Shares of Oxford-AstraZeneca Covid-19 Vaccine Startup Trade Down in Debut

30 April 2021 - 10:44PM

Dow Jones News

By Matt Grossman

Vaccitech PLC, a British company that co-invented the

AstraZeneca PLC Covid-19 vaccine, closed its first day of trading

with shares down 17%.

American depositary shares of the company, an offshoot of

University of Oxford research efforts, closed Friday at $14.10,

compared with their initial public offering price of $17 a

share.

Vaccitech came to prominence over the past year because of its

Covid-19 vaccine work. Its vaccine, marketed by AstraZeneca, has

been one of a handful of shots invented at blistering speed to

combat the pandemic, relative to the typically plodding pace of

pharmaceutical development.

More recently, however, the vaccine has experienced a rocky

world-wide rollout amid safety concerns and production

challenges.

Vaccitech was co-founded five years ago by two University of

Oxford professors, Adrian Hill and Sarah Gilbert. Its technology

focuses on priming the body's immune system to fight disease.

The company's approach, which uses an adenovirus vector encoded

with the target antigen, can be used in vaccines to prevent

diseases caused by infections, such as Covid-19. It can also

harness the immune system to treat illnesses such as cancer,

Vaccitech said.

In addition to its work on Covid-19, the company is developing a

vaccine for shingles and a treatment for prostate cancer, among

other therapeutic and prophylactic projects.

In 2020, Vaccitech's revenue was $4.8 million. The company spent

$14.4 million on research and development, and it recorded a net

loss attributable to shareholders of $17.7 million. In a regulatory

filing, Vaccitech said it expects to continue incurring significant

losses for the foreseeable future, citing development expenses.

In the IPO, Vaccitech issued 6.5 million shares, raising total

gross proceeds of $110.5 million. The shares are trading on the

Nasdaq Global Market under ticker symbol "VACC."

Some investors went into the listing with concerns about the

bumpy path of the Oxford-AstraZeneca vaccine, and in particular

blood clots that have affected a small number of people

postvaccination, investors said. The vaccine has yet to be approved

in the U.S., where in March AstraZeneca found itself in a spat with

regulators over the precise way it had stated the vaccine's

efficacy statistics.

The European Union, meanwhile, is suing AstraZeneca, saying that

the company hasn't delivered nearly as many doses as it had

promised.

An even bigger factor that weighed on Vaccitech was the recent

downdraft in biotechnology valuations broadly, investors said.

Vaccitech Chief Executive Bill Enright said Friday in an

interview that the prospects for clinical-stage treatments for

prostate cancer, hepatitis B and human papillomavirus were the

biggest focus of investor interest. He said the company is

monitoring the blood-clotting issues for any potential impact on

other Vaccitech projects using the same technology.

"I think people recognize that the safety events we've seen are

very rare and don't see a significant impact on our existing

portfolio," Mr. Enright said.

Jenny Strasburg contributed to this article.

Write to Matt Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

April 30, 2021 16:29 ET (20:29 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

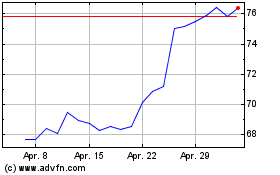

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

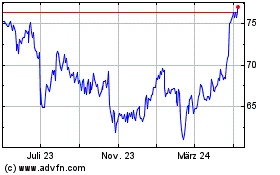

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024