TIDMSWG

RNS Number : 2065U

Shearwater Group PLC

22 November 2023

22 November 2023

SHEARWATER GROUP PLC

("Shearwater" or the "Group")

Interim Results for the six months ended 30 September 2023

Resilient performance despite the backdrop, with an encouraging

pipeline across both divisions

Shearwater Group plc, the cybersecurity, advisory and managed

security services group, announces its unaudited results for the

six months ended 30 September 2023.

Financial summary

-- Group revenue of GBP10.5m (H1 FY23: GBP10.8m).

-- Adjusted EBITDA1 of GBP0.6m (H1 FY23: GBP0.1m).

-- Adjusted loss before tax2 of GBP0.1m (H1 FY23: adjusted loss GBP0.5 million).

-- Healthy balance sheet, with cash as at 30 September 2023 of GBP2.2m (H1 FY23: GBP0.9m).

Operational summary

-- Customer engagement levels have remained high, winning 41 new

clients in H1, notwithstanding the challenging market.

-- Decisive action to streamline and optimise operations,

emerging a leaner, more unified business:

- GeoLang integrated into SecurEnvoy

- Xcina integrated into Brookcourt Solutions

-- Encouraging pipeline remains across the Services division

with focus on building strategic and scalable relationships with

major blue chip organisations.

-- Integrated Software division now benefiting from enhanced

opportunities, with full product set now introduced across the

Group's global distribution network.

-- Winner of five significant industry awards, serving as a

testament to the value of the Group's offering.

Board Update

-- Adam Hurst appointed as Interim CFO in October and appointed

to the Board as an Executive Director in early November.

Outlook

-- Board currently expects to meet full year management

expectations based on the visibility of the sales opportunities,

including securing remaining Services deals which were deferred

from prior periods.

-- Services pipeline underpinned by offering major corporates

specialist solutions that assist in meeting their regulatory

security obligations.

-- Higher margin Software division pursuing a number of promising opportunities.

-- Clear H2 objective of converting the pipeline of opportunities across both divisions.

(1. Adjusted EBITDA is defined as loss before tax, before one

off exceptional items, share based payment charges, finance

charges, impairment of intangible assets, other income,

depreciation and amortisation.)

(2. Adjusted Loss Before Tax defined as net loss before tax,

exceptional items, share based payments, other income and

amortisation of acquired intangible assets.)

Phil Higgins, Chief Executive Officer of Shearwater Group PLC,

commented: "We have traded resiliently in the first half despite

continuing to contend with a challenging market, and we are already

seeing benefits from the recent operational enhancements we have

implemented. We move into the second half strengthened by a healthy

balance sheet and clearly focused on the conversion of our pipeline

of opportunities across each division."

Enquiries:

Shearwater Group plc www.shearwatergroup.com

David Williams, Chairman c/o Alma

Phil Higgins, CEO

Adam Hurst, Interim CFO

Cavendish Securities plc - NOMAD

Adrian Hadden / Ben Jeynes- Corporate

Finance

Henry Nicol / Dale Bellis / Michael Johnson

- Sales +44 (0) 20 7397 8900

Alma shearwater@almastrategic.com

Justine James / Joe Pederzolli +44 (0) 20 3405 0205

About Shearwater Group plc

Shearwater Group plc is an award-winning group providing cyber

security, managed security and professional advisory solutions to

create a safer online environment for organisations and their end

users.

The Group's differentiated full service offering spans identity

and access management and data security, cybersecurity solutions

and managed security services, and security governance, risk and

compliance. Its growth strategy is focused on building a scalable

group that caters to the entire spectrum of cyber security and

managed security needs, through a focused buy and build

approach.

The Group is headquartered in the UK, serving customers globally

across a broad spectrum of industries.

Shearwater shares are listed on the London Stock Exchange's AIM

under the ticker "SWG". For more information, please visit

www.shearwatergroup.com .

Chief Executive's review

The first half of the financial year has seen the Group trade

resiliently amidst a challenging backdrop. While we continue to see

a healthy number of opportunities within our pipeline, we continue

to experience hesitancy from some customers in the commencement of

projects in response to continuing wider market uncertainty. While

contracts in the Group's robust order book are continuing to be

fulfilled, some timings continue to be deferred into future

periods.

In the traditionally quieter first half, the Group delivered

revenue of GBP10.5m (H1 FY23: GBP10.8m) and adjusted EBITDA of

GBP0.6m (H1 FY23: GBP0.1m). Our underlying business remains robust

and engagement levels are high, notwithstanding the current

volatility in the market. We are pleased with the benefits already

being seen from the recent operational enhancements, which have

streamlined our offering and strengthened our positioning.

We continue to be supported by a healthy balance sheet, with

cash as at 30 September 2023 of GBP2.2m (H1 FY23: GBP0.9m). The

outflow since March is as expected by management and in line with

previous years, due to the seasonal nature of contracting and

impact on working capital flows.

Moving into the second half the Group is bolstered by an

encouraging pipeline of opportunities, with revenues identified

from either contracted, scheduled or existing contract renewals,

including a GBP1.3m Government agency win in October, and other new

projects identified from new and existing customers. Consequently

the Board currently anticipates it will meet management's

expectations for the full year.

