing of the availability of data from

the combined company’s clinical trials; the outcome of preclinical testing and clinical trials of the combined company’s product

candidates, including the ability of those trials to satisfy relevant governmental or regulatory requirements; the combined company’s

plans to research, develop and commercialize its current and future product candidates; the clinical utility, potential benefits and market

acceptance of the combined company’s product candidates; the requirement for additional capital to continue to advance these product

candidates, which may not be available on favorable terms or at all; the combined company’s ability to attract, hire, and retain

skilled executive officers and employees; the combined company’s ability to protect its intellectual property and proprietary technologies;

the combined company’s reliance on third parties, contract manufacturers, and contract research organizations; the possibility that

Tvardi, Cara or the combined company may be adversely affected by other economic, business, or competitive factors; risks associated with

changes in applicable laws or regulations; those factors discussed in Cara’s filings with the Securities and Exchange Commission,

including the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ending December 31, 2023,

and its other documents subsequently filed with or furnished to the Securities and Exchange Commission, including its Form 10-Q for the

quarter ended September 30, 2024. All forward-looking statements contained in this Current Report on Form 8-K speak only as of the date

on which they were made. Cara undertakes no obligation to update such statements to reflect events that occur or circumstances that exist

after the date on which they were made, except as required by law.

Additional Information and Where to Find It

In connection with the proposed

transaction between Cara and Tvardi, Cara intends to file relevant materials with the SEC, including a registration statement on Form

S-4 that will contain a proxy statement and prospectus. CARA URGES INVESTORS AND STOCKHOLDERS TO READ THESE MATERIALS CAREFULLY AND IN

THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CARA, TVARDI, THE PROPOSED TRANSACTION

AND RELATED MATTERS. Stockholders will be able to obtain free copies of the proxy statement, prospectus and other documents filed by Cara

with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. In addition, stockholders will be

able to obtain free copies of the proxy statement, prospectus and other documents filed by Cara with the SEC by contacting Investor Relations

by email at investor@caratherapeutics.com. Stockholders are urged to read the proxy statement, prospectus and the other relevant materials

when they become available before making any voting or investment decision with respect to the proposed transaction.

Participants in the Solicitation

Cara and Tvardi, and each

of their respective directors and executive officers and certain of their other members of management and employees, may be deemed to

be participants in the solicitation of proxies in connection with the proposed transaction. Information about Cara’s directors and

executive officers, consisting of Helen M. Boudreau, Jeffrey L. Ives, Ph.D., Christopher Posner, Susan Shiff, Ph.D., Martin Vogelbaum,

Lisa von Moltke, M.D., Ryan Maynard and Scott Terrillion, including a description of their interests in Cara, by security holdings or

otherwise, can be found under the captions, “Security Ownership of Certain Beneficial Owners and Management,” “Executive

Compensation” and “Director Compensation” contained in the definitive proxy statement on Schedule 14A for Cara’s

2024 annual meeting of stockholders, filed with the SEC on April 22, 2024 (the “2024 Cara Proxy Statement”). To the extent

that Cara’s directors and executive officers and their respective affiliates have acquired or disposed of security holdings since

the applicable “as of” date disclosed in the 2024 Cara Proxy Statement, such transactions have been or will be reflected on

Statements of Change in Beneficial Ownership on Form 4 filed with the SEC. Additional information regarding the persons who may be deemed

participants in the proxy solicitation, including the information about the directors and executive officers of Tvardi, and a description

of their direct and indirect interests, by security holdings or otherwise, will also be included in a registration statement filed on

Form S-4 that will contain a proxy statement (and prospectus and other relevant materials) to be filed with the SEC when they become available.

Investors should read the registration statement, proxy statement/prospectus and the other relevant materials when they become available

before making any voting or investment decision with respect to the proposed transaction. These documents can be obtained free of charge

from the sources indicated above.

