TIDMHVT

RNS Number : 1316P

Heavitree Brewery PLC

15 February 2021

The Heavitree Brewery PLC

Trood Lane

Matford

Exeter EX2 8YP

Date: 15 February 2021

Contact: Graham Crocker - Managing Director - 01392 217733

Nicola McLean - Company Secretary - 01392 217733

Patrick Castle /Anita Ghanekar - Shore Capital - 0207 408

4052

Following a Board Meeting held today, 15 February 2021, the

Directors announce the preliminary statement of results for the

year ended 31 October 2020.

ISIN: GB0004182720 for 'A' Limited Voting Ordinary Shares

ISIN: GB0004182506 for Ordinary Shares

Chairman's statement

At the half-year I reported a 61% reduction in operating profit

as the fallout from the restrictions in trading and the first

lockdown started to impact our financial results. That impact has

been felt over the second half of the year under review with a

significant decrease in turnover, and obviously it will be felt

moving into the next financial year as the Company continues to

support all our tenants and leaseholders with rent concessions to

help them to endure long periods of tier restrictions and full

lockdowns. Although the summer months allowed some level of trade

the Board was under no illusions that a possible second wave of

infection would inevitably bring further restrictions on the sector

and we would need to do all that we could to support our pubs. At

the time of writing, it is now obvious that our concerns during the

summer have become the reality.

The consequence is that turnover for the year under review has

decreased by 33.32% from the previous year to GBP5,019,000. In

turn, the Group has returned an operating profit of GBP539,000, a

decrease of 70.69% on the previous year. The operating profit has

been distorted by the IFRS 16 Lease Accounting calculation which

has been applied to the rent concessions given to our tenants. The

accounting standards setters consider these waivers, rather

peculiarly, to be 'incentives' and as a result the total rent over

the full term of the tenancy has to be apportioned. Accordingly, we

are required to recognise a write back of rents totalling

GBP333,000, money which we have not actually received or even

charged during the period. This has also attracted a corporation

tax charge of GBP63,000.

The Group results are also affected by an impairment cost of

GBP279,000 relating to the Lysley Arms in Pewsham and the George

and Dragon in Dartmouth.

DIVID

The Directors do not recommend the payment of a dividend at the

year-end. When trading is back on a more even keel after

restrictions are eased, the Board will be able to review future

dividends.

SALE OF PROPERTY

I reported at the half-year that a small parcel of land had been

sold in Christow realising a book profit of GBP15,000. Further

sales were achieved in the second half of the year. Two further

parcels of land, one in Strete and the other adjacent to our Kings

Arms in Kingsteignton were sold realising book profits of GBP15,156

and GBP56,244 respectively. Also, an outbuilding adjacent to the

Sandygate Inn near Newton Abbot was sold realising GBP60,738.

Finally, the Bell Inn in Cullompton was sold realising

GBP178,507.

After the end of the financial year, sales have been completed

at The Maltster's Arms and the adjacent Bridge House in

Harbertonford. These properties were held for sale throughout the

year under review. Further properties are the subject of offers

and/or are being marketed for sale and I shall report further on

these at the half-year.

Chairman's statement

W P TUCKER

After a period of ill health which started at the end of 2019

and which made it difficult for him to attend Board meetings, my

father Bill Tucker offered to resign from the Board in August. With

obvious mixed feelings I accepted his resignation. He joined the

Company in 1954 and was appointed to the Board in 1955. He became

Managing Director in 1970 and oversaw, in the same year, the

ceasing of our brewing operations. In 1974 he took over as Chairman

from my Grandfather and, from then, he was instrumental in shaping

the future of the Company as an operator of an estate of quality

pubs. He remains a shareholder with a keen interest in the Company,

our pubs and especially our people. His wealth of knowledge about

our business will always be only a phone call away. I am sure you

all will want to join me in wishing him the happiest of (full)

retirements.

