TIDMFEV

Fidelity European Values PLC

Half-Yearly results for the six months ended 30 June 2020 (unaudited)

Financial Highlights:

* The Board of Fidelity European Values PLC (the "Company") recommends an

interim dividend of 2.60 pence per share.

* The Company recorded a net asset value ("NAV") total return of +3.0%

compared to a total return of -1.9% for the Company's Benchmark Index

* The discount to NAV widened over the period from 6.2% to 7.4%, due to a

share price total return of +1.7%.

* The EU's European Recovery Fund is a strong political and economic

statement

Contacts

For further information, please contact:

Smita Amin

Company Secretary

01737 836347

FIL Investments International

PORTFOLIO MANAGER'S HALF-YEARLY REVIEW

PERFORMANCE REVIEW

During the first six months of the year the net asset value ("NAV") total

return was +3.0% compared to a total return of -1.9% for the FTSE World Europe

(ex UK) Index which is the Company's Benchmark Index. The share price total

return was +1.7%, which is below the NAV total return because of a widening of

the share price discount to NAV. (All figures in UK sterling.)

MARKET REVIEW

Continental European markets were very volatile in the first half of this year.

The first quarter was one of the worst on record while the second was one of

the best. Overall, share prices declined during the review period, although

this was cushioned by the weakness of the pound which depreciated seven percent

against the euro.

The catalyst of this volatility was, of course, the uncertainty caused by the

Coronavirus (COVID-19) pandemic which brought much of the world to a standstill

and caused markets to crash during the first quarter. Share prices recovered

rapidly during the second quarter as central banks and governments responded to

a looming economic crisis with an awesome barrage of monetary and fiscal

easing.

Lockdowns, to control the spread of COVID-19, have, inevitably, resulted in

significant downward revisions to economic growth forecasts. Encouragingly,

however, this appears to have galvanised the European Union ("EU") into action

with the announcement, among other fiscal remedies, of an euro 750bn "Recovery

Fund" to support its members' economies with a range of infrastructure and

renewable energy projects. As always, the substance of the package will be

subject to scrutiny and ultimate implementation, but the initiative has been

greeted as a step in the right direction, particularly by investors wary of a

new Eurozone crisis.

Shorter term earnings and dividends for European companies have suffered

substantial cuts too in the wake of the pandemic. Indeed, dividends have,

unusually, proven even less resilient than earnings for a range of reasons

including regulatory constraints in the financial sectors and political

pressure to restrain payments to shareholders, particularly in France. Some

companies have also not been able to pay dividends due to fundamental pressure

on liquidity as revenues ground to a halt. While the equity markets'

resilience, despite these downgrades to earnings and dividends, may suggest

that investors view these reductions as transitory, the reductions in long term

bond yields, and the liquidity being pumped into markets by central banks, will

support the valuation of equities for some time to come.

Sector returns, in general, have diverged dramatically over the review period.

Although the pandemic's impact on activity was the main determinant of

performance, other factors also played their roles. Most notably, the growing

focus on environmental, social and governance (ESG) standards influenced fund

flows and sector performance too. Sectors such as energy, that were on the

wrong side of both, performed particularly poorly. Technology, at the other

extreme, was the outstanding beneficiary as the pandemic appeared likely to

accelerate structural trends such as the shift to on-line and the

digitalisation of companies.

PORTFOLIO MANAGER'S REPORT

The Company's NAV increased slightly in the six months to 30 June 2020,

performing better than the Benchmark Index which declined slightly.

The Company's focus on companies with strong balance sheets provided notable

resilience during the first quarter as equity markets fell precipitously.

Pleasingly, the Company was able to keep pace with the Benchmark in the second

quarter partly thanks to a slight increase in gearing after the Company closed

all its short positions and went ex-dividend. Overall, relative performance was

encouraging during the review period although absolute returns were lacklustre.

The relative outperformance was helped by stock-picking. Swedish Match was,

once again, the stand-out performer reporting strong first quarter results as

the company benefited from the on-going success of Zyn, the nicotine pouch

business in the United States, and from consumers stocking up on their products

as lockdowns began. At the other end of the spectrum, many of the Company's

bank holdings performed poorly as investors worried about the outlook for bad

debts. Traffic-related companies, such as MTU and Atlantia, also performed

poorly as did Sodexo, the contract caterer, which struggled given the closure

of most offices and the cancellation of most events.

In terms of activity, two holdings were sold during the review period. Royal

Dutch Shell was disposed early in the year after the company published

disappointing fourth quarter results which made it clear that there was no

prospect of dividend growth. Iliad, the French telecoms company, was also sold,

partly in a tender offer by the majority share owner Xavier Niel.

Three new positions were acquired: Enel, an Italian utility company, which

stands to benefit from the continued growth of renewable energy, SIG Combibloc,

a Swiss packaging company and Zurich Insurance which should benefit from

improved premium pricing after a difficult year for claims in 2020.

