Amended Current Report Filing (8-k/a)

01 September 2022 - 11:05PM

Edgar (US Regulatory)

0001868573

true

APx Acquisition Corp. I (the "Company") is filing this Amendment No. 1 on Form 8-K/A (the "Amendment") to amend and restate the Company's audited balance sheet as of December 9, 2021 that had been filed with the Company's Current Report on Form 8-K originally filed with the U.S. Securities and Exchange Commission (the "SEC") on December 15, 2021 (the "Original 8-K"). The Company previously presented that the Class A ordinary shares were valued at a price of $10.00 per Class A ordinary share. While the Company offered the units in the initial public offering at an offering price of $10.00 per unit, the Company deposited in the trust account $10.20 per Class A ordinary share, implying an initial value of $10.20 per Class A ordinary share. After discussion and evaluation, including with the Company's independent registered public accounting firm, Marcum LLP, the Company has concluded that the value of each Class A ordinary share should be considered $10.20 instead of $10.00. On August 16, 2022, the Audit Committee of the Board of Directors of the Company concluded, after discussion with the Company's management, that the Company's audited balance sheet as of December 9, 2021 filed as Exhibit 99.1 to the Current Report on Form 8-K filed with the SEC on December 15, 2021 should no longer be relied upon due to changes required to the value of the Class A ordinary share, as described above. The Board of Directors of the Company discussed with independent accountants and are in agreement with the matters as disclosed in this Amendment. The correction of the aforementioned error resulted from the erroneous value of each Class A ordinary share is reflected in Exhibit 99.1 included with this Amendment. The Company does not expect any of the above changes will have any impact on its cash position and cash held in the trust account.

00-0000000

0001868573

2021-12-15

2021-12-15

0001868573

us-gaap:CommonClassAMember

2021-12-15

2021-12-15

0001868573

us-gaap:WarrantMember

2021-12-15

2021-12-15

0001868573

us-gaap:CapitalUnitsMember

2021-12-15

2021-12-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 1, 2022 (December 15, 2021)

APX ACQUISITION CORP. I

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands |

|

001-41125 |

|

N.A. |

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

Juan Salvador Agraz 65

Contadero, Cuajimalpa de Morelos

Mexico City, Mexico

|

|

05370 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| Registrant’s telephone number, including area code: +52 (55) 4744 1100 |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 140.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A ordinary shares, par value $0.0001 per share |

|

APXI |

|

The NASDAQ Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

APXIW |

|

The NASDAQ Stock Market LLC |

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

APXIU |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

EXPLANATORY NOTE

APx Acquisition Corp.

I (the “Company”) is filing this Amendment No. 1 on Form 8-K/A (the “Amendment”) to amend and restate

the Company’s audited balance sheet as of December 9, 2021 that had been filed with the Company’s Current Report on Form 8-K

originally filed with the U.S. Securities and Exchange Commission (the “SEC”) on December 15, 2021 (the “Original

8-K”).

The Company previously

presented that the Class A ordinary shares were valued at a price of $10.00 per Class A ordinary share. While the Company offered the

units in the initial public offering at an offering price of $10.00 per unit, the Company deposited in the trust account $10.20 per Class

A ordinary share, implying an initial value of $10.20 per Class A ordinary share. After discussion and evaluation, including with the

Company’s independent registered public accounting firm, Marcum LLP, the Company has concluded that the value of each Class A ordinary

share should be considered $10.20 instead of $10.00.

On August 16, 2022, the

Audit Committee of the Board of Directors of the Company concluded, after discussion with the Company’s management, that the Company’s

audited balance sheet as of December 9, 2021 filed as Exhibit 99.1 to the Current Report on Form 8-K filed with the SEC on December 15,

2021 should no longer be relied upon due to changes required to the value of the Class A ordinary share, as described above.

The Board of Directors

of the Company discussed with independent accountants and are in agreement with the matters as disclosed in this Amendment. The correction

of the aforementioned error resulted from the erroneous value of each Class A ordinary share is reflected in Exhibit 99.1 included with

this Amendment. The Company does not expect any of the above changes will have any impact on its cash position and cash held in the trust

account.

The Company’s management

has concluded that in light of the restatement caused by the valuation error described above, a material weakness exists in the Company’s

internal control over financial reporting and that the Company’s disclosure controls and procedures were not effective.

Except as described above,

this Amendment does not amend, update or change any other disclosures in the Original 8-K. In addition, the information contained in this

Amendment does not reflect events occurring after the filing of the Original 8-K and does not modify or update the disclosures therein,

except as specifically identified above. Among other things, forward-looking statements made in the Original 8-K have not been revised

to reflect events, results or developments that occurred or facts that became known to the Company after the date of the Original 8-K,

other than as described herein, and such forward-looking statements should be read in conjunction with the Company’s filings with

the SEC.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| Exhibit No. |

|

Description |

| 99.1 |

|

Audited Balance Sheet |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

Date: September 1, 2022

| |

APX ACQUISITION CORP. I |

| |

|

| |

|

| |

By: |

/s/ Xavier Martinez |

| |

|

Xavier Martinez |

| |

|

Chief Financial Officer |

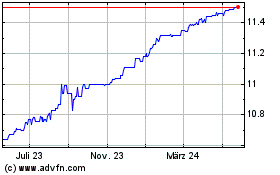

APx Acquisition Corporat... (NASDAQ:APXI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

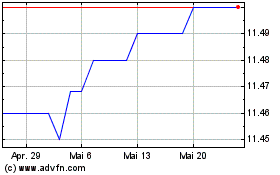

APx Acquisition Corporat... (NASDAQ:APXI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024