Following the reorganisation of the business reported at the

time of the full year results, our Services and Software divisions

are now much better positioned to capitalise on the long-term

growth opportunities we are seeing.

While customers continue to face unfavourable market conditions

and the timing of orders is difficult to predict, we are encouraged

that engagement levels remain high moving into the second half.

Shearwater continues to provide a best-in class service and the

underlying long-term drivers of the Group's end markets remain

strong, providing confidence in delivery in the second half of the

year and beyond.

Operational Review

The Group comprises two divisions, Services (89% revenue) and

Software (11% revenue). We serve a number of multinational,

blue-chip organisations with clients spanning a range of

sectors.

Notwithstanding the current market conditions impacting

short-term customer decision-making and ongoing uncertainty

regarding contract timing, we are encouraged by the pipeline in

both Services and Software, and continue to win new clients. We are

continuing to benefit from renewals and cross-selling successes,

especially from our penetration and consulting services where we

are particularly pleased with the rate at which new business is

being won.

Following the reorganisation of the business, with GeoLang now

successfully integrated into SecurEnvoy and Xcina into Brookcourt,

staff numbers have remained broadly consistent with the prior

period, ensuring we are rightsized to capitalise on the long-term

growth opportunities we are seeing.

Brookcourt has enlisted its inaugural commission-only sales

representative to promote our proprietary SecurEnvoy software and

strategic solutions. This innovative sales strategy complements our

current approach, eliminating a fixed salary and relying solely on

commissions, which are disbursed exclusively upon the successful

conclusion of a sale. Our intention is to expand this initiative by

bringing in more personnel.

As outlined in the Full Year results, the Group took decisive

action to streamline and optimise its operations, in order to

emerge a leaner, more unified business. The action taken has

resulted in a strengthened positioning, with a robust pipeline of

opportunities across our Services division and our integrated

Software business benefiting from a global distribution network.

While in the context of the slower decision-making of the

corporates we work with, our resilient performance provides

optimism moving forwards. Our clear H2 objective is to convert the

opportunities across both divisions.

In the period, we are once again pleased to report the Group has

continued to win significant awards which serve as a clear

testament to the value of the Shearwater offering. SecurEnvoy was

honoured as the Identity & Access Management Solution of the

Year at the Computing Security Magazine Awards 2023, while also

achieving recognition in the Security Software Solution of the Year

category for Data Discovery. Brookcourt received the Customer

Service Award at the same event. Earlier in the year Brookcourt won

the Logo Acquisition Award 2023 at Proofpoint channel event for the

successful acquisition of an Enterprise bank over a three-year

sales cycle. Finally, Pentest emerged as the winner at Pwn2Own

Toronto for successfully compromising the Samsung Galaxy S23.

Services

Services revenue was generated from contract wins and renewals

from the company's large customer base. In the first half

Brookcourt Solutions delivered contracts across a diverse range of

clients. These included a leading British mobile network operator,

a prominent European Cyber Managed Security Services Provider

(MSSP), an international retail chemist and cosmetics company and

an essential security services contract for a UK government

department. These clients generated a total contract value of

GBP5.5m which is being recognised in FY24. It was particularly

pleasing to add a new vertical to our customer base with the award

of our first significant Government contract.

The merging of Xcina Consulting into Brookcourt Solutions has

resulted in greater traction and new business opportunities which

are being converted. Recent wins include a disaster recovery

planning contract for a global manufacturing group in Germany,

information security framework development for an Australian-based

international mining group and PCI-DSS engagement for an ASX-listed

food sector operator headquartered in the Netherlands.

Pentest has had a strong first half, ahead of management

expectations. The Company continues to secure new business and

uphold its prominent status and successfully fulfilled contracts

that had been delayed from the previous financial year.

Additionally the company achieved success with its Secure Code

Workshop, acquiring a new client and securing ongoing onsite

workshops for a large team of developers. The company has expanded

its 'Internet of Things' testing capability, resulting in a growing

number of engagements, and has secured 15 new accounts, including a

leading financial services company, a global technology company in

the energy sector, a prominent UK education business, and a

significant win with a leading technology and services

provider.

12 months to

H1 FY24 H1 FY23 YOY 31 March 2023

GBP000 GBP000 % GBP000

--------- --------- ------ ----------------

Revenue 9,334 9,136 +2% 23,830

--------- --------- ------ ----------------

Gross profit 2,330 1,571 +48% 4,657

--------- --------- ------ ----------------

Gross profit margin

% 25% 17% 20%

--------- --------- ------ ----------------

Overheads (1,366) (1,738) (4,508)

--------- --------- ------ ----------------

Adjusted EBITDA 964 (167) 149

--------- --------- ------ ----------------

Adjusted EBITDA % 10% (2%) 1%

--------- --------- ------ ----------------

Software

While the Software business has seen a softened performance

against the prior period, renewals are tracking ahead of management

expectations and we are already seeing the effects of integration

and operational efficiencies following the merging of SecurEnvoy

with Geolang to form a unified software division. The unified

company is benefiting from 350 resellers across the world, with

Geolang seeing an increase in opportunities now coming in through

SecurEnvoy's reseller network, which had not been the case

previously.

