TIDMERO1

RNS Number : 5372F

Eros Media World PLC

10 July 2023

EROS MEDIA WORLD PLC

(incorporated as a limited company and registered in the Isle of

Man under the Companies Act 2006 (Isle of Man) with company number

007466V)

(the "Company")

NOTICE RELATING TO REPURCHASE

to the holders (the " Bondholders ") of GBP50,000,000 9.00 per

cent. Bonds due 2026

(the "Bonds")

issued by the Company

Reference is made to the repurchase and consent solicitation

memorandum dated 8 March 2023 (the "Memorandum"). Capitalised terms

used and not defined in this notice have the meaning given to them

in the Memorandum.

The Company hereby gives NOTICE to Bondholders of the

following:

1. Repurchase Total

Pursuant to the terms of the Memorandum, the Company proposes to

repurchase no less than GBP2,000,000 in aggregate nominal amount of

Bonds tendered for repurchase (such amount being the Repurchase

Total).

The Company reserves the right to increase the Repurchase Total

by notice to the Bondholders prior to the Settlement Date (as

defined below). The Company will not reduce the Repurchase

Total.

2. Purchase Price

The original Purchase Price of GBP60 per GBP100 principal amount

of Bonds accepted for repurchase, together with accrued but unpaid

interest to the Settlement Date, will continue to apply.

Interest will continue to accrue on all outstanding Bonds until

such time as any Bonds are repurchased or no longer remain

outstanding, and the Company will continue to make payments of

interest on the Bonds when required pursuant to the Conditions.

The Consent Fee was paid to eligible Bondholders in May 2023.

For the avoidance of doubt, no further Consent Fee is payable in

connection with the Repurchase.

3. Settlement of Repurchase

The Company expects to settle the Repurchase by no later than 31

March 2024 (the "Settlement Date"), and accordingly the Final

Deadline is extended to 4.00 p.m. (London time) on 21 March 2024,

or such earlier date as is notified in advance by the Company to

Bondholders. The Company reserves the right to bring forward the

Settlement Date and the Final Deadline.

4. Revocation

All Bondholders who tendered their Bonds for repurchase as part

of the Repurchase may revoke their Repurchase Instructions so that

their Bonds are no longer blocked in the Clearing Systems. Any such

Bondholders who do revoke their Repurchase Instructions will be

required to submit a new Repurchase Instruction prior to the Final

Deadline in order to participate in the Repurchase (see "Repurchase

Instructions" below).

5. Repurchase Instructions

Bondholders who have previously validly submitted a Repurchase

Instruction in respect of the Repurchase and who do not choose to

revoke that Repurchase Instruction need take no further action in

respect of the Repurchase.

Bondholders wishing to participate in the Repurchase who have

validly revoked their Repurchase Instruction must make the

necessary arrangements for the delivery to the Tender, Tabulation

and Information Agent on or before the Final Deadline of a further

valid Repurchase Instruction in respect of the Repurchase.

A separate Repurchase Instruction must be completed on behalf of

each beneficial owner.

6. Scaling

If the aggregate principal amount of Bonds validly offered for

repurchase by Bondholders pursuant to the Repurchase exceeds the

Repurchase Total, the Company will accept such offered Bonds on a

pro rata basis such that the aggregate nominal amount of such Bonds

accepted for repurchase is no greater than the Repurchase

Total.

In the circumstances described in the Memorandum in which Bonds

validly repurchased pursuant to the Repurchase are to be accepted

on a pro rata basis, each such Repurchase Instruction will be

scaled by a factor (the "Pro-ration factor") equal to (i) the

Repurchase Total divided by (ii) the aggregate nominal amount of

the Bonds that have been validly accepted for repurchase.

Each repurchase of Bonds that is scaled in this manner will be

rounded down to the nearest GBP100 in nominal amount of the Bonds,

provided that in the event of any such scaling, the Company will

only accept repurchases of Bonds subject to scaling to the extent

such scaling will not result in (i) the relevant Bondholder

transferring Bonds to the Company in an aggregate nominal amount of

less than a Specified Denomination or (ii) the Company rejecting

the Bonds from such Bondholder in an aggregate nominal amount of

less than a Specified Denomination.

7. Notices

The Company will announce whether it will accept valid

repurchases of Bonds pursuant to the Repurchase and, if so

accepted, the aggregate nominal amount of Bonds accepted for

repurchase (together with the applicable Pro-ration factor, if any)

following the Final Deadline.

Notices in respect of the Repurchase will be delivered through

(i) the issue of a press release to RNS and/or (ii) the issue of a

press release to a Notifying News Service and/or (iii) delivery of

notices to the Clearing Systems for communication to Direct

Participants, and may also be found on the relevant Reuters

International Insider Screen, or by any other means, at the

discretion of the Company or the Tender, Tabulation and Information

Agent.

8. Consent Solicitation / Nature of Repurchase

The Consent Solicitation was validly concluded in April 2023,

and (for the avoidance of doubt) neither this notice nor any of the

information contained within this notice, nor any action taken by

the Company in respect of this notice or any such information, has

any bearing on the Consent Solicitation.

Furthermore, the Company wishes to confirm (for the avoidance of

doubt) that none of this notice, the Repurchase, or any of the

terms of the Repurchase, forms part of the Conditions of the

Bonds.

9. Further Information

Questions and requests for assistance in connection with the

Repurchase may be directed to the Tender, Tabulation and

Information Agent, the contact details of which are on the last

page of the Memorandum.

Eros Media World PLC

10 July 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCRMMJTMTJBBAJ

(END) Dow Jones Newswires

July 10, 2023 09:38 ET (13:38 GMT)

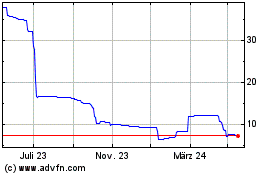

Eros Media 26 (LSE:ERO1)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

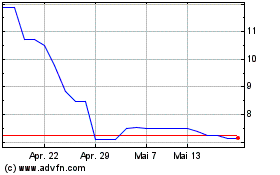

Eros Media 26 (LSE:ERO1)

Historical Stock Chart

Von Jan 2024 bis Jan 2025