Clear improvement in operating

performance

On track to achieve medium-term

targets

- Revenue for H1 2023: €2,840.1m, equating to total growth of

11.6% and organic growth1 of 8.1%

- Organic revenue growth of 7.1% in Q2

- Operating margin on business activity of 8.8%, up 0.8 points

from H1 2022

- Integration of CS Group and Tobania under way

- Net profit attributable to the Group stable at €112.5m, due

in large part to a temporary rise in non-recurring costs

- Robust free cash flow totalling €122.9m (€66.3m in H1

2022)

- Full-year 2023 revenue guidance revised upward: organic

growth of at least 6% (compared with “between 3% and 5%”

previously)

Regulatory News:

At its meeting on 26 July 2023, Sopra Steria’s

(Paris:SOP) Board of Directors, chaired by Pierre

Pasquier, approved the financial statements for the first half of

2023. The Statutory Auditors have conducted a limited review of the

financial statements.

Sopra Steria: 2023 Half-year results H1 2023 H1

2022 Amount Margin Change Amount

Margin Key income statement items Revenue €m

2,840.1

11.6%

2,543.8

Organic growth % +8.1% Operating profit on business activity

€m

251.1

8.8%

23.6%

203.1

8.0%

Profit from recurring operations €m

207.8

7.3%

20.8%

172.0

6.8%

Operating profit €m

177.1

6.2%

9.3%

162.1

6.4%

Net profit attributable to the Group €m

112.5

4.0%

0.2%

112.3

4.4%

Weighted average number of shares in issue excl. treasury

shares m

20.20

20.22

Basic earnings per share €

5.57

0.3%

5.55

Recurring earnings per share €

6.80

14.8%

5.92

Key balance sheet items 6/30/2023

6/30/2022 Net financial debt €m

558.9

62.1%

344.9

Equity attributable to the Group €m

1,794.9

-1.6%

1,823.1

__________________________________

1 Alternative performance measures are

defined in the glossary at the end of this document.

Cyril Malargé, Chief Executive Officer of Sopra Steria Group,

commented:

“I’m pleased with the good performance in the first half of

2023. Business activity was buoyant in both volume and sales price.

Organic revenue growth was 8.1%. Our substantial presence in the

public sector, aerospace and defence helped achieve this

performance. The 0.8 basis point improvement in our operating

margin on business activity to 8.8% shows that we are well on track

to achieve our announced target of around 10% in 2024.

This performance reflects the impact of our strategy to

transform our offerings and move them further up the value chain

while boosting our operational efficiency, to which Sopra Steria’s

teams are devoting their full attention.

We are also stepping up our efforts in the field of generative

AI, for example by integrating all AI tools and methodologies

within our Ingine software engineering platform, which has already

been rolled out to all of the Group’s 10,000 developers

worldwide.

The integration processes for CS Group and Tobania are well

under way. Alongside this, the Ordina acquisition is proceeding in

line with the original schedule, with the public offer by Sopra

Steria launched on 19 July 2023 and the closing expected during the

second half of 2023. These acquisitions are aimed at strengthening

the Group’s positions in the defence and security sector as well as

in the BeNeLux region, where we plan to create a benchmark player

in digital services generating around €700 million in pro forma

revenue and employing over 4,000 professionals.

The Group’s performance in the first half of the year and our

visibility into the second half have enabled us to raise our

full-year revenue guidance for 2023. We now expect organic revenue

growth to reach at least 6%, up from the previous guidance of

between 3% and 5%.”

Detailed breakdown of operating performance in H1

2023

Revenue totalled €2,840.1 million, an increase of 11.6%

relative to H1 2022. Changes in scope had a positive impact of

€129.6 million, and currency fluctuations had a negative impact of

€45.2 million. At constant scope and exchange rates, revenue grew

8.1%. In the second quarter alone, organic growth remained robust

at 7.1%, despite a less favourable calendar (two fewer days than in

the second quarter of 2022) and the start of a slowdown,

particularly in the consulting business, which nevertheless

recorded growth of 7%.

The Group’s operating profit on business activity rose 23.6%

to €251.1 million, equating to a margin of 8.8%, up 0.8 points

from H1 2022.