Five Highest Contributors to NAV total return Sector Country %

Swedish Match Consumer Sweden +1.2

Staples

Deutsche Boerse Financials Germany +0.6

ASML Information Netherlands +0.5

Technology

Airbus Industrials France +0.5

Fresenius Medical Care Healthcare Germany +0.5

Five Highest Detractors to NAV total return Sector Country %

ABN AMRO Bank Financials Netherlands -0.8

Sodexo Consumer France -0.6

Discretionary

DNB Financials Norway -0.5

MTU Aero Engines Industrials Germany -0.5

3i Group Financials UK -0.5

OUTLOOK

The second half of this year is likely to be testing; not least because the

pandemic is not yet over. Herd immunity or a vaccine are distant on the horizon

so further waves and lockdowns appear inevitable. Central banks and governments

are doing their utmost to support economies, and markets, but in doing so are

potentially creating new problems for the future. Many companies that would

otherwise have gone out of business will limp along, with reduced levels of

staffing, such that many industries will continue to be oversupplied. Consumers

are likely to remain wary and companies will hesitate before investing. Any

economic recovery is likely to be fitful and anaemic. Equity markets have

already bounced back strongly in the second quarter of this year so further

progress will rely on a recovery in earnings and dividends much stronger than

your Portfolio Manager currently anticipates, given that valuations, in

aggregate, are already full. Presidential elections in the United States, not

to mention the negotiations around a new relationship between the United

Kingdom and the EU, have the potential to create moments of panic or relief in

the second half of this year.

Your Portfolio Manager will, however, as always, stay fully invested because,

as has been demonstrated time and again, equities do well over the long term

even through many crises and despite many bleak outlooks. Your Portfolio

Manager will also continue to focus on attractively-valued companies which are

able to sustain consistent dividend growth. As mentioned before, consistency in

dividend growth has become more challenging for many continental European

companies, including some of those held in the portfolio. Determining the best

course of action will be decided on a case by case basis with an eye on

valuation. Although execution of this investment strategy has become more

complicated, its merit will not diminish especially in what is likely to

continue to be an unusually volatile environment.

By order of the Board

FIL INVESTMENTS INTERNATIONAL

3 August 2020

INTERIM MANAGEMENT REPORT AND DIRECTORS' RESPONSIBILITY STATEMENT

COMPANY NAME CHANGE

As reported in the Annual Report for the year ended 31 December 2019, the Board

announced its intention to change the Company's name from Fidelity European

Values PLC to Fidelity European Trust PLC. The reason for this was to align the

Company's name more closely to its objective, and to avoid confusion with value

products. It had been expected that the name change would have been effective

on 12 May 2020, the date of the Company's Annual General Meeting, and following

the requisite statutory filings. However, the impact of COVID-19, and the

resultant Government's Stay at Home Measures, have caused substantial delays in

the usual statutory filing process. It is not currently possible to deliver the

required documents in person to Companies House for action on the same day,

which would provide shareholders and the market appropriate certainty about the

date of the Company's name change. It still remains the Board's intention to

change the name of the Company to Fidelity European Trust PLC. However, until

this can be executed with Companies House at a planned future date, the Board

has decided that the Company should continue as Fidelity European Values PLC at

least until 30 September 2020. The delay in the name change was announced on

the London Stock Exchange on 6 May 2020.

Whenever the change to the Company's name is made, it will retain its existing

ticker (FEV.L), SEDOL (BK1PKQ9) and ISIN (GB00BK1PKQ95). An announcement will

be made on the London Stock Exchange ahead of the change in name taking effect.

INTRODUCTION OF CO-PORTFOLIO MANAGER

The Board has agreed with Fidelity to appoint Marcel Stotzel as a Co-Portfolio

Manager alongside Sam Morse, the Company's Portfolio Manager. Marcel and Sam

have worked closely together in recent years. Marcel is a very talented analyst

and investor, with extensive experience in European companies. Marcel will help

Sam with oversight of his different strategies and mandates and will assist in

client servicing and marketing.

The move to a Co-Portfolio Manager structure should strengthen the investment

process by introducing greater challenge and also increase the ability to meet

more companies and, effectively, be in two places at once. Marcel as

Co-Portfolio Manager, will have a permanent association with the Company, and

will share a common investment approach and complementary investment

experience.

BOARD CHANGES

Having served on the Board for ten years as a non-executive Director, Dr Robin

Niblett stepped down from the Board at the conclusion of the Annual General

Meeting on 12 May 2020. As Dr Niblett's successor, Sir Ivan Rogers was

appointed on the Board as a non-executive Director on 1 January 2020.

INTERIM DIVID

The Board's dividend policy, which was updated last year, is to pay dividends

twice yearly in order to smooth the dividend payments for the reporting year.

The Company's revenue return for the six months to 30 June 2020 was 3.99 pence

per share.

The Board has declared an interim dividend of 2.60 pence per share which is a

modest 0.4% increase on the 2.59 pence per share paid as the interim dividend

in 2019. This will be paid on 30 October 2020 to shareholders on the register

on 25 September 2020 (ex-dividend date 24 September 2020). The Board's policy

is to seek to pay a progressive dividend in normal circumstances. Owing to

COVID-19 and its economic effects, however, some companies have cut or

cancelled their dividend payments this year, and this pattern is likely to

continue while the virus remains in broad circulation. Accordingly, the Board's

present intention during this period is to pay nominal increases in total

annual dividends, utilising reserves as necessary. Should company dividend

practices be judged, once the crisis is over, to have changed on a permanent

rather than temporary basis, then the Board will reconsider its dividend paying

policy at that time.

Shareholders may choose to reinvest their dividends for additional shares in

the Company. Details of the Dividend Reinvestment Plan can be found in the

Half-Yearly Report.

