Record PLC Fourth Quarter Trading Update (9693I)

22 April 2022 - 8:00AM

UK Regulatory

TIDMREC

RNS Number : 9693I

Record PLC

22 April 2022

22 April 2022

RECORD PLC

FOURTH QUARTER TRADING UPDATE

Record plc ('Record' or the 'Company'), the specialist currency

and derivatives manager, is pleased to announce its trading update

for the three months ended 31 March 2022 ("Q4-2022").

Highlights

-- AUME increased by +3.7% during the financial year ended 31 March 2022

-- Net inflows of US$2.4 billion during the financial year

-- Performance fees of GBP0.5 million earned during the quarter

-- Post period end US$1.0 billion inflow in Dynamic Hedging; a

further US$1.0 billion anticipated in the first half of the current

financial year

Leslie Hill, Chief Executive of Record plc, commented :

"We closed the financial year with AUME at US$83.1 billion, an

increase of US$3.0 billion (+3.7%) over the financial year. This

included positive net inflows in the final quarter and for the

financial year of US$0.8 billion and US$2.4 billion,

respectively.

"As expected, increased uncertainty in financial markets linked

predominantly to the war in Ukraine impacted the value of some

clients' underlying portfolios, reflected by a decrease in AUME of

US$2.3 billion (-2.7%) from market movements over the quarter.

"Performance fees of GBP0.5 million were earned in the quarter

from opportunities arising from recent increases in interest rate

differentials linked to changes in central banks monetary

policies.

"Meanwhile, the positive momentum in the growth of our

higher-margin revenue products over the financial year to 31 March

2022 has continued since quarter end with further inflows from an

existing Dynamic Hedging client of approximately US$1.0 billion,

which is expected to grow to approximately US$2.0 billion by the

end of the first half of the current financial year."

Trading Analysis

1. AUME composition

The Group's AUME as at 31 March 2022 totalled US$83.1 billion

(31 December 2021: US$85.3 billion), and expressed in sterling

totalled GBP63.1 billion (31 December 2021: GBP63.0 billion). The

composition of AUME by product was as follows:

AUME - US$ billion

31 March 2022 31 December 2021

-------------- -----------------

Dynamic Hedging 10.6 11.5

Passive Hedging 62.8 63.8

Currency for Return 5.0 4.9

Multi-Product 4.5 4.9

Cash & Futures 0.2 0.2

-------------- -----------------

Total 83.1 85.3

-------------- -----------------

2. AUME Movement

Net client AUME movement in the three months to 31 March 2022

was as follows:

Net AUME movement - US$ billion

3 months to 3 months to

31 March 2022 31 December 2021

--------------- ------------------

Dynamic Hedging (0.3) 1.1

Passive Hedging 1.3 (0.5)

Currency for Return 0.0 (0.6)

Multi-Product (0.2) (0.3)

Cash & Futures 0.0 0.0

--------------- ------------------

Total net flows 0.8 (0.3)

--------------- ------------------

FX movements and mandate

volatility targeting (0.7) 0.7

--------------- ------------------

Movements in global stock

and other markets (2.3) 0.8

--------------- ------------------

TOTAL AUME MOVEMENT (2.2) 1.2

--------------- ------------------

3. AVERAGE FEE RATES AND PERFORMANCE FEES

During Q4-2022, fee rates remained broadly unchanged from the

previous quarter. However, a slight decrease to the overall average

fee rate from Dynamic Hedging is expected going forward, which can

be attributed to the recent increase in mandate size from an

existing client, as noted above.

Performance fees of GBP0.5 million were earned in the

quarter.

Record will announce its FY-2022 results on 21 June 2022 and its

Q1-2023 trading update on 22 July 2022. If you wish you attend FY

results in June, please contact record@buchanan.uk.com .

-Ends -

For further information, please contact:

Record plc Tel: +44 (0) 1753 852 222

Leslie Hill, Chief Executive Officer

Steve Cullen, Chief Finance Officer

Buchanan Tel: +44 (0) 20 7466 5000

Giles Stewart

record@buchanan.uk.com

Simon Compton

Henry Wilson

George Beale

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAKLFADXAEFA

(END) Dow Jones Newswires

April 22, 2022 02:00 ET (06:00 GMT)

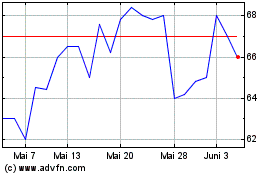

Record (LSE:REC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Record (LSE:REC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024