In France (42% of the Group total), revenue grew sharply

(17.1%) to €1,198.9 million. CS Group has been consolidated in

Sopra Steria’s accounts for four months and contributed revenue of

€106.5 million, corresponding to a growth rate of 8.7%. Excluding

changes in scope, organic revenue growth for the reporting unit was

6.9%. The best-performing vertical markets were defence, the public

sector, aerospace and transport. Operating margin on business

activity stood at 9.1% (9.7% in the first half of 2022). The

initial consolidation of CS Group diluted the operating margin on

business activity for the first half.

Revenue for the United Kingdom (16% of Group total) was

€461.0 million, representing organic growth of 8.3%, driven by the

aeronautics, defence and security sector, for overall growth of

around 30%, as well as the two joint ventures specialising in

business process services for the public sector (SSCL and NHS SBS),

which delivered double-digit growth. Operating margin on business

activity (11.4%) was up 0.9 points from the first half of 2022.

The Other Europe (29% of the Group total) reporting unit

posted €819.8 million in revenue, representing positive organic

growth of 11.4%. The fastest growth was seen in Scandinavia, Spain,

Italy and, to a lesser extent, BeNeLux and Germany. The reporting

unit’s operating margin on business activity came to 8.9%, compared

with 5.0% in the year-earlier period, fuelled by the return to a

normal level of operating performance in Germany and improvements

at several other entities.

Revenue for Sopra Banking Software (8% of Group total)

came to €218.0 million, representing organic growth of 4.0%. The

confirmation of a return to growth over the first two quarters of

the year was driven by the performance of digital offerings

(Digital Banking Suite and Open Banking Platform, Regulatory

Reporting, Wholesale Digital Audit, Instant Payment…). This

resulted in a 9.7% increase in subscription revenue. Meanwhile,

licence sales rose 5.3%. Overall, software revenue (60% of the

total) was up 3.4% while services revenue grew 5.0%. Efforts

focused on the return to growth for sales resulted in a higher

level of R&D investment than expected during the first half and

lower operating profit than in the year-earlier period (1.3% vs

4.1%).

The Other Solutions reporting unit (5% of the Group

total) posted revenue of €142.4 million, representing organic

growth of 5.3%. Human resources solutions posted growth of 4.2%.

Property Management Solutions posted a 7.6% increase in revenue.

The reporting unit’s operating margin on business activity came to

10.0%, up 1.2 points from its level at 30 June 2022.

Comments on the components of net profit for H1 2023

Profit from recurring operations came to €207.8 million,

up 20.8% relative to the first half of 2022. It included a €28.4

million share-based payment expense (mainly due to the rise in the

Sopra Steria share price compared with the first half of 2022) and

a €14.9 million amortisation expense on allocated intangible

assets.

Operating profit was €177.1 million, up 9.3%, after a net

expense of €30.7 million for other operating income and expenses

(compared with a net expense of €10.0 million in the first half of

2022). The year-on-year increase in expenses was largely due to the

temporary rise in non-recurring costs relating to business

combinations (CS Group, Tobania and Ordina) and the discontinuation

of low-margin businesses.

Net interest expense was €12.5 million (versus €3.9

million in the first half of 2022).

The tax expense was €42.5 million in the half-year

period, versus €43.2 million in the first half of 2022, translating

to a Group-wide tax rate of 25.8%. For the 2023 financial year as a

whole, the tax rate is estimated at 26%.

Net profit from associates (including Axway) amounted to

an expense of €0.1 million (compared with profit of €0.1 million in

the first half of 2022).

After deducting €9.5 million in non-controlling

interests, net profit attributable to the Group came to

€112.5 million (compared with €112.3 million in the first half of

2022).

Basic earnings per share came to €5.57 (up 0.3%),

compared with €5.55 per share in the first half of 2022.

Financial position at 30 June 2023

Free cash flow was very strong in H1 2023 at €122.9

million (compared with €66.3 million in the first half of 2022). It

includes early net inflows amounting to about €50 million.

Net financial debt totalled €558.9 million at 30 June

2023. It includes outflows early in the half-year period due to the

closing of the CS Group and Tobania acquisitions. It equated to

1.03x pro forma 12-month rolling EBITDA before the impact of IFRS

16 (with the financial covenant stipulating a maximum of 3x).

Acquisition and external growth transactions

Following the proposed acquisition of Ordina announced on

the 21 March 2023, a public offer was launched on 19 July 2023. The

offer will remain open until 26 September 2023. This public offer

was approved by the Dutch Authority for the Financial Markets (AFM)

on 17 July 2023. It is also supported by Ordina’s two largest

shareholders as well as by each of the members of Ordina’s

Supervisory Board and Management Board. Ordina’s two largest

shareholders, together representing approximately 26% of Ordina’s

share capital, have agreed to tender their shares to the offer.

