Crown Place VCT PLC Crown Place Vct Plc : Interim Management Statement

14 November 2013 - 12:15PM

UK Regulatory

TIDMCRWN

Crown Place VCT PLC Interim Management Statement

Introduction

I am pleased to present Crown Place VCT PLC's interim management

statement for the period from 1 July 2013 to 14 November 2013 as

required by the UK Listing Authority's Disclosure and Transparency Rule

4.3.

Performance and dividends

The Group's unaudited net asset value per share (NAV), based on

management accounts, as at 30 September 2013 was GBP26.8 million or

31.74 pence per share (excluding treasury shares), after accounting for

a dividend of 1.25 pence per share which is payable on 29 November 2013

to shareholders on the register on 1 November 2013.

The NAV as at 30 June 2013 was 31.01p (after accounting for the dividend

of 1.25 pence per share).

After taking account of the dividend, the Company's NAV has risen by

0.73 pence per share or 2.4 per cent. since 30 June 2013 as a result of

an increase in investment valuations.

Share issues and buybacks

During the period from 1 July 2013 to 14 November 2013, the Company

purchased 675,000 shares for cancellation at an average price of 29.8

pence per share.

It remains the Board's policy to buy back shares in the market, subject

to the overall constraint that such purchases are in the Company's

interest, including the maintenance of sufficient resources for

investment in existing and new portfolio companies and the continued

payment of dividends to shareholders.

It is the Board's intention for such buy-backs to be at around a 5 per

cent. discount to net asset value, so far as market conditions and

liquidity permit.

Portfolio

The following investments have been made during the period from 1 July

2013 to 14 November 2013:

Name GBP000's Activity

New

investments

Aridhia

Informatics

Limited 270 Healthcare informatics and analysis

Relayware

Limited 231 Business collaboration and communication solutions

Cisiv Web-based solutions for healthcare data capture and

Limited 97 management

Silent

Herdsman

Holdings

Limited 82 Remote monitoring of animal health

Erin Solar

Limited 29 Photo-voltaic installations on commercial buildings

Total new

investments 709

Further

investments

Bravo Inns

II Limited 45 Owner and operator of public houses

AMS Sciences Provider of metabolism data in clinical and pre-clinical

Limited 18 development.

Mi-Pay

Limited 15 Provider of mobile payment services

Rostima

Holdings Provider of labour management software for the marine

Limited 9 and aviation industries

Abcodia Validation and discovery of molecular biomarkers linked

Limited 6 to age related diseases

Total

further

investments 93

Disposals and loan stock repayments

The following disposals and loan stock repayments were made by portfolio

companies during the period from 1 July 2013 to 14 November 2013:

Name GBP000's

Opta Sports Data Limited 559 Proceeds on disposal in July 2013

Prime Care Holdings Limited 209 Proceeds on disposal in July 2013

Radnor House School (Holdings) 140 Loan stock repayment

Limited

Masters Pharmaceuticals Limited 53 Loan stock repayment

Tower Bridge Health Club Limited 14 Loan stock repayment

The Dunedin Pub Company VCT 2 Loan stock repayment

Limited

Top ten holdings as at 30 September 2013:

% of

net

Carrying value asset

Investment GBP000's value Activity

Radnor House School

(Holdings) Limited 2,744 10.2% Independent school for children ages 7-18

Oakland Care Centre

Limited 2,433 9.1% Owner and operator of care home for residents

ELE Advanced

Technologies

Limited 2,194 8.2% Manufacturer of precision engineering components

The Crown Hotel

Harrogate Limited 1,908 7.1% Owner and operator of the Crown Hotel, Harrogate

Kensington Health Owner and operator of a health and fitness club in

Club Limited 1,202 4.5% West London

Orchard Portman Owner and operator of a psychiatric hospital in

Hospital Limited 941 3.5% Taunton

Lowcosttravelgroup

Limited 910 3.4% Online travel business

Provider of mobile data solutions for the logistics

Blackbay Limited 880 3.3% and field service sectors

The Charnwood Pub

Company Limited 845 3.2% Owner and operator of freehold pubs

Kew Green 844 3.1% Owner and operator of the 'Holiday Inn Express' at

(Stansted) VCT Stansted Airport

Limited

A full breakdown of the Company's portfolio can be found on the funds

website under current portfolio at

www.albion-ventures.co.uk/ourfunds/CRWN.htm.

Albion VCTs Top Up Offers 2013/2014

On 6 November 2013 the Company announced the launch of a top up offer

(the "Offer") as part of the Albion VCTs Top Up Offers 2013/2014 which

are seeking to raise in aggregate GBP15 million under the Offers.

Within this total, the amount to be raised by the Crown Place VCT PLC

Offer is expected to amount to GBP2-3 million.

The proceeds of the Offer will be used to provide further resources to

the Company at a time when a number of attractive new investment

opportunities are being seen.

An Investor Guide and Offer Document can be found on the website

www.albion-ventures.co.uk.

The Offer will close on 13 June 2014 (unless fully subscribed or

extended by the Company).

Material Events and Transactions

There have been no further significant events or transactions that the

Board is aware of which would have a material impact on the financial

position of the Company between 1 July 2013 and 14 November 2013.

Further information

The Company continues to offer a Dividend Reinvestment Scheme to

existing shareholders. Details of this Scheme can be found at

www.albion-ventures.co.uk/ourfunds/CRWN.htm.

Further information regarding historic and current financial performance

and other useful shareholder information can be found on the Fund's

website under www.albion-ventures.co.uk/ourfunds/CRWN.htm.

Patrick Crosthwaite, Chairman

14 November 2013

For further information please contact:

Patrick Reeve, Albion Ventures LLP - tel: 020 7601 1850

This announcement is distributed by Thomson Reuters on behalf of Thomson

Reuters clients.

The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and other

applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the

information contained therein.

Source: Crown Place VCT PLC via Thomson Reuters ONE

HUG#1743218

http://www.closeventures.co.uk

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

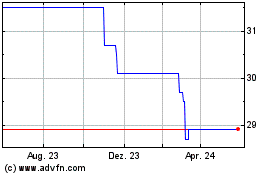

Albion Crown Vct (LSE:CRWN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024