BCB Bancorp, Inc. (the “Company”), (NASDAQ: BCBP), the holding

company for BCB Community Bank (the “Bank”), today reported net

income of $8.6 million for the second quarter of 2023, compared to

$8.1 million in the first quarter of 2023, and $10.2 million for

the second quarter of 2022. Earnings per diluted share for the

second quarter of 2023 were $0.50, compared to $0.46 in the

preceding quarter and $0.58 in the second quarter of 2022. Net

income and earnings per diluted share for the second quarter of

2023, adjusted for the unrealized losses on equity investments,

were $9.1 million and $0.53, respectively.

The Company announced that its Board of

Directors declared a regular quarterly cash dividend of $0.16 per

share. The dividend will be payable on August 18, 2023 to common

shareholders of record on August 4, 2023.

“We continue to be very profitable in a

challenging macro environment where competition for deposits and

cost of funding remain high. We are focused on protecting our net

interest income while also maintaining a strong liquidity position

and a robust capital profile. The slowdown in our balance sheet

growth during the second quarter, despite high customer demand, is

reflective of prudent management of our liquidity and capital

resources,” stated Thomas Coughlin, President and Chief Executive

Officer.

“Looking ahead, we remain committed to growing

our profitability and franchise value. We expect to benefit from

the successful execution of a number of internal projects that are

designed to enhance our digital footprint and also from the hiring

efforts that have increased the overall talent profile of our

institution. We firmly believe that our strategic actions will help

us come out stronger on the other side of the current economic

cycle,” said Mr. Coughlin.

“Our asset quality remains strong and our

non-accrual loans to total loans ratio was 0.17 percent at June 30,

2023, compared to 0.16 percent at March 31, 2023, and 0.35 percent

a year ago. We adopted the CECL methodology commencing January 1,

2023 and under the new methodology, we recorded a loan loss

provision of $1.35 million during the second quarter of 2023

compared to $622,000 during the preceding quarter,” said Mr.

Coughlin.

Executive Summary

- Total deposits were $2.886 billion

at June 30, 2023, up from $2.867 billion at March 31, 2023.

- Net interest margin was 2.92

percent for the second quarter of 2023, compared to 3.15 percent

for the first quarter of 2023, and 3.74 percent for the second

quarter of 2022.

- Total yield on interest-earning

assets increased 25 basis points to 5.11 percent for the second

quarter of 2023, compared to 4.86 percent for the first quarter of

2023, and increased 101 basis points from 4.10 percent compared to

the second quarter of 2022.

- Total cost of interest-bearing

liabilities increased 56 basis points to 2.80 percent for the

second quarter of 2023, compared to 2.24 percent for the first

quarter of 2023, and increased 230 basis points from 0.50 percent

for the second quarter of 2022.

- The efficiency ratio for the second

quarter was 52.3 percent compared to 53.7 percent in the prior

quarter, and 47.6 percent in the second quarter of 2022.

- The annualized return on average

assets ratio for the second quarter was 0.90 percent, compared to

0.90 percent in the prior quarter, and 1.32 percent in the second

quarter of 2022.

- The annualized return on average

equity ratio for the second quarter was 11.6 percent, compared to

11.0 percent in the prior quarter, and 15.0 percent in the second

quarter of 2022.

- The provision for credit losses was

$1.35 million in the second quarter of 2023 compared to $622,000

for the first quarter and no provision for the second quarter of

2022.

- Allowance for credit losses (“ACL”)

as a percentage of non-accrual loans was 530.3 percent at June 30,

2023, compared to 571.0 percent for the prior quarter-end and 370.7

percent at June 30, 2022. The total non-accrual loans were $5.70

million at June 30, 2023, $5.06 million at March 31, 2023 and $9.20

million at June 30, 2022.

- Total loans receivable, net of

allowance for credit losses, increased 26.7 percent to $3.320

billion at June 30, 2023, up from $2.621 billion at June 30,

2022.

Balance Sheet Review

Total assets increased by $326.7 million, or 9.2

percent, to $3.873 billion at June 30, 2023, from $3.546 billion at

December 31, 2022. The increase in total assets was mainly related

to increases in total loans and in cash and cash equivalents.

Total cash and cash equivalents increased by

$43.9 million, or 19.1 percent, to $273.2 million at June 30, 2023,

from $229.4 million at December 31, 2022. The increase was

primarily due to an increase in Federal Home Loan Bank (“FHLB”)

borrowings and in deposits.

Loans receivable, net, increased by $274.4

million, or 9.0 percent, to $3.320 billion at June 30, 2023, from

$3.045 billion at December 31, 2022. Total loan increases during

2023 included increases of $145.7 million in commercial real estate

and multi-family loans, $86.9 million in commercial business

loans, $34.2 million in construction loans, $222,000 in residential

one-to-four family loans and $5.5 million in home equity and

consumer loans. The allowance for credit losses decreased $2.2

million to $30.2 million, or 530.3 percent of non-accruing loans

and 0.90 percent of gross loans, at June 30, 2023, as compared to

an allowance for credit losses of $32.4 million, or 633.7 percent

of non-accruing loans and 1.05 percent of gross loans, at December

31, 2022. Upon adoption of the CECL methodology, the Day One CECL

adjustment resulted in a $4.2 million reduction to our ACL.

Total investment securities decreased by $8.9

million, or 8.2 percent, to $100.5 million at June 30, 2023, from

$109.4 million at December 31, 2022, representing unrealized

losses, calls and maturities, and repayments.

Deposit liabilities increased by $74.1 million,

or 2.6 percent, to $2.886 billion at June 30, 2023, from $2.811

billion at December 31, 2022. Interest bearing demand and savings

and club deposits decreased by $65.5 million offset by the increase

in non-interest bearing, money market, and certificates of deposits

of $139.6 million during the first six months of 2023.

Debt obligations increased by $240.4 million to

$660.2 million at June 30, 2023 from $419.8 million at December 31,

2022. The weighted average interest rate of FHLB advances was 4.53

percent at June 30, 2023 and 4.07 percent at December 31, 2022. The

weighted average maturity of FHLB advances as of June 30, 2023 was

1.27 years. The fixed interest rate of our subordinated debt

balances was 5.62 percent at June 30, 2023 and December 31,

2022.

Stockholders’ equity increased by $8.4 million,

or 2.9 percent, to $299.6 million at June 30, 2023, from $291.3

million at December 31, 2022. The increase was primarily

attributable to the increase in retained earnings of $13.8 million,

or 12.0 percent, to $128.9 million at June 30, 2023 from $115.1

million at December 31, 2022 partially offset by the $2.9 million

increase in accumulated other comprehensive loss during the first

six months of 2023.

Second Quarter 2023 Income Statement

Review

Net income was $8.6 million for the second

quarter ended June 30, 2023 and $10.2 million for the second

quarter ended June 30, 2022. The decline was primarily driven by

lower net interest income, higher credit loss provisioning and

higher non-interest expenses for the second quarter of 2023 as

compared with the second quarter of 2022.