Workforce

The Group’s net headcount stood at 53,954 employees at 30

June 2023, up from 49,690 employees at 31 December 2022 and 48,707

employees at 30 June 2022. A total of 9,400 staff were employed at

international service centres (India, Poland, Spain, etc.) in the

first half of 2023, versus 9,000 staff in the same period of the

previous year.

At 30 June 2023, the subcontracting rate was 2.3

percentage points higher than the low point reached in 2020, at the

end of a period deeply affected by the Covid-19 pandemic.

The workforce attrition rate was 15.7% (vs 19.3% in the

first half of 2022).

Upward revision to full-year 2023 revenue organic growth

guidance

In a global macroeconomic environment expected to be less

favourable in the second half, but fairly resilient given its

characteristics, Sopra Steria is revising upward its revenue growth

target for financial year 2023 while confirming all of its other

targets:

- Organic revenue growth of at least 6% (versus “between 3% and

5%” previously);

- Operating margin on business activity slightly over 9%;

- Free cash flow of at least €300 million.

Medium-term targets

In the medium term, Sopra Steria is targeting annual organic

revenue growth of between 4% and 6%. The Group has also set targets

to achieve an operating margin on business activity of around 10%

by 2024 and generate free cash flow of between 5% and 7% of

revenue.

Presentation meeting

The results for the first half of 2023 will be presented to

financial analysts and investors in a French/English webcast on

Thursday, 27 July 2023 at 9:00 a.m. CET.

- Register for the French-language webcast

here

- Register for the English-language webcast

here

Or by phone:

- French-language phone number: +33 (0)1 70

37 71 66

- English-language phone number: +44 (0)33

0551 0200

Practical information about the presentation and webcast can be

found in the ‘Investors’ section of the Group’s website:

https://www.soprasteria.com/investors

Upcoming financial releases

Friday, 27 October 2023 before market open: Publication of Q3

2023 revenue

Glossary

- Restated revenue: Revenue

for the prior year, expressed on the basis of the scope and

exchange rates for the current year.

- Organic revenue growth:

Increase in revenue between the period under review and restated

revenue for the same period in the prior financial year.

- EBITDA: This measure, as

defined in the Universal Registration Document, is equal to

consolidated operating profit on business activity after adding

back depreciation, amortisation and provisions included in

operating profit on business activity.

- Operating profit on business

activity: This measure, as defined in the Universal

Registration Document, is equal to profit from recurring operations

adjusted to exclude the share-based payment expense for stock

options and free shares and charges to amortisation of allocated

intangible assets.

- Profit from recurring

operations: This measure is equal to operating profit

before other operating income and expenses, which includes any

particularly significant items of operating income and expense that

are unusual, abnormal, infrequent or not foreseeable, presented

separately in order to give a clearer picture of performance based

on ordinary activities.

- Basic recurring earnings per

share: This measure is equal to Basic earnings per share

before other operating income and expenses net of tax.

- Free cash flow: Free cash

flow is defined as the net cash from operating activities; less

investments (net of disposals) in property, plant and equipment,

and intangible assets; less lease payments; less net interest paid;

and less additional contributions to address any deficits in

defined-benefit pension plans.

- Downtime: Number of days

between two contracts (excluding training, sick leave, other leave

and pre-sales) divided by the total number of business days.

Disclaimer

This document contains forward-looking information subject to

certain risks and uncertainties that may affect the Group’s future

growth and financial results. Readers are reminded that licence

agreements, which often represent investments for clients, are

signed in greater numbers in the second half of the year, with

varying impacts on end-of-year performance. Actual outcomes and

results may differ from those described in this document due to

operational risks and uncertainties. More detailed information on

the potential risks that may affect the Group’s financial results

can be found in the 2022 Universal Registration Document filed with

the Autorité des Marchés Financiers (AMF) on 17 March 2023 (see

pages 40 to 45 in particular). Sopra Steria does not undertake any

obligation to update the forward-looking information contained in

this document beyond what is required by current laws and

regulations. The distribution of this document in certain countries

may be subject to the laws and regulations in force. Persons

physically present in countries where this document is released,

published or distributed should enquire as to any applicable

restrictions and should comply with those restrictions.

