Alphatec Holdings, Inc. (“Alphatec” or the “Company”)

(Nasdaq:ATEC), a provider of innovative spine surgery solutions

with a mission to improve patient lives through the relentless

pursuit of superior outcomes, announced today recent corporate

highlights and financial results for its second quarter ended June

30, 2017.

Second Quarter 2017 Financial Highlights

- Total revenues of $24.4 million; revenue from the Company's

U.S. commercial business of $21.9 million

- General and administrative expenses declined by approximately

$0.9 million sequentially

- Cash burn improved to $6.4 million from $11.5 million

sequentially; cash balance of $19.1 million at June 30, 2017

- Operating loss of $0.7 million, sequential improvement from

$3.4 million in the first quarter

- Non-GAAP adjusted EBITDA of $1.2 million improved sequentially

from $0.5 million in the first quarter

- U.S. commercial gross margin of 71%

Organizational and Product Highlights

- Continued transition of sales organization from non-exclusive

to dedicated, building exceptional momentum with current and new

potential distributors and surgeons. Sales from dedicated sales

agents and distributors increased from less than 15% of U.S.

commercial revenue in the first quarter to more than 18% in the

second quarter

- Enhanced sales, marketing and product development organizations

with the addition of key sales leadership and engineering

talent

- Awarded patent for its innovative and novel uniplanar and

monoaxial screws, currently marketed under the Arsenal Deformity

product line

- Awarded patent that distinguishes and protects proprietary

features of the Alphatec Squadron Lateral Retractor, a key

component of the Company’s Battalion Lateral System, which will be

fully launched in late 2017 and will mark the Company’s entry into

the $500M U.S. Lateral market

“We delivered results that were firmly in-line

with our expectations,” said Terry Rich, CEO of Alphatec.

“Importantly, we continued to make excellent progress executing on

our priorities as we reposition the Alphatec brand. Despite our

deliberate decision to disrupt short-term revenue by exiting

non-strategic relationships, we continue to see positive traction

from new and existing distributors. This sets us up well for

revenue growth in the second half of 2017. I am extremely

confident in the team, the culture we are building, and the

expertise that surrounds me, and I believe that Alphatec is

exceptionally well-positioned to drive future growth and

shareholder value.”

Comparison of Financial Results for the

Second Quarter 2017 to First Quarter 2017

Following is a table, comparing key second

quarter 2017 results to key first quarter 2017 results. The

Company believes that sequential results, at this time, are the

best indicators for evaluating the Company's core performance.

These are the comparisons management uses in its own evaluation of

continuing operating performance, given the re-focus of the

Company’s strategy under Alphatec’s new leadership team.

