Paris, 30 August

2017 (6.00 p.m.)

HIGHCO POSTS

HEALTHY HALF-YEAR 2017 RESULTS

Business

growth

-

H1 2017 gross profit of €42.28 M, up 2.5%

on a reported basis and 2.3% LFL1.

-

Digital businesses up 6.2% LFL, accounting for

47.3% of the Group's total gross profit in H1 2017.

Growth in

profitability

-

Adjusted headline PBIT2 of

€10.88 M, up 6.7%.

-

Adjusted operating margin2 of

25.7%, up 100 basis points.

-

Adjusted attributable net income3

up 12.8% to €6.80 M.

Strong cash

generation

-

Operating cash flow of €8.19 M, up

€1.18 M (up 16.8%) compared with H1 2016.

-

Net cash4 of

€58.88 M at 30 June 2017, up by €9.26 M compared with 31

December 2016.

Revised outlook

from July 2017 confirmed

-

Growth in gross profit revised from more than 4%

to more than 1% LFL.

-

Growth in adjusted headline PBIT2

revised from equal to or greater than 6% to between 4% and

6%.

-

Increase in adjusted operating margin (adjusted

headline PBIT/gross profit)2 maintained at

equal to or greater than 50 bp.

-

| (€ M) |

H1 2017 |

H1 2016 restated5 |

H1 2017/ H1 2016

Change restated5 |

| Gross

profit |

42.28 |

41.27 |

+2.5%

(+2.3% LFL1) |

| Adjusted headline PBIT2 |

10.88 |

10.20 |

+6.7% |

| Operating margin2 (%) |

25.7% |

24.7% |

+100 bp |

| Adjusted

recurring operating income6 |

10.78 |

10.04 |

+7.4% |

| Adjusted attributable net income3 |

6.80 |

6.03 |

+12.8% |

| Net

cash4 |

58.88 |

49.627 |

+€9.26

M |

1 Like for

like: Based on a comparable scope (i.e. including CapitalData over

six months in 2016 and 2017) and at constant exchange rates (i.e.

applying the average exchange rate over the period to data from the

compared period).

2 Adjusted

headline profit before interest & tax: Recurring operating

income before restructuring costs and excluding the cost of

performance share plans (€1.54 M in H1 2017; no costs in H1 2016).

Adjusted operating margin: Adjusted headline PBIT/Gross

profit.

3 Adjusted

attributable net income: Attributable net income excluding the

after-tax cost of performance share plans (€1.05 M in H1 2017;

no costs in H1 2016) and excluding net income from assets held

for sale and discontinued operations (income of €0.17 M in

H1 2017; income of €0.39 M in H1 2016).

4 Net cash (or

net cash surplus): Cash and cash equivalents less gross current and

non-current financial debt.

Didier Chabassieu, Chairman of the

Management Board, stated, "HighCo achieved a

healthy first half in 2017 after a remarkable year in 2016. This

first half saw continued business growth, an increase in

profitability and strong cash generation. We expect further growth

in annual earnings with a confirmed rise in profitability of

50 bp. As a result, we are moving forward with our investment

strategy in Digital, especially businesses specialised in data and

mobile technologies."

FINANCIAL PERFORMANCE IN H1

2017

Business

growth

Following the like-for-like growth

in Q1 and Q2 of 4.2% and 0.7% respectively, H1 2017 gross profit totalled €42.28 M, rising by

2.5% on a reported basis and by 2.3% on a like-for-like basis.

After an excellent year in 2016, the growth trend over the half

year remained driven by Digital, which increased 6.2% like for

like.

The strong growth

trend continued in France in H1 2017 (up

7.0% like for like to €29.98 M, i.e. 70.9% of the Group's

gross profit) despite a slowdown in Q2 2017.

International

business decreased in H1 2017 (down 7.5% like for like to

€12.30 M):

Growth in

profitability

Business growth, combined with

sound cost control, resulted in 6.7% growth in

adjusted headline PBIT to €10.88 M in H1 2017

with:

Adjusted

operating margin (adjusted headline PBIT/gross profit)

rose substantially by 100 basis points,

coming to 25.7% (versus 24.7% in H1 2016 on a restated

basis).