SecurEnvoy has maintained a consistently robust release schedule

for its Access Management Solution since May 2023, highlighted by

the notable V3.R3 update in October. This release not only fulfils

elevated security standards essential for government and critical

networks but also broadens deployment options to encompass

On-Premise (Windows & LINUX) and Private Cloud (Azure &

AWS). Additionally the introduction of an MSP edition caters to the

escalating demand for managed services and streamlining of billing

processes. The expansion of channel partnerships through new

agreements further underscores SecurEnvoy's commitment to

innovation and collaboration in the evolving landscape.

12 months to

H1 FY24 H1 FY23 YOY 31 March 2023

GBP000 GBP000 % GBP000

--------- --------- ------ ----------------

Revenue 1,167 1,654 -29% 2,856

--------- --------- ------ ----------------

Gross profit 822 1,144 -28% 1,793

--------- --------- ------ ----------------

Gross profit margin

% 70% 69% 63%

--------- --------- ------ ----------------

Overheads (357) (441) (818)

--------- --------- ------ ----------------

Adjusted EBITDA 465 703 977

--------- --------- ------ ----------------

Adjusted EBITDA

% 40% 43% 34%

--------- --------- ------ ----------------

Board Update

In September 2023, Paul McFadden, CFO, informed the Board of his

decision to step down from the Board, remaining with the Group

until his successor was appointed and for a short transition

period. In October 2023, Adam Hurst was appointed Interim CFO and

in early November Adam was appointed to the Board as Executive

Director.

Current trading and outlook

Management continues to expect to meet its full year

expectations based on the current sales pipeline and opportunities.

From regular customer engagement, we remain confident in securing

the Services deals which were deferred from previous periods, and

in parallel we are encouraged by the opportunities for higher

margin software deals which will have a meaningful impact on top

line growth. We move into the second half with cautious optimism

and our core objective for the remainder of the period will be to

convert our pipeline of opportunities.

Phil Higgins

Chief Executive Officer

21 November 2023

Finance review

Revenue

Revenue of GBP10.5 million (H1 FY23: GBP10.8 million) was

slightly behind the prior year with some growth in the Services

business offset by the impact of lower sales in the Software

division.

Adjusted EBITDA

Adjusted EBITDA of GBP0.6 million (H1 FY22: GBP0.1 million) was

ahead of the prior year. The prior year was adversely impacted by a

GBP0.9 million unrealised foreign exchange charge. Excluding this

impact Adjusted EBITDA was slightly lower than the prior year,

broadly in line with revenue performance.

The income statement below details both statutory and

alternative measures which, in the Directors' opinion, provides

additional relevant information to the reader in assessing the

adjusted performance of the business.

12 months

to 31 March

H1 FY24 H1 FY23 Change 2023

GBP000 GBP000 % GBP000

-------------------------------------- --------- --------- -------- --------------

Revenue 10,501 10,790 -3% 26,686

Gross profit 3,152 2,715 +16% 6,450

Gross profit margin % 30% 25% 24%

Overheads (2,559) (2,654) -4% 6,651

-------------------------------------- --------- --------- -------- --------------

Adjusted EBITDA 593 61 (201)

Adjusted EBITDA margin % 6% 1% -1%

Finance charge (net) (38) (31) (77)

Depreciation (137) (127) (240)

Amortisation of intangible assets

- computer software (511) (396) (792)

-------------------------------------- --------- --------- -------- --------------

Adjusted loss before tax (93) (493) (1,310)

Amortisation of acquired intangible

assets (1,050) (1,050) (2,099)

Share based payments (42) (82) (85)

Exceptional items (202) - (6,139)

Loss before tax (1,387) (1,625) (9,633)

Taxation credit 440 306 1,458

Loss after tax (947) (1,319) (8,175)

-------------------------------------- --------- --------- -------- --------------

Net finance charges

Net finance charges are slightly above the prior year due mainly

to increased interest on capitalised leases.

Depreciation

Depreciation, which includes Right of Use assets, is broadly in

line with the previous year.

Amortisation of intangibles assets - computer software

Increased amortisation compared to the prior year reflects

software developed in previous periods that has been released in

the first half this year.

Adjusted loss before tax

Adjusted loss before tax of GBP0.1 million (H1 FY23: adjusted

loss GBP0.5 million) is an improvement on the prior year due to the

absence of a foreign exchange loss in the current year.

Amortisation of acquired intangible assets

Amortisation of acquired intangible assets of GBP1.1 million (H1

FY23: GBP1.1 million) is in line with the previous year.

Exceptional costs

Exceptional costs of GBP0.2 million were incurred in connection

with completing the restructuring that commenced at the end of the

previous financial year and largely comprises redundancy costs.

Share based payments

The share based payments charge relates to long-term incentive

plans and is lower than the prior year due to fewer participants in

the share schemes.

Loss before tax

Loss before tax in the period was GBP1.4 million (H1 FY23:

GBP1.6 million) and recognises the year-on-year improvement in

adjusted loss before tax partly offset by the exceptional item in

the first half.