About Sopra Steria

Sopra Steria, a major tech player in Europe recognised for its

consulting, digital services and software development, helps its

clients drive their digital transformation and obtain tangible and

sustainable benefits. It provides end-to-end solutions to make

large companies and organisations more competitive by combining

in-depth knowledge of a wide range of business sectors and

innovative technologies with a fully collaborative approach. Sopra

Steria places people at the heart of everything it does and is

committed to putting digital to work for its clients in order to

build a positive future for all. With 50,000 employees in nearly 30

countries, the Group generated revenue of €5.1 billion in 2022.

The world is how we shape it.

Sopra Steria Group (SOP) is listed on Euronext Paris

(Compartment A) - ISIN: FR0000050809

For more information, visit us at www.soprasteria.com

Annexes

Sopra Steria: Impact on revenue of changes in scope and exchange

rates – H1 2023 €m H1 2023 H1 2022

Growth Revenue

2,840.1

2,543.8

+11.6% Changes in exchange rates

-45.2

Revenue at constant exchange rates

2,840.1

2,498.5

+13.7% Changes in scope

129.6

Revenue at constant scope and exchange rates

2,840.1

2,628.2

+8.1% Sopra Steria: Changes in exchange rates – H1

2023 For €1 / % Average rateH1 2023 Average

rateH1 2022 Change Pound sterling

0.8764

0.8424

-3.9

%

Norwegian krone

11.3195

9.9817

-11.8

%

Swedish krona

11.3329

10.4796

-7.5

%

Danish krone

7.4462

7.4402

-0.1

%

Swiss franc

0.9856

1.0319

+4.7%

Sopra Steria: Revenue by reporting unit (€m / %) – H1

2023 H1 2023 H1 2022Restated* H1 2022

Organicgrowth Totalgrowth France

1,198.9

1,121.3

1,023.7

+6.9% +17.1% United Kingdom

461.0

425.8

442.6

+8.3% +4.2% Other Europe

819.8

736.2

731.3

+11.4% +12.1% Sopra Banking Software

218.0

209.6

210.9

+4.0% +3.4% Other Solutions

142.4

135.3

135.2

+5.3% +5.3%

Sopra Steria Group

2,840.1

2,628.2

2,543.8

+8.1% +11.6% * Revenue at 2023 scope and exchange

rates

Sopra Steria: Revenue by reporting unit (€m / %) – Q2

2023 Q2 2023 Q2 2022Restated* Q2 2022

Organicgrowth Totalgrowth France

609.0

582.9

510.4

+4.5% +19.3% United Kingdom

244.3

218.1

223.6

+12.0% +9.2% Other Europe

409.4

373.2

366.4

+9.7% +11.7% Sopra Banking Software

110.3

107.2

107.7

+2.9% +2.4% Other Solutions

71.8

68.0

67.9

+5.6% +5.6%

Sopra Steria Group

1,444.7

1,349.4

1,276.1

+7.1% +13.2% * Revenue at 2023 scope and exchange

rates

Sopra Steria: Performance by reporting unit – H1 2023

H1 2023 H1 2022 €m % €m %

France Revenue

1,198.9

1,023.7

Operating profit on business activity

108.8

9.1%

99.6

9.7%

Profit from recurring operations

90.1

7.5%

89.6

8.8%

Operating profit

84.2

7.0%

88.7

8.7%

United Kingdom Revenue

461.0

442.6

Operating profit on business activity

52.4

11.4%

46.6

10.5%

Profit from recurring operations

45.5

9.9%

40.4

9.1%

Operating profit

38.2

8.3%

40.6

9.2%

Other Europe Revenue

819.8

731.3

Operating profit on business activity

72.8

8.9%

36.4

5.0%

Profit from recurring operations

66.0

8.1%

31.5

4.3%

Operating profit

56.2

6.9%

26.8

3.7%

Sopra Banking Software Revenue

218.0

210.9

Operating profit on business activity

2.8

1.3%

8.7

4.1%

Profit from recurring operations

-6.3

-2.9%

-0.1

-0.1%

Operating profit

-13.6

-6.2%

-4.5

-2.1%

Other Solutions Revenue

142.4

135.2

Operating profit on business activity

14.3

10.0%

11.9

8.8%

Profit from recurring operations

12.4

8.7%

10.6

7.9%