Non-Solicitation

This Current Report on Form

8-K shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No public offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit

No. |

|

Description |

| 2.1* |

|

Agreement and Plan of Merger and Reorganization, dated December 17, 2024, by and among Cara Therapeutics, Inc., CT Convergence Merger Sub, Inc. and Tvardi Therapeutics, Inc. (incorporated by reference to Exhibit 2.1 to the Original Form 8-K) |

| 10.1 |

|

Form of Cara Therapeutics, Inc. Stockholder Support Agreement, dated December 17, 2024 (incorporated by reference to Exhibit 10.1 to the Original Form 8-K) |

| 10.2 |

|

Form of Tvardi Therapeutics, Inc. Stockholder Support Agreement, dated December 17, 2024 (incorporated by reference to Exhibit 10.2 to the Original Form 8-K) |

| 10.3 |

|

Form of Lock-Up Agreement, dated December 17, 2024 (incorporated by reference to Exhibit 10.3 to the Original Form 8-K) |

| 10.4* |

|

Asset Purchase Agreement, dated December 17, 2024, by and among Cara Therapeutics, Inc. Cara Royalty Sub, LLC and Vifor Fresenius Medical Care Renal Pharma, Ltd. (incorporated by reference to Exhibit 10.4 to the Original Form 8-K) |

| 99.1 |

|

Joint Press Release of Cara Therapeutics, Inc. and Tvardi Therapeutics, Inc. issued on December 18, 2024 (incorporated by reference to Exhibit 99.1 to the Original Form 8-K) |

| 99.2 |

|

Investor Presentation |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Exhibits and/or schedules have been omitted

pursuant to Item 601(a)(5) or 601(b)(2) of Regulation S-K, as applicable. The registrant hereby undertakes to furnish supplementally copies

of any of the omitted exhibits and schedules upon request by the SEC; provided, however, that the registrant may request confidential

treatment pursuant to Rule 24b-2 under the Exchange Act for any exhibits or schedules so furnished.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CARA THERAPEUTICS, INC. |

|

| |

|

| By: |

/s/ Ryan Maynard |

|

| |

Ryan Maynard |

|

| |

Chief Financial Officer |

|

Dated: December 20, 2024

Exhibit 99.2

| 1

Proposed

Merger

Overview

December 18, 2024 |

| 2

Disclaimer and Forward-Looking Statements

This presentation and any accompanying oral commentary have been prepared by Tvardi Therapeutics, Inc. (“Tvardi”) and Cara Therapeutics, Inc. (“Cara”) for informational purposes only and to assist

such parties in making their own evaluation with respect to the potential combination (the “Proposed Merger”) of a wholly-owned subsidiary of Cara with and into Tvardi and related transactions and not

for any other purpose. All statements contained in this presentation and the accompanying oral commentary, other than statements of historical facts, are forward-looking statements, including:

statements about the combined company’s expectations regarding the potential benefits, activity, effectiveness, and safety of its product candidates; the combined company’s expectations with regard

to the design and results of its research and development programs, preclinical studies, and clinical trials, including the timing and availability of data from such studies and trials; the combined

company’s preclinical, clinical, and regulatory development plans for its product candidates, including the timing or likelihood of regulatory filings and approvals for the combined company’s product

candidates; the combined company’s expectations with regard to its ability to license, acquire, discover, and develop additional products candidates and advance such product candidates into, and

successfully complete, preclinical studies and clinical trials; the potential market size and size of the potential patient populations for the combined company’s product candidates and any future product

candidates; ability to maintain existing, and establish new, strategic collaborations, licensing, or other arrangements; the scope of protection the combined company is able to establish and maintain for

intellectual property rights covering its initial product candidate and any future product candidates; the combined company’s business strategy; the combined company’s future results of operations and

financial position; the combined company’s expectations with respect to future performance and anticipated financial impacts of the Proposed Merger; the satisfaction of closing conditions to the

Proposed Merger and the timing of the completion of the Proposed Merger, including obtaining the approval of the Proposed Merger and issuance of shares contemplated thereby by Cara’s

stockholders. These statements involve substantial known and unknown risks, uncertainties and other factors that may cause the combined company’s actual results, timing of results, levels of activity,

performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. New risks emerge from time to time. It is not possible for Tvardi’s

and Cara’s management to predict all risks, nor can they assess the impact of all factors on the combined company’s business or the extent to which any factor, or combination of factors, may cause

actual results to differ materially and adversely from those anticipated or implied in the forward-looking statements.

Tvardi and Cara may not actually achieve the plans, intentions, or expectations disclosed in their forward-looking statements, and you should not place undue reliance on such forward-looking

statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements Tvardi and Cara make. The forward-looking

statements in this presentation represent Tvardi’s and Cara’s views as of the date of this presentation. Tvardi and Cara anticipate that subsequent events and developments will cause their views to

change. However, while Tvardi and Cara may elect to update these forward-looking statements at some point in the future, they have no current intention of doing so except to the extent required by

applicable law. Except as required by law, neither Tvardi and Cara nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements in this presentation

and the accompanying oral commentary. You should, therefore, not rely on these forward-looking statements as representing Tvardi’s or Cara’s views as of any date subsequent to the date of this

presentation.