DISCOUNT MANAGEMENT AND TREASURY SHARES

The Board operates an active discount management policy, the primary purpose of

which is to reduce discount volatility. Buying shares at a discount also

results in an enhancement to the NAV per share. As a consequence, the Board

seeks to maintain the discount in single digits in normal market conditions. In

order to assist in managing the discount, the Board has shareholder approval to

hold in Treasury ordinary shares repurchased by the Company, rather than

cancelling them. These shares are then available to re-issue at NAV per share

or at a premium to NAV, facilitating the management of and enhancing liquidity

in the Company's shares.

In the six months to 30 June 2020 and as at the date of this report, the

Company has not repurchased any ordinary shares into Treasury or for

cancellation.

PRINCIPAL RISKS AND UNCERTAINTIES

The Board, with the assistance of the Alternative Investment Fund Manager (FIL

Investment Services (UK) Limited (the "Manager")), has developed a risk matrix

which, as part of the risk management and internal controls process, has

identified the key risks and uncertainties faced by the Company. These

principal risks and uncertainties fall into the following categories: market

risk; performance risk; key person risk; economic and political risk; discount

control risk; gearing risk; derivatives risk; operational risks from cybercrime

and other significant events such as the COVID-19 pandemic; tax and regulatory

risks; and third party service providers operational risks. Information on each

of these risks is given in the Strategic Report section of the Annual Report

for the year ended 31 December 2019 which can be found on the Company's pages

of the Manager's website at www. fidelityinvestmenttrusts.com.

These risks and uncertainties have not materially changed during the six months

to 30 June 2020, with the exception of the impact of the risks arising from

COVID-19, and are equally applicable to the remaining six months of the

Company's financial year.

CORONAVIRUS (COVID-19)

The risks arising from COVID-19 are being kept under constant review by the

Board and the Manager. The Manager has contingency plans in place to allow for

the continuation of Fidelity's operations and to look after the safety of their

employees.

Investors should be prepared for market fluctuations and remember that holding

shares in the Company should be considered to be a long term investment. These

risks are somewhat mitigated by the investment trust structure of the Company

which means that no forced sales will need to take place to deal with any

redemptions. Therefore, investments in the Company's portfolio can be held over

a longer time horizon.

The Manager is keeping its business continuity plans and operational resilience

strategies under constant review and will take all reasonable steps to continue

meeting its regulatory obligations and to assess operational risks, the ability

to continue operating and the steps it needs to take to serve and support its

clients, including the Board. For example, to enhance its resilience, the

Manager has mandated work from home arrangements and implemented split team

working for those whose work is deemed necessary to be carried out in the

office. The Manager has also imposed self-isolation arrangements on staff in

line with Government recommendations and guidance. The Company's other third

party service providers have also implemented similar measures to ensure

business disruption can be kept to a minimum.

TRANSACTIONS WITH THE MANAGER AND RELATED PARTIES

The Manager has delegated the Company's portfolio management and company

secretariat services to FIL Investments International. Transactions with the

Manager and related party transactions with the Directors are disclosed in Note

14 to the Financial Statements below.

GOING CONCERN STATEMENT

The Directors have considered the Company's investment objective, risk

management policies, liquidity risk, credit risk, capital management policies

and procedures, the nature of its portfolio (being mainly securities which are

readily realisable) and its expenditure and cash flow projections and have

concluded that the Company has adequate resources to continue in operational

existence for the foreseeable future. Thus, they continue to adopt the going

concern basis of accounting in preparing these Financial Statements.

This conclusion also takes into account the Board's assessment of the risks

arising from COVID-19.

Continuation votes are held every two years and the next continuation vote will

be put to shareholders at the Annual General Meeting in 2021.

By order of the Board

FIL INVESTMENTS INTERNATIONAL

3 August 2020

DIRECTORS' RESPONSIBILITY STATEMENT

The Disclosure and Transparency Rules ("DTR") of the UK Listing Authority

require the Directors to confirm their responsibilities in relation to the

preparation and publication of the Interim Management Report and Financial

Statements.

The Directors confirm to the best of their knowledge that:

a) the condensed set of Financial Statements contained within the

Half-Yearly Report has been prepared in accordance with the Financial Reporting

Council's Standard FRS 104: Interim Financial Reporting; and

b) the Interim Management Report, together with the Portfolio Manager's

Half-Yearly Review above, includes a fair review of the information required by

DTR 4.2.7R and 4.2.8R.

In line with previous years, the Half-Yearly Report has not been audited or

reviewed by the Company's Independent Auditor.

The Half-Yearly Report was approved by the Board on 3 August 2020 and the above

responsibility statement was signed on its behalf by Vivian Bazalgette,

Chairman.

TWENTY LARGEST HOLDINGS AS AT 30 JUNE 2020

The Gross Asset Exposures shown below and on the next page measure exposure to

market price movements as a result of owning shares and derivative instruments.

The Balance Sheet Value is the actual value of the portfolio. Where a contract

for difference ("CFD") is held, the Balance Sheet Value reflects the profit or

loss on the contract since it was opened and is based on how much the share

price of the underlying share has moved.