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Change |

| |

|

|

June 30, 2017 |

|

March 31, 2017 |

|

$000's |

|

% |

| |

|

|

(unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

U.S. commercial

revenue |

|

$ |

21,877 |

|

|

$ |

23,437 |

|

|

$ |

(1,560 |

) |

|

(6.7 |

%) |

| |

U.S gross profit |

|

|

15,521 |

|

|

|

16,269 |

|

|

|

(748 |

) |

|

(4.6 |

%) |

| |

U.S. gross margin |

|

|

70.9 |

% |

|

|

69.4 |

% |

|

|

1.5 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Operating Expenses |

|

|

|

|

|

|

|

|

| |

Research and

development |

|

$ |

990 |

|

|

$ |

1,449 |

|

|

$ |

(459 |

) |

|

(31.7 |

%) |

| |

Sales and

marketing |

|

|

10,298 |

|

|

|

11,103 |

|

|

|

(805 |

) |

|

(7.3 |

%) |

| |

General and

administrative |

|

|

5,351 |

|

|

|

6,223 |

|

|

|

(872 |

) |

|

(14.0 |

%) |

| |

Amortization of

intangible assets |

|

|

172 |

|

|

|

172 |

|

|

|

- |

|

|

|

| |

Restructuring

expenses |

|

|

528 |

|

|

|

1,231 |

|

|

|

(703 |

) |

|

(57.1 |

%) |

| |

Gain on sale of

assets |

|

|

(856 |

) |

|

|

- |

|

|

|

(856 |

) |

|

|

| |

Total

operating expenses |

|

$ |

16,483 |

|

|

|

20,178 |

|

|

$ |

(3,695 |

) |

|

(18.3 |

%) |

| |

|

|

|

|

|

|

|

|

|

| |

Operating loss |

|

$ |

(735 |

) |

|

$ |

(3,399 |

) |

|

$ |

2,664 |

|

|

78.4 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

Loss from continuing

operations |

|

$ |

(2,629 |

) |

|

$ |

(5,424 |

) |

|

$ |

2,795 |

|

|

51.5 |

% |

| |

|

|

|

|

|

|

|

|

|

| |

Non-GAAP Adjusted

EBITDA |

|

$ |

1,218 |

|

|

$ |

508 |

|

|

$ |

710 |

|

|

139.8 |

% |

| |

|

|

|

|

|

|

|

|

|

U.S. commercial revenues for the second quarter

of 2017 were $21.9 million, down $1.6 million, or approximately 7%,

compared to $23.4 million in the first quarter of 2017. The

sequential revenue decline was largely driven by deliberate

decisions to discontinue non-strategic relationships.

U.S. gross profit and gross margin for the

second quarter of 2017 were $15.5 million and 70.9%, respectively,

compared to $16.3 million and 69.4%, respectively, for the first

quarter of 2017. The gross margin improvement was a result of

supply chain optimization and a sequential reduction in inventory

kit write-offs related to distributor turnover.

Total operating expenses for the second quarter

of 2017 were $16.5 million, reflecting a decrease of $3.7 million,

an approximate 18% improvement over the first quarter of 2017.

On a non-GAAP basis, excluding restructuring charges and a

gain on sale of assets, total operating expenses in the second

quarter of 2017 improved $2.1 million, or approximately 11%,

compared to the first quarter of 2017. The improvements reflect the

execution of operational improvement initiatives, including

workforce reductions implemented in October 2016 and February 2017,

consolidation of facilities, and ongoing successful efforts to

reduce expenses.

GAAP loss from continuing operations for the

second quarter of 2017 was $2.6 million, compared to a loss of $5.4

million for the first quarter of 2017.

Non-GAAP Adjusted EBITDA in the second quarter

of 2017 was $1.2 million, compared to $0.5 million in the first

quarter of 2017. For more detailed information, please refer

to the table, "Alphatec Holdings, Inc. Reconciliation of Non-GAAP

Financial Measures" that follows.

Current and Long-term debt includes $33.6

million in term debt and $8.9 million outstanding under the

Company’s revolving credit facility at June 30, 2017. This compares

to $34.2 million in term debt and $10.4 million outstanding under

the Company’s revolving credit facility at March 31, 2017.

Cash and cash equivalents were $19.1 million at

June 30, 2017, compared to $25.5 million reported at March 31,

2017.

Comparison of Financial Results for the

Three and Six Months Ended June 30, 2017 and 2016

Revenue decreased on a year-over-year basis,

resulting from the Company’s execution of the transition of its

sales organization, in addition to the impact of lost revenue

related to the financial and operational challenges the Company

faced in 2016 prior to the sale of its international

business. The year-over-year improvement in operating

expenses is the result of a comprehensive initiative to reduce

costs and drive operational efficiencies. For additional

information, please reference the following financial statement

tables and the Company’s Quarterly Report on Form 10-Q to be filed

with the Securities and Exchange Commission on August 11, 2017.

Non-GAAP Information

To supplement the Company’s financial statements

presented in accordance with U.S. generally accepted accounting

principles (GAAP), the Company reports certain non-GAAP financial

measures such as Adjusted EBITDA. Adjusted EBITDA included in

this press release is a non-GAAP financial measure that represents

net income (loss), excluding the effects of interest, taxes,

depreciation, amortization, stock-based compensation expenses, and

other non-recurring income or expense items, such as sale of

assets, impairments, restructuring expenses, severance expenses and

transaction-related expenses. The Company believes that

non-GAAP Adjusted EBITDA provides investors with an additional tool

for evaluating the Company's core performance, which management

uses in its own evaluation of continuing operating performance, and

a baseline for assessing the future earnings potential of the

Company. For completeness, management uses non-GAAP Adjusted

EBITDA in conjunction with GAAP earnings and earnings per common

share measures. The Company’s Adjusted EBITDA measure may not

provide information that is directly comparable to that provided by

other companies in the Company’s industry, as other companies in

the industry may calculate non-GAAP financial results differently,

particularly related to non-recurring, unusual items. Adjusted

EBITDA should be considered in addition to, and not as a substitute

for, or superior to, financial measures calculated in accordance

with GAAP. Included below are reconciliations of the

non-GAAP financial measures to the comparable GAAP financial

measure.