This presentation also contains estimates and other statistical data made by independent parties and by Tvardi and Cara relating to market size and growth and other data about the combined

company’s industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates

of the combined company’s future performance and the future performance of the markets in which it will operate are necessarily subject to a high degree of uncertainty and risk.

This presentation contains trademarks, service marks, trade names and copyrights of Tvardi, Cara and other companies which are the property of their respective owners.

This presentation shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. |

| 3

C O N F I D E N T I A L

Chris Posner

CEO, Cara Therapeutics |

| 4

Merger of Tvardi and Cara Therapeutics

• Tvardi, a clinical-stage biopharmaceutical company focused on the development of novel, oral,

small molecule therapies targeting STAT3 to treat fibrosis-driven diseases with significant unmet need, intends

to merge with Cara Therapeutics, Inc. (Nasdaq: CARA)

• Cara exploration of strategic alternatives initiated in July 2024 evaluating several potential merger candidates

• Supported by the Board of Directors of both companies and is subject to stockholder approval and other

customary closing conditions

• Combined company will focus on advancing the development of Tvardi programs

• Upon close, combined company is expected to be renamed "Tvardi Therapeutics, Inc." trading as

Nasdaq: TVRD

Overview

• Merger expected to close in 1H:2025

• Pro forma company ownership: 83.0% Tvardi and 17.0% Cara, before giving effect to Tvardi financing

• Combined company will be well capitalized including $28 million from concurrent financing, combined with

Cara’s anticipated cash at the closing of the merger

• Merger and combined financings would fund the company into the 2H:2026, well past multiple Phase 2

readouts in IPF and HCC (expected 2H:2025) and prepare programs for Phase 3 development

Transaction

Summary

• Tvardi management will operate pro forma company

• Combined Board of Directors to contain to contain six representatives from Tvardi and one from Cara

Management &

Board |

| 5

C O N F I D E N T I A L

Imran Alibhai, PhD

CEO, Tvardi Therapeutics |

| 6

Targeting STAT3: Central Mediator of Fibrosis-Driven Diseases

Deep expertise in

STAT3 biology

Potential to serve as a

disease-modifying

therapy in IPF1

Well-positioned to

differentiate therapeutic

impact in HCC2

Multiple near-term data

catalysts expected

• Unlocking highly-validated,

yet historically

"undruggable" target within

fibrosis-driven diseases

• IPF models demonstrated

reversal of fibrosis and

restoration of lung function

• Phase 2 blinded

data suggests encouraging

trends in lung function

• Early signs of response in

both mono- and

combination therapy from

completed and ongoing

clinical trials

• IPF Phase 2 unblinded

data in H2:2025

• HCC Phase 1b/2 topline

data in H2:2025

• TTI-109 IND3 submission

planned for H1:2025

1. Idiopathic pulmonary fibrosis. 2. Hepatocellular carcinoma. 3. Investigational new drug. |

| 7

STAT3’s Canonical Function Plays a Central Role in Fibrosis-Driven Diseases

CONFIDENTIAL 7

Mitochondria

STAT3 exists as a

monomer in the electron

transport chain

IL6

Growth Factor Receptors Cytokine Receptors Non-TRKs

Extracellular

Idiopathic pulmonary fibrosis, Hepatocellular

carcinoma, Systemic sclerosis

Cytosol

Nucleus

G Protein

Tvardi’s small molecules

inhibit STAT3

nuclear function…

…With no impact on

STAT3 mitochondrial

function

Canonical STAT3 Nuclear Function Non-Canonical Function

Intrinsic:

Proliferation & Survival

Extrinsic:

Immune Suppression |

| 8

The Dual Mechanism of Action of STAT3’s Function in the

Canonical Pathway

EXTRINSICALLY

Up-regulates

T-cell Activation

Immune

Activation

Degradation

Tvardi’s Approach Tvardi’s Impact

INTRINSICALLY

Down-regulates

Proliferation

INTRINSIC

(Cellular)

EXTRINSIC

(Immune)