Balance

Sheet

Gross Asset Exposure Value

Long Exposures - shares unless otherwise stated GBP'000

GBP'000 %1

Nestlé

Packaged Food 87,439 7.6 87,439

-------------- -------------- --------------

Roche

Pharmaceuticals 70,525 6.1 70,525

-------------- -------------- --------------

SAP

Software 52,873 4.6 52,873

-------------- -------------- --------------

ASML

Semiconductors 49,890 4.3 49,890

-------------- -------------- --------------

LVMH Moët Hennessy

Personal Goods 48,674 4.2 48,674

-------------- -------------- --------------

Sanofi (long CFD)

Pharmaceuticals 46,974 4.1 7,259

-------------- -------------- --------------

L'Oréal

Personal Goods 43,168 3.7 43,168

-------------- -------------- --------------

Novo Nordisk

Healthcare Services 39,824 3.4 39,824

-------------- -------------- --------------

Enel

Electricity 39,814 3.4 39,814

-------------- -------------- --------------

Swedish Match

Tobacco 36,655 3.2 36,655

-------------- -------------- --------------

Total

Oil & Gas 36,010 3.1 36,010

-------------- -------------- --------------

Deutsche Boerse

Financial Services 34,997 3.0 34,997

-------------- -------------- --------------

Linde (long CFD)

Chemicals 32,691 2.8 1,724

-------------- -------------- --------------

Symrise

Chemicals 31,183 2.7 31,183

-------------- -------------- --------------

EssilorLuxottica

Health Care Equipment & Services 31,119 2.7 31,119

-------------- -------------- --------------

3i Group

Financial Services 27,689 2.4 27,689

-------------- -------------- --------------

Legrand

Electronic & Electrical Equipment 27,026 2.4 27,026

-------------- -------------- --------------

Telenor

Mobile Telecommunications 26,784 2.3 26,784

-------------- -------------- --------------

Fresenius Medical Care

Healthcare Services 24,932 2.2 24,932

-------------- -------------- --------------

Partners Group

Financial Services 24,505 2.1 24,505

-------------- -------------- --------------

Twenty largest long exposures 812,772 70.3 742,090

-------------- -------------- --------------

Other long exposures 392,679 34.0 392,679

======== ======== ========

Total long exposures before long futures2,3 1,205,451 104.3 1,134,769

======== ======== ========

Long Futures

Euro Stoxx 50 Future September 20203 40,438 3.5 1,051

-------------- -------------- --------------

Gross Asset Exposure3,4 1,245,889 107.8

-------------- --------------

Portfolio Fair Value5 1,135,820

--------------

Net current assets (excluding derivative assets and 19,913

liabilities)

========

Shareholders' Funds (per the Balance Sheet below) 1,155,733

========

1 Gross Asset Exposure is expressed as a percentage of Shareholders' Funds.

2 Total long exposures before long futures comprises investments of GBP

1,125,786,000 and long CFDs of GBP79,665,000.

3 See Note 13 below.

4 Gross Asset Exposure comprises market exposure to investments of GBP

1,125,786,000 plus market exposure to all derivative instruments of GBP

120,103,000. Derivative instruments comprise long CFDs of GBP79,665,000 and long

futures of GBP40,438,000.

5 Portfolio Fair Value comprises investments of GBP1,125,786,000 plus

derivative assets of GBP10,034,000 (per the Balance Sheet below).

FINANCIAL STATEMENTS

INCOME STATEMENT FOR THE SIX MONTHSED 30 JUNE 2020

six months ended 30 June 2020 six months ended 30 June 2019 year ended 31 December 2019

unaudited unaudited audited

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gains on investments - 12,987 12,987 - 157,063 157,063 - 183,944 183,944

Gains on derivative - 5,215 5,215 - 7,806 7,806 - 17,516 17,516

instruments

Income 4 18,950 - 18,950 28,016 - 28,016 34,201 - 34,201

Investment management fees 5 (1,061) (3,182) (4,243) (1,010) (3,030) (4,040) (2,119) (6,357) (8,476)

Other expenses (428) - (428) (406) - (406) (857) - (857)

Foreign exchange (losses)/ - (129) (129) - 505 505 - 199 199

gains

-------------- -------------- -------------- -------------- -------------- -------------- -------------- -------------- --------------

Net return on ordinary 17,461 14,891 32,352 26,600 162,344 188,944 31,225 195,302 226,527

activities before finance

costs and taxation

Finance costs 6 (57) (173) (230) (140) (419) (559) (254) (760) (1,014)

-------------- -------------- -------------- -------------- -------------- -------------- -------------- -------------- --------------

Net return on ordinary 17,404 14,718 32,122 26,460 161,925 188,385 30,971 194,542 225,513

activities before taxation

Taxation on return on 7 (986) - (986) (1,587) - (1,587) (2,155) - (2,155)

ordinary activities

======== ======== ======== ======== ======== ======== ======== ======== ========

Net return on ordinary 16,418 14,718 31,136 24,873 161,925 186,798 28,816 194,542 223,358

activities after taxation

for the period

======== ======== ======== ======== ======== ======== ======== ======== ========

Return per ordinary share 8 3.99p 3.58p 7.57p 6.04p 39.32p 45.36p 7.00p 47.26p 54.26p

======== ======== ======== ======== ======== ======== ======== ======== ========

The Company does not have any other comprehensive income. Accordingly the net

return on ordinary activities after taxation for the period is also the total

comprehensive income for the period and no separate Statement of Comprehensive

Income has been presented.

The total column of this statement represents the Income Statement of the

Company. The revenue and capital columns are supplementary and presented for

information purposes as recommended by the Statement of Recommended Practice

issued by the AIC.

