An online financial information company with millions of users

would normally have a market value in the tens, if not hundreds of

millions. Not ADVFN.

Content reproduced with permission from undervalued-shares.com

The company has about 5m users, but its market cap is a paltry

GBP 6.5m.

In fact, its market cap is just a smidgen higher than its net

cash reserves. The users are currently valued at less than a pound

each.

This has attracted a group of Israeli tech entrepreneurs who

come with an extraordinary track record in investing. The same

group once built a large stake in another British Internet firm

that had fallen on hard times, and in just a few years they made

10x their money on USD 25m.

Will the new investors manage to turn ADVFN (LSE:AFN) into an

even more astounding home run?

ADVFN’s history in a nutshell

London-listed ADVFN (ISIN

GB00BPT24C10, UK:AFN) is one of the world’s largest online

financial information providers.

When it started in 1999, it had a simple but important ambition:

to level the playing field for retail investors by providing access

to information that was previously the preserve of institutional

investors and professional traders. ADVFN was first in the UK to

make “Level 2” market data available to retail investors.

The company went public in March 2000, at the very peak of the

dotcom bubble.

Anyone who invested then lost 99% of their investment in the

space of a few years. The information that ADVFN provided was a

boon for private investors, but for its shareholders it produced

nothing but losses – with one exception.

ADVFN’s CEO, Clem Chambers, only owned a small stake in the

company, but he managed to make himself the prime beneficiary. In

between salary, travel expenses, and equity options, Chambers made

a decent living off the company. He even managed to secure himself

a contract with a three-year (!) notice period. This was probably

unique among publicly listed British companies, and an effective

poison pill for anyone who dared challenge his position. It

summarised what a self-service shop ADVFN was for its management

team.

I met Chambers once, over a decade ago. Despite my natural

tendency to look for the good in anyone, he was one of the few

characters whom I instantly disliked – a lot!

I’ve been following ADVFN’s developments ever since.

It’s a tiny company with limited free-float, which is why few

others paid attention. ADVFN last properly made it into the news in

the mid-2010s when a group of Israeli investors tried to wrestle

control of the company.

In 2015, two shell companies, Sweet Sky Limited and Shellhouse

Limited, declared a holding of over 25%. They requisitioned an

extraordinary general meeting of shareholders and suggested to

defenestrate the management.

The Israeli investors backing the attempt had not done their

homework. ADVFN itself was not a regulated firm, but it owned 100%

of ALLIPO, an FCA-regulated business. As such, anyone buying more

than 10% of ADVFN had to get FCA approval before surpassing this

threshold.

Even though the Israeli reportedly had the backing of 40% of the

share capital, Chambers was able to fend off the shareholder

revolt. The brokerage custodians acting for the group decided not

to proceed with the requisition for a general meeting, and instead

advised the Israelis that they had breached multiple FCA

regulations. The putsch was over before it had

even begun.

The market briefly anticipated change, driving the share price

from 60 pence to 100 pence. A year later, it was trading as low as

16 pence. It stayed around this sell-out level until 2020, when the

Israelis re-emerged from the shadows.

Following further re-arranging and building their stakes, the

activists once again stepped forward in early 2022 to demand

changes to the board. This time, they had done their homework. The

incumbent board decided that it was best to negotiate a deal and

move on.

Chambers agreed to step down in exchange for two years’ worth of

salary in cash and stock, and a consulting agreement. The Israelis

underwent compliance procedures and got board representation. The

second putsch attempt succeeded without a single

shot fired.

With new management in charge, it begs the question…

Who are the Israelis?

Little is known publicly about the new investors who are now in

charge of ADVFN. Most of what’s in the public domain relates to

their previous involvement with QXL, a former publicly listed

online auction house and one of the original Internet wonder

stocks.

QXL floated in the early 2000s alongside other famous names such

as lastminute.com and Scoot.com. It was also the inaugural British

member of what was then called the “99% Club”, named to recognise

dotcom companies that had lost 99% of their value since going

public. In the short space of just eight months after the IPO in

April 2020, QXL’s market cap sank from GBP 2bn to almost

nothing.

QXL survived the subsequent funding crisis, and parts of its

business thrived. In 2004, its management tried to take advantage

of the beaten-down stock price and launched a management buy-out,

offering shareholders GBP 7 per share. Florissant, the venture

capital firm backed by Icelandic entrepreneur Björgólfur

Björgólfsson, stepped in with an offer of GBP 14. Björgólfsson’s

attempt failed because a group of Israeli investors built a stake

of 26% and drove the price up to GBP 16.

The Israelis believed there was much more value left in QXL, and

kept buying more shares, even at a price of GBP 30. The following

year, QX’s share price rose to GBP 120.

In late 2007, QXL was taken over by Naspers, Africa’s largest

media group, for GBP 946m. The Israelis had a 10x on their

investment and walked away with a cool USD 270m.