Immune

Suppression

Pro-proliferative cells

Activation of

STAT3

Deposition and

Proliferation

Mechanism of the Canonical Pathway

STAT3P- STAT3P+ STAT3P- MDSC STAT3P+ MDSC CD8+ Apoptotic Cell |

| 9

Sujal Shah Chairman

Michael Wyzga Director

Shaheen Wirk, MD Director

Wallace Hall Director

Cara Representative Director

Seasoned Leadership: Deep R&D and Operational Expertise &

Strong Existing Support

Imran Alibhai, PhD CEO & Director Dan Conn, JD, MBA CFO John Kauh, MD CMO

David Tweardy, MD Founder & Advisor

Ron DePinho, MD Founder & Advisor

Keith Flaherty, MD Advisor (Oncology)

Lisa Lancaster, MD Advisor (IPF)

Jeff Swigris, DO Advisor (IPF)

Management Team

Scientific Advisory Board

Existing Investors

Board of Directors

BioMatrix Partners |

| 10

Our Pipeline

Program Indication Discovery & Preclinical Phase 1 Phase 2 Phase 3 Anticipated Milestone

TTI-101 Idiopathic Pulmonary

Fibrosis

H2:2025

Phase 2 data

TTI-101 Hepatocellular

Carcinoma

H2:2025

Phase 1b/2 topline data

TTI-109 Fibrosis-driven

Disease1

H1:2025

IND submission

Phase 2

Phase 1b/2

1. We plan to commence clinical trials in fibrosis and/or oncology pending IND submission and FDA feedback. |

| 11

CONFIDENTIAL

TTI-101 in IPF |

| 12

IPF Unmet Need Represents a Large Commercial Opportunity

• IPF is a rare, chronic, interstitial lung disease characterized by inflammation, progressive fibrosis, and lung damage

• Patients with IPF have a poor prognosis, poor quality of life, and are at a higher risk of early mortality

We believe there is a significant commercial opportunity for a differentiated IPF treatment

Prevalence

~150K in US1

Incidence

~50K in US1

Survival

Median <5 years2

from

time of diagnosis

High unmet need remains, even with two FDA approved drugs, Ofev® (nintedanib) and Esbriet® (pirfenidone)

• Neither reverse / halt clinical decline: both only slow the progression of disease

• Only ~25%4 of US IPF patients initiate standard of care

• Estimated >40% of patients discontinue therapy4

Peak Sales3

$3.8B in 2023 $1.1B in 2020

1. Raghu, G., Weycker, D., Edelsberg, J., Bradford, W. Z., & Oster, G. Incidence and prevalence of idiopathic pulmonary fibrosis.

American journal of respiratory and critical care medicine, 174(7), 810–816 (2006). https://doi.org/10.1164/rccm.200602-163OC

2. Du, K., Zhu, Y., Mao, R. et al. Medium-long term prognosis prediction for idiopathic pulmonary fibrosis patients based on

quantitative analysis of fibrotic lung volume. Respir Res 23, 372 (2022). https://doi.org/10.1186/s12931-022-02276-3

3. Based on $3.8B in sales of Ofev and $1.1B in sales of Esbriet from Boehringer Ingelheim and Genentech (Roche) filings.

4. Dempsey, T. M., Payne, S., Sangaralingham, L., Yao, X., Shah, N. D., & Limper, A. H. (2021). Adoption of the Antifibrotic

Medications Pirfenidone and Nintedanib for Patients with Idiopathic Pulmonary Fibrosis. Annals of the American Thoracic Society,

18(7), 1121–1128. https://doi.org/10.1513/AnnalsATS.202007-901OC |

| 13

STAT3 Activation is a Central Catalyst in the Fibrotic Cascade

IL6-/- STAT3+/- WT

%

△ Lung Collagen

Denton CP Ann Rheum Dis 2018; O’Donoghue RJ et al EMBO Mol Med 2012

Notch

IL6

TGFβ

NF-KB

MAPK

Hedgehog

PI3K/AKT

Wnt

Injury Triggers

Fibrotic

Signaling

Pathways

Haploinsufficiency of

STAT3 (STAT3+/-

) protects

mice from development of

lung fibrosis vs. knockout

of IL6 or TGFβR which still

results in fibrosis

Clotting & Coagulation

Fibroblast Proliferation

ECM Deposition

Macrophage Neutrophil

T-cell

Platelet

Activation

ECM

Fibrosis

Fibroblast Myofibroblast

Inflammatory Cell Migration

Major Drivers P

Feedback Loops

Feedback Loops |

| 14

Pedroza et al Rheum 2017; Tight skin (Tsk-1) mice spontaneously develop fibrosis as a result of a duplication in the fibrillin-1 gene