No operations were acquired or discontinued in the period and all items in the

above statement derive from continuing operations.

STATEMENT OF CHANGES IN EQUITY FOR THE SIX MONTHSED 30 JUNE 2020

Share Capital Total

share premium redemption capital revenue shareholders'

capital account reserve reserve reserve funds

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Six months ended 30 June

2020 (unaudited)

Total shareholders' funds 10,411 58,615 5,414 1,037,007 29,115 1,140,562

at 31 December 2019

Net return on ordinary - - - 14,718 16,418 31,136

activities after taxation

for the period

Dividend paid to 9 - - - - (15,965) (15,965)

shareholders

-------------- -------------- -------------- -------------- -------------- --------------

Total shareholders' funds 10,411 58,615 5,414 1,051,725 29,568 1,155,733

at 30 June 2020

-------------- -------------- -------------- -------------- -------------- --------------

Six months ended 30 June

2019 (unaudited)

Total shareholders' funds 10,411 58,615 5,414 844,043 36,828 955,311

at 31 December 2018

Net return on ordinary - - - 161,925 24,873 186,798

activities after taxation

for the period

Repurchase of ordinary 11 - - - (1,591) - (1,591)

shares

Dividend paid to 9 - - - - (25,872) (25,872)

shareholders

-------------- -------------- -------------- -------------- -------------- --------------

Total shareholders' funds 10,411 58,615 5,414 1,004,377 35,829 1,114,646

at 30 June 2019

-------------- -------------- -------------- -------------- -------------- --------------

Year ended 31 December

2019 (audited)

Total shareholders' funds 10,411 58,615 5,414 844,043 36,828 955,311

at 31 December 2018

Net return on ordinary - - - 194,542 28,816 223,358

activities after taxation

for the year

Repurchase of ordinary 11 - - - (1,578) - (1,578)

shares

Dividends paid to 9 - - - - (36,529) (36,529)

shareholders

-------------- -------------- -------------- -------------- -------------- --------------

Total shareholders' funds 10,411 58,615 5,414 1,037,007 29,115 1,140,562

at 31 December 2019

======== ======== ======== ======== ======== ========

BALANCE SHEET AS AT 30 JUNE 2020

Company Number 2638812

30 June 31 December 30 June

2020 2019 2019

unaudited audited unaudited

Notes GBP'000 GBP'000 GBP'000

Fixed assets

Investments 10 1,125,786 1,108,702 1,084,330

-------------- -------------- --------------

Current assets

Derivative instruments 10 10,034 16,576 8,856

Debtors 11,490 5,134 9,535

Amounts held at futures clearing houses and brokers 6,113 2,029 640

Fidelity Institutional Liquidity Fund 106 46 38

Cash at bank 6,576 9,444 15,252

-------------- -------------- --------------

34,319 33,229 34,321

-------------- -------------- --------------

Creditors

Derivative instruments 10 - (457) (648)

Other creditors (4,372) (912) (3,357)

-------------- -------------- --------------

(4,372) (1,369) (4,005)

-------------- -------------- --------------

Net current assets 29,947 31,860 30,316

-------------- -------------- --------------

Net assets 1,155,733 1,140,562 1,114,646

======== ======== ========

Capital and reserves

Share capital 11 10,411 10,411 10,411

Share premium account 58,615 58,615 58,615

Capital redemption reserve 5,414 5,414 5,414

Capital reserve 1,051,725 1,037,007 1,004,377

Revenue reserve 29,568 29,115 35,829

-------------- -------------- --------------

Total shareholders' funds 1,155,733 1,140,562 1,114,646

======== ======== ========

Net asset value per ordinary share 12 280.88p 277.19p 270.90p

======== ======== ========

NOTES TO THE FINANCIAL STATEMENTS

1 PRINCIPAL ACTIVITY

Fidelity European Values PLC is an Investment Company incorporated in England

and Wales with a premium listing on the London Stock Exchange. The Company's

registration number is 2638812, and its registered office is Beech Gate,

Millfield Lane, Lower Kingswood, Tadworth, Surrey, KT20 6RP. The Company has

been approved by HM Revenue & Customs as an Investment Trust under Section 1158

of the Corporation Tax Act 2010 and intends to conduct its affairs so as to

continue to be approved.

2 PUBLICATION OF NON-STATUTORY ACCOUNTS

The Financial Statements in this Half-Yearly Report have not been audited by

the Company's Independent Auditor and do not constitute statutory accounts as

defined in section 434 of the Companies Act 2006 (the Act). The financial

information for the year ended 31 December 2019 is extracted from the latest

published Financial Statements of the Company. Those Financial Statements were

delivered to the Registrar of Companies and included the Independent Auditor's

Report which was unqualified and did not contain a statement under either

section 498(2) or 498(3) of the Act.

3 BASIS OF PREPARATION

The Company prepares its Financial Statements on a going concern basis and in

accordance with UK Generally Accepted Accounting Practice ("UK GAAP") and FRS

102: The Financial Reporting Standard applicable in the UK and Republic of

Ireland, issued by the Financial Reporting Council. The Financial Statements

are also prepared in accordance with the Statement of Recommended Practice:

Financial Statements of Investment Trust Companies and Venture Capital Trusts

("SORP") issued by the Association of Investment Companies ("AIC") in October

2019. FRS 104: Interim Financial Reporting has also been applied in preparing

this condensed set of Financial Statements. The accounting policies followed

are consistent with those disclosed in the Company's Annual Report and

Financial Statements for the year ended 31 December 2019.