Only limited information is available about who backed the

transaction involving QXL, but some names did make it into the

public domain – such as Ron Izaki or Izhaki (his name was spelled

one way during the heydays of the QXL deal and is now spelled

another way in the filings for ADVFN). The Financial

Times once described him as a “real estate

developer“. Izhaki today holds 6.48% of ADVFN.

Another key figure is Yair Tauman, who may well have instigated

the entire affair. Tauman had first become a non-executive director

of ADVFN in 2010. A professor of economics at The State University

of New York and an expert on game theory, he had made money as

co-founder of Bidorbuy.com, then Africa’s largest online auction

site. Tauman stepped down from his position in 2014 when the

activists first demanded changes, but returned to the board in

2022. He today holds 9.18%, while his son and ADVFN CEO, Amit

Tauman, owns another 11.82%.

Another investor associated with the group is Dan Horsky, who

owns 8.85% of ADVFN.

Clem Chambers’ holding company, Blockchain PLC, is currently

listed on the ADVFN website with a 6.63% stake. However, recent

regulatory disclosures show that Blockchain PLC has already sold

off parts of its stake and now only owns 4.95%.

Given their previous tussle with FCA regulations, the market has

not yet given the Israelis much credit for taking control of ADVFN.

Currently trading at 14 pence, the stock is down massively since it

peaked at 75 pence in early 2022 when headlines about Chambers’

resignation appeared. Remarkably, it’s also down a lot since a

share placement at 33 pence in January 2023. The new investors had

agreed to back a GBP 6.8m share issue at the price, to give ADVFN

the necessary financial manoeuvring room to implement changes.

Given ADVFN’s tiny size and how all parties involved handled

themselves at some point in the past, it’d be easy to ignore all of

these developments. ADVFN is not conventionally investible.

However, there are too many aspects that make it worth a closer

look.

E.g., there is the fact that between 2000 and 2008, Dan Horsky

managed to increase his personal investment portfolio from USD

500,000 to USD 80m (i.e., 160x), primarily on the back of being an

early investor in QXL. (Horsky then took his portfolio to USD 220m

by 2016 but eventually got done for tax evasion, as described

in this

US government filing.)

Clearly, these Israeli investors are no muppets.

Of late, they even have the support of a former executive of

eToro, the UD 3.5bn social investment platform that also came out

of Israel.

ADVFN’s offering in a nutshell: data, chat, advertising

ADVFN still operates an information platform for private

investors.

As the corporate website describes it, “ADVFN Plc provides

comprehensive global stock, crypto, forex and commodity market

information to the private investors in the UK, US, Brazil, Italy

and other international retail markets. It offers a unique

environment for premium data where financial advertisers and

companies engage directly with a huge active audience of

investors.”

ADVFN’s service attracts 34m unique global users per year, with

10m+ monthly visitors generating over one billion page impressions

every year. Based on a mixture of subscription fees and advertising

income, ADVFN’s roughly 35 staff generate about GBP 5.5m in annual

revenue.

ADVFN had long had one of the most atrocious-looking websites of

the finance world, and its revenue is barely enough to keep the

lights on. Then again, the Israeli investors seem to have spotted

an opportunity that excites them. After all, they have now been

involved with the company for ten years already. You don’t stick to

a labour-intense investment for that long unless you believe that

you are onto something big.

5m registered users on a platform that offers financial

information is a tremendous asset, and it begs to be exploited in a

more efficient way.

As a mere example, if ADVFN’s new management got 1% of the

registered users to sign up to a monthly subscription product that

costs GBP 10 per month, that alone would double the company’s

annual revenue. Given the digital nature of the business, much of

such additional revenue would go to the bottom line.

The scalability of this type of business is tremendous.

Just as much, the new investors seem to have punchy ambitions.

In the 2023 annual report, the firm’s new CEO closed by saying:

“In 2024 we plan to introduce a new product which we believe

is going to revolutionise the way our users consume financial

information, utilise our existing community and tools in different

ways.”

To get there, Tauman first had to carry out extensive

restructuring. Overcoming the legacy left behind by the reign of

Clem Chambers involved:

- Reshaping the board structure and related activities, which

incurred legal expenses of GBP 200,000.

- Addressing outdated infrastructure and the risks associated

with old hardware.

- Resolving “complexities” with the joint venture in Brazil.

- Winding down non-core operations.

To get the business to move forward, ADVFN also:

- Invested in high-capacity, low-latency data processing to

improve site stability.

- Expanded its product offering through the launch of real-time

option data and option flow product, new and unique editorial

content, comprehensive global fundamental data for relevant

markets, and the revamp of the InvestorsHub message board.

- Optimised the ad tech operations.

- Streamlined the funnels for user engagement and

monetisation.

- Integrated advanced analytics into the operations.

- Reduced operational costs by 20% while onboarding new senior

team members.

What about this “new product that will revolutionise the way

the users consume financial information“?

ADVFN had promised to have its new app ready by the end of

Q2/2024. In its most recent corporate update published in early

July 2024, it had to admit that the plan has now shifted to the end

of Q3/2024.