Net interest income decreased by $752,000, or

2.7 percent, to $27.0 million for the second quarter of 2023,

from $27.7 million for the second quarter of 2022. The

decrease in net interest income resulted from higher interest

expense which was partially offset by higher interest income.

Interest income increased by $16.8 million, or

55.1 percent, to $47.2 million for the second quarter of 2023 from

$30.5 million for the second quarter of 2022. The average

balance of interest-earning assets increased $725.9 million, or

24.5 percent, to $3.695 billion for the second quarter of 2023 from

$2.969 billion for the second quarter of 2022, while the average

yield increased 101 basis points to 5.11 percent for the second

quarter of 2023 from 4.10 percent for the second quarter of

2022.

Interest expense increased by $17.5 million to

$20.2 million for the second quarter of 2023 from

$2.7 million for the second quarter of 2022. The increase

resulted primarily from an increase in the average rate on

interest-bearing liabilities of 230 basis points to 2.80 percent

for the second quarter of 2023 from 0.50 percent for the second

quarter of 2022, while the average balance of interest-bearing

liabilities increased by $717.8 million to $2.891 billion for the

second quarter of 2023 from $2.174 billion for the second quarter

of 2022. The increase in the average cost of funds resulted

primarily from the persistently high interest rate environment.

The net interest margin was 2.92 percent for the

second quarter of 2023 compared to 3.74 percent for the second

quarter of 2022. The decrease in the net interest margin compared

to the second quarter of 2022 was the result of the increase in the

cost of interest-bearing liabilities partially offset by the

increase in the yield on interest-earning assets. In a persistently

high interest rate environment, management has been proactive in

managing both the yield on earning assets and the cost of funds to

protect net interest margin and continue to support the growth of

net interest income.

During the second quarter of 2023, the Company

experienced $27,000 in net charge-offs compared to $133,000 in net

recoveries in the second quarter of 2022. The Bank had non-accrual

loans totaling $5.70 million, or 0.17 percent of gross loans,

at June 30, 2023 as compared to $9.2 million, or 0.35 percent

of gross loans, at June 30, 2022. The allowance for credit losses

on loans was $30.2 million, or 0.90 percent of gross loans at

June 30, 2023, and $34.1 million, or 1.28 percent of gross

loans at June 30, 2022. The provision for credit losses was $1.35

million for the second quarter of 2023 compared to no provisioning

for loan losses for the second quarter of 2022. Management believes

that the allowance for credit losses on loans was adequate at June

30, 2023 and June 30, 2022.

Non-interest income increased by $1.4 million to

$1.1 million for the second quarter of 2023 from a loss of

$313,000 for second quarter of 2022. The increase in total

non-interest income was mainly related to the decrease in the

realized and unrealized losses on equity securities from $2.3

million to $669,000 thousand partially offset by a decrease in BOLI

income of $419,000. The realized and unrealized losses on equity

securities are based on market conditions.

Non-interest expense increased by $1.7 million,

or 12.6 percent, to $14.7 million for the second quarter of

2023 from $13.1 million for the second quarter of 2022. The

increase in operating expenses for the first quarter of 2023 was

primarily driven by the higher salaries, higher regulatory

assessment charges, and increased data processing expenses compared

to the second quarter of 2022. The increase in salaries related to

targeted hiring and normal compensation increases. The number of

full-time equivalent employees for the second quarter of 2023 was

307, as compared to 301 for the same period in 2022.

The income tax provision decreased by $762,000,

or 18.1 percent, to $3.4 million for the second quarter of

2023 from $4.2 million for the second quarter of 2022. The

consolidated effective tax rate was 28.6 percent for the second

quarter of 2023 compared to 29.3 percent for the second quarter of

2022.

Year-to-Date Income Statement

Review

Net income decreased by $3.4 million, or

16.9 percent, to $16.7 million for the first six months of

2023 from $20.1 million for the first six months of 2022. The

decrease in net income was driven primarily by a higher loan loss

provision and an increase in operating expenses for 2023 as

compared to 2022.

Net interest income increased by

$1.6 million, or 3.1 percent, to $54.5 million for the first

six months of 2023 from $52.8 million for the first six months of

2022. The increase in net interest income resulted from a $31.4

million increase in interest income, partly offset by an increase

of $29.8 million in interest expense.

Interest income increased by $31.4 million, or

54.0 percent, to $89.6 million for the first six months of 2023,

from $58.2 million for the first six months of 2022. The average

balance of interest-earning assets increased $655.1 million, or

22.3 percent, to $3.590 billion for the first six months of 2023,

from $2.935 for the first six months of 2022, while the average

yield increased 102 basis points to 4.99 percent from 3.97 percent

for the same comparable period. The increase in the average balance

of interest-earning assets mainly related to an increase in the

Company’s level of average loans receivable for the first six

months of 2023, as compared to the same period in

2022.

The increase in interest income mainly related

to an increase in the average balance of loans receivable of $809.8

million to $3.241 billion for the first six months of 2023, from

$2.431 billion for the first six months of 2022. The increase in

the average balance of loans receivable was a result of the

continued strength of the Company’s loan pipeline.

Interest expense increased by $29.8 million, or

553.9 percent, to $35.1 million for 2023, from $5.4 million for

2022. This increase resulted primarily from an increase in the

average rate on interest-bearing liabilities of 203 basis points to

2.53 percent for the first six months of 2023, from 0.50 percent

for the first six months of 2022, and an increase in the average

balance of interest-bearing liabilities of $635.2 million, or 29.7

percent, to $2.777 billion from $2.142 billion over the same

period. The increase in the average cost of funds primarily

resulted from the high interest rate environment and an increase in

the level of borrowed funds in the first six months of 2023

compared to the same period in 2022.

Net interest margin was 3.03 percent for the

first six months of 2023, compared to 3.60 percent for the first

six months of 2022. The decrease in the net interest margin

compared to the prior period was the result of an increase in the

average volume of interest-bearing liabilities as well as an

increase in the cost of interest-bearing liabilities.

During the first six months of 2023, the Company

experienced $25,000 in net recoveries compared to $431,000 in net

charge offs for the same period in 2022. The Bank had non-accrual

loans totaling $5.7 million, or 0.17 percent, of gross loans

at June 30, 2023 as compared to $9.2 million, or 0.35 percent

of gross loans at June 30, 2022. The allowance for credit losses

was $30.2 million, or 0.90 percent of gross loans at June 30,

2023, and $34.1 million, or 1.28 percent of gross loans at

June 30, 2022. The provision for credit losses was $2.0 million for

the first six months of 2023 compared to a credit to the provision

for loan losses of $2.6 million for the same period in 2022.

Management believes that the allowance for credit losses was

adequate at June 30, 2023 and June 30, 2022.

Non-interest income increased by $367,000 to a

loss of $546,000 for the first six months of 2023 from a loss of

$913,000 for the first six months of 2022. The improvement in total

noninterest income was mainly related to a decrease of $1.1 million

in the realized and unrealized gains and losses on equity

securities (from a loss of $5.0 million to a loss of $3.9 million)

partially offset by a decrease of $753,000 in BOLI income. The

realized and unrealized gains or losses on equity securities are

based on market conditions.

