Raises Concerns Surrounding Lucien Selce's

Self-Serving Proposals and Lack of Credibility

Glass Lewis Recommends that Aurinia

Shareholders Vote FOR the Re-Election to the Board of Directors of

All Nine Incumbent Directors

Aurinia Pharmaceuticals Inc. (NASDAQ: AUPH) (Aurinia or the

Company) today issued the following letter to shareholders in

response to a letter from Lucien Selce.

Dear Fellow Shareholders:

Aurinia’s Board of Directors and management

team have been taking a range of actions to position the Company

for sustainable success and build value for shareholders, while

staying true to our core focus of delivering therapies to treat

targeted patient populations with high unmet medical needs. We

believe we have established strong momentum in the business based

on recent actions to support our strategy in three key areas:

- Focus on commercial execution after restructuring

operations

- Maximizing free cash flows, moving towards profitability,

currently debt free with excess of $320M in cash, cash equivalents,

restricted cash and investments

- Advancing autoimmune pipeline with Phase 1 clinical program for

AUR200, a potential next generation therapy for B-cell mediated

autoimmune diseases that targets both BAFF (B-cell Activating

Factor) and APRIL (A Proliferation-Inducing Ligand)

Alarming Proposals

from Lucien Selce

As part of Aurinia’s strategy, the Company is

always open to constructive feedback from shareholders, while

looking for ways to build shareholder value. However, the recent

letter from Lucien Selce lacks substance and many of his ideas and

criticisms are not grounded in facts.

The Company believes it is important to set

the record straight, and for all Aurinia shareholders to know the

following:

- Mr. Selce’s own background is particularly concerning. Public

sources indicate that he was previously charged with money

laundering and insider trading, casting serious doubt on his

integrity, trustworthiness and motives. He is asking shareholders

to blindly trust him.

- Given Mr. Selce's lack of transparency (discussed further

below), combined with charges of unethical and illegal conduct, the

Company has serious doubts about whether he can be trusted to

ethically serve shareholder interests and drive long-term value

creation.

- Mr. Selce’s letter asks shareholders to grant him control of

the Company by giving support to his unnamed board nominees, so

that he can enact a plan devised by an unidentified investment

bank, the specifics of which plan he has not shared.

- Despite having ample opportunity to propose alternative

directors as part of this year’s proxy process, Mr. Selce failed to

do so. Moving forward with Mr. Selce’s idea would be completely at

odds with sound corporate governance practices and, if followed by

shareholders, could result in a public company without oversight

and direction from a board of directors.

- Mr. Selce's unsubstantiated reference to an unnamed investment

bank is concerning.

- If any investors have had serious conversations with

investment banks about alternative strategies, Aurinia is always

open to hearing them. However, the Company has not received any

such proposals, including from Mr. Selce.

- Mr. Selce's letter is rife with speculative bluster, lacks

concrete details, and fails to provide anything that remotely

resembles a specific strategy.

- Mr. Selce's vague assertions and lack of specificity

demonstrate his unpreparedness. If Mr. Selce were serious about his

proposals or experienced in corporate governance best practices, he

would provide specificity and actionable steps. In addition,

Aurinia has already run a robust strategic review process led by a

top tier investment bank – reiterating the same process again would

be a questionable use of the Company’s resources.

- Mr. Selce’s letter makes numerous serious false accusations

with no factual basis.

- No institutional shareholders have any agreements or

understandings with Aurinia’s CEO or other members of the

management team. The timing of the AGM was not related to the

vesting of any awards for nominees for election as a

director.

Aurinia shareholders deserve to have detail

about Mr. Selce’s “just trust me” approach. It should be alarming

that a mere 10 days before an annual shareholder meeting, a

shareholder would put forth a letter that is suspiciously opaque

and fails to provide any actionable suggestions or detailed plans

for putting Aurinia on a stronger path for growth or any names and

backgrounds of who would serve on a Board that would oversee such a

strategy.

Seasoned Board with

New Directors and Deep Industry and Leadership Experience –

Supported by a Leading Independent Proxy Advisory

Service

The Company recommends that shareholders

review the recent report from Glass Lewis, a leading independent

proxy advisor, which recommends that Aurinia shareholders vote FOR

the re-election to the Board of Directors of all nine incumbent

directors.

Aurinia is pleased that Glass Lewis

recognizes the strength and value of the current Board and the

actions the Board and management team are taking to accelerate the

Company’s growth. Aurinia has added three new directors in the last

year, including a director appointed in direct collaboration with a

shareholder. Each director brings distinct and relevant experience

to the Company – including pharmaceutical and biotech industry,

corporate governance, capital markets and operational expertise –

and is focused on the best interests of the Company, with a view to

building value for shareholders and ensuring the Company is

continuing to deliver on its long-term targets.

We also note that ISS’s recent

recommendations against three of Aurinia’s directors relate to the

Company’s 2023 say-on-pay proposal, and not to the operating or

financial performance of the business.

Continuing Aurinia’s

Business Momentum

Following the announcement of the Board’s

actions to support Aurinia’s strategy earlier this year, there has

been momentum across the business. On May 2, 2024, Aurinia

announced the following positive steps in its first quarter

results:

- Year over year growth of approximately 46% in total net revenue

and 40% in net product revenue, extending the trend of consistent

growth in LUPKYNIS® (voclosporin) sales

- Rapidly completed restructuring while maintaining focus on

commercial execution; and

- Ahead of prior projections, to be cash flow positive, excluding

share repurchases, in the second quarter 2024.