The growth in adjusted headline

PBIT and the drop in restructuring costs (€0.10 M in

H1 2017 versus €0.16 M in H1 2016 on a restated

basis), led to a 7.4% rise in adjusted recurring

operating income to €10.78 M (as against €10.04 M in

H1 2016 on a restated basis).

Half-year operating income,

including the cost of performance share plans (€1.54 M in H1 2017),

amounted to €9.24 M, down 7.9%.

Half-year

adjusted attributable net income climbed 12.8% to €6.80 M

and half-year attributable net income came to €5.93 M.

The Group reported adjusted

half-year EPS of €0.33, up 13.2% (up 11.9% on a diluted basis) from

H1 2016.

Furthermore, with the cancellation

of combined put and call options on a 49% stake in the subsidiary

High Connexion, the corresponding share in net income will be

recognised under non-controlling interests (NCIs) as of H2 2017.

For information purposes, this cancellation would have lowered

adjusted 2016 EPS8 from €0.42 to

€0.38.

5 In

application of IFRS 5 Non-current Assets Held for Sale and

Discontinued Operations, the businesses in the United Kingdom were

classified and presented as discontinued operations as of the third

quarter of 2016. For reasons of consistency, the data reported for

H1 2016 have been restated to account for the impact of the UK

businesses. Net income and the loss on the sale of these businesses

are presented net of tax as a single item in the consolidated

income statement under Net income from assets held for sale or

discontinued operations.

6 Adjusted

recurring operating income: Recurring operating income excluding

the cost of performance share plans.

7 At 31

December 2016.

8 EPS excluding

the after-tax cost of performance share plans and excluding net

income from assets held for sale or discontinued operations (MRM

and POS Media).

Strong cash generation

Half-year cash flow rose sharply

by 16.8% to €8.19 M. As such, the net cash

position was up by €9.26 M to €58.88 M at 30 June

2017. Working capital improved by €3.48 M. Excluding operating

working capital (€54.88 M at 30 June 2017), net debt came

out negative at €4 M, down by €5.78 M with respect to

31 December 2016.

HIGHLIGHTS

Digital

strategy

Gross profit in Digital grew 6.2%

in H1 2017. Digital businesses represented 47.3% of the

Group's gross profit as at end-June 2017, up from 46.6% at

end-2016.

-

Fully digital DRIVE TO STORE

solutions

Although total volumes of

digital coupons issued fell over the half-year

(down 17%), "next-generation" solutions (Load to Card and Click

& Collect) grew sharply (up 16%), representing nearly

10 million digital coupons issued over the period. HighCo

signed with a new retailer (Franprix) for its Load to Card solution

and now wants to take it a step further to combine brand loyalty

programmes with different retailers.

After several years of strong

growth, despite further growth in the volume of push SMS and

notifications (up 8%), mobile businesses fell

slightly with the impact of the price repositioning for Internet+

Mobile services.

Brand content and targeted media

on social networks upheld their excellent

performance, rising further in H1 2017 with the acquisition of

new clients such as eBay.

At the same time, the Group

continues to develop its hyper-personalisation

solution for advertising and promotional messages for advertisers

(CapitalData's Data Management Platform). While renewing targeting

campaigns for its long-standing advertiser clients, the Group now

develops web-to-store programmatic campaigns

as an effective alternative for paper flyers for retailers, with

new retailers from Casino group (Géant Casino, Monoprix and Leader

Price).

-

Strong growth in the

digitisation of IN-STORE solutions

Digital services continue to grow

significantly in the still predominantly "paper-based" area of

IN-STORE solutions. The proportion increased from 23.6% for

H1 2016 to 33% for H1 2017.

Point-of-sale

paper coupon and media businesses rose further in France but

declined in Belgium. The Group's main contracts with its retail

partners remained in effect over the period. In Belgium, digital coupon and media kiosks installed at the end of

2016 in the Carrefour network posted good initial results.

After signing with a new client

(Intermarché), and as Click & Collect continues to expand,

HighCo offers a unique media and targeted coupon offer now deployed

across nearly 90% (in value) of Click &

Collect websites in France.

-

Growth trend remains strong for

DATA solutions

The share of digital DATA

solutions rose from 36.3% at end-June 2016 to 38.3% at end-June

2017.

Although the volume of paper

coupons cleared in France and Belgium fell, the share increased

slightly in the volume of coupons cleared

digitally, covering coupons from e-commerce websites, in-store

kiosks and downloads to loyalty cards.