Non-interest expense increased by $2.5 million,

or 9.8 percent, to $28.6 million for the first six months of

2023 from $26.0 million for the same period in 2022. The increase

in operating expenses for 2023 was driven primarily by the increase

in salaries and employee benefits, higher data processing expenses,

and an increase in the regulatory assessments. The increase in

salaries related to targeted hiring of additional staff. The number

of full-time equivalent employees for the period ended June 30,

2023 was 307, as compared with 301 for the same period in 2022.

The income tax provision decreased by $1.7

million or 20.0 percent, to $6.7 million for the first six months

of 2023 from $8.3 million for the same period in 2022. The

decrease in the income tax provision was a result of the lower

taxable income for the six months ended June 30, 2023 compared to

the same period in 2022. The consolidated effective tax

rate was 28.5 percent for the first six months of 2023 compared to

29.3 percent for the first six months of 2022.

Asset Quality

The Bank had non-accrual loans totaling

$5.7 million, or 0.17 percent, of gross loans at June 30,

2023, as compared to $5.1 million, or 0.17 percent, of gross

loans at December 31, 2022. The allowance for credit

losses was $30.2 million, or 0.90 percent of gross loans at

June 30, 2023, and $32.4 million, or 1.05 percent of gross loans at

December 31, 2022. The allowance for credit losses was 530.3

percent of non-accrual loans at June 30, 2023, and 633.6

percent of non-accrual loans at December 31, 2022.

About BCB Bancorp, Inc.

Established in 2000 and headquartered in

Bayonne, N.J., BCB Community Bank is the wholly-owned subsidiary of

BCB Bancorp, Inc. (NASDAQ: BCBP). The Bank has 24 branch offices in

Bayonne, Edison, Hoboken, Fairfield, Holmdel, Jersey City,

Lyndhurst, Maplewood, Monroe Township, Newark, Parsippany,

Plainsboro, River Edge, Rutherford, South Orange, Union, and

Woodbridge, New Jersey, and four branches in Hicksville and Staten

Island, New York. The Bank provides businesses and individuals a

wide range of loans, deposit products, and retail and commercial

banking services. For more information, please go to

www.bcb.bank.

Forward-Looking Statements

This release, like many written and oral

communications presented by BCB Bancorp, Inc., and our authorized

officers, may contain certain forward-looking statements regarding

our prospective performance and strategies within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. We intend

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and are including this

statement for purposes of said safe harbor provisions.

Forward-looking statements, which are based on certain assumptions

and describe future plans, strategies, and expectations of the

Company, are generally identified by use of words “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan,” “project,”

“seek,” “strive,” “try,” or future or conditional verbs such as

“could,” “may,” “should,” “will,” “would,” or similar expressions.

Our ability to predict results or the actual effects of our plans

or strategies is inherently uncertain. Accordingly, actual results

may differ materially from anticipated results.

The most significant factors that could cause

future results to differ materially from those anticipated by our

forward-looking statements include the ongoing impact of higher

inflation levels, higher interest rates and general economic and

recessionary concerns, all of which could impact economic growth

and could cause a reduction in financial transactions and business

activities, including decreased deposits and reduced loan

originations; our ability to manage liquidity in a rapidly changing

and unpredictable market; supply chain disruptions, labor

shortages; and additional interest rate increases by the Federal

Reserve. Other factors that could cause actual results to differ

materially from forward-looking statements or historical

performance: the inability to close loans in our pipeline; changes

in asset quality and credit risk; the inability to sustain revenue

and earnings growth; changes in interest rates and capital markets;

inflation; supply chain disruptions; any future pandemics and the

related adverse local and national economic consequences; civil

unrest in the communities that the company serves; customer

acceptance of the Bank’s products and services; customer borrowing,

repayment, investment and deposit practices; customer

disintermediation; the introduction, withdrawal, success and timing

of business initiatives; competitive conditions; economic

conditions; the impact, extent and timing of technological changes,

capital management activities, actions of governmental agencies and

legislative and regulatory actions and reforms, other factors

discussed elsewhere in this release, and in other reports we filed

with the SEC, including under “Risk Factors” in Part I, Item 1A of

our Annual Report on Form 10-K for the year-ended December 31,

2022, and in Part II, Item 1A of our quarterly report on Form 10-Q

for the quarter-ended March 31, 2023, and our other periodic

reports that we file with the SEC.

Annualized, pro forma, projected and estimated

numbers are used for illustrative purpose only, are not forecasts

and may not reflect actual results.

Explanation of Non-GAAP Financial

Measures

Reported amounts are presented in accordance

with accounting principles generally accepted in the United States

of America ("GAAP"). This press release also contains certain

supplemental Non-GAAP information that the Company’s management

uses in its analysis of the Company’s financial results. The

Company’s management believes that providing this information to

analysts and investors allows them to better understand and

evaluate the Company’s financial results for the periods in

question.

The Company provides measurements and ratios

based on tangible stockholders' equity and efficiency ratios. These

measures are utilized by regulators and market analysts to evaluate

a company’s financial condition and, therefore, the Company’s

management believes that such information is useful to investors.

For a reconciliation of GAAP to Non-GAAP financial measures

included in this press release, see "Reconciliation of GAAP to

Non-GAAP Financial Measures" below.