PROSPECTS

In this third lockdown the strain on our hospitals and health

system is being reported daily with harrowing and distressing

images. This is in spite of the restrictions to our normal daily

lives that we have been and are currently living under. Confronting

this health crisis in the best way possible has also placed an

incredible stress on the hospitality sector. The situation remains

fluid; there is hope following the fast rollout of the vaccination

programme but also concerns about the various variant strains of

Covid-19 that are appearing around the world. With this backdrop, I

am proud and grateful for the resilience and patience shown by our

landlords and landladies and of the determination and morale shown

by every one of our staff at head office. It is a commendable

achievement that since March 2020 we have had only three vacancies

to fill. One now has new tenants and the other two have approved

interested parties working with our tenancy team to formalise

agreements. We have continued to attract good candidates even while

the industry is unable to trade.

Even though our cashflow forecasts have shown that we are able

to trade within our banking facility, I am most grateful for the

understanding shown by Barclays Bank. The bank has formally agreed

to waive the testing of our banking covenants until April 2022. As

referred to in the Strategic Review, we have accelerated our

programme of selling non-core assets to keep us well within our

facility.

Since the first lockdown in March of last year, the one constant

our tenants and leaseholders have been able to rely on is the

consistent support from this Company. We have cancelled rents

during the lockdown periods and made fair concessions during the

incredibly difficult trading environment that arose with the tier

systems. The detail of this was reported in our trading update

released to the Stock Exchange on 22 December 2020. The Board are

also determined to look after our head office staff and to use the

Government's Job Retention Scheme to help us retain and protect all

jobs. We continue to conserve cash within the business and I feel

the Company is as best placed as it can be to resume trading when

permitted.

N H P TUCKER

Chairman

15 February 2021

Group income statement

for the year ended 31 October 2020

Notes Total Total

2020 2019

GBP000 GBP000

Revenue 5,019 7,528

--------- ---------

Other operating income 317 302

Purchase of inventories (2,065) (3,100)

Staff costs (1,310) (1,385)

Depreciation of property,

plant and equipment (177) (222)

Other operating charges (1,245) (1,284)

--------- ---------

(4,480) (5,689)

--------- ---------

Group operating profit 539 1,839

Profit on sale of property

plant and equipment 293 185

Impairment of fixed

assets (279) -

Group profit before

finance costs and taxation 553 2,024

Finance income 2 4

Finance costs (141) (184)

Other finance costs - -

- pensions

--------- ---------

(139) (180)

Profit before taxation 414 1,844

Tax expense (300) (313)

Profit for the year

attributable to equity

holders of the parent 114 1,531

--------- ---------

Basic earnings per

share 2 2.4p 32.0p

--------- ---------

Diluted earnings per

share 2 2.4p 32.0p

--------- ---------

Group statement of comprehensive income

for the year ended 31 October 2020

2020 2019

GBP000 GBP000

Profit for the year 114 1,531

-------- --------

Items that will not be reclassified

to profit or loss

Fair value adjustment on investment

in equity

Actuarial (losses) on defined benefit (12) (9)

scheme - -

Tax relating to items that will not - -

be reclassified

-------- --------

(12) (6)

Items that may be reclassified to

profit or loss

Exchange rate differences on translation

of subsidiary undertaking (4) 2

(4) 2

Other comprehensive income for the

year, net of tax 98 1,527

-------- --------

Total comprehensive income attributable

to:

Equity holders of the parent 98 1,527

Group balance sheet

at 31 October 2020

2020 2019

GBP000 GBP000

Non-current assets

Property, plant and equipment 16,615 17,692

Investment property 2,130 1,485

--------- ---------

18,745 19,177

Financial assets 30 41

Deferred tax asset 16 16

--------- ---------

18,791 19,234

--------- ---------

Current assets

Inventories 10 10

Trade and other receivables 1,277 1,344

Cash and cash equivalents 49 51

--------- ---------

1,336 1,405

--------- ---------

Assets held for sale 219 -

--------- ---------

Total assets 20,346 20,639

--------- ---------

Current liabilities

Trade and other payables (666) (953)

Financial liabilities (1,520) (6,087)

Income tax payable (237) (231)

--------- ---------

(2,423) (7,271)

--------- ---------

Non-current liabilities

Other payables (274) (284)

