APx Acquisition Corp. I Announces Approval of Extension Meeting Proposals and Intention to Extend Combination Period

27 Februar 2023 - 11:05PM

Business Wire

APx Acquisition Corp. I (“APx” or the “Company”), a special

purpose acquisition company, announced today that at the

extraordinary general shareholders meeting held on February 27,

2023, the Company’s shareholders voted in favor of proposals to

approve an amendment to the Investment Management Trust Agreement,

dated December 6, 2021, and the Company’s Amended and Restated

Memorandum and Articles of Association (the “Amended Articles of

Association”) to change the payment required to extend the date by

which the Company must consummate an initial business combination

(the “Combination Period”) by two three-month periods. As amended,

the required payments are the deposit by the Company into the trust

account (the “Trust Account”) established in connection with the

Company’s initial public offering (the “IPO”), of the lesser of (a)

$750,000 and (b) $0.125 for each Class A ordinary share then

outstanding for each three month amendment.

In connection with the vote to approve the proposals, holders of

10,693,417 shares of Class A ordinary shares issued as part of the

units sold in the IPO (the “Public Shares”) properly exercised

their right to redeem their shares (and did not withdraw their

redemption) for cash at a redemption price of approximately $10.41

per share, for an aggregate redemption amount of approximately

$111,346,281.12. Following such redemptions, approximately

$68,271,080.69 will remain in the Trust Account and 6,556,583

Public Shares will remain issued and outstanding.

On February 27, 2023, the Company’s sponsor notified the Company

of its intent to extend the Combination Period by one three-month

period.

About APx Acquisition Corp. I

APx Acquisition Corp. I is a blank check company formed for the

purpose of effecting a merger, amalgamation, share exchange, asset

acquisition, share purchase, reorganization or similar business

combination with one or more businesses.

Cautionary Note Concerning Forward-Looking Statements

This press release contains statements that constitute

"forward-looking statements," including with respect to the

Company’s search for an initial business combination. No assurance

can be given that the Company will ultimately complete a business

combination transaction. Forward-looking statements are subject to

numerous conditions, many of which are beyond the control of the

Company, including those set forth in the Risk Factors section of

the Company's registration statement for the initial public

offering and other reports filed with the SEC. Copies are available

on the SEC's website, www.sec.gov. The Company expressly disclaims

any obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company’s expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230227005904/en/

Investor

Xavier Martinez Chief Financial Officer Xavi@apxcap.mx

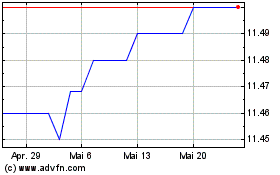

APx Acquisition Corporat... (NASDAQ:APXI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

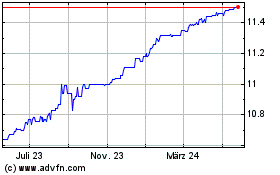

APx Acquisition Corporat... (NASDAQ:APXI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024