With more than 300 campaigns for

digital cashback offers launched in H1 2017, e-CBO campaigns continued to grow, up 26%. These

digital DATA tools now include a new solution, e-GWPs, featuring fully dematerialised management of

gift-with-purchase offers.

Lastly, the Group plans to

continue supporting its brands and retailer clients in new market

trends, namely with gamification. This

solution encompasses a comprehensive, fully digital range of

services, from game development to media coverage and prize

shipment.

Governance

HighCo announces that Didier

Chabassieu is currently facing health problems. However, he

continues to carry out his duties as Chairman of the Management

Board alongside Cécile Collina-Hue, member of the Management Board

and Managing Director. The Executive Committee, made up of business

unit managers and experts serving in their positions since 2013,

supports them in ensuring the Group's day-to-day operations, and

strategic and managerial issues.

2017

GUIDANCE

Given the performance reported for

the first half of the year and the outlook expected for the second

half, the Group has confirmed its revised guidance for 2017

announced in July, as follows:

-

Growth in 2017 gross profit revised from more

than 4% to more than 1% like for like (2016 gross profit: up 11.8%

like for like), with the Group's share of digital business expected

to reach its target of 50% (2016: 46.6%);

-

Growth in adjusted headline PBIT2

revised from equal to or greater than 6% to between 4% and 6%

(adjusted 2016 headline PBIT: €14.1 M);

-

Rise in adjusted operating margin2

maintained at equal to or greater than 50 bp (adjusted 2016

operating margin: 17.4%).

As a reminder, the Group's financial resources

will be allocated as a priority to:

-

Capital expenditure, for between €1.5 M and

€2 M (€1.08 M in 2016, €0.70 M in

H1 2017);

-

Share buybacks totalling between €0.5 M and

€1 M (€0.66 M in 2016, €0.25 M in

H1 2017).

The Group continues to review acquisitions and

investments in the Digital sector, especially businesses

specialised in data and mobile technologies.

A conference call with analysts will take place on

Thursday, 31 August 2017 at 11 a.m. The presentation will

be available online on the Company's website www.highco.com.

HighCo

is deeply saddened by the loss this summer of its founder, Frédéric

Chevalier.

Frédéric Chevalier imagined, dreamt, founded, developed and guided

HighCo. He was an ambitious, visionary and talented leader in its

soul and will remain so forever.

HighCo and the people at HighCo will be paying tribute to him in

the weeks to come.

About HighCo

Since its creation, HighCo has placed innovation at the

heart of its values, offering its clients - brands and retailers -

Intelligent Marketing Solutions to influence shopper behaviour with

the right deal, in the right place, at the right time and on the

right channel.

Listed in compartment C of

Euronext Paris, and eligible for the "long only" DSS, HighCo has

more than 700 employees and since 2010 has been included in

the Gaia Index, a selection of 70 responsible Small and Mid

Caps.

Your contacts

Cécile

Collina-Hue

Cynthia Lerat

Managing

Director

Press Relations

+33 1 77 75 65

06

+33 1 77 75 65 16

comfi@highco.com

c.lerat@highco.com

Upcoming events

Publications take place after market close.

Conference call on 2017 half-year

earnings: Thursday, 31 August 2017 (11.00 a.m. CET)

Q3 and 9-month YTD 2017 Gross Profit: Wednesday, 18 October

2017

Q4 and FY 2017 Gross Profit: Wednesday, 24 January 2018

HighCo is a

component stock of the indices CAC® Small (CACS), CAC®

Mid&Small (CACMS) and CAC® All-Tradable (CACT).

ISIN: FR0000054231

Reuters: HIGH.PA

Bloomberg: HCO FP

For further financial information and press

releases, go to www.highco.com

This

English translation is for the convenience of English-speaking

readers. Consequently, the translation may not be relied upon to

sustain any legal claim, nor should it be used as the basis of any

legal opinion. HighCo expressly disclaims all liability for any

inaccuracy herein.

Download the press

release

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: HIGHCO via Globenewswire

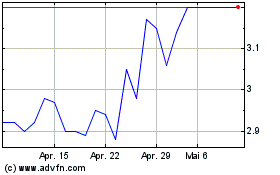

High (EU:HCO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

High (EU:HCO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024