Investor Conference Call

Alphatec will hold a conference today at 1:30

p.m. PT / 4:30 p.m. ET to discuss the results. The dial-in numbers

are (877) 556-5251 for domestic callers and (720) 545-0036 for

international callers. The conference ID number is 57049951. A live

webcast of the conference call will be available online from the

investor relations page of the Company's corporate website at

www.alphatecspine.com.

About Alphatec Holdings,

Inc.

Alphatec Holdings, Inc., through its wholly

owned subsidiary Alphatec Spine, Inc., is a medical device company

that designs, develops, and markets spinal fusion technology

products and solutions for the treatment of spinal disorders

associated with disease and degeneration, congenital deformities,

and trauma. The Company's mission is to improve lives by providing

innovative spine surgery solutions through the relentless pursuit

of superior outcomes. The Company markets its products in the U.S.

via independent sales agents and a direct sales force.

Additional information can be found at

www.alphatecspine.com.

Forward Looking Statements

This press release may contain "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995 that involve risks and uncertainty. Such

statements are based on management's current expectations and are

subject to a number of risks and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. The Company cautions investors that

there can be no assurance that actual results or business

conditions will not differ materially from those projected or

suggested in such forward-looking statements as a result of various

factors. Forward-looking statements include the references to the

Company’s strategy in significantly repositioning the Alphatec

brand and turning the Company into a growth organization. The

important factors that could cause actual operating results to

differ significantly from those expressed or implied by such

forward-looking statements include, but are not limited to:

the uncertainty of success in developing new products or

products currently in the Company’s pipeline; the uncertainties in

the Company’s ability to execute upon its strategic operating plan;

the uncertainties regarding the ability to successfully license or

acquire new products, and the commercial success of such products;

failure to achieve acceptance of the Company’s products by the

surgeon community, including Battalion and Arsenal Deformity;

failure to obtain FDA or other regulatory clearance or approval for

new products, or unexpected or prolonged delays in the process;

continuation of favorable third party reimbursement for procedures

performed using the Company’s products; unanticipated expenses or

liabilities or other adverse events affecting cash flow or the

Company’s ability to successfully control its costs or achieve

profitability; uncertainty of additional funding; the Company’s

ability to compete with other competing products and with emerging

new technologies; product liability exposure; an unsuccessful

outcome in any litigation in which the Company is a defendant;

patent infringement claims; claims related to the Company’s

intellectual property and the Company’s ability to meet its

financial obligations under its credit agreements and the Orthotec

settlement agreement. The words “believe,” “will,” “should,”

“expect,” “intend,” “estimate” and “anticipate,” variations of such

words and similar expressions identify forward-looking statements,

but their absence does not mean that a statement is not a

forward-looking statement. A further list and description of

these and other factors, risks and uncertainties can be found in

the Company's most recent annual report, and any subsequent

quarterly and periodic reports, filed with the Securities and

Exchange Commission. Alphatec disclaims any intention or obligation

to update or revise any forward-looking statements, whether as a

result of new information, future events, or otherwise, unless

required by law.