Recent commentary in May 2024 from sell-side

analysts also reinforce the strong prospects for Aurinia1:

- RBC Capital Markets analyst Douglas Miehm authored a report

stating: “We believe Aurinia Pharmaceuticals is well positioned for

future growth from its FDA-approved drug, voclosporin (brand name

LUPKYNIS).”

- Analyst Ed Arce of H.C. Wainwright has reported, “We believe

all signs point to a strong year for LUPKYNIS.”

- Jefferies analyst Maury Raycroft, Ph.D., reported, “Stock has

an appealing profile, where [Aurinia] is gearing up to be cash flow

positive in 2Q with disciplined spend and strong balance sheet,

which should allow cash accumulation that can be leveraged for

future asset in-licensing or other options.”

Aurinia’s Board is well positioned to lead

Aurinia and build on this momentum as we stay focused on delivering

transformative therapies that enable patients to live their fullest

lives.

About Aurinia Aurinia Pharmaceuticals is a fully

integrated biopharmaceutical company focused on delivering

therapies to people living with autoimmune diseases with high unmet

medical needs. In January 2021, the Company introduced LUPKYNIS®

(voclosporin), the first FDA-approved oral therapy dedicated to the

treatment of adult patients with active lupus nephritis. The

Company’s head office is in Edmonton, Alberta, its U.S. commercial

office is in Rockville, Maryland. The Company focuses its

development efforts globally.

Forward-Looking Statements Certain statements made in

this press release may constitute forward-looking information

within the meaning of applicable Canadian securities law and

forward-looking statements within the meaning of applicable United

States securities law. These forward-looking statements or

information include but are not limited to statements or

information with respect to Aurinia’s expectations to be cash flow

positive, excluding share repurchases, in the second quarter of

2024. It is possible that such results or conclusions may change.

Words such as “anticipate”, “will”, “believe”, “estimate”,

“expect”, “intend”, “target”, “plan”, “goals”, “objectives”, “may”

and other similar words and expressions, identify forward-looking

statements. We have made numerous assumptions about the

forward-looking statements and information contained herein,

including among other things, assumptions about: the accuracy of

reported data from third party studies and reports; the number, and

timing of receipt, of PSFs and their rate of conversion into

patients on therapy; assumptions relating to pricing for LUPKYNIS

and patient persistency on the product; that Aurinia’s intellectual

property rights are valid and do not infringe the intellectual

property rights of third parties; Aurinia’s assumptions relating to

the capital required to fund operations; the assumption that

Aurinia’s current good relationships with its suppliers, service

providers and other third parties will be maintained; assumptions

relating to the burn rate of Aurinia’s cash for operations; and

that Aurinia’s third party service providers will comply with their

contractual obligations. Even though the management of Aurinia

believes that the assumptions made, and the expectations

represented by such statements or information are reasonable, there

can be no assurance that the forward-looking information will prove

to be accurate.

Forward-looking information by their nature are based on

assumptions and involve known and unknown risks, uncertainties and

other factors which may cause the actual results, performance, or

achievements of Aurinia to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking information. Should one or more of these risks and

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

in forward-looking statements or information. Such risks,

uncertainties and other factors include, among others, the

following: Aurinia’s actual future financial and operational

results may differ from its expectations; difficulties Aurinia may

experience in completing the commercialization of voclosporin; the

market for the LN business may not be as estimated; Aurinia may

have to pay unanticipated expenses; Aurinia may not be able to

obtain sufficient supply to meet commercial demand for voclosporin

in a timely fashion; the results from Aurinia’s clinical studies

and from third party studies and reports may not be accurate;

Aurinia’s third party service providers may not, or may not be able

to, comply with their obligations under their agreements with

Aurinia; and Aurinia’s assets or business activities may be subject

to disputes that may result in litigation or other legal claims.

Although Aurinia has attempted to identify factors that would cause

actual actions, events, or results to differ materially from those

described in forward-looking statements and information, there may

be other factors that cause actual results, performances,

achievements, or events to not be as anticipated, estimated or

intended. Also, many of the factors are beyond Aurinia’s control.

There can be no assurance that forward-looking statements or

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, you should not place undue reliance on

forward-looking statements or information. All forward-looking

information contained in this press release is qualified by this

cautionary statement. Additional information related to Aurinia,

including a detailed list of the risks and uncertainties affecting

Aurinia and its business, can be found in Aurinia’s most recent

Annual Report on Form 10-K and its other public available filings

available by accessing the Canadian Securities Administrators’

System for Electronic Document Analysis and Retrieval (SEDAR)

website at www.sedarplus.ca or the U.S. Securities and Exchange

Commission’s Electronic Document Gathering and Retrieval System

(EDGAR) website at www.sec.gov/edgar, and on Aurinia’s website at

www.auriniapharma.com.

_________________________ 1 Permission to quote was neither

sought nor obtained in connection with this press release. These

statements represent the views of the third party cited and not

necessarily those of Aurinia.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240604970763/en/

Media and Investor Inquiries: Andrea Christopher

Corporate Communications and Investor Relations, Aurinia

achristopher@auriniapharma.com ir@auriniapharma.com

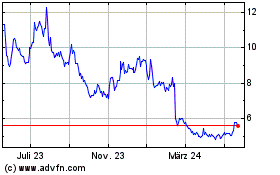

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

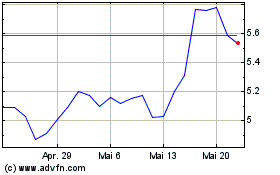

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

Von Nov 2023 bis Nov 2024