Taxation

The credit in the period was GBP0.4 million (H1 FY23: GBP0.3

million) giving an effective tax rate of 32% (H1 FY22: 19%). The

tax rate benefited from the impact of enhanced allowances in the UK

on research and development spend.

Earnings/Loss per share

Adjusted basic and diluted earnings per share was GBP0.01 (H1

FY23: loss per share GBP0.01) incorporates the year-on-year

improvement in adjusted profit/(loss) after tax. Reported basic and

diluted loss per share was GBP0.04 (H1 FY23: basic loss and diluted

per share GBP0.06).

Statement of Cash flow

The second half weighted trading performance of the Group in

recent years has typically resulted in an expected cash outflow in

the first half of the year. The operating cash outflow to September

2023 of GBP1.4 million was an improvement on the GBP3.9 million

outflow in the first half of the prior year, which arose mainly due

to timing of cash receipts on certain large contracts arising in

the previous year. Cash held at 30 September of GBP2.2 million

compares to GBP0.9 million at the same point in the prior year and

has been maintained at a similar level at the end of October

2023.

The Group continues to invest in the development of internally

created software, with expenditure of GBP0.5 million in the period

(H1 FY23: GBP0.7 million). This is slightly lower than the previous

year due to efficiencies in the nature of spend arising from the

increased use of internal staff and a reduction in external

contracting.

6 months to 30

September

12 months

to 31 March

H1 FY24 H1 FY23 2023

GBP000 GBP000 GBP000

---------------------------------------- --------- --------- --------------

Adjusted EBITDA 593 61 (201)

Movements in working capital and

exceptional items (1,989) (3,959) 485

---------------------------------------- --------- --------- --------------

Cash used / generated from operations (1,396) (3,898) 284

Capital expenditure (net of disposal

proceeds) (528) (686) (1,337)

Tax received / (paid) 301 - (285)

Interest paid (31) (26) (83)

Payments of lease liabilities (124) (108) (200)

FX and other - 13 10

---------------------------------------- --------- --------- --------------

Movement in cash (1,778) (4,705) (1,611)

Opening cash and cash equivalents 3,964 5,575 5,575

Closing cash and cash equivalents 2,186 870 3,964

---------------------------------------- --------- --------- --------------

Alternative performance measures

This review includes alternative performance measures ('APMs')

alongside the standard IFRS measures. The Directors believe that

alternative measures provide additional relevant information

regarding the adjusted performance of the business. APMs are used

to enhance the comparability of information between reporting

periods by adjusting for one off exceptional and other items that

affect the IFRS measure. Consequently, the Directors and management

use APM's in addition to IFRS measures to assess the adjusted

performance of the business.

Alternative performance measures used include:

-- Adjusted EBITDA

-- Adjusted loss before tax

-- Adjusted loss after tax

-- Adjusted earnings/loss per share

Adjusting items include:

Exceptional items which are one off by their nature such as

acquisition costs or re-organisation costs and do not form part of

the underlying operational cost of the business.

Share based payment charges awarded from long-term remuneration

incentives to certain staff. Despite the plans not having a cash

cost to the business, a share-based payment charge is taken to the

statement of comprehensive income which the directors believe does

not form part of the underlying operating cost of the business.

Amortisation of identified intangible assets acquired as part of

an acquisition is charged to the statement of comprehensive income

but does not form part of the underlying operating cost of the

business.

A full reconciliation between adjusted and reported results is

detailed below:

Six months to 30 September H1 FY24 H1 FY23

GBP000 GBP000

Adjusted EBITDA 593 61

Exceptional items (202) -

Share based payments charge (42) (82)

------------------------------ --------- ---------

EBITDA 349 (21)

------------------------------ --------- ---------

Adjusted loss before tax (93) (493)

Amortisation of acquired intangibles (1,050) (1,050)

Exceptional items (202) -

Share based payments charge (42) (82)

--------------------------------------- --------- ---------

Reported loss before tax (1,387) (1,625)

--------------------------------------- --------- ---------

Adjusted profit/(loss) after tax 152 (298)

Amortisation of acquired intangibles (net

of tax) (905) (939)

Exceptional items (net of tax) (152) -

Share based payments charge (42) (82)

-------------------------------------------- ------- ---------

Reported loss after tax (947) (1,319)

-------------------------------------------- ------- ---------

GBP GBP

Adjusted basic & diluted earnings/(loss)

per share 0.01 (0.01)

Amortisation of acquired intangibles (0.04) (0.04)

Exceptional items (0.01) -

Share based payments charge (0.00) (0.01)

------------------------------------------- -------- --------

Reported basic & diluted loss per share (0.04) (0.06)

------------------------------------------- -------- --------

Principal risks and uncertainties

The Group works to minimise its exposure to operational,

financial and other risks, however in pursuit of achieving its

growth strategy there will always be an element of risk that needs

to be considered. The Group's principal risks and uncertainties, as

detailed in the financial statements for the year ended 31 March

2023, are all still considered to be valid.

