- organic growth: +4.0% over the quarter and

+5.5% over 9 months

- Dynamic activity outside of France

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20221108005964/en/

(Graphic: Orpea)

The ORPEA Group (Paris:ORP) today announced its revenue for the

third quarter of 2022 and the first nine months of the year, to 30

September 2022.

Evolution of revenue in the third

quarter of 2022 and over the first nine months of the

year

In €m

Quarterly figures

9 months to 30/09

Q3 2021

Q3 2022

Change

o/w organic1

2021

2022

Change

o/w organic1

France Benelux UK Ireland

681.6

695.8

+2.1%

+1.6%

1,959.4

2,086.9

+6.5%

+4.4%

Central Europe

282.5

307.7

+8.9%

+5.3%

798.8

885.0

+10.8%

+5.6%

Eastern Europe

100.6

112.5

+11.9%

+10.1%

293.4

322.6

+9.9%

+7.9%

Iber. Peninsula and Latam

44.4

64.3

+45.0%

+17.7%

125.5

178.5

+42.2%

+16.1%

Rest of the World

0.8

1.0

+19.9%

+8.6%

2.3

2.9

+26.0%

+18.6%

Total revenue

1,109.9

1,181.3

+6.4%

+4.0%

3,179.4

3,475.8

+9.3%

+5.5%

Composition of the geographical areas: Central Europe (Germany,

Italy and Switzerland), Eastern Europe (Austria, Poland, the Czech

Republic, Slovenia, Latvia, Croatia), Iberian Peninsula and Latam

(Spain, Portugal, Brazil, Uruguay, Mexico, Colombia, Chile), Rest

of the World (China).

The Group's revenue in the third quarter of 2022 amounted

to €1,181.3m, up 6.4%, of which 4.0% was organic growth.

In France Benelux UK Ireland, revenue growth was 2.1% and

was mainly organic (+1.6%). The growth observed in both the

Netherlands and Belgium made it possible to offset the slight

decrease observed in France (-0.6%), resulting from a higher basis

of comparison over the same period in 2021, with retirement homes

activity still impacted by the crisis context. Thus, during the 3rd

quarter, after the decline observed between January and April 2022,

the occupancy rate in retirement homes in France has risen slightly

to an average of 85.4%, i.e. an increase of +0.9 point compared to

the 2nd quarter of 2022 (a level nevertheless approximately 1.5

points lower than the average rate observed in the third quarter of

2021). On the other hand, the turnover of the clinics in France

showed a good resilience, remaining almost stable compared to the

3rd quarter of 2021.

The rest of the Group's activity, in line with previous

quarters, showed good momentum in the third quarter thanks to

rising occupancy rates and the contribution of facilities opened in

the last 12 months.

Central Europe thus grew at a sustained rate of +8.9%, of

which +5.3% was organic, benefiting in particular from favorable

price changes in Germany and dynamic activity in Switzerland.

The Group's activities in Eastern Europe grew by +11.9%,

mainly organically (+10.1%), benefiting from the increase in the

number of facilities opened in various countries in the region.

Lastly, growth in activity was sustained in Spain thanks to an

increase in occupancy rates, while the rest of the Iberian

Peninsula and Latam region benefited from the inclusion of

Brazil Senior Living Group within the scope of consolidation as of

1 January 2022. In total, this geographical area posted growth of

+45%, of which +17.7% was organic.

For the first nine months of the year, consolidated

revenue amounted to € 3,475.8 million, an increase of 9.3%, of

which 5.5% was organic. All geographical areas showed good organic

growth momentum, resulting from several factors:

- in France Benelux UK Ireland, higher

occupancy rates than their average level in 2021 despite the impact

of the crisis in France; - an average level of activity that is

increasing in all activities and geographical areas; - the ramp-up

of facilities opened in previous quarters. At the end of September

2022, the Group had thus continued its development with the opening

of around 2,000 beds, corresponding to new facilities and

extensions.

Financial agenda: presentation of the

transformation plan

The presentation of ORPEA's transformation plan by its new

management team will take place on the morning of Tuesday 15

November 2022. Details of how to attend will be communicated

separately.