TTI-101 Inhibited Activation of STAT3 and Key Pro-fibrotic

Mediators in Sclerosis

TTI-101 Decreased

Hypodermal Fibrosis in Tsk-1 Mice

Control mice +

DMSO

Tsk-1 mice +

DMSO

Tsk-1 mice +

TTI-101

These mechanisms are individually

targeted in clinical trials;

TTI-101 observed to down-regulate

all factors simultaneously via STAT3

inhibition

Results from this GEM model with TTI-101

also replicated in a chemically induced skin fibrosis model

TTI-101 Inhibits STAT3 Activation

Activated STAT3

(pY-STAT3)

TTI-101 Inhibited STAT3

Activation

TTI-101 Inhibits Pro-fibrotic Mediators

Control

TTI-101

Col1 TGF-ß IL-6

α-SMA CTGF Fibronectin

TTI-101 Inhibited Profibrotic Mediators |

| 15

STAT3 is Activated in Major Compartments of IPF-Affected Mouse

and Human Lung Tissue

Pedroza et al FASEB J 2016

Activated STAT3 is

overexpressed in IPF

human lung tissue

Activated STAT3 is

similarly overexpressed in

lung tissue of murine IPF

pY-STAT3 / GAPDH

Fold Induction

pY-STAT3 / Actin

Fold Induction

Alveolar

Epithelial Cells

Alveolar

Fibroblasts

Alveolar

Macrophages

Normal

pY-STAT3 pY-STAT3 pY-STAT3 pY-STAT3 |

| 16

IPF Transplant-free survival over the course of 3.5 years

post-diagnosis in a cohort of patients (n=55) based on

STAT3 expression. Activated STAT3 (pSTAT3) induces the

expression of STAT3 transcript.

Celada et al Sci Transl Med 2018

STAT3 Correlates with High Mortality in IPF Patients |

| 17

Reduction of Lung Fibrosis and Statistically Significant

Improvement of Oxygen Saturation Observed with TTI-101

* TTI-101 dosed therapeutically 14 days after bleomycin (Bleo) induction of fibrosis; whereas, most experimental therapeutics are dosed

prophylactically to demonstrate an effect of fibrosis

Pedroza et al FASEB J 2016

Untreated Bleo + Control

TTI-101 +

14 days after Bleo

IPF pathogenesis IPF induced by bleomycin reversed with TTI-101

Fibrosis Diminished Lung Function

Masson’s Trichrome

Mouse Lung Tissue |

| 18

Mechanistic Data Revealed TTI-101 Down-regulated Deposition

(Injury) and Up-regulated Degradation (Repair)

↑ Deposition

↑ Clotting & coagulation

↑ Immunomodulation

↑ Fibroblast proliferation

↑ ECM deposition

IPF

↓ Degradation

↓ T-cell responses

↓ Deposition

✓Attenuation of clotting &

coagulation

✓Reverse fibroblast activation

✓Reverse ECM deposition

IPF +

↑ Degradation

✓Induce T-cell maturation

and activation

✓Induce cytotoxic effect

of NK- and T-cells

Injury Repair

TUMORIGENESIS &

DRUG RESISTANCE

TTI-101 |

| 19

Well-Established Target Preclinical

Biological Activity

Clinical Proof of

Mechanism – Phase 1

Next Step:

IPF Clinical POC

✓ STAT3 is a central mediator

in fibrosis

✓ TTI-101 designed to target

the canonical pathway of

STAT3

STAT3 correlates with high

mortality in IPF patients1

✓ Well-tolerated

✓ High blood exposure (PK)

✓ Hits STAT3 target (PD)

Reduced pY-STAT3 in

humans3

✓ No Phase 1 SAD / MAD HV

study needed per FDA;

progressed straight to

Phase 2 REVERTIPF trial

Phase 2 clinical trial

underway

✓ Targets full pathogenesis of

IPF

✓ TTI-101 in additional fibrotic

mouse models demonstrated

downregulation of key factors

Observed to reduce fibrosis

and improve lung function2

TTI-101 is Designed to Address the Unmet Need in IPF

1. Celada et al 2018. IPF Transplant-free survival over the course of 3.5 years post-diagnosis in a cohort of patients (n=55) based on STAT3 expression. Activated STAT3 (pY-STAT3) induces the expression of