4 INCOME

six months six months

ended ended year ended

30.06.20 30.06.19 31.12.19

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

Investment income

Overseas dividends 15,705 24,621 29,019

Overseas scrip dividends 219 347 795

UK dividends 673 1,145 2,058

-------------- -------------- --------------

16,597 26,113 31,872

-------------- -------------- --------------

Derivative income

Income recognised from futures contracts 675 428 567

Dividends received on long CFDs 1,615 1,431 1,658

Interest received on long CFDs1 36 20 45

-------------- -------------- --------------

2,326 1,879 2,270

-------------- -------------- --------------

Investment and derivative income 18,923 27,992 34,142

======== ======== ========

Other interest

Interest received on deposits and money market funds 27 24 48

Interest received on tax reclaims - - 11

-------------- -------------- --------------

27 24 59

-------------- -------------- --------------

Total income 18,950 28,016 34,201

======== ======== ========

1 Due to negative interest rates during the reporting period, the Company

received interest on its long CFDs.

No special dividends have been recognised in capital during the period (six

months ended 30 June 2019: GBPnil and year ended 31 December 2019: GBPnil).

5 INVESTMENT MANAGEMENT FEES

Revenue Capital Total

GBP'000 GBP'000 GBP'000

Six months ended 30 June 2020 (unaudited)

Investment management fees 1,061 3,182 4,243

-------------- -------------- --------------

Six months ended 30 June 2019 (unaudited)

Investment management fees 1,010 3,030 4,040

-------------- -------------- --------------

Year ended 31 December 2019 (audited)

Investment management fees 2,119 6,357 8,476

======== ======== ========

FIL Investment Services (UK) Limited is the Company's Alternative Investment

Fund Manager and has delegated portfolio management to FIL Investments

International ("FII"). Both companies are Fidelity group companies.

FII charges investment management fees at an annual rate of 0.85% of net assets

up to GBP400 million and 0.75% of net assets in excess of GBP400 million. Fees are

payable monthly in arrears and are calculated on a daily basis.

6 FINANCE COSTS

Revenue Capital Total

GBP'000 GBP'000 GBP'000

Six months ended 30 June 2020 (unaudited)

Interest paid on deposits1 18 54 72

Interest paid on short CFDs1 7 21 28

Dividends paid on short CFDs 32 98 130

-------------- -------------- --------------

57 173 230

======== ======== ========

Six months ended 30 June 2019 (unaudited)

Interest paid on deposits1 6 18 24

Interest paid on short CFDs1 20 59 79

Dividends paid on short CFDs 114 342 456

-------------- -------------- --------------

140 419 559

======== ======== ========

Year ended 31 December 2019 (audited)

Interest paid on deposits1 30 89 119

Interest paid on short CFDs1 27 81 108

Dividends paid on short CFDs 197 590 787

-------------- -------------- --------------

254 760 1,014

======== ======== ========

1 Due to negative interest rates during the reporting period, the Company

paid interest on its short CFDs and deposits.

7 TAXATION ON RETURN ON ORDINARY ACTIVITIES

six six

months months year

ended ended ended

30.06.20 30.06.19 31.12.19

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

Overseas taxation 986 1,587 2,155

======== ======== ========

8 RETURN PER ORDINARY SHARE

six months six months

ended ended year ended

30.06.20 30.06.19 31.12.19

unaudited unaudited audited

Revenue return per ordinary share 3.99p 6.04p 7.00p

Capital return per ordinary share 3.58p 39.32p 47.26p

-------------- -------------- --------------

Total return per ordinary share 7.57p 45.36p 54.26p

======== ======== ========

The return per ordinary share is based on the net return on ordinary activities

after taxation for the period divided by the weighted average number of

ordinary shares held outside of Treasury during the period, as shown below:

GBP'000 GBP'000 GBP'000

Net revenue return on ordinary activities after taxation for 16,418 24,873 28,816

the period

Net capital return on ordinary activities after taxation for 14,718 161,925 194,542

the period

-------------- -------------- --------------

Net total return on ordinary activities after taxation for 31,136 186,798 223,358

the period

======== ======== ========

number number number

Weighted average number of ordinary shares held outside of 411,466,049 411,828,509 411,645,789

Treasury during the period

========== ========== ==========

9 DIVIDS PAID TO SHAREHOLDERS

six months six months

ended ended year ended

30.06.20 30.06.19 31.12.19

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

Final dividend of 3.88 pence per ordinary share for the year 15,965 - -

ended 31 December 2019

Interim dividend of 2.59 pence per ordinary share for the - - 10,657

year ended 31 December 2019

Final dividend of 6.28 pence per ordinary share for the year - 25,872 25,872

ended 31 December 2018

-------------- -------------- --------------

15,965 25,872 36,529

======== ======== ========

The Company has declared an interim dividend for the six month period to 30

June 2020 of 2.60 pence per ordinary share (2019: 2.59 pence). The interim

dividend will be paid on 30 October 2020 to shareholders on the register on 25

September 2020 (ex-dividend date 24 September 2020). The total cost of this

interim dividend, which has not been included as a liability in these Financial

Statements, is GBP10,698,000 (2019: GBP10,657,000). This amount is based on the

number of ordinary shares held outside of Treasury at the date of this report.