Background information on the financing

of the Group

In a highly inflationary economic environment that has impacted

financial results, and in the context of the strategic and

financial review conducted by the new management team, the company

reminds that a conciliation procedure was opened on 25 October with

the President of the Nanterre specialized Commercial Court to

enable future discussions with ORPEA SA's financial creditors to

take place within a stable and legally secure framework. The

objective of this procedure is to reach amicable solutions under

the aegis of the appointed conciliator, Maître Hélène Bourbouloux

(FHB), in order to achieve a sustainable financial structure by

drastically reducing its debt and securing the liquidity necessary

to continue its activity.

These discussions are made necessary by the impossibility for

ORPEA SA of implementing, in the current economic environment and,

the asset disposal programme in the proportions and timeframes

originally contemplated in the financing plan agreed with the

Group’s main banking partners in May this year.

At this stage, the solutions considered include the conversion

into equity of all of ORPEA SA's unsecured debt (which represented

approximately €4 billion as at 31 October 2022), amendment of the

"R1" and "R2" financial covenants contained in many of the Group’s

financing agreements not impacted by the conversion of debt into

equity, and certain modifications to existing secured debt to

facilitate the necessary injection of new financing in the form of

secured debt and capital increase.

The first meeting with ORPEA SA's unsecured debt holders will be

held on 15 November under the aegis of Maître Hélène Bourbouloux.

It is reminded that only relevant financial creditors will be

entitled to participate.

At the same time, the Group has continued to implement the

Financing Agreement announced on 13 June 2022. This financing,

amounting €1.729 billion spread over several loans (A1, A2, A3, A4

and B) as mentioned in the recent financial publications2, is to be

made available gradually until 31 December 2022, subject to the

fulfilment of conditions precedent. It is completed by an optional

refinancing line of a maximum amount of €1.5 billion (C1 and C2

loans), intended to refinance any existing financing (excluding any

bond financing, Euro PP and Schuldschein) of the ORPEA Group that

is not secured. The situation of the drawings on the various credit

lines as at 8 November 2022 is summarised in the table below, with

a reminder of the situation detailed in the press release of 28

September 2022:

It should also be noted that after taking into account a

drawdown of approximately €462 million on the C Loan, which is

expected to be irrevocably drawn on 16 November 2022, the amount of

financing available under this facility will be approximately €242

million.

At 30 September 2022, consolidated gross debt was €9,527m, while

cash stood at €854m (€831m as of 2 November 2022).

The maturity schedule of the gross financial debt as at 1

November 2022, pro forma of the drawings made under the Financing

Agreement, is shown below:

About ORPEA ORPEA is a leading global player, expert in

the care of all types of frailty. The Group operates in 22

countries and covers three core businesses: care for the elderly

(nursing homes, assisted living, home care), post-acute and

rehabilitation care and mental health care (specialized clinics).

It has more than 71,000 employees and welcomes more than 255,000

patients and residents each year.

https://www.orpea-group.com/

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a

member of the SBF 120, STOXX 600 Europe, MSCI Small Cap Europe and

CAC Mid 60 indices.

1 Organic growth of Group revenue reflects the following

factors: 1. The year-on-year change in the revenue of existing

facilities as a result of changes in their occupancy rates and per

diem rates; 2. The year-on-year change in the revenue of

redeveloped facilities or those where capacity has been increased

in the current or year-earlier period; 3. Revenue generated in the

current period by facilities created during the year or

year-earlier period, and the change in revenue of recently acquired

facilities by comparison with the previous equivalent period

2 Press releases dated 13 June, 28 September and 26 October

2022

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221108005964/en/

Investor Relations ORPEA Benoit Lesieur Investor

Relations Director b.lesieur@orpea.net

Toll free tel. nb. for shareholders: +33 (0) 805 480

480

Investor Relations NewCap Dusan Oresansky Tel.:

+33 (0)1 44 71 94 94 ORPEA@newcap.eu

Media Relations ORPEA Isabelle Herrier-Naufle

Media Relations Director Tel.: +33 (0)7 70 29 53 74 i.herrier-naufle@orpea.net

Image 7 Laurence Heilbronn

Tel.: +33 (0)6 89 87 61 37 lheilbronn@image7.fr

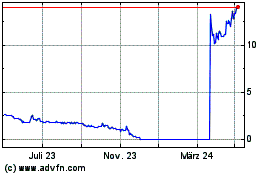

Orpea (EU:ORP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

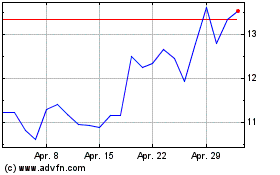

Orpea (EU:ORP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024