STAT3 transcript. 2. Pedroza et al FASEB J 2016. 3. Tsimberidou 2024 accepted in Clin Cancer Research. 8/10 patients had elevated pY-STAT3 at baseline; elevated pY-STAT3 defined as H-score >30 on a 0-

300 scale. |

| 20

REVERTIPF: Double Blind Randomized Phase 2 Study of TTI-101

• Oral dosing (BID)

• 12-week double blind, randomized, placebo-controlled study

• Alone or in combination with nintedanib

• Enrollment of mild and moderate IPF subjects

• 1º & 2º Objectives: Safety & PK

• Exploratory Objectives:

• Phase 3 endpoints: △FVC, △DLCO, HRCT, 6MWT

• Biomarkers

TTI-101 800 mg/day (N=25)

TTI-101 400 mg/day (N=25)

Placebo (N=25)

Randomization

Treatment Period

12 weeks

Early blinded clinical data has demonstrated encouraging trends

(26 US Sites, N = 75)

NCT05671835 |

| 21

Driving inhibition of STAT3

activation to address both

IPF disease pathologies

(downregulating deposition

and upregulating

degradation)

REVERTIPF Phase 2 trial

ongoing with clinically relevant

endpoints and collection of

STAT3-mediated biomarkers

Results from ongoing

Phase 2 REVERTIPF trial

expected in H2:2025

Compelling and validated

target → central mediator

in fibrosis

STAT3: Well-Established Biology

Differentiated

Approach

Clinical PoC

Underway

Near-Term Clinical

Milestones

Key Takeaways: TTI-101 in IPF |

| 22

CONFIDENTIAL

TTI-101 in HCC |

| 23

TTI-101 Reversed Multiple Pathogenic Steps of Liver Cancer in a

NASH-induced HCC Model

Inflammation Fibrosis/Cirrhosis HCC

STAT3-mediated

pathogenesis

TTI-101 STAT3-inhibition

in NASH-induced HCC

TTI-101

Microsteatosis Tumor volume

Placebo TTI-101 TTI-101

Fibrosis

Placebo TTI-101

After formation

of tumors at

11 months, we

observed

treatment with

TTI-101

therapeutically

reduced

inflammation,

fibrosis, and

tumor growth

Jung KH et al, Clin Cancer Res 2017 – Genetically engineered HepPTEN- murine model which replicates nonalcoholic steatohepatitis (NASH) induced hepatocellular carcinoma (HCC) |

| 24

Phase 1 Clinical Trial: TTI-101 Monotherapy Led to Durable

Partial Responses in Fibrotic Tumors

Baseline Cycle 3, Day 1 Cycle 5, Day 1

Diameter Length in mm (% Change from Baseline)

41mm (0%) 21mm (-49%) 14mm (-66%)

46mm (0%) 19mm (-59%) 14mm (-70%)

Target Lung Met Target Liver Met

Partial Responder A: HCC

• Failed sorafenib, pembro,

nivo, nivo+bev

• Best Response: 42%

Reduction in Sum of

Targets Overall

• Sustained PR for 10 months

Partial Responder B: HCC

• Failed lenvatinib, nivo

• Best Response: 66%

Reduction in Sum of

Targets Overall

• Sustained PR for 14 months

Tsimberidou et al 2023 |

| 25

• Well-tolerated BID oral

dosing

• No DLTs

*Most severe AE counted per subject by grade (G1/2=grade

1 or 2, G3=grade 3) **5 subjects started on F2 and

transitioned to F3 ***Elevated alanine

aminotransferase/aspartate aminotransferase (ALT/AST) is

the sum of elevated ALT and AST events

Tolerability

TRAEs Occurring in >10% of

Patients

• Exposures in humans

above the level required

for efficacy in preclinical

oncology and fibrosis

models

• Linear PK from DL1-3

• Cmin above the IC90 for

STAT3 induced growth

• Exposure plateaued at

DL3, resulting in a

RP2D of 12.8mg/kg/day

Median % Change from

Baseline in pY-STAT3 H-Score

(proportion and intensity of pY-STAT3 staining)

