Bear of the Day: American Capital Agency Corp (AGNC) - Bear of the Day

26 November 2013 - 10:54AM

Zacks

Mortgage REITs (mREIT for short) have long been favorites of

dividend investors, and especially before taper concerns came back

into the picture. Securities in this space often pay double digit

yields, and with such a sluggish market for income, these were

preferred picks by many.

The structure of mREITs also increased their appeal when rates were

stable. That is because mREITs generally borrow at short-term rates

and then invest in longer term securities. So in this strategy, a

big spread between short term and long term rates is key for

strength in their business model.

However, as taper talk has resumed the spread has shrunk between

these two key figures, while there is a threat of further

compression in the weeks and months ahead as well. This has been

terrible news for the space and many have jumped out of stocks in

this corner of the market as a result. In particular, one to watch

for further losses is

American Capital Agency Corp

(AGNC).

AGNC’s Recent Earnings

The latest earnings report for AGNC was pretty terrible by any

estimation. Third quarter results came in at 61 cents a share,

falling well short of the consensus estimate of 84 cents a share.

Results also represented a decline sequentially too, as last

quarter saw 66 cents of earnings, while the year ago period saw 79

cents a share.

Especially concerning from the report was the average yield on its

agency security portfolio, which slumped by 33 basis points down to

just 2.59%. Meanwhile, its cost of funds which was more or less

stable—down just four basis points—to 1.39%. This means that the

interest rate spread declined by 29 basis points to just 1.20%,

eating into the company’s profits and future prospects as well.

Live by the dividend, Die by the dividend

Dividends, one of the main reasons to buy a mortgage REIT, have

also been on the decline for AGNC. The firm’s Q3 dividend came in

at 80 cents a share, a nearly 24% decline from the previous

quarter, and when annualized, a huge drop from previous years.

Thanks to declining margins and slumping yields, investors have

sold off AGNC in droves. Shares of the company are down more than

30% YTD, and the stock is within striking distance of its 52 week

low as well.

Estimates are falling too

And based on the latest earnings report and the sluggish trend in

the interest rate market, many analysts seem to believe that the

slump isn’t over for AGNC. In fact, analysts have been slashing

their forward estimates for AGNC to the bone as of late, suggesting

that more pain is on the way.

The magnitude of these revisions has been colossal too, with

estimates for the current year falling from $6.92/share 30 days ago

to just $4.37/share today. Next year figures are also depressing,

with estimates falling from $3.26/share 30 days ago to just

$2.60/share today, representing a decline of over 20%.

Due to these factors, and a horrendous history at earnings

season—four straight misses of at least 11%-- we have no choice but

to assign AGNC a dreaded Zacks Rank #5 (Strong Sell). So we are

looking for more underperformance from this struggling company to

close out the year, and especially so if the interest rate spread

compresses even more in the coming months.

Other Options

Other Options

Unfortunately, the mREIT industry has a terrible industry rank,

coming in at just 229 out of 260, putting it near the bottom 10%.

Yet despite this poor rank, there is one company that appears

well-positioned in the space and could actually be a decent pick;

Ellington Residential (EARN).

This company has a Zacks Rank #1 (Strong Buy) and this actually

represents an increase from a week ago when the stock had a Rank of

3. The firm also saw a strong surprise in the previous earnings

release, and solid estimate revisions higher too.

So if you are looking to stay in the mREIT space, consider going a

little smaller and focusing on EARN. This company has a double

digit yield and it could be better positioned than the struggling

AGNC at this time.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days.

Click to get this free report

>>

AMER CAP AGENCY (AGNC): Free Stock Analysis Report

ELLINGTON RESID (EARN): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

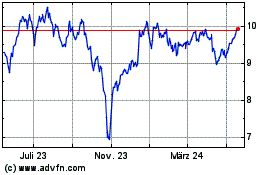

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024