Statement of Directors' responsibilities

We confirm that to the best our knowledge that:

-- The condensed interim set of financial statements have been

prepared in accordance with IAS 34 Interim Financial Reporting as

adopted by the United Kingdom;

-- The interim report includes a fair review of information

required by DTR 4.2.7R (indication of important events during the

first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

-- The interim report includes a fair review of the information

required by DTR 4.2.8R (disclosure of related parties transactions

and any change therein).

Adam Hurst

Interim Chief Financial Officer

21 November 2023

Unaudited condensed consolidated statement of comprehensive

income

for the 6 months to 30 September 2023

2023 2022

Note GBP000 GBP000

------------------------------------------------- ------ --------- ------------

Revenue 3 10,501 10,790

Cost of sales (7,349) (8,075)

---------------------------------------------------- ------ --------- ------------

Gross profit 3,152 2,715

Administrative expenses (2,803) (2,736)

Depreciation and amortisation (1,698) (1,573)

Total operating costs (4,501) (4,309)

Operating loss (1,349) (1,594)

Adjusted EBITDA 3 593 61

Depreciation and amortisation (1,698) (1,573)

Exceptional items (202) -

Share-based payments (42) (82)

Operating loss (1,349) (1,594)

---------------------------------------------------- ------ --------- ------------

Finance cost 4 (43) (31)

Finance income 4 5 -

Loss before taxation (1,387) (1,625)

---------------------------------------------------- ------ --------- ------------

Income tax credit 5 440 306

Loss for the period and attributable to equity

holders of the Company (947) (1,319)

---------------------------------------------------- ------ --------- ------------

Other comprehensive income

Items that may be classified

to profit and loss:

Exchange differences on translation of

foreign operations 0 14

Total comprehensive loss for

the period (947) (1,305)

---------------------------------------------------- ------ --------- ------------

Earnings / (Loss) per ordinary share attributable

to the owners of the parent GBP GBP

(Restated)

Basic (GBP per share) 6 (0.04) (0.06)

Diluted (GBP per share) 6 (0.04) (0.06)

Adjusted basic and diluted (GBP

per share) 6 0.01 (0.01)

Unaudited condensed consolidated statement of financial

position

as at 30 September 2023

2022

2023 (Restated)

Note GBP000 GBP000

------------------------------------ ---- ---- ---- ------ ---------- --------------

Assets

Non-current assets

Intangible assets 43,901 51,779

Property, plant and equipment 388 213

Deferred tax 903 -

Trade and other receivables 7 4,151 8,326

Total non-current assets 49,343 60,318

------------------------------------------------------ ------ ---------- --------------

Current assets

Trade and other receivables 8 11,389 12,728

Cash and cash equivalents 2,186 870

Total current assets 13,575 13,598

------------------------------------------------------ ------ ---------- --------------

Total assets 62,918 73,916

------------------------------------------------------ ------ ---------- --------------

Liabilities

Current liabilities

Trade and other payables 9 9,806 10,573

Total current liabilities 9,806 10,573

------------------------------------------------------ ------ ---------- --------------

Non-current liabilities

Creditors: amounts falling due after

more than one year 10 5,894 8,360

Total non-current liabilities 5,894 8,360

------------------------------------------------------ ------ ---------- --------------

Total liabilities 15,700 18,933

------------------------------------------------------ ------ ---------- --------------

Net assets 47,218 54,983

------------------------------------------------------ ------ ---------- --------------

Capital and reserves

Share capital 11 22,278 22,278

Share premium 34,581 34,581

Other reserves 23,484 24,468

Translation reserve 30 37

Accumulated losses (33,155) (26,381)

Equity attributable to owners

of the Company 47,218 54,983

------------------------------------------------------ ------ ---------- --------------

Total equity and liabilities 62,918 73,916

------------------------------------------------------ ------ ---------- --------------

Unaudited condensed consolidated statement of changes in equity

for the 6 months to 30 September 2023

Share Share Other Translation Accumulated Total

capital premium reserves reserve losses Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------------- ---------- ---------- ----------- ------------- ------------- ---------

At 31 March 2022 (audited) 22,278 34,581 24,386 23 (25,062) 56,206

Loss for the period - - - - (1,319) (1,319)

Other comprehensive profit

for the period - - - 14 - 14

------------------------------------- ---------- ---------- ----------- ------------- ------------- ---------

Total comprehensive loss

for the period - - - 14 (1,319) (1,305)

Contributions by and distributions

to owners

Share-based payments - - 82 - - 82

------------------------------------- ---------- ---------- ----------- ------------- ------------- ---------

At 30 September 2022 (unaudited) 22,278 34,581 24,468 37 (26,381) 54,983

Loss for the period - - - - (6,856) (6,856)

Other comprehensive loss

for the period - - - (7) - (7)

Expiry of share options - - (1,029) - 1,029 -

------------------------------------- ---------- ---------- ----------- ------------- ------------- ---------

Total comprehensive loss

for the period - - (1,029) (7) (5,827) (6,863)

Contributions by and distributions

to owners

Share-based payments - - 3 - - 3

------------------------------------- ---------- ---------- ----------- ------------- ------------- ---------

At 31 March 2023 (audited) 22,278 34,581 23,442 30 (32,208) 48,123

Loss for the period - - - - (947) (947)

