TIDMLOGP

RNS Number : 8703Y

Lansdowne Oil & Gas plc

08 January 2024

8 January 2024

Lansdowne Oil & Gas plc

("Lansdowne" or the "Company")

New Year Outlook and

Comments on Energy Security in Ireland to 2030 publication

With the completion of the recent equity placing following the

Company's General Meeting on 29 December 2023, the Company is now

focused upon progressing its Energy Charter Treaty claim against

Ireland, following the refusal to award a Lease Undertaking for the

Barryroe oil and gas field ("Barryroe").

On 14 November 2023 the Irish Government finally published its

strategy for Ireland's Energy Security, and having reviewed this

Lansdowne provides the following comments:

The voluminous documentation produced identifies numerous

actions to be taken and the setting up of additional committees,

all to be overseen by a new Energy Security Group (ESG).

Some of the key findings in the report are:

-- Concern about gas supply leading to the need recognized for a

Strategic Gas Emergency Reserve.

-- Also concern regarding oil supply with need to strengthen

National Oil Reserves Agency (NORA).

-- Actions to be taken on both will add further cost burden to consumers.

Lansdowne believes that an alternative pathway, allowing the

development of the Barryroe oil and gas field, would deliver

greater energy security at lower cost and with lower associated

emissions.

Lansdowne considered that the report highlights the following

key risks:

Supply-side risks:

-- As one of the most energy import dependent countries in the

EU with limited diversity of supply, Ireland is exposed to this

risk. In 2022, 82% of Ireland's energy needs came from imports. 48%

of energy used in 2022 was from imported oil and nearly 31% from

natural gas. 74% of Ireland's natural gas came from imports through

two interconnectors from the UK.

-- A disruption of gas supplies from the UK, for whatever

reason, would have a significant impact on Ireland's economic and

social wellbeing.

Demand side risks:

-- The dependence of the electricity system on natural gas is

expected to increase in the short to medium-term, particularly at

times of very low wind. In addition, the peak day demand for

natural gas is expected to increase. This means the electricity

system will continue to rely on natural gas as a fuel source as it

transitions to a majority-renewables system and phases out natural

gas in the medium term.

Introduction of a Strategic Gas Emergency Reserve:

-- It is anticipated that a floating reserve (FSRU) will best

meet the criteria set by the Government.

-- The costs of this state-owned enterprise will be paid for by

an additional levy on the consumer, as applies for NORA (National

Oil Reserves Agency)

The Oil Sector

-- Ireland relies heavily on imports to meet its oil

requirements as it does not produce crude oil and is a net importer

of refined products.

Given all of the above, it is extraordinary that Eamon Ryan

Minister for Environment, Climate and Communications and Minister

for Transport blocked the progress of the Barryroe oil and gas

field, that contains abundant supplies of both fuels, especially

given the application was also noted as being satisfactory from a

technical standpoint.

The development of Barryroe would ensure secure indigenous

supplies of both oil and gas, with lower emissions/carbon

footprint, compared with imports. A study commissioned by Europa

Oil and Gas (Holdings) plc and announced on 7(th) March 2023, found

that the Emission Intensity (EI) from the indigenous Corrib Field

at 5 kgCO2e/boe is 14% of the EI of imported gas from the UK and

3.5% of the EI of LNG imported from the US.

Offshore Wind

Minister Ryan is placing all his faith in developing offshore

wind at scale and at pace. As recognised in the McCarthy Report on

the Security of Electricity Supply, "The ambition to decarbonise

has not been matched by sufficient management of the project

delivery risks, with evidence of an underestimation of risk in the

sector."

A recent article on Offshore Wind in the Guardian newspaper (27

October 2023) commented on the headwinds facing the industry.

Siemens Energy had encountered problems with the turbines it

manufactures and was in rescue talks with the German Government to

secure EUR15 billion to shore up its balance sheet.

Vatenfall AB had stopped work on a windfarm project off the

coast of Norfolk as the recent 40% rise in costs meant it was no

longer profitable.

The Danish windfarm giant Ørsted A/S announced a near GBP2

billion asset write-down due to delays in windfarm projects

offshore the U.S.

On 4(th) January 2024 Equinor ASA and BP Plc announced the

termination of the Offshore Wind Renewable Energy Certificate

(OREC) Agreement for the Empire 2 project offshore the U.S.A.

recognising that "commercial conditions driven by inflation,

interest rates and supply chain disruptions that prevented Empire

Wind 2's existing OREC agreement from being viable."

Conclusion:

It is the Company's view that the long delayed report on

Ireland's Energy Security has taken a blinkered approach, driven

entirely by environmental dogma, and will ensure that Ireland's

energy insecurity will persist to 2030 and beyond and that the

Irish consumer, already paying some of the highest electricity

prices in Europe, will face additional cost burden. Energy

insecurity of this nature will be magnified many times over in the

event that global disruptions occur thus also multiplying the costs

to the Irish consumer. Domestic energy supply can help to alleviate

this multiplier effect.

There is an obvious alternative pathway, to allow the

development of already discovered oil and gas resources in the

Barryroe field, delivering greater security at lower cost and with

lower associated emissions. There is no reliable forecast which

shows an elimination of oil and gas imports to Ireland. Domestic

oil and gas can provide energy security and be provided at a much

lower emissions cost than imported oil and gas.

The Company remains willing to engage in any worthwhile or

pragmatic discussion with the Irish Government, however all

attempts to engage in such conversations at an appropriate level

have been ignored by the Irish government. Without an ability to

engage in a respectful and frank conversation the Company has no

alternative other than to pursue its arbitration efforts under the

Energy Charter Treaty.

For further information please contact:

Lansdowne Oil & Gas plc +353 1 963 1760

Steve Boldy

SP Angel Corporate Finance LLP +44 (0) 20 3470 0470

Nominated Adviser and Joint

Broker

Stuart Gledhill

Richard Hail

Tavira Financial Limited +44 (0) 20 3192 1739

Joint Broker

Oliver Stansfield

Notes to editors:

About Lansdowne

Lansdowne Oil & Gas (LOGP.LN) is an oil and gas exploration

and appraisal company focused on the North Celtic Sea and quoted on

the AIM market and head quartered in Dublin.

In May 2023 the application for a Lease Undertaking for the

Barryroe Field, in which Lansdowne held a 20% interest, was refused

by the Irish Department of the Environment, Climate and

Communications.

In June 2023 Lansdowne announced the commencement of action

under the Arbitration Process of the Energy Charter Treaty.

Since 20 September 2023, Lansdowne has been designated a

"Cash-Shell" under AIM Rule 15.

For more information on Lansdowne, please refer to

www.lansdowneoilandgas.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDDGDBRDGDGSR

(END) Dow Jones Newswires

January 08, 2024 02:00 ET (07:00 GMT)

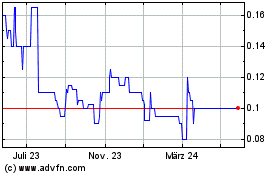

Lansdowne Oil & Gas (LSE:LOGP)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Lansdowne Oil & Gas (LSE:LOGP)

Historical Stock Chart

Von Nov 2023 bis Nov 2024