|

|

Statements of Income - Three Months Ended, |

|

|

|

|

|

June 30, 2023 |

March 31, 2023 |

June 30, 2022 |

June 30, 2023 vs.Mar. 31, 2023 |

|

June 30, 2023 vs.June 30, 2022 |

|

Interest and dividend income: |

(In thousands, except per share amounts,

Unaudited) |

|

|

|

|

Loans, including fees |

$ |

42,644 |

|

$ |

38,889 |

|

$ |

28,781 |

|

9.7 |

% |

|

48.2 |

% |

|

Mortgage-backed securities |

|

184 |

|

|

186 |

|

|

47 |

|

-1.1 |

% |

|

291.5 |

% |

|

Other investment securities |

|

1,070 |

|

|

1,120 |

|

|

939 |

|

-4.5 |

% |

|

14.0 |

% |

|

FHLB stock and other interest earning assets |

|

3,339 |

|

|

2,157 |

|

|

694 |

|

54.8 |

% |

|

381.1 |

% |

|

Total interest and dividend

income |

|

47,237 |

|

|

42,352 |

|

|

30,461 |

|

11.5 |

% |

|

55.1 |

% |

|

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

Demand |

|

4,190 |

|

|

3,154 |

|

|

946 |

|

32.8 |

% |

|

342.9 |

% |

|

Savings and club |

|

143 |

|

|

118 |

|

|

110 |

|

21.2 |

% |

|

30.0 |

% |

|

Certificates of deposit |

|

8,474 |

|

|

6,453 |

|

|

849 |

|

31.3 |

% |

|

898.1 |

% |

|

|

|

12,807 |

|

|

9,725 |

|

|

1,905 |

|

31.7 |

% |

|

572.3 |

% |

|

Borrowings |

|

7,441 |

|

|

5,156 |

|

|

815 |

|

44.3 |

% |

|

813.0 |

% |

|

Total interest

expense |

|

20,248 |

|

|

14,881 |

|

|

2,720 |

|

36.1 |

% |

|

644.4 |

% |

|

|

|

|

|

|

|

|

|

Net interest income |

|

26,989 |

|

|

27,471 |

|

|

27,741 |

|

-1.8 |

% |

|

-2.7 |

% |

|

Provision for credit losses |

|

1,350 |

|

|

622 |

|

|

- |

|

117.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

Net interest income after provision for credit

losses |

|

25,639 |

|

|

26,849 |

|

|

27,741 |

|

-4.5 |

% |

|

-7.6 |

% |

|

|

|

|

|

|

|

|

|

Non-interest income: |

|

|

|

|

|

|

|

Fees and service charges |

|

1,442 |

|

|

1,098 |

|

|

1,213 |

|

31.3 |

% |

|

18.9 |

% |

|

Gain on sales of loans |

|

- |

|

|

6 |

|

|

43 |

|

-100.0 |

% |

|

-100.0 |

% |

|

Realized and unrealized loss on equity investments |

|

(669 |

) |

|

(3,227 |

) |

|

(2,302 |

) |

-79.3 |

% |

|

-70.9 |

% |

|

BOLI income |

|

267 |

|

|

421 |

|

|

686 |

|

-36.6 |

% |

|

-61.1 |

% |

|

Other |

|

78 |

|

|

38 |

|

|

47 |

|

105.3 |

% |

|

66.0 |

% |

|

Total non-interest

income (loss) |

|

1,118 |

|

|

(1,664 |

) |

|

(313 |

) |

-167.2 |

% |

|

-457.2 |

% |

|

|

|

|

|

|

|

|

|

Non-interest expense: |

|

|

|

|

|

|

|

Salaries and employee benefits |

|

7,711 |

|

|

7,618 |

|

|

6,715 |

|

1.2 |

% |

|

14.8 |

% |

|

Occupancy and equipment |

|

2,560 |

|

|

2,552 |

|

|

2,673 |

|

0.3 |

% |

|

-4.2 |

% |

|

Data processing and communications |

|

1,795 |

|

|

1,665 |

|

|

1,469 |

|

7.8 |

% |

|

22.2 |

% |

|

Professional fees |

|

622 |

|

|

566 |

|

|

489 |

|

9.9 |

% |

|

27.2 |

% |

|

Director fees |

|

270 |

|

|

265 |

|

|

296 |

|

1.9 |

% |

|

-8.8 |

% |

|

Regulatory assessment fees |

|

796 |

|

|

536 |

|

|

244 |

|

48.5 |

% |

|

226.2 |

% |

|

Advertising and promotions |

|

350 |

|

|

278 |

|

|

254 |

|

25.9 |

% |

|

37.8 |

% |

|

Other real estate owned, net |

|

1 |

|

|

1 |

|

|

4 |

|

0.0 |

% |

|

-75.0 |

% |

|

Other |

|

601 |

|

|

373 |

|

|

912 |

|

61.1 |

% |

|

-34.1 |

% |

|

Total non-interest

expense |

|

14,706 |

|

|

13,854 |

|

|

13,056 |

|

6.1 |

% |

|

12.6 |

% |

|

|

|

|

|

|

|

|

|

Income before income tax provision |

|

12,051 |

|

|

11,331 |

|

|

14,372 |

|

6.4 |

% |

|

-16.1 |

% |

|

Income tax provision |

|

3,447 |

|

|

3,225 |

|

|

4,209 |

|

6.9 |

% |

|

-18.1 |

% |

|

|

|

|

|

|

|

|

|

Net Income |

|

8,604 |

|

|

8,106 |

|

|

10,163 |

|

6.1 |

% |

|

-15.3 |

% |

|

Preferred stock dividends |

|

174 |

|

|

173 |

|

|

138 |

|

0.6 |

% |

|

26.2 |

% |

|

Net Income available to common stockholders |

$ |

8,430 |

|

$ |

7,933 |

|

$ |

10,025 |

|

6.3 |

% |

|

-15.9 |

% |

|

|

|

|

|

|

|

|

|

Net Income per common share-basic and diluted |

|

|

|

|

|

|

|

Basic |

$ |

0.50 |

|

$ |

0.47 |

|

$ |

0.59 |

|

7.1 |

% |

|

-15.0 |

% |

|

Diluted |

$ |

0.50 |

|

$ |

0.46 |

|

$ |

0.58 |

|

8.6 |

% |

|

-13.0 |

% |

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

outstanding |

|

|

|

|

|

|

|

Basic |

|

16,824 |

|

|

16,949 |

|

|

16,997 |

|

-0.7 |

% |

|

-1.0 |

% |

|

Diluted |

|

16,831 |

|

|

17,208 |

|

|

17,404 |

|

-2.2 |

% |

|

-3.3 |

% |

| |

|

|

|

|

|

|

|

|

Statements of Income - Six Months Ended, |

|

|

|

June 30, 2023 |

June 30, 2022 |

June 30, 2023 vs.June 30, 2022 |

|

Interest and dividend income: |

(In thousands, except per share amounts,

Unaudited) |

|

|

Loans, including fees |

$ |

81,533 |

|

$ |

55,102 |

|

48.0 |

% |

|

Mortgage-backed securities |

|

370 |

|

|

206 |

|

79.6 |

% |

|

Other investment securities |

|

2,190 |

|

|

1,887 |

|

16.1 |

% |

|

FHLB stock and other interest earning assets |

|

5,496 |

|

|

990 |

|

455.2 |

% |

|

Total interest and dividend

income |

|

89,589 |

|

|

58,185 |

|

54.0 |

% |

|

|

|

|

|

|

Interest expense: |

|

|

|

|

Deposits: |

|

|

|

|

Demand |

|

7,344 |

|

|

1,704 |

|

331.0 |

% |

|

Savings and club |

|

261 |

|

|

218 |

|

19.7 |

% |

|

Certificates of deposit |

|

14,927 |

|

|

1,829 |

|

716.1 |

% |

|

|

|

22,532 |

|

|

3,751 |

|

500.7 |

% |

|

Borrowings |

|

12,597 |

|

|

1,621 |

|

677.1 |

% |

|

Total interest

expense |

|

35,129 |

|

|

5,372 |

|

553.9 |

% |

|

|

|

|

|

|

Net interest income |

|

54,460 |

|

|

52,813 |

|

3.1 |

% |

|

Provision (benefit) for credit

losses |

|

1,972 |

|

|

(2,575 |

) |

-176.6 |

% |

|

|

|

|

|

|

Net interest income after provision (credit) for credit