| ALPHATEC HOLDINGS, INC. |

|

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| (in thousands, except

per share amounts - unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues |

$ |

24,379 |

|

|

$ |

32,242 |

|

|

|

$ |

52,357 |

|

|

$ |

66,448 |

|

|

| |

Cost of revenues |

|

8,631 |

|

|

|

11,083 |

|

|

|

|

19,830 |

|

|

|

20,802 |

|

|

| |

Gross profit |

|

15,748 |

|

|

|

21,159 |

|

|

|

|

32,527 |

|

|

|

45,646 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Operating

expenses: |

|

|

|

|

|

|

|

|

|

| |

Research and

development |

|

990 |

|

|

|

2,072 |

|

|

|

|

2,439 |

|

|

|

5,713 |

|

|

| |

Sales and

marketing |

|

10,298 |

|

|

|

12,794 |

|

|

|

|

21,401 |

|

|

|

27,734 |

|

|

| |

General and

administrative |

|

5,351 |

|

|

|

6,274 |

|

|

|

|

11,574 |

|

|

|

15,278 |

|

|

| |

Amortization of

intangible assets |

|

172 |

|

|

|

255 |

|

|

|

|

344 |

|

|

|

510 |

|

|

| |

Restructuring

expenses |

|

528 |

|

|

|

84 |

|

|

|

|

1,759 |

|

|

|

173 |

|

|

| |

Gain on sale of

assets |

|

(856 |

) |

|

|

- |

|

|

|

|

(856 |

) |

|

|

- |

|

|

| |

Total

operating expenses |

|

16,483 |

|

|

|

21,479 |

|

|

|

|

36,661 |

|

|

|

49,408 |

|

|

| |

Operating loss |

|

(735 |

) |

|

|

(320 |

) |

|

|

|

(4,134 |

) |

|

|

(3,762 |

) |

|

| |

Interest and

other expense, net |

|

(1,879 |

) |

|

|

(1,578 |

) |

|

|

|

(3,855 |

) |

|

|

(2,361 |

) |

|

| |

Loss from continuing

operations before taxes |

|

(2,614 |

) |

|

|

(1,898 |

) |

|

|

|

(7,989 |

) |

|

|

(6,123 |

) |

|

| |

Income tax

provision |

|

15 |

|

|

|

11 |

|

|

|

|

64 |

|

|

|

34 |

|

|

| |

Loss from continuing

operations |

|

(2,629 |

) |

|

|

(1,909 |

) |

|

|

|

(8,053 |

) |

|

|

(6,157 |

) |

|

| |

Loss from discontinued

operations |

|

(68 |

) |

|

|

(3,324 |

) |

|

|

|

(159 |

) |

|

|

(5,693 |

) |

|

| |

Net loss |

$ |

(2,697 |

) |

|

$ |

(5,233 |

) |

|

|

$ |

(8,212 |

) |

|

$ |

(11,850 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Net loss per share

continuing operations |

$ |

(0.24 |

) |

|

$ |

(0.22 |

) |

|

|

$ |

(0.80 |

) |

|

$ |

(0.73 |

) |

|

| |

Net loss per share

discontinued operations |

|

(0.01 |

) |

|

|

(0.39 |

) |

|

|

|

(0.02 |

) |

|

|

(0.67 |

) |

|

| |

Net loss per

share - basic and diluted |

$ |

(0.24 |

) |

|

$ |

(0.62 |

) |

|

|

$ |

(0.82 |

) |

|

$ |

(1.40 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Weighted-average shares

- basic and diluted |

|

11,047 |

|

|

|

8,488 |

|

|

|

|

10,033 |

|

|

|

8,477 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

ALPHATEC HOLDINGS, INC. |

|

| |

CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

| |

(in

thousands) |

|

| |

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

(unaudited) |

|

|

|

|

|

ASSETS |

|

| |

Current assets: |

|

|

|

|

| |

Cash and cash

equivalents |

$ |

19,107 |

|

|

$ |

19,593 |

|

|

| |

Accounts

receivable, net |

|

13,126 |

|

|

|

18,512 |

|

|

| |

Inventories,

net |

|

29,810 |

|

|

|

30,093 |

|

|

| |

Prepaid expenses

and other current assets |

|

2,114 |

|

|

|

4,262 |

|

|

| |

Current assets of

discontinued operations |

|

69 |

|

|

|

364 |

|

|

| |

Total current

assets |

|

64,226 |

|

|

|

72,824 |

|

|

| |

|

|

|

|

|

| |

Property and equipment,

net |

|

14,467 |

|

|

|

15,076 |

|

|

| |

Intangibles, net |

|

5,243 |

|

|

|

5,711 |

|

|

| |

Other assets |

|

222 |

|

|

|

516 |

|

|

| |

Noncurrent assets of

discontinued operations |

|

39 |

|

|

|

61 |

|

|

| |

Total assets |

$ |

84,197 |

|

|

$ |

94,188 |

|

|

| |

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS'

DEFICIT |

|

| |

Current

liabilities: |

|

|

|

|

| |

Accounts

payable |

$ |

2,861 |

|

|

$ |

8,701 |

|

|

| |

Accrued

expenses |

|

23,917 |

|

|

|

27,589 |

|

|

| |

Current portion

of long-term debt |

|

2,333 |

|

|

|

3,113 |

|

|

| |

Current

liabilities of discontinued operations |

|

464 |

|

|

|

732 |

|

|

| |

Total current

liabilities |

|

29,575 |

|

|

|

40,135 |

|

|

| |

|

|

|

|

|

| |

Total long term

liabilities |

|

62,569 |

|

|

|

71,954 |

|

|

| |

Redeemable

preferred stock |

|

23,603 |

|

|

|

23,603 |

|

|

| |

Stockholders'