Other comprehensive profit/loss

for the period - - - - - -

------------------------------------- ---------- ---------- ----------- ------------- ------------- ---------

Total comprehensive profit/loss

for the period - - - - (947) (947)

Contributions by and distributions

to owners

Share-based payments - - 42 - - 42

At 30 September 2023 (unaudited) 22,278 34,581 23,484 30 (33,155) 47,218

------------------------------------- ---------- ---------- ----------- ------------- ------------- ---------

Unaudited condensed consolidated cash flow statement

for the 6 months to 30 September 2023

2023 2022

GBP000 GBP000

----------------------------------------------- --------- ---------

Cash flows from operating

activities

Loss for the period (947) (1,319)

Adjustments for:

Amortisation of intangible

assets 1,561 1,446

Depreciation of right of use

assets 113 101

Depreciation of property, plant

and equipment 24 26

Share-based payment charge 42 82

Exceptional items 202 -

Finance costs 43 31

Finance income (5) -

Income tax (440) (306)

--------------------------------------------------- --------- ---------

Cash flows from operating activities before

changes in working capital 593 61

Decrease/(increase) in trade and other

receivables 3,699 (726)

(Decrease)/increase in trade

and other payables (5,486) (3,233)

Cash used in operations (1,194) (3,898)

--------------------------------------------------- --------- ---------

Net foreign exchange movements - 12

Finance costs paid (31) (26)

Tax received 301 -

Net cash used in operating activities before

exceptional items (924) (3,912)

--------------------------------------------------- --------- ---------

Net cash flows on exceptional

items (202) -

Net cash used in operating

activities (1,126) (3,912)

--------------------------------------------------- --------- ---------

Investing activities

Purchase of property, plant

and machinery (5) (25)

Purchase of intangibles (523) (661)

Net cash used in investing

activities (528) (686)

--------------------------------------------------- --------- ---------

Financing activities

Repayment of lease liabilities (124) (108)

Net cash used in financing

activities (124) (108)

--------------------------------------------------- --------- ---------

Net decrease in cash and cash

equivalents (1,778) (4,706)

--------------------------------------------------- --------- ---------

Foreign exchange movements on cash and

cash equivalents - 1

Cash and cash equivalents at the beginning

of the period 3,964 5,575

Cash and cash equivalents at the

end of the period 2,186 870

------------------------------------------------ --------- ---------

Notes

1. General information

The unaudited interim condensed consolidated financial

information was authorised by the board of directors for issue on

22 November 2023. The information for the six-month period ended 30

September 2023 has not been audited and does not constitute

statutory accounts as defined in section 434 of the Companies Act

2006, and should therefore be read in conjunction with the audited

consolidated financial statements of the Company and its

subsidiaries for the year ended 31 March 2023, which have been

prepared in accordance with UK Adopted International Accounting

Standards (IFRS) and filed with the Registrar of Companies. The

Independent Auditor's Report on that Annual Report and Financial

Statements for 2023 was unqualified, did not draw attention to any

matters by way of emphasis, and did not contain a statement under

498(2) or 498(3) of the Companies Act 2006.

2. Accounting policies

a) Basis of preparation

These unaudited interim condensed consolidated financial

statements have been prepared on the historical cost accounting

basis, in accordance with UK adopted International Accounting

Standards ('IFRS') and with those parts of the Companies Act 2006

applicable to companies reported under IFRS and are consistent with

those that are expected to be adopted in the annual statutory

financial statements for the year ended 31 March 2024.

The interim consolidated financial information does not comply

with IAS 34 Interim Financial Reporting, as permissible under the

rules of AIM.

Prior year interim information has been restated, as

follows:

- Diluted loss per share for the six month period to 30

September 2022 was previously reported as GBP0.05 per share. It has

been restated to GBP0.06 per share as the potential dilutive shares

were anti-dilutive for the period as the Group was loss making.

- On the Statement of Financial Position, consistent with the

accounts to the year to 31 March 2023, Accrued income of

GBP1,232,000 within Current Assets, Trade and Other Receivables has

been reclassified to Accrued income within Non-Current Assets,

Trade and Other Receivables; in addition, Accruals and Other

Payables of GBP1,139,000 within Current Liabilities has been

reclassified to Accruals and Other Payables within Non-Current

Liabilities.

b) Going concern

After making enquiries, the directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for at least twelve months from the date of

publication of these interim financial statements. Accordingly,

they continue to adopt the going concern basis in preparing these

consolidated financial statements.

The Directors have reviewed the Group's going concern position

taking into account its current business activities, performance to

date against budgeted targets and the factors likely to affect its

future development which include the Group's strategy, principal

risks and uncertainties and its exposure to credit and liquidity

risks.

The Group's GBP4.0 million 3-year revolving credit facility with

Barclays Bank plc, signed on the 25 March 2021 remains in place

which can provide working capital support if required. To date this

facility remains unutilised.

The Directors have reviewed a detailed reforecast of trading

which includes a cash flow forecast for a period which covers a

period of trading to December 2024 and have challenged the

assumptions used to create these forecasts. This forecast

demonstrates that the Group is able to pay its debts as they fall

due during this period.