Financial liabilities (4,322) (37)

Deferred tax liabilities (536) (394)

Defined benefit pension plan deficit (92) (92)

--------- ---------

(5,224) (807)

--------- ---------

Total liabilities (7,647) (8,078)

--------- ---------

Net assets 12,669 12,561

--------- ---------

Capital and reserves

Equity share capital 264 264

Capital redemption reserve 673 673

Treasury shares (1,522) (1,562)

Fair value adjustments reserve 5 17

Currency translation 13 17

Retained earnings 13,266 13,152

--------- ---------

Total equity 12,699 12,561

--------- ---------

Group statement of cash flows

for the year ended 31 October 2020

2020 2019

GBP000 GBP000

Operating activities

Profit for the year 114 1,531

Tax expense 301 313

Net finance costs 139 180

Profit on disposal of non-current assets

and assets held for sale (293) (185)

Depreciation and impairment of property,

plant and equipment

Exchange gain on cash, liquid resources 177 222

and loans - -

Difference between pension contributions

paid and amounts

recognised in the income statement - 52

(Increase)/decrease in trade and other

receivables 220 (72)

(Decrease)/increase in trade and other

payables (274) (145)

Impairment of fixed assets 279 -

--------- --- ---------

Cash generated from operations 663 1,896

Income taxes paid (151) (97)

Interest paid (141) (184)

Net cash inflow from operating activities 371 1,615

--------- --- ---------

Investing activities

Interest received 2 4

Proceeds from sale of property, plant

and equipment and assets held for sale 186 278

Payments to acquire property, plant

and equipment (315) (506)

Net cash (outflow)/inflow from investing

activities (127) (224)

--------- --- ---------

Financing activities

Preference dividend paid (1) (1)

Equity dividends paid - (379)

Consideration received by EBT on sale

of shares 62 56

Consideration paid by EBT on purchase

of shares (25) (298)

Capital element of finance lease rental

payments (9) (15)

Loan repayment (1,500) -

Net cash outflow from financing activities (1,473) (637)

--------- --- ---------

(Decrease)/increase in cash and cash

equivalents (1,229) 754

Cash and cash equivalents at the beginning

of the year (3) (757)

--------- --- ---------

Cash and cash equivalents at the year

end (1,232) (3)

--------- --- ---------

Group statement of changes in equity

for the year ended 31 October 2020

Equity Capital Fair

share redemption Treasury value Currency Retained Total

capital reserve shares adjustment translation earnings equity

GBP000 GBP000 GBP000 reserve GBP000 GBP000 GBP000

GBP000

At 1 November

2018 264 673 (1,317) 23 15 11,997 11,655

Profit for the

year - - - - - 1,531 1,531

Other comprehensive

income for the

year

net of income

tax - - - (6) 2 - (4)

--------- ------------ ----------- ------------ -------------- ----------- ---------

Total comprehensive

income for the

year - - - (6) 2 1,531 1,527

--------- ------------ ----------- ------------ -------------- ----------- ---------

Consideration

received

by EBT on sale

of

shares - - 56 - - - 56

Consideration

paid by

EBT on purchase

of shares - - (298) - - - (298)

Loss by EBT on

sale

of shares - - (3) - - 3 -

Equity dividends

paid - - - - - (379) (379)

--------- ------------ ----------- ------------ -------------- ----------- ---------

At 31 October

2019 264 673 (1,562) 17 17 13,152 12,561

--------- ------------ ----------- ------------ -------------- ----------- ---------

Equity Capital Fair

share redemption Treasury value Currency Retained Total

capital reserve shares adjustment translation earnings equity

GBP000 GBP000 GBP000 reserve GBP000 GBP000 GBP000

GBP000

At 1 November

2019 264 673 (1,562) 17 17 13,152 12,561

Profit for the

year - - - - - 114 114

Other comprehensive

income for the

year

net of income

tax - - - (12) (4) - (16)

--------- ------------ ----------- ------------ -------------- ----------- ---------

Total comprehensive

income for the

year - - - (12) (4) 114 98

--------- ------------ ----------- ------------ -------------- ----------- ---------