losses |

|

52,488 |

|

|

55,388 |

|

-5.2 |

% |

|

|

|

|

|

|

Non-interest income: |

|

|

|

|

Fees and service charges |

|

2,540 |

|

|

2,427 |

|

4.7 |

% |

|

Gain on sales of loans |

|

6 |

|

|

108 |

|

-94.4 |

% |

|

Realized and unrealized (loss) gain on equity investments |

|

(3,896 |

) |

|

(4,987 |

) |

-21.9 |

% |

|

BOLI income |

|

688 |

|

|

1,441 |

|

-52.3 |

% |

|

Other |

|

116 |

|

|

98 |

|

18.4 |

% |

|

Total non-interest

loss |

|

(546 |

) |

|

(913 |

) |

-40.2 |

% |

|

|

|

|

|

|

Non-interest expense: |

|

|

|

|

Salaries and employee benefits |

|

15,329 |

|

|

13,451 |

|

14.0 |

% |

|

Occupancy and equipment |

|

5,112 |

|

|

5,368 |

|

-4.8 |

% |

|

Data processing and communications |

|

3,460 |

|

|

2,934 |

|

17.9 |

% |

|

Professional fees |

|

1,188 |

|

|

983 |

|

20.9 |

% |

|

Director fees |

|

535 |

|

|

617 |

|

-13.3 |

% |

|

Regulatory assessments |

|

1,332 |

|

|

548 |

|

143.1 |

% |

|

Advertising and promotions |

|

628 |

|

|

395 |

|

59.0 |

% |

|

Other real estate owned, net |

|

2 |

|

|

5 |

|

-60.0 |

% |

|

Other |

|

974 |

|

|

1,714 |

|

-43.2 |

% |

|

Total non-interest

expense |

|

28,560 |

|

|

26,015 |

|

9.8 |

% |

|

|

|

|

|

|

Income before income tax provision |

|

23,382 |

|

|

28,460 |

|

-17.8 |

% |

|

Income tax provision |

|

6,672 |

|

|

8,345 |

|

-20.0 |

% |

|

|

|

|

|

|

Net Income |

|

16,710 |

|

|

20,115 |

|

-16.9 |

% |

|

Preferred stock dividends |

|

347 |

|

|

414 |

|

-16.2 |

% |

|

Net Income available to common stockholders |

$ |

16,363 |

|

$ |

19,701 |

|

-16.9 |

% |

|

|

|

|

|

|

Net Income per common share-basic and diluted |

|

|

|

|

Basic |

$ |

0.97 |

|

$ |

1.16 |

|

-16.4 |

% |

|

Diluted |

$ |

0.96 |

|

$ |

1.13 |

|

-15.2 |

% |

|

|

|

|

|

|

Weighted average number of common shares

outstanding |

|

|

|

|

Basic |

|

16,886 |

|

|

16,989 |

|

-0.6 |

% |

|

Diluted |

|

17,010 |

|

|

17,375 |

|

-2.1 |

% |

|

Statements of Financial Condition |

June 30,2023 |

March 31,2023 |

December 31, 2022 |

June 30, 2023 vs.March 31, 2023 |

June 30, 2023 vs.December 31,2022 |

|

ASSETS |

(In Thousands, Unaudited) |

|

|

|

Cash and amounts due from depository institutions |

$ |

13,378 |

|

$ |

13,213 |

|

$ |

11,520 |

|

1.2 |

% |

16.1 |

% |

|

Interest-earning deposits |

|

259,834 |

|

|

247,862 |

|

|

217,839 |

|

4.8 |

% |

19.3 |

% |

|

Total cash and cash equivalents |

|

273,212 |

|

|

261,075 |

|

|

229,359 |

|

4.6 |

% |

19.1 |

% |

|

|

|

|

|

|

|

|

Interest-earning time deposits |

|

735 |

|

|

735 |

|

|

735 |

|

- |

|

- |

|

|

Debt securities available for sale |

|

87,648 |

|

|

86,988 |

|

|

91,715 |

|

0.8 |

% |

-4.4 |

% |

|

Equity investments |

|

12,825 |

|

|

14,458 |

|

|

17,686 |

|

-11.3 |

% |

-27.5 |

% |

|

Loans held for sale |

|

- |

|

|

- |

|

|

658 |

|

- |

|

-100.0 |

% |

|

Loans receivable, net of allowance for credit losses |

|

|

|

|

|

|

of $30,205, $28,882 and $32,373, respectively |

|

3,319,721 |

|

|

3,231,864 |

|

|

3,045,331 |

|

2.72 |

% |

9.01 |

% |

|

Federal Home Loan Bank of New York stock, at cost |

|

31,667 |

|

|

26,875 |

|

|

20,113 |

|

17.8 |

% |

57.4 |

% |

|

Premises and equipment, net |

|

13,561 |

|

|

10,106 |

|

|

10,508 |

|

34.2 |

% |

29.1 |

% |

|

Accrued interest receivable |

|

15,384 |

|

|

14,717 |

|

|

13,455 |

|

4.5 |

% |

14.3 |

% |

|

Other real estate owned |

|

75 |

|

|

75 |

|

|

75 |

|

- |

|

- |

|

|

Deferred income taxes |

|

16,445 |

|

|

15,178 |

|

|

16,462 |

|

8.3 |

% |

-0.1 |

% |

|

Goodwill and other intangibles |

|

5,324 |

|

|

5,359 |

|

|

5,382 |

|

-0.7 |

% |

-1.1 |

% |

|

Operating lease right-of-use asset |

|

13,658 |

|

|

15,111 |

|

|

13,520 |

|

-9.6 |

% |

1.0 |

% |

|

Bank-owned life insurance ("BOLI") |

|

72,344 |

|

|

72,077 |

|

|

71,656 |

|

0.4 |

% |

1.0 |

% |

|

Other assets |

|

10,254 |

|

|

8,438 |

|

|

9,538 |

|

21.5 |

% |

7.5 |

% |

|

Total Assets |

$ |

3,872,853 |

|

$ |

3,763,056 |

|

$ |

3,546,193 |

|

2.9 |

% |

9.2 |

% |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Non-interest bearing deposits |

$ |

620,509 |

|

$ |

604,935 |

|

$ |

613,910 |

|

2.6 |

% |

1.1 |

% |

|

Interest bearing deposits |

|

2,265,212 |

|

|

2,262,274 |

|

|

2,197,697 |

|

0.1 |

% |

3.1 |

% |

|

Total deposits |

|

2,885,721 |

|

|

2,867,209 |

|

|

2,811,607 |

|

0.6 |

% |

2.6 |

% |

|

FHLB advances |

|

622,536 |

|

|

532,399 |

|

|

382,261 |

|

16.9 |

% |

62.9 |

% |

|

Subordinated debentures |

|

37,624 |

|

|

37,566 |

|

|

37,508 |

|

0.2 |

% |

0.3 |

% |

|

Operating lease liability |

|

14,003 |

|

|

15,436 |

|

|

13,859 |

|

-9.3 |

% |

1.0 |

% |

|

Other liabilities |

|

13,346 |

|

|

12,828 |

|

|

9,704 |

|

4.0 |

% |

37.5 |

% |

|

Total Liabilities |

|

3,573,230 |

|

|

3,465,438 |

|

|

3,254,939 |

|

3.1 |

% |

9.8 |

% |

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Preferred stock: $0.01 par value, 10,000 shares authorized |

|

- |

|

|

- |

|

|

- |

|

|

|

|

Additional paid-in capital preferred stock |

|

21,003 |

|

|

21,003 |

|

|

21,003 |

|

0.0 |

% |

0.0 |

% |

|

Common stock: no par value, 40,000 shares authorized |

|

- |

|

|

- |

|

|

- |

|

|

|

|

Additional paid-in capital common stock |

|

197,521 |

|

|

197,197 |

|

|

196,164 |

|

0.2 |

% |

0.7 |

% |

|

Retained earnings |

|

128,867 |

|

|

123,121 |

|

|

115,109 |

|

4.7 |

% |

12.0 |

% |

|

Accumulated other comprehensive loss |

|

(9,421 |

) |

|

(6,613 |

) |

|

(6,491 |

) |

42.5 |

% |

45.1 |

% |

|

Treasury stock, at cost |

|

(38,347 |

) |

|

(37,090 |

) |

|

(34,531 |

) |

3.4 |

% |

11.1 |

% |

|

Total Stockholders'