The Directors have reviewed a highly sensitised stress test

which has factored in what the Directors believe would be an

extreme scenario which incorporates a significant reduction in new

business revenues across both segments of the Group, a reduction of

renewal rates in our software division and a scaling back of

revenues within our Services division. Costs have also been scaled

back in line with the reduction in revenues. Overall, the

sensitised cash flow forecast demonstrates that the Group will be

able to pay its debts as they fall due for the period to at least

31 December 2024.

c) Critical accounting judgements estimates and assumptions

The preparation of financial statements requires management to

make judgements, estimates and assumptions that affect the amounts

reported for income and expenses during the year and that affect

the amounts reported for assets and liabilities at the reporting

date.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those described in the last annual

financial statements.

Revenue recognition

Management make judgements, estimates and assumptions in

determining the revenue recognition of material contracts sold by

the Group's Services division. The Group work with large enterprise

clients, providing services and solutions to support the clients'

needs. In many cases a third-party's products or services will be

provided as part of a solution. Management will consider the

implications around timing of recognition, with factors such as

determining the point control passes to the client and the

subsequent fulfilment of the Group's performance obligations. In

addition to this management will consider if it is acting as agent

or principal.

Impairment of goodwill, intangible assets and investment in

subsidiaries

Management make judgements, estimates and assumptions in

supporting the fair value of goodwill, intangible assets and

investments in subsidiaries. The Group carry out annual impairment

reviews to support the fair value of these assets. In doing so

management will estimate future growth rates, weighted average cost

of capital and terminal values.

Leases

Management make judgements, estimates and assumptions regarding

the life of leases. Management continue to review all existing

leases, which all relate to office space, and will look to reduce

the number of offices across the Group if they are not sufficiently

utilised. For this reason management have assumed that the life of

leases does not extend past the current contracted expiry date. A

judgement has been taken with regard to the incremental borrowing

rate based upon the rate at which the Group can borrow money.

3. Segmental information

In accordance with IFRS 8, the Group's operating segments are

based on the operating results reviewed by the Board, which

represents the chief operating decision maker. The Group reports

its results in two segments as this accurately reflects the way the

Group is managed.

The Group is organised into two reportable segments based on the

types of products and services from which each segment derives its

revenue - software and services.

Segment information for the 6 months ended 30 September 2023 is

presented below and excludes intersegment revenue, as it is not

material, and assets as the Directors do not review assets and

liabilities on a segmental basis.

Six-month period ended 30 September

2023 2023 2022 2022

Revenue Profit Revenue Profit

(unaudited) (unaudited) (unaudited) (unaudited)

GBP000 GBP000 GBP000 GBP000

------------------------------ ------------- ------------- ------------- -------------

Services 9,334 964 9,136 (167)

Software 1,167 465 1,654 703

------------------------------ ------------- ------------- ------------- -------------

Group total 10,501 1,429 10,790 536

Group costs (836) (475)

------------------------------ ------------- ------------- ------------- -------------

Adjusted EBITDA 593 61

Amortisation of intangibles (1,561) (1,446)

Depreciation (137) (127)

Share-based payments (42) (82)

Exceptional items (202) -

Finance costs (net) (38) (31)

Loss before tax (1,387) (1,625)

------------------------------ ------------- ------------- ------------- -------------

The Group is domiciled in the United Kingdom and currently the

majority of its revenues come from external customers that are

transacted in the United Kingdom. A number of transactions which

are transacted from the United Kingdom represent global framework

agreements, meaning our services, whilst transacted in the United

Kingdom, are delivered globally. The geographical analysis of

revenue detailed below is on the basis of country of origin in

which the master agreement is held with the customer (where the

sale is transacted).

Six-month period ended

30 September

2023 2022

(unaudited) (unaudited)

GBP000 GBP000

-------------------- ------------- -------------

United Kingdom 6,532 6,888

Rest of Europe 2,364 2,667

North America 1,499 972

Rest of the world 106 263

10,501 10,790

-------------------- ------------- -------------

4. Finance costs and income

Six-month period ended

30 September

2023 2022

(unaudited) (unaudited)

Finance costs GBP000 GBP000

---------------------------------------- ------------- -------------

Revolving Credit Facility charges 31 26

Interest payable on lease liabilities 12 5

43 31

---------------------------------------- ------------- -------------

Finance income in the period was GBP5k (H1 FY23: Nil)

5. Income Tax

The tax credit recognised reflects management estimates of the

tax for the period and has been calculated using the estimated

average tax rate of UK corporation tax for the financial period of

25% (FY23: 19%)

6. Earnings/(loss) per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period. For

diluted loss per share, the weighted average number of shares in

issue is adjusted to assume conversion of all the potential

dilutive ordinary shares. The potential dilutive shares were

anti-dilutive for the six months ended 30 September 2023 and six

months ended 30 September 2022 as the Group was loss making.

Adjusted earnings per share has been calculated using adjusted

earnings calculated as profit after taxation but before

amortisation of acquired intangibles after tax, share based

payments, impairment of intangible assets and exceptional items

after tax. The potential dilutive shares were anti-dilutive for the

six months ended 30 September 2022 as the Group was loss

making.