Consideration

received

by EBT on sale

of

shares - - 62 - - - 62

Consideration

paid by

EBT on purchase

of shares - - (24) - - - (24)

Loss by EBT on

sale

of shares - - 2 - - - 2

Equity dividends - - - - - - -

paid

--------- ------------ ----------- ------------ -------------- ----------- ---------

At 31 October

2020 264 673 (1,522) 5 13 13,266 12,699

--------- ------------ ----------- ------------ -------------- ----------- ---------

Equity share capital

The balance classified as share capital includes the total net

proceeds (nominal amount only) arising or deemed to arise on the

issue of the Company's equity share capital, comprising Ordinary

Shares of 5p each and 'A' Limited Voting Ordinary Shares of 5p

each.

Capital redemption reserve

The capital redemption reserve arises on the re-purchase and

cancellation by the Company of Ordinary Shares .

Treasury shares

Treasury shares represent the cost of The Heavitree Brewery PLC

shares purchased in the market and held by The Heavitree Brewery

PLC Employee Benefits Trust and Employee Share Option Scheme

('EBT').

At 31 October 2020 the Group held 183,719 Ordinary Shares and

254,153 'A' Limited Voting Ordinary Shares (2019: 179,053 Ordinary

Shares and 300,002 'A' Limited Voting Ordinary Shares) of its own

shares. During the year there were purchases of 4,666 Ordinary

Shares and 2,500 'A 'Limited Voting ordinary Shares and sales of

48,349 'A; Limited Voting Ordinary Shares.

Fair value adjustments reserve

The fair value adjustments reserve is used to record differences

in the year on year fair value of the investment classified as fair

value through other comprehensive income.

Foreign currency translation reserve

The foreign currency translation reserve is used to record

exchange differences arising from the translation of the financial

statements of foreign subsidiaries.

Notes to the preliminary announcement

1. Basis of preparation

These figures do not constitute full accounts within the meaning

of Section 396 of the Companies Act 2006. They have been extracted

from the statutory financial statements for the year ended 31

October 2020. The statutory financial statements have not yet been

delivered to the Registrar of Companies.

The auditors, PKF Francis Clark, have reported on the accounts

for the years ended 31 October 2020 and 31 October 2019. Their

audit reports in both years were unqualified, did not include a

reference to any matters to which the auditors drew attention by

way of emphasis without qualifying their report and did not contain

a statement under Section 498 (2) or (3) of the Companies Act 2006

in respect of those accounts.

The financial information in this statement has been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted for use in the European Union. The accounting policies

have been consistently applied and are described in full in the

statutory financial statements for the year ended 31 October 2020,

which are expected to be mailed to shareholders on 12 March 2021.

The financial statements will also be available on the Group's

website www.heavitreebrewery.co.uk .

Going concern

With the uncertain nature of the current Covid-19 pandemic the

Directors have considered the Group's financial resources including

a review of the medium-term financial plan, along with a range of

cash flow forecasts for 12 months from the date of approval of

these financial statements, the Group has positive cash generation

from its operations and the gearing remains low. These forecasts

include continued rent concessions for Tenants and factoring in a

possible lockdown until the end of May 2021 and the tier

restrictions still being in place over the summer trading months.

The mitigation measures which were put in place in March 2020 and

are detailed on page 9 are still in place in order to protect the

cash position of the business and these have been incorporated into

the forecasts for future cash positions. The forecast for capital

receipts in 2021 include non-core asset sales of GBP2m. These

forecasts leave the Group with headroom of over GBP1.1m on an

overdraft facility of GBP3m. The Board has looked at the ability to

sustain cashflow if lockdown continued into the summer and will

continue to review cashflows as guidance from Government

changes.

Since the year end, the Board also made the decision to

accelerate the paying down of its current GBP4.5m term loan by the

selling of non-core assets to secure its current position and the

long term trading position of the Group. The board has identified

up to 15 non-core assets with a value of between GBP5m and GBP7m to

be realised over a period of 2 to 3 years, these include unlicensed

properties and developments with permissions which are already

within the Estate.