10 FAIR VALUE HIERARCHY

The Company is required to disclose the fair value hierarchy that classifies

its financial instruments measured at fair value at one of three levels,

according to the relative reliability of the inputs used to estimate the fair

values.

Classification Input

Level 1 Valued using quoted prices in active markets for identical assets

Level 2 Valued by reference to inputs other than quoted prices included within

level 1 that are observable (i.e. developed using market data) for the

asset or

liability, either directly or indirectly.

Level 3 Valued by reference to valuation techniques using inputs that are not based

on observable market data

Categorisation within the hierarchy has been determined on the basis of the

lowest level input that is significant to the fair value measurement of the

relevant asset. The table below sets out the Company's fair value hierarchy:

level 1 level 2 level 3 total

30 June 2020 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

Financial assets at fair value through profit or

loss

Investments 1,125,786 - - 1,125,786

Derivative instrument assets 1,051 8,983 - 10,034

-------------- -------------- -------------- --------------

1,126,837 8,983 - 1,135,820

-------------- -------------- -------------- --------------

Financial liabilities at fair value through profit

or loss

Derivative instrument liabilities - - - -

======== ======== ======== ========

level 1 level 2 level 3 total

31 December 2019 (audited) GBP'000 GBP'000 GBP'000 GBP'000

Financial assets at fair value through profit or

loss

Investments 1,108,702 - - 1,108,702

Derivative instrument assets - 16,576 - 16,576

-------------- -------------- -------------- --------------

1,108,702 16,576 - 1,125,278

-------------- -------------- -------------- --------------

Financial liabilities at fair value through profit

or loss

Derivative instrument liabilities (137) (320) - (457)

======== ======== ======== ========

level 1 level 2 level 3 total

30 June 2019 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

Financial assets at fair value through profit or

loss

Investments 1,084,330 - - 1,084,330

Derivative instrument assets 242 8,614 - 8,856

-------------- -------------- -------------- --------------

1,084,572 8,614 - 1,093,186

-------------- -------------- -------------- --------------

Financial liabilities at fair value through profit

or loss

Derivative instrument liabilities - (648) - (648)

======== ======== ======== ========

11 SHARE CAPITAL

30 June 2020 31 December 2019 30 June 2019

unaudited audited unaudited

number of number of number of

shares GBP'000 shares GBP'000 shares GBP'000

Issued, allotted and fully paid

Ordinary shares of 2.5 pence each

held outside of Treasury

Beginning of the period 411,466,049 10,286 412,172,826 10,304 412,172,826 10,304

Ordinary shares repurchased into - - (706,777) (18) (706,777) (18)

Treasury

----------------- -------------- ----------------- -------------- -------------- --------------

End of the period 411,466,049 10,286 411,466,049 10,286 411,466,049 10,286

----------------- -------------- ----------------- -------------- -------------- --------------

Ordinary shares of 2.5 pence each

held in Treasury1

Beginning of the period 4,981,861 125 4,275,084 107 4,275,084 107

Ordinary shares repurchased into - - 706,777 18 706,777 18

Treasury

----------------- -------------- ----------------- -------------- -------------- --------------

End of the period 4,981,861 125 4,981,861 125 4,981,861 125

----------------- -------------- ----------------- -------------- -------------- --------------

Total share capital 10,411 10,411 10,411

======== ======== ========

1 Ordinary shares held in Treasury carry no rights to vote, to receive a

dividend or to participate in a winding up of the Company.

There were no ordinary shares repurchased into Treasury during the period (year

ended 31 December 2019: cost of GBP1,578,000 (net of stamp duty) and six months

ended 30 June 2019: cost of GBP1,591,000).

12 NET ASSET VALUE PER ORDINARY SHARE

The net asset value per ordinary share is based on net assets of GBP1,155,733,000

(31 December 2019: GBP1,140,562,000 and 30 June 2019: GBP1,114,646,000) and on

411,466,049 (31 December 2019: 411,466,049 and 30 June 2019: 411,466,049)

ordinary shares, being the number of ordinary shares of 2.5 pence each held

outside of Treasury at the period end. It is the Company's policy that shares

held in Treasury will only be reissued at net asset value per ordinary share or

at a premium to net asset value per ordinary share and, therefore, shares held

in Treasury have no dilutive effect.

13 CAPITAL RESOURCES AND GEARING

The Company does not have any externally imposed capital requirements. The

financial resources of the Company comprise its share capital and reserves, as

disclosed on the Balance Sheet above, and any gearing, which is achieved

through the use of derivative instruments. Financial resources are managed in

accordance with the Company's investment policy and in pursuit of its

investment objective.