The calculation of the basic and diluted earnings per share from

total operations attributable to shareholders is based on the

following data:

Six-month period ended

30 September

2023 2022

(unaudited) (unaudited)

GBP000 GBP000

--------------------------------------------- ------------- -------------

Net loss from total operations

Loss for the purposes of basic and diluted

earnings / loss per share being net loss

attributable to shareholders: (947) (1,319)

Add/(remove)

Amortisation of acquired intangibles (net

of tax) 905 939

Share based payments 42 82

Exceptional items (net of tax) 152 -

Adjusted earnings for the purpose of

adjusted earnings per share 152 (298)

----------------------------------------------- ------------- -------------

No

Number of shares No (Restated)

--------------------------------------------- ------------- -------------

Weighted average number of ordinary shares

for the purpose of basic and adjusted

earnings per share 23,826,379 23,818,059

Weighted average number of ordinary shares

for the purpose of basic and adjusted

diluted earnings per share 23,826,379 23,818,059

----------------------------------------------- ------------- -------------

GBP

Earnings/(Loss) per share GBP (Restated)

Basic loss per share (0.04) (0.06)

Diluted loss per share (0.04) (0.06)

Adjusted Basic and diluted earnings/(loss)

per share 0.01 (0.01)

---------------------------------------------- ------------- -------------

7. Non-current assets: Trade and other receivables

Period ended 30 September

2023 2022

(unaudited,

(unaudited) restated)

GBP000 GBP000

-------------------- --------------- ---------------

Trade receivables 1,245 7,094

Accrued income 2,906 1,232

4,151 8,326

-------------------- --------------- ---------------

8. Current assets: Trade and other receivables

Period ended 30 September

2023 2022

(unaudited,

(unaudited) restated)

GBP000 GBP000

------------------------------------ --------------- ---------------

Trade receivables 6,946 10,043

Accrued income 4,098 2,035

Prepayments and other receivables 345 469

Deferred tax asset - 181

11,389 12,728

------------------------------------ --------------- ---------------

9. Trade and other payables

Period ended 30 September

2023 2022

(unaudited,

(unaudited) restated)

GBP000 GBP000

------------------------------------- -------------- -------------

Trade payables 837 2,757

Accruals and other payables 8,053 5,570

Other taxation and social security 606 1,261

Deferred income 203 454

Corporation tax 6 444

Lease liabilities 101 87

9,806 10,573

------------------------------------- -------------- -------------

10. Creditors: amounts falling due after more than one year

Period ended 30 September

2023 2022

(unaudited,

(unaudited) restated)

GBP000 GBP000

------------------------------ -------------- -------------

Deferred tax 3,341 3,744

Accruals and other payables 2,359 4,600

Lease liabilities 194 16

5,894 8,360

------------------------------ -------------- -------------

11. Share capital

The table below details movements in share capital during the

year:

Six-month period ended

30 September

2023 2022

In thousands of shares 000 000

--------------------------- ------------ ------------

In issue at 31 March 23,826 23,810

In issue at 30 September 23,826 23,810

--------------------------- ------------ ------------

Allotted, called up and fully paid GBP000 GBP000

Ordinary shares of GBP0.10 each 2,382 2,382

Deferred shares of GBP0.90 each 19,896 19,896

------------------------------------- --------- ---------

22,278 22,278

------------------------------------- --------- ---------

The Company did not issue any shares in the six-month period

ended 30 September 2023.

12. Related party transactions

The Directors of the Group and their immediate relatives have an

interest of 19% ( H1 FY23 : 18%) of the voting shares of the

Group.

13. Events after the reporting date

There are no material events after the reporting period to

report.

14. Cautionary statement

This Interim Report has been prepared solely to provide

additional information to shareholders to assess the Company's

strategies and the potential for these strategies to succeed. The

Interim Report should not be relied on by any other party or for

any purpose. The Interim Report contains certain forward-looking

statements with respect to the financial condition, results of

operations and businesses of the Company. These statements are made

in good faith based on the information available to them up to the

time of their approval of this report. However, such statements

should be treated with caution as they involve risk and uncertainty

because they relate to events and depend upon circumstances that

will occur in the future. There are a number of factors that could

cause actual results or developments to differ materially from

those expressed or implied by these forward-looking statements. The

continuing uncertainty in global economic outlook inevitably

increases the economic and business risks to which the Company is

exposed. Nothing in this announcement should be construed as a

profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFLLLXFLXFBK

(END) Dow Jones Newswires

November 22, 2023 02:00 ET (07:00 GMT)

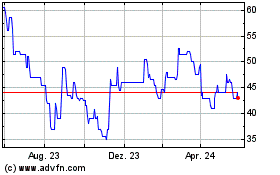

Shearwater (LSE:SWG)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

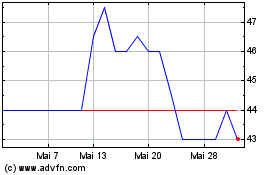

Shearwater (LSE:SWG)

Historical Stock Chart

Von Nov 2023 bis Nov 2024