The Board has engaged with the bank regarding its current

facilities and forward trading, this has included the securing of

the overdraft facilities and the waiving of covenant testing until

April 2022 along with the agreement on paying down of loan

facilities. The bank is satisfied that the Group's forecasts and

projections, which take account of the anticipated changes which

will come about as a direct result of the Covid-19 pandemic and

shows that the Group will be able to operate within its facilities.

The current trading performance of the Group also shows that it

will be able to operate within the level of its facilities for the

foreseeable future. With the value in the Estate being realised

over time and with the support from the bank there are no material

uncertainties. For this reason, the Group continues to adopt the

going concern basis in preparing its financial statements.

2. Earnings per share

Basic earnings per share amounts are calculated by dividing

profit for the year attributable to ordinary equity holders of the

parent by the weighted average number of Ordinary shares and 'A'

Limited Voting Ordinary shares outstanding during the year.

The following reflects the income and shares data used in the

basic and diluted earnings per share

Computation:

2020 2019

GBP000 GBP000

Profit for the year 114 1,531

-------- --------

2020 2019

N(o) . N(o) .

(000) (000)

-------- --------

Basic weighted average number of shares

(excluding treasury shares) 4,801 4,786

-------- --------

There have been no other transactions involving ordinary shares

or potential ordinary shares between the reporting date and the

date of completion of these financial statements.

3. Dividends paid and proposed

2020 2019

GBP000 GBP000

Declared and paid during the year:

Equity dividends on ordinary shares:

Final dividend for 2019: nil (2018: 3.675p) - 224

First dividend for 2020: nil (2019: 3.675p) - 194

Less dividend on shares held within employee

share schemes - (39)

Dividends paid - 379

-------- --------

Proposed for approval at AGM

(not recognised as a liability as at 31

October)

- 224

Final dividend for 2020 nil (2019: 4.25p)

Cumulative preference dividends 1 1

-------- --------

4. Segment information

Primary reporting format - business segments

During the year the Group operated in one business segment -

leased estate.

Leased estate represents properties which are leased to tenants

to operate independently from the Group, under tied and free of tie

tenancies.

Secondary reporting format - geographical segments

The following tables present revenue, expenditure and certain

asset information regarding the Group's geographical segments for

the years ended 31 October 2020 and 2019. Revenue is based on the

geographical location of customers and assets are based on the

geographical location of the asset.

Segment information

Year ended 31 October 2020 UK United Total

GBP000 States GBP000

GBP000

Revenue

Sales to external customers 5,019 - 5,019

Other segment information

Segment assets 20,304 42 20,346

-------- -------- --------

Total Assets 20,304 42 20,346

-------- -------- --------

Capital expenditure

Property, plant and equipment 355 - 355

-------- -------- --------

Year ended 31 October 2019 UK United Total

GBP000 States GBP000

GBP000

Revenue

Sales to external customers 7,528 - 7,528

Other segment information

Segment assets

20,596 43 20,639

-------- -------- --------

Total Assets 20,596 43 20,639

-------- -------- --------

Capital expenditure

Property, plant and equipment 505 - 505

5. General information

The 2020 Annual Report and Financial Statements will be

published and posted to shareholders on 12th March 2021 Further

copies may be obtained by contacting the Company Secretary at The

Heavitree Brewery PLC, Trood Lane, Matford, Exeter EX2 8YP. The

2020 Annual Report and Financial Statements will also be available

on the Company's website at

http://www.heavitreebrewery.co.uk/financial/

The Annual General Meeting will be held at the Registered Office

on 15 April 2021 at 11.30am.

Ends.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKPBPDBKDPBD

(END) Dow Jones Newswires

February 15, 2021 10:00 ET (15:00 GMT)

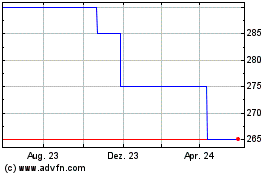

Heavitree Brewery (LSE:HVT)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Heavitree Brewery (LSE:HVT)

Historical Stock Chart

Von Jan 2024 bis Jan 2025