Equity |

|

299,623 |

|

|

297,618 |

|

|

291,254 |

|

0.7 |

% |

2.9 |

% |

|

|

|

|

|

|

|

|

Total Liabilities and

Stockholders' Equity |

$ |

3,872,853 |

|

$ |

3,763,056 |

|

$ |

3,546,193 |

|

2.9 |

% |

9.2 |

% |

| |

|

|

|

|

|

| Outstanding common

shares |

16,788 |

16,884 |

16,931 |

|

|

|

|

Three Months Ended June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

Average Balance |

Interest Earned/Paid |

Average Yield/Rate (3) |

|

Average Balance |

Interest Earned/Paid |

Average Yield/Rate (3) |

|

|

(Dollars in thousands) |

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

Loans Receivable(4)(5) |

$ |

3,315,120 |

$ |

42,644 |

5.15 |

% |

|

$ |

2,517,283 |

$ |

28,781 |

4.57 |

% |

|

Investment Securities |

|

100,971 |

|

1254 |

4.97 |

% |

|

|

107,132 |

|

986 |

3.68 |

% |

|

FHLB stock and other interest-earning assets |

|

278,746 |

|

3,339 |

4.79 |

% |

|

|

344,510 |

|

694 |

0.81 |

% |

|

Total Interest-earning assets |

|

3,694,837 |

|

47,237 |

5.11 |

% |

|

|

2,968,926 |

|

30,461 |

4.10 |

% |

|

Non-interest-earning assets |

|

125,032 |

|

|

|

|

107,156 |

|

|

|

Total assets |

$ |

3,819,869 |

|

|

|

$ |

3,076,081 |

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

Interest-bearing demand accounts |

$ |

712,414 |

$ |

2,209 |

1.24 |

% |

|

$ |

796,227 |

$ |

569 |

0.29 |

% |

|

Money market accounts |

|

331,339 |

|

1,981 |

2.39 |

% |

|

|

356,062 |

|

376 |

0.42 |

% |

|

Savings accounts |

|

312,201 |

|

143 |

0.18 |

% |

|

|

346,432 |

|

110 |

0.13 |

% |

|

Certificates of Deposit |

|

904,766 |

|

8,474 |

3.75 |

% |

|

|

565,479 |

|

850 |

0.60 |

% |

|

Total interest-bearing deposits |

|

2,260,721 |

|

12,807 |

2.27 |

% |

|

|

2,064,199 |

|

1,905 |

0.37 |

% |

|

Borrowed funds |

|

630,706 |

|

7,441 |

4.72 |

% |

|

|

109,436 |

|

815 |

2.98 |

% |

|

Total interest-bearing liabilities |

|

2,891,427 |

|

20,248 |

2.80 |

% |

|

|

2,173,636 |

|

2,720 |

0.50 |

% |

|

Non-interest-bearing liabilities |

|

630,928 |

|

|

|

|

631,430 |

|

|

|

Total liabilities |

|

3,522,355 |

|

|

|

|

2,805,066 |

|

|

|

Stockholders' equity |

|

297,514 |

|

|

|

|

271,015 |

|

|

|

Total liabilities and stockholders' equity |

$ |

3,819,869 |

|

|

|

$ |

3,076,081 |

|

|

|

Net interest income |

|

$ |

26,989 |

|

|

|

$ |

27,741 |

|

|

Net interest rate spread(1) |

|

|

2.31 |

% |

|

|

|

3.60 |

% |

|

Net interest margin(2) |

|

|

2.92 |

% |

|

|

|

3.74 |

% |

|

|

|

|

|

|

|

|

|

|

(1) Net interest rate spread represents the difference

between the average yield on average interest-earning assets and

the average cost of average interest-bearing liabilities. |

|

(2) Net interest margin represents net interest income

divided by average total interest-earning assets. |

|

(3) Annualized. |

|

(4) Excludes allowance for credit losses. |

|

(5) Includes non-accrual loans which are immaterial to

the yield. |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

Average Balance |

Interest Earned/Paid |

Average Yield/Rate (3) |

|

Average Balance |

Interest Earned/Paid |

Average Yield/Rate (3) |

|

|

(Dollars in thousands) |

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

Loans Receivable(4)(5) |

$ |

3,240,812 |

$ |

81,533 |

5.03 |

% |

|

$ |

2,431,043 |

$ |

55,102 |

4.53 |

% |

|

Investment Securities |

|

104,898 |

|

2,560 |

4.88 |

% |

|

|

108,024 |

|

2,093 |

3.88 |

% |

|

FHLB stock and other interest-earning assets |

|

243,987 |

|

5,496 |

4.51 |

% |

|

|

395,512 |

|

990 |

0.50 |

% |

|

Total Interest-earning assets |

|

3,589,697 |

|

89,589 |

4.99 |

% |

|

|

2,934,580 |

|

58,185 |

3.97 |

% |

|

Non-interest-earning assets |

|

120,965 |

|

|

|

|

104,666 |

|

|

|

Total assets |

$ |

3,710,663 |

|

|

|

$ |

3,039,245 |

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

Interest-bearing demand accounts |

$ |

713,097 |

$ |

3,998 |

1.12 |

% |

|

$ |

751,396 |

$ |

967 |

0.26 |

% |

|

Money market accounts |

|

322,930 |

|

3,346 |

2.07 |

% |

|

|

350,842 |

|

736 |

0.42 |

% |

|

Savings accounts |

|

317,451 |

|

261 |

0.16 |

% |

|

|

341,531 |

|

218 |

0.13 |

% |

|

Certificates of Deposit |

|

876,762 |

|

14,927 |

3.40 |

% |

|

|

588,518 |

|

1,828 |

0.62 |

% |

|

Total interest-bearing deposits |

|

2,230,241 |

|

22,532 |

2.02 |

% |

|

|

2,032,286 |

|

3,751 |

0.37 |

% |

|

Borrowed funds |

|

546,528 |

|

12,597 |

4.61 |

% |

|

|

109,272 |

|

1,621 |

2.97 |

% |

|

Total interest-bearing liabilities |

|

2,776,769 |

|

35,129 |

2.53 |

% |

|

|

2,141,558 |

|

5,372 |

0.50 |

% |

|

Non-interest-bearing liabilities |

|

638,406 |

|

|

|

|

626,520 |

|

|

|

Total liabilities |

|

3,415,175 |

|

|

|

|

2,768,078 |

|

|

|

Stockholders' equity |

|

295,488 |

|

|

|

|

271,168 |

|

|

|

Total liabilities and stockholders' equity |