deficit |

|

(31,550 |

) |

|

|

(41,504 |

) |

|

| |

Total liabilities and

stockholders' deficit |

$ |

84,197 |

|

|

$ |

94,188 |

|

|

| |

|

|

|

|

|

| ALPHATEC HOLDINGS, INC. |

| RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES |

| (in thousands -

unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

March 31, |

|

|

June 30, |

|

|

June 30, |

|

|

|

|

|

2017 |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Operating loss, as

reported |

|

$ |

(3,399 |

) |

|

|

$ |

(735 |

) |

|

$ |

(320 |

) |

|

|

$ |

(4,134 |

) |

|

$ |

(3,762 |

) |

| |

Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Depreciation |

|

|

1,634 |

|

|

|

|

1,636 |

|

|

|

1,775 |

|

|

|

|

3,270 |

|

|

|

4,029 |

|

| |

Amortization of

intangible assets |

|

|

234 |

|

|

|

|

234 |

|

|

|

270 |

|

|

|

|

468 |

|

|

|

540 |

|

| |

Total EBITDA |

|

|

(1,531 |

) |

|

|

|

1,135 |

|

|

|

1,725 |

|

|

|

|

(396 |

) |

|

|

807 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Add back significant

items: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Stock-based compensation and stock price guarantee |

|

808 |

|

|

|

|

411 |

|

|

|

659 |

|

|

|

|

1,219 |

|

|

|

1,523 |

|

| |

Restructuring and other charges |

|

|

1,231 |

|

|

|

|

528 |

|

|

|

84 |

|

|

|

|

1,759 |

|

|

|

173 |

|

| |

Gain on sale of assets |

|

|

- |

|

|

|

|

(856 |

) |

|

|

- |

|

|

|

|

(856 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

EBITDA, as adjusted for

significant items |

|

$ |

508 |

|

|

|

$ |

1,218 |

|

|

$ |

2,468 |

|

|

|

$ |

1,726 |

|

|

$ |

2,503 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ALPHATEC HOLDINGS, INC. |

|

| RECONCILIATION OF GEOGRAPHIC SEGMENT REVENUES

AND GROSS PROFIT |

|

| (in thousands, except percentages -

unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

June 30, |

|

June 30, |

|

| |

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Revenues by source |

|

|

|

|

|

|

|

|

| |

U.S. commercial

revenue |

$ |

21,877 |

|

|

$ |

28,279 |

|

|

$ |

45,314 |

|

|

$ |

57,512 |

|

|

| |

Other |

|

2,502 |

|

|

|

3,963 |

|

|

|

7,043 |

|

|

|

8,936 |

|

|

| |

Total revenues |

$ |

24,379 |

|

|

$ |

32,242 |

|

|

$ |

52,357 |

|

|

$ |

66,448 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Gross profit by

source |

|

|

|

|

|

|

|

|

| |

U.S. |

$ |

15,521 |

|

|

$ |

20,251 |

|

|

$ |

31,790 |

|

|

$ |

43,974 |

|

|

| |

Other |

|

227 |

|

|

|

908 |

|

|

|

737 |

|

|

|

1,672 |

|

|

| |

Total gross profit |

$ |

15,748 |

|

|

$ |

21,159 |

|

|

$ |

32,527 |

|

|

$ |

45,646 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Gross profit margin by

source |

|

|

|

|

|

|

|

|

| |

U.S. |

|

70.9 |

% |

|

|

71.6 |

% |

|

|

70.2 |

% |

|

|

76.5 |

% |

|

| |

Other |

|

9.1 |

% |

|

|

22.9 |

% |

|

|

10.5 |

% |

|

|

18.7 |

% |

|

| |

Total gross profit

margin |

|

64.6 |

% |

|

|

65.6 |

% |

|

|

62.1 |

% |

|

|

68.7 |

% |

|

| |

|

|

|

|

|

|

|

|

|

Investor/Media Contact:

Zack Kubow

The Ruth Group

(646) 536-7000

alphatec@theruthgroup.com

Company Contact:

Jeff Black

Executive Vice President and Chief Financial Officer

Alphatec Holdings, Inc.

(760) 431-9286

jblack@alphatecspine.com

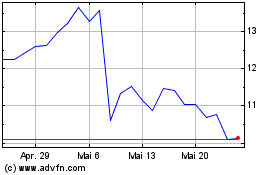

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

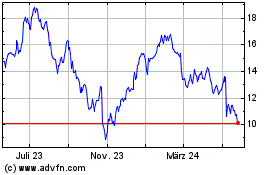

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024