Without a doubt, though, the company has made tremendous

progress already, as outlined in its recent update:

“Revamping the ADVFN offering, including the redesign and

mobile optimisation of the website, is phased as follows:

- Phase 1 completed: The first phase of the Platform updates,

which includes most of the core tools and pages ADVFN offers and

ADVFN AI Intelligence, is now live on advfn.com;

- Phase 2 initiated: We have commenced the rollout of these

enhancements to additional countries, with completion anticipated

in the Autumn; and

- Long Tail Redesign: Upon the conclusion of Phase 2, we will

proceed with a comprehensive update of the remaining sections of

the platform.

- We have also successfully integrated advanced analytics

into our operations, significantly enhancing our data-driven

decision-making capabilities.

- Optimisation and monetisation efforts are underway, with

the primary objective of increasing our subscription

base.“

Of late, this progress has started to attract a different kind

of talent, such as Shalom Berkovitz, former Chief Financial Officer

and Deputy Chief Executive of eToro, who was appointed ADVFN’s

non-executive director in June 2024.

The writing on the wall is clear: the Israeli investors now in

charge of ADVFN have the experience, the network, and the resources

to create something big. After ten years of efforts, they’ll want

to see their investment become a home run similar to QXL.

What’s an investor to do?

ADVFN is a most peculiar opportunity.

With a market cap of currently GBP 6.5m, it is barely trading on

par with its cash reserves of GBP 4.8m.

Its 5m registered users are almost given away for free, as is

the rest of its web traffic.

Then again, ADVFN has been bleeding money of late. In the six

months that ended 31 December 2023, it lost GBP 0.5m. Cleaning up

legacy issues, investing in new systems, and cutting off some

existing product categories cost the company dearly. In 2023,

revenue sank by 30%, from GBP 7.8m to GBP 5.5m.

Does the new team have what it takes to turn ADVFN into a new

company altogether?

Based on results so far and with the recent impressive addition

to the board, ADVFN may now turn the corner.

Could this be a 100-bagger one day?

Given the global footprint of its business, the scalability of

the business model and the players involved, ADVFN could have the

potential for something remarkable. After all, ADVFN is able to

speak to FIVE MILLION investors – and that’s just the ones who have

registered. Just think how much it would cost to recreate such a

user base from scratch. The replacement value of the existing

system sure is a lot higher than the current market cap.

It’s too early to produce any estimates, but the current share

price seems remarkably low. After all, in January 2023, the new

investors were entirely content to add millions to their investment

by subscribing to more stock at a price of then 33 pence. Right

now, the share price is trading at not even half that.

Normally, such a micro-cap would barely deserve featuring, given

the limited trading activity. However, of late, larger amounts of

stock have become available, as Clem Chambers has been reducing his

stake that he held indirectly as CEO of Blockchain PLC. In June

2024, Blockchain PLC reportedly reduced its stake from 6.63% to

5.91%, followed by a further reduction to 4.95% in July 2024.

Blockchain PLC’s public filings reveal a challenging financial

situation. According to the annual report as of June 2023,

“there is material uncertainty that may cast doubt over the

Group’s ability to continue as a going concern“, and “the

Group’s and Company’s ability to continue as going concern

is dependent on the cashflows from sale of shares in

AVDFN Plc and ability of the Group to raise

additional funds.”

The remaining stake in ADVFN held by Blockchain PLC translates

to about 2.3m shares (out of 46m) or about GBP 300,000 worth of

shares. Whether Blockchain PLC remains in the market as a seller

right now cannot be known for sure. Now may be an opportunity to

build a small position, though.

If the Israelis are only half as successful as I think they plan

to be, even holding a GBP 5,000 stake could one day add up to

serious money. If anything, the stock should be trading at least at

the 33 pence level at which the share issue took place – or higher,

given the progress made since then.

It’s a strange story, and the loss-making company with its

quirky band of renegade investors is not without risk. It’d be

difficult to refute, though, that a global investor platform with

5m registered users couldn’t be turned into something much more

valuable.

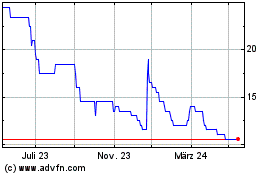

Advfn (LSE:AFN)

Historical Stock Chart

Von Aug 2024 bis Sep 2024

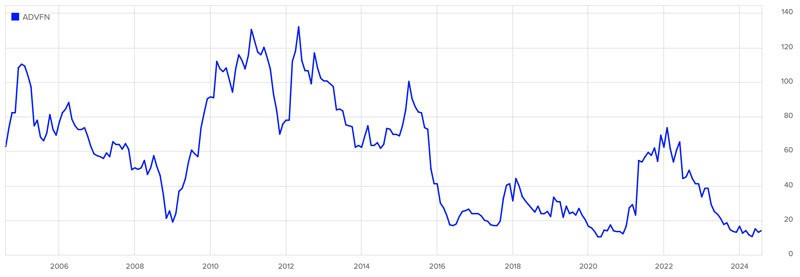

Advfn (LSE:AFN)

Historical Stock Chart

Von Sep 2023 bis Sep 2024