$ |

3,710,663 |

|

|

|

$ |

3,039,245 |

|

|

|

Net interest income |

|

$ |

54,460 |

|

|

|

$ |

52,813 |

|

|

Net interest rate spread(1) |

|

|

2.46 |

% |

|

|

|

3.46 |

% |

|

Net interest margin(2) |

|

|

3.03 |

% |

|

|

|

3.60 |

% |

|

|

|

|

|

|

|

|

|

|

(1) Net interest rate spread represents the difference

between the average yield on average interest-earning assets and

the average cost of average interest-bearing liabilities. |

|

(2) Net interest margin represents net interest income

divided by average total interest-earning assets. |

|

(3) Presented on an annualized basis, where

appropriate. |

|

(4) Excludes allowance for credit losses. |

|

(5) Includes non-accrual loans which are immaterial to

the yield. |

|

|

Financial Condition data by quarter |

|

|

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

|

|

|

|

|

|

|

|

(In thousands, except book values) |

|

Total assets |

$ |

3,872,853 |

|

$ |

3,763,056 |

|

$ |

3,546,193 |

|

$ |

3,265,612 |

|

$ |

3,072,771 |

|

|

Cash and cash equivalents |

|

273,212 |

|

|

261,075 |

|

|

229,359 |

|

|

221,024 |

|

|

206,172 |

|

|

Securities |

|

100,473 |

|

|

101,446 |

|

|

109,401 |

|

|

111,159 |

|

|

105,717 |

|

|

Loans receivable, net |

|

3,319,721 |

|

|

3,231,864 |

|

|

3,045,331 |

|

|

2,787,015 |

|

|

2,620,630 |

|

|

Deposits |

|

2,885,721 |

|

|

2,867,209 |

|

|

2,811,607 |

|

|

2,712,946 |

|

|

2,655,030 |

|

|

Borrowings |

|

660,160 |

|

|

569,965 |

|

|

419,769 |

|

|

249,573 |

|

|

124,377 |

|

|

Stockholders’ equity |

|

299,623 |

|

|

297,618 |

|

|

291,254 |

|

|

282,682 |

|

|

271,637 |

|

|

Book value per common share1 |

$ |

16.60 |

|

$ |

16.38 |

|

$ |

15.96 |

|

$ |

15.42 |

|

$ |

15.04 |

|

|

Tangible book value per common share2 |

$ |

16.28 |

|

$ |

16.07 |

|

$ |

15.65 |

|

$ |

15.11 |

|

$ |

14.73 |

|

|

|

|

|

|

|

|

|

|

Operating data by quarter |

|

|

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

|

(In thousands, except for per share amounts) |

|

Net interest income |

$ |

26,989 |

|

$ |

27,471 |

|

$ |

30,181 |

|

$ |

30,951 |

|

$ |

27,741 |

|

|

Provision (benefit) for credit losses |

|

1,350 |

|

|

622 |

|

|

(500 |

) |

|

- |

|

|

- |

|

|

Non-interest income (loss) |

|

1,118 |

|

|

(1,664 |

) |

|

1,062 |

|

|

1,446 |

|

|

(313 |

) |

|

Non-interest expense |

|

14,706 |

|

|

13,854 |

|

|

16,037 |

|

|

13,453 |

|

|

13,056 |

|

|

Income tax expense |

|

3,447 |

|

|

3,225 |

|

|

3,634 |

|

|

5,552 |

|

|

4,209 |

|

|

Net income |

$ |

8,604 |

|

$ |

8,106 |

|

$ |

12,072 |

|

$ |

13,392 |

|

$ |

10,163 |

|

|

Net income per diluted share |

$ |

0.50 |

|

$ |

0.46 |

|

$ |

0.69 |

|

$ |

0.76 |

|

$ |

0.58 |

|

|

Common Dividends declared per share |

$ |

0.16 |

|

$ |

0.16 |

|

$ |

0.16 |

|

$ |

0.16 |

|

$ |

0.16 |

|

|

|

|

|

|

|

|

|

|

Financial Ratios(3) |

|

|

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

Return on average assets |

|

0.90% |

|

|

0.90% |

|

|

1.46% |

|

|

1.74% |

|

|

1.32% |

|

|

Return on average stockholders' equity |

|

11.57% |

|

|

11.05% |

|

|

16.99% |

|

|

19.42% |

|

|

15.00% |

|

|

Net interest margin |

|

2.92% |

|

|

3.15% |

|

|

3.76% |

|

|

4.18% |

|

|

3.74% |

|

|

Stockholders' equity to total assets |

|

7.74% |

|

|

7.91% |

|

|

8.21% |

|

|

8.66% |

|

|

8.84% |

|

|

Efficiency Ratio4 |

|

52.32% |

|

|

53.68% |

|

|

51.33% |

|

|

41.53% |

|

|

47.60% |

|

| |

|

|

|

|

|

|

|

Asset Quality Ratios |

|

|

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

|

(In thousands, except for ratio %) |

|

Non-Accrual Loans |

$ |

5,696 |

|

$ |

5,058 |

|

$ |

5,109 |

|

$ |

8,505 |

|

$ |

9,201 |

|

|

Non-Accrual Loans as a % of Total Loans |

|

0.17% |

|

|

0.16% |

|

|

0.17% |

|

|

0.30% |

|

|

0.35% |

|

|

ACL as % of Non-Accrual Loans |

|

530.3% |

|

|

571.0% |

|

|

633.6% |

|

|

390.3% |

|

|

370.7% |

|

|

Individually Analyzed Loans |

|

28,250 |

|

|

17,585 |

|

|

28,272 |

|

|

40,524 |

|

|

42,411 |

|

| |

|

|

|

|

|

|

(1) Calculated by dividing stockholders' equity, less preferred

equity, to shares outstanding. |

|

|

|

(2) Calculated by dividing tangible stockholders’ common equity, a

non-GAAP measure, by shares outstanding. Tangible

stockholders’ |

|

common equity is stockholders’ equity less goodwill and preferred

stock. See “Reconciliation of GAAP to Non-GAAP Financial Measures

by quarter.” |

|

(3) Ratios are presented on an annualized basis, where

appropriate. |

|

|

|

|

(4) The Efficiency Ratio, a non-GAAP measure, was calculated by

dividing non-interest expense by the total of net interest

income |

|

and non-interest income. See “Reconciliation of GAAP to Non-GAAP

Financial Measures by quarter.” |

|

|

|

Recorded Investment in Loans Receivable by quarter |

|

|