All patients with paired

biopsies n=8

All SD patients with

paired biopsies n=3

-80%

-60%

-40%

-20%

0%

↓79%

Among

Stable

Disease

8/10 patients had elevated pY-STAT3 at

baseline; elevated pY-STAT3 defined as H-score

>30 on a 0-300 scale

↓55%

Overall

• 100% of patients with

elevated pY-STAT3 levels

at baseline demonstrated

decrease within ~6 weeks

of TTI-101 therapy

• 55% decrease in pY-STAT3 overall; 79% in SD

PK / PD

• Enhanced biological

activity in fibrotic cancers

with ORR that exceeds

current standard of care

in HCC

• Current expected ORR in

2L HCC is <5%

35%

47%

3, 18%

Best Overall Response Among

HCC Patients, N=17

Median prior therapies=2

Biological Activity

Paired Biopsies after ~6 weeks

of TTI-101

Partial Response Stable Disease

Progressive Disease

Phase 1: TTI-101 Monotherapy Clinical Trial Summary

Formulation F1

N=15

F2

N=47

F3

N=7**

Grade, n (%) G1/2 G3 G1/2 G3 G1/2 G3

Diarrhoea 3 (20) 3 (20) 16 (34) 6 (13) 2 (29) 0 (0)

Nausea 4 (26) 0 (0) 6 (13) 1 (2) 0 (0) 1 (14)

Fatigue 6 (40) 0 (0) 4 (8) 0 (0) 0 (0) 0 (0)

Elevated

ALT/AST*** 1 (7) 1 (7) 1 (2) 4 (8) 1 (14) 1 (14)

Dose reduction 3 (20) 2 (4) 0 (0)

Dose discont. 0 (0) 2 (4) 0 (0)

Tsimberidou et al 2023; SD: Stable Disease; TREAE: Treatment related adverse events; F1-3: Formulation 1-3 |

| 26

→

→

Ph 2: Danvatirsen (STAT3 ASO) +

Durvalumab (ICI) in 2L HNSCC2

% Change from Baseline

0

-20

-40

-60

-80

-100

20

40

60

80

100

0 20 40 60 80 100

Weeks

Danv. development suspended due to several limitations:

• Observed AEs: Thrombocytopenia and transaminitis

• Onerous dosing: IV 3x week 1 then Q weekly

• Poor PD: Inhibition of STAT3 occurred only in

stroma/TME, not in tumor

Progressive Disease

Stable Disease

Partial Response

Complete Response

Not Evaluable

POC Established for STAT3

Inhibition + ICI

Strong Rationale for Combo Therapy with STAT3 TTI-101

Durva3 Dan+Durva2

ORR 9% 23%

CR 0% 7%

TTI-101 additive to 1L SoC

(ICI + Bev)1

Preclinical Model

0

20

40

60

80

100

120

0 90 180 270 360 450 540

Days

Sum of Targets

Non-Target Lesion

Progression due to

non-target lesion

New

Response

ICI + Bev

Rechallenge

Sum of Tumor Responses After ICI Failure, On TTI-101

Therapy and After ICI+Bev Rechallenge4

0

20

40

60

80

100

120

ICI Failure: Nivolumab 1 cycle

Lesion Measurement (diameter long, mm)

Phase 1 Trial Responder Overcame ICI

Resistance After TTI-101 Monotherapy

1. Adapted from Zhao, Y et. al. Hepatology 2021; 2. Cohen et al 2018; 3. Siu et al 2019 ; ICI: Immune Checkpoint Inhibition; Bev: Bevacizumab. Certain data on this slide are based on cross study comparisons and

are not based on any head to head clinical trials. Cross study comparisons are inherently limited and may suggest misleading similarities and differences. The values shown in the cross study comparisons are

directional and may not be directly comparable. 4. Tsimberidou et al 2024 accepted in Clin Cancer Research

TTI-101 Treatment: 14 cycles |

| 27

Overview of Current Treatment Landscape + Role of TTI-101

TTI-101 is Designed to Provide a Distinct and Synergistic

Mechanism for Unmet Need in HCC

• HCC is 3rd leading cause of cancer deaths in the world1

• Annually in the US, >42,000 new cases of HCC and ~32,000 deaths recorded2

• Incidence has more than tripled since 19803

HCC Disease Overview

Triplet

Anti-PD-(L)1

Combos +

TTI-101

Potential

SoC with

TTI-101

Doublet

Anti-PD-1s + TTI-101

Monotherapy

TTI-101

1. World Health Organization (WHO); 2. WHO US Statistics; 3. American Cancer Society; 4. Represents range of ORRs from previous studies (MORPHEUS, Tempest, IMBrave150). 5. Listed 2nd line ORR expected

to be <5% as 2nd line therapies inhibit VEGF/angiogenesis as common mechanism with bevacizumab and pembrolizumab (anti-PD-1) has common mechanism with atezolizumab (anti-PDL-1).