The Company's gearing at the end of the period is shown below:

gross asset exposure net asset exposure

GBP'000 %1 GBP'000 %1

30 June 2020 (unaudited)

Investments 1,125,786 97.4 1,125,786 97.4

Long CFDs 79,665 6.9 79,665 6.9

Long futures 40,438 3.5 40,438 3.5

-------------- -------------- -------------- --------------

Total long exposures 1,245,889 107.8 1,245,889 107.8

Short CFDs - - - -

-------------- -------------- -------------- --------------

Gross/net asset exposure 1,245,889 107.8 1,245,889 107.8

-------------- -------------- -------------- --------------

Shareholders' funds 1,155,733 1,155,733

-------------- -------------- -------------- --------------

Gearing2 7.8 7.8

======== ========

31 December 2019 (audited)

Investments 1,108,702 97.2 1,108,702 97.2

Long CFDs 72,774 6.4 72,774 6.4

Long futures 26,151 2.3 26,151 2.3

-------------- -------------- -------------- --------------

Total long exposures 1,207,627 105.9 1,207,627 105.9

Short CFDs 13,973 1.2 (13,973) (1.2)

-------------- -------------- -------------- --------------

Gross/net asset exposure 1,221,600 107.1 1,193,654 104.7

-------------- -------------- -------------- --------------

Shareholders' funds 1,140,562 1,140,562

-------------- --------------

Gearing2 7.1 4.7

======== ========

1 Exposure to the market expressed as a percentage of shareholders' funds.

2 Gearing is the amount by which the gross/net asset exposure exceeds

shareholders' funds expressed as a percentage of shareholders' funds.

gross asset exposure net asset exposure

GBP'000 %1 GBP'000 %1

30 June 2019 (unaudited)

Investments 1,084,330 97.3 1,084,330 97.3

Long CFDs 66,941 6.0 66,941 6.0

Long futures 9,082 0.8 9,082 0.8

-------------- -------------- -------------- --------------

Total long exposures 1,160,353 104.1 1,160,353 104.1

Short CFDs 15,453 1.4 (15,453) (1.4)

-------------- -------------- -------------- --------------

Gross/net asset exposure 1,175,806 105.5 1,144,900 102.7

-------------- -------------- -------------- --------------

Shareholders' funds 1,114,646 1,114,646

-------------- -------------- -------------- --------------

Gearing2 5.5 2.7

======== ========

1 Exposure to the market expressed as a percentage of shareholders' funds.

2 Gearing is the amount by which the gross/net asset exposure exceeds

shareholders' funds expressed as a percentage of shareholders' funds.

14 TRANSACTIONS WITH THE MANAGER AND RELATED PARTIES

FIL Investment Services (UK) Limited is the Company's Alternative Investment

Fund Manager and has delegated portfolio management services and the role of

company secretary to FIL Investments International ("FII"), the Investment

Manager. Both companies are Fidelity group companies. Details of the fee

arrangements are given in Note 5 above.

During the period, fees for portfolio management services of GBP4,243,000 (six

months ended 30 June 2019: GBP4,040,000 and year ended 31 December 2019: GBP

8,476,000) were payable to FII. At the Balance Sheet date, fees for portfolio

management services of GBP733,000 (31 December 2019: GBP752,000 and 30 June 2019: GBP

705,000) were accrued and included in other creditors. FII also provides the

Company with marketing services. The total amount payable for these services

during the period was GBP80,000 (six months ended 30 June 2019: GBP80,000 and year

ended 31 December 2019: GBP189,000). At the Balance Sheet date, GBP16,000 (31

December 2019: GBP7,000 and 30 June 2019: GBP2,000) for marketing services was

accrued and included in other creditors.

As at 30 June 2020, the Board consisted of five non-executive Directors (shown

in the Directory in the Half-Yearly Report), all of whom are considered to be

independent by the Board. None of the Directors have a service contract with

the Company. The Chairman receives an annual fee of GBP41,500, the Audit

Committee Chair an annual fee of GBP32,500, the Senior Independent Director an

annual fee of GBP29,500 and each other Director an annual fee of GBP27,000. The

following members of the Board hold ordinary shares in the Company: Vivian

Bazalgette 30,000 shares, Fleur Meijs 28,970 shares, Sir Ivan Rogers nil

shares, Marion Sears 25,475 shares and Paul Yates 32,000 shares.

The financial information contained in this Half-Yearly Results Announcement

does not constitute statutory accounts as defined in section 435 of the

Companies Act 2006. The financial information for the six months ended 30 June

2020 and 30 June 2019 has not been audited or reviewed by the Company's

Independent Auditor.

The information for the year ended 31 December 2019 has been extracted from the

latest published audited financial statements, which have been filed with the

Registrar of Companies, unless otherwise stated. The report of the Auditor on

those financial statements contained no qualification or statement under

sections 498(2) or (3) of the Companies Act 2006.

Neither the contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website (or any other website) is

incorporated into, or forms part of, this announcement.

A copy of the Half-Yearly Report will shortly be submitted to the National

Storage Mechanism and will be available for inspection at www.morningstar.co.uk

/uk/NSM

The Half-Yearly Report will also be available on the Company's website at

www.fidelityinvestmenttrusts.com where up to date information on the Company,

including daily NAV and share prices, factsheets and other information can also

be found.

END

(END) Dow Jones Newswires

August 04, 2020 02:00 ET (06:00 GMT)

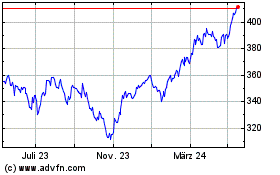

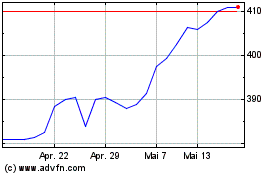

Fidelity European (LSE:FEV)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Fidelity European (LSE:FEV)

Historical Stock Chart

Von Jul 2023 bis Jul 2024