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

|

(In thousands) |

|

Residential one-to-four family |

$ |

250,345 |

|

$ |

246,683 |

|

$ |

250,123 |

|

$ |

242,238 |

|

$ |

235,883 |

|

|

Commercial and multi-family |

|

2,490,883 |

|

|

2,466,932 |

|

|

2,345,229 |

|

|

2,164,320 |

|

|

2,030,597 |

|

|

Construction |

|

179,156 |

|

|

162,553 |

|

|

144,931 |

|

|

153,103 |

|

|

155,070 |

|

|

Commercial business |

|

368,948 |

|

|

327,598 |

|

|

282,007 |

|

|

205,661 |

|

|

181,868 |

|

|

Home equity |

|

61,595 |

|

|

58,822 |

|

|

56,888 |

|

|

56,064 |

|

|

51,808 |

|

|

Consumer |

|

3,994 |

|

|

3,383 |

|

|

3,240 |

|

|

2,545 |

|

|

2,656 |

|

|

|

$ |

3,354,921 |

|

$ |

3,265,971 |

|

$ |

3,082,418 |

|

$ |

2,823,931 |

|

$ |

2,657,882 |

|

|

Less: |

|

|

|

|

|

|

Deferred loan fees, net |

|

(4,995 |

) |

|

(5,225 |

) |

|

(4,714 |

) |

|

(3,721 |

) |

|

(3,139 |

) |

|

Allowance for credit losses |

|

(30,205 |

) |

|

(28,882 |

) |

|

(32,373 |

) |

|

(33,195 |

) |

|

(34,113 |

) |

|

|

|

|

|

|

|

|

Total loans, net |

$ |

3,319,721 |

|

$ |

3,231,864 |

|

$ |

3,045,331 |

|

$ |

2,787,015 |

|

$ |

2,620,630 |

|

| |

|

|

|

|

|

|

|

Non-Accruing Loans in Portfolio by quarter |

|

|

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

|

(In thousands) |

|

Residential one-to-four family |

$ |

178 |

|

$ |

237 |

|

$ |

243 |

|

$ |

263 |

|

$ |

267 |

|

|

Commercial and multi-family |

|

- |

|

|

340 |

|

|

346 |

|

|

757 |

|

|

757 |

|

|

Construction |

|

4,145 |

|

|

3,217 |

|

|

3,180 |

|

|

3,180 |

|

|

3,043 |

|

|

Commercial business |

|

1,373 |

|

|

1,264 |

|

|

1,340 |

|

|

4,305 |

|

|

5,104 |

|

|

Home equity |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

30 |

|

|

Total: |

$ |

5,696 |

|

$ |

5,058 |

|

$ |

5,109 |

|

$ |

8,505 |

|

$ |

9,201 |

|

| |

|

|

|

|

|

|

|

Distribution of Deposits by quarter |

|

|

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

|

(In thousands) |

|

Demand: |

|

|

|

|

|

|

Non-Interest Bearing |

$ |

620,509 |

|

$ |

604,935 |

|

$ |

613,910 |

|

$ |

610,425 |

|

$ |

595,167 |

|

|

Interest Bearing |

|

714,420 |

|

|

686,576 |

|

|

757,614 |

|

|

726,012 |

|

|

810,535 |

|

|

Money Market |

|

328,543 |

|

|

361,558 |

|

|

305,556 |

|

|

370,353 |

|

|

360,356 |

|

|

Sub-total: |

$ |

1,663,472 |

|

$ |

1,653,069 |

|

$ |

1,677,080 |

|

$ |

1,706,790 |

|

$ |

1,766,058 |

|

|

Savings and Club |

|

307,435 |

|

|

319,131 |

|

|

329,753 |

|

|

338,864 |

|

|

347,279 |

|

|

Certificates of Deposit |

|

914,814 |

|

|

895,009 |

|

|

804,774 |

|

|

667,291 |

|

|

541,693 |

|

|

Total Deposits: |

$ |

2,885,721 |

|

$ |

2,867,209 |

|

$ |

2,811,607 |

|

$ |

2,712,945 |

|

$ |

2,655,030 |

|

| |

|

|

|

|

|

|

|

Reconciliation of GAAP to Non-GAAP Financial Measures by

quarter |

|

|

|

|

|

|

|

|

|

Tangible Book Value per Share |

|

|

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

|

(In thousands, except per share amounts) |

|

Total Stockholders' Equity |

$ |

299,623 |

|

$ |

297,618 |

|

$ |

291,254 |

|

$ |

282,682 |

|

$ |

271,637 |

|

|

Less: goodwill |

|

5,252 |

|

|

5,252 |

|

|

5,252 |

|

|

5,252 |

|

|

5,252 |

|

|

Less: preferred stock |

|

21,003 |

|

|

21,003 |

|

|

21,003 |

|

|

21,003 |

|

|

16,563 |

|

|

Total tangible common stockholders' equity |

|

273,368 |

|

|

271,363 |

|

|

264,999 |

|

|

256,427 |

|

|

249,822 |

|

|

Shares common shares outstanding |

|

16,788 |

|

|

16,884 |

|

|

16,931 |

|

|

16,974 |

|

|

16,960 |

|

|

Book value per common share |

$ |

16.60 |

|

$ |

16.38 |

|

$ |

15.96 |

|

$ |

15.42 |

|

$ |

15.04 |

|

|

Tangible book value per common share |

$ |

16.28 |

|

$ |

16.07 |

|

$ |

15.65 |

|

$ |

15.11 |

|

$ |

14.73 |

|

| |

|

|

|

|

|

|

|

Efficiency Ratios |

|

|

Q2 2023 |

Q1 2023 |

Q4 2022 |

Q3 2022 |

Q2 2022 |

|

|

(In thousands, except for ratio %) |

|

Net interest income |

$ |

26,989 |

|

$ |

27,471 |

|

$ |

30,181 |

|

$ |

30,951 |

|

$ |

27,741 |

|

|

Non-interest income (loss) |

|

1,118 |

|

|

(1,664 |

) |

|

1,062 |

|

|

1,446 |

|

|

(313 |

) |

|

Total income |

|

28,107 |

|

|

25,807 |

|

|

31,243 |

|

|

32,397 |

|

|

27,428 |

|

|

Non-interest expense |

|

14,706 |

|

|

13,854 |

|

|

16,037 |

|

|

13,453 |

|

|

13,056 |

|

|

Efficiency Ratio |

|

52.32% |

|

|

53.68% |

|

|

51.33% |

|

|

41.53% |

|

|

47.60% |

|

|

|

|

|

|

|

|

| |

|

| CONTACT: |

THOMAS COUGHLIN, |

| |

PRESIDENT & CEO |

| |

JAWAD CHAUDHRY, CFO |

| |

(201) 823-0700 |

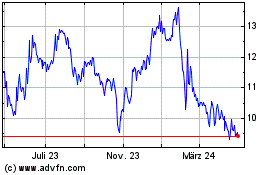

BCB Bancorp (NASDAQ:BCBP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

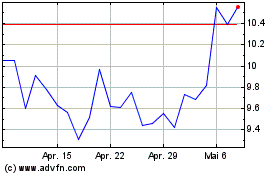

BCB Bancorp (NASDAQ:BCBP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024