Anti-PD-(L)1 +

Anti-VEGF

10-27% ORR4

Standard

of Care

First Line

TKIs & Anti-VEGF

Therapy

<5% ORR5

Second Line

No Available Therapies

Third Line

~70% do not respond

and eventually >95%

progress

>90% do not respond

and progress |

| 28

REVERTHCC: Phase 2 Study of TTI-101 in HCC

• Overall Response Rate

(ORR)

• Duration of Response (DoR)

• Progression-free survival

• Overall survival

• Liver stiffness (elastogram)

• Biomarkers (IL-6/AFP)

• pY-STAT3 in tumor

(21 US Sites)

Phase 1b

Dose Finding

(up to N=54)

Phase 2

Expansion

(N=100)

TTI-101 RP2D

(N=30)

TTI-101

(N=12)

Last Line: no available

therapies that will confer

clinical benefit

RP2D

Last Line Rationale: Confirmation of P1 PoC TTI-101 monotherapy

A

TTI-101 RP2D

+ pembrolizumab

(N=30)

TTI-101

+ pembrolizumab

(N=11)

RP2D

2

nd Line Rationale: TTI-101 overcomes anti-PD-(L)1 resistance

2

nd Line: progressed on

anti-PD-(L)1 first line

B

TTI-101 RP2D

+ atezo/bev

(N=40)

TTI-101

+ atezo/bev

(N=up to 24)

RP2D

1

st

Line Rationale: TTI-101 is synergistic with anti-PD-L1 and anti-angiogenic inhibition

1

st Line: treatment naïve

C

NCT05440708

Early clinical data suggests clinical benefit across treatment lines |

| 29

Inhibition of STAT3

activation to have dual

therapeutic effect on cancer

cells – overcoming

tumorigenesis and immune

suppression

REVERTHCC trial Phase 2

assessing activity in both

monotherapy and combination

therapy in areas of unmet

need

Topline results from

ongoing Phase 2

REVERTHCC trial expected

in H2:2025

STAT3 long recognized as

prime target in oncology;

>95% of patients with HCC

have activated STAT3 in

their tumors

STAT3: Well-Established Biology

Differentiated

Approach

Clinical PoC

Underway

Near-Term Clinical

Milestones

Key Takeaways: TTI-101 in HCC |

| 30

Near-Term Anticipated Value-Creating Milestones

TTI-101

HCC P2

Topline

Readout

TTI-101

IPF P2

Unblinded

Readout

Announce

Transaction

TTI-109

IND

Submission

Transaction

Closes

2H 1H 2H

2024 2025

Pro forma company would be well-capitalized with a frequent cadence

of inflection points and have runway

~1 year post P2 readouts |

| 31

Targeting STAT3: Central Mediator of Fibrosis-Driven Diseases

Deep expertise in

STAT3 biology

Potential to serve as a

disease-modifying

therapy in IPF1

Well-positioned to

differentiate therapeutic

impact in HCC2

Multiple near-term data

catalysts expected

• Unlocking highly-validated,

yet historically

"undruggable" target within

fibrosis-driven diseases

• IPF models demonstrated

reversal of fibrosis and

restoration of lung function

• Phase 2 Clinical PoC

ongoing

• Evaluating both mono- and

combination therapy from

an ongoing clinical trial

• IPF Phase 2 unblinded

data in H2:2025

• HCC Phase 1b/2 topline

data in H2:2025

• TTI-109 IND3 submission

planned for H1:2025

1. Idiopathic pulmonary fibrosis. 2. Hepatocellular carcinoma. 3. Investigational new drug. |

Cover

|

Dec. 17, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 17, 2024

|

| Entity File Number |

001-36279

|

| Entity Registrant Name |

CARA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001346830

|

| Entity Tax Identification Number |

75-3175693

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400 Atlantic Street

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Stamford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06901

|

| City Area Code |

203

|

| Local Phone Number |

406-3700

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

CARA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

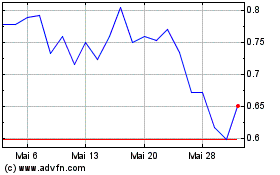

Cara Therapeutics (NASDAQ:CARA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Cara Therapeutics (NASDAQ:CARA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024