Operating profit

12.0

8.5%

10.4

7.7%

Sopra Steria: Consolidated income statement – H1 2023 H1

2023 H1 2022 €m % €m %

Revenue

2,840.1

2,543.8

Staff costs

-1,755.0

-1,589.8

Operating expenses

-768.8

-689.6

Depreciation, amortisation and provisions

-65.2

-61.2

Operating profit on business activity

251.1

8.8%

203.1

8.0%

Share-based payment expenses

-28.4

-14.5

Amortisation of allocated intangible assets

-14.9

-16.6

Profit from recurring operations

207.8

7.3%

172.0

6.8%

Other operating income and expenses

-30.7

-10.0

Operating profit

177.1

6.2%

162.1

6.4%

Cost of net financial debt

-6.4

-4.8

Other financial income and expenses

-6.1

0.9

Tax expense

-42.5

-43.2

Net profit from associates

-0.1

0.1

Net profit

122.0

4.3%

115.1

4.5%

Attributable to the Group

112.5

4.0%

112.3

4.4%

Non-controlling interests

9.5

2.8

Weighted average number of shares in issue excl. treasury shares

(m)

20.20

20.22

Basic earnings per share (€)

5.57

5.55

Sopra Steria: Change in net financial debt (€m) – H1 2023

H1 2023 H1 2022

Operating profit on business activity

251.1

203.1

Depreciation, amortisation and provisions (excl. allocated

intangible assets)

67.0

62.1

EBITDA

318.1

265.3

Non-cash items

1.6

-1.8

Tax paid

-46.8

-44.5

Change in operating working capital requirement

-14.0

-51.4

Reorganisation and restructuring costs

-29.9

0.1

Net cash flow from operating activities

229.0

167.7

Lease payments

-46.2

-45.8

Change relating to investing activities

-47.2

-45.0

Net interest

-5.8

-0.6

Additional contributions related to defined-benefit pension plans

-6.9

-10.2

Free cash flow

122.9

66.3

Impact of changes in scope

-428.6

-4.2

Financial investments

-6.7

-4.2

Dividends paid

-87.5

-71.6

Dividends received from equity-accounted companies

2.7

2.7

Purchase and sale of treasury shares

-3.1

-5.4

Impact of changes in foreign exchange rates

-6.6

-1.4

Change in net financial debt

-406.9

-17.8

Net financial debt at beginning of period

152.0

327.1

Net financial debt at end of period

558.9

344.9

Sopra Steria: Simplified balance sheet (€m) – 30/06/2023

6/30/2023 12/31/2022 Goodwill

2,316.0

1,943.9

Allocated intangible assets

93.9

108.3

Other fixed assets

274.1

261.3

Right-of-use assets

387.6

359.9

Equity-accounted investments

179.2

183.5

Fixed assets

3,250.8

2,857.0

Net deferred tax

71.0

58.5

Trade accounts receivable (net)

1,383.5

1,104.2

Other assets and liabilities

-1,612.6

-1,347.6

Working capital requirement (WCR)

-229.0

-243.4

Assets + WCR

3,092.8

2,672.1

Equity

1,844.8

1,893.4

Pensions – Post-employment benefits

164.5

137.7

Provisions for contingencies and losses

97.2

98.5

Lease liabilities

427.4

390.5

Net financial debt

558.9

152.0

Capital invested

3,092.8

2,672.1

Sopra Steria: Workforce breakdown – 30/06/2023

6/30/2023 6/30/2022 France

22,363

20,106

United Kingdom

7,693

7,208

Other Europe

13,943

11,944

Rest of the World

555

467

X-Shore

9,400

8,982

Total

53,954

48,707

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230726298228/en/

Investor Relations Olivier Psaume

olivier.psaume@soprasteria.com +33 (0)1 40 67 68 16

Press Relations Caroline Simon (Image 7)

caroline.simon@image7.fr +33 (0)1 53 70 74 65

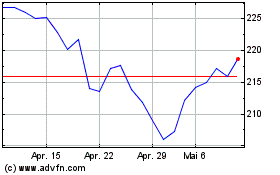

Sopra Steria (EU:SOP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

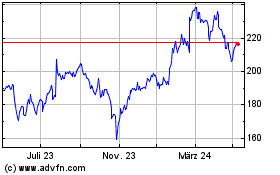

Sopra Steria (EU:SOP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024