Coface SA: Description of the 2024-2025 Share Buyback Program

Description of the 2024-2025 Share

Buyback Program

- INTRODUCTION

It is reminded that the Shareholders’ Combined

General Meeting of COFACE SA (the Company) held on of 16 May 2023,

had previously authorized the Board of Directors, in its fourth

(4th) resolution, to carry out transactions on

COFACE SA’s shares under the framework of the 2023-2024 Share

Buyback Program. The main features and description of the said

program are published on the Company’s website and on the

2023 Universal Registration Document.

The Company, listed on Euronext Paris -

Compartment A -, wishes to continue to have a Share Buyback Program

(the Program), pursuant to applicable regulation (See "Legal

Framework" below).

To this end, the Shareholders’ Combined General

Meeting of 16 May 2024 issued a new authorization to the Board of

Directors, with the power to sub delegate in accordance with

legislative and regulatory provisions, fourth (4th)

resolution, to implement a new Share Buyback Program on the

Company’s shares (Code ISIN FR0010667147). This Program shall

replace the existing one established by the Combined General

Meeting of 16 May 2023.

- MAIN CHARACTERISTICS OF THE

2024-2025 SHARE BUYBACK PROGRAM

2.1 Date of Shareholders' General Meeting authorizing

the Program

The 2024-2025 Program was authorized by the

Shareholders’ Combined General Meeting of 16 May 2024, in

its fourth (4th) resolution.

The Board of Directors of 5 August 2024,

authorized COFACE SA, with the power to sub delegate to the

CEO, pursuant to the delegation given by the Shareholder’s Combined

General Meeting of 16 May 2024 in its fourth (4th)

resolution, to trade on the Company’s share through the "2024-2025

Share Buyback Program", whose main features are described

below.

2.2 Allotment by objective of shares held as of 31 July

2024

COFACE SA held, as of 31 July 2024, 0.56% of its

share capital or 834,406 common shares. At that date, the breakdown

by objective of the number of shares held was as follows:

|

Objectives |

Number of own shares held |

|

a) ensure liquidity and boost the market for the

Company’s stock through an investment service provider acting

independently within the context of a liquidity contract in

compliance with the Charter of Ethics recognized by the French

Financial Markets Authority |

166,119 |

b) allot shares to employees of the Company and in

particular within the context:

(1) of profit sharing;

(2) any stock option plan of the Company, pursuant

to the provisions of Articles L.225-177 et seq. of the French

Commercial Code;

(3) any savings plan in compliance with Articles

L.3331-1 et seq. of the French Labour Code;

(4) any allocation of bonus shares pursuant to the

provisions of Articles L.225-197-1 et seq. of the French Commercial

Code;

as well as performing all hedging operations relating thereto,

under the conditions provided for by the market authorities and at

the times to be determined by the Board of Directors or the person

acting upon its delegation |

0

0

0

668,287 |

|

e) cancel all or part of the stock thus

purchased |

0 |

|

TOTAL |

834,406 |

2.3 Objectives of the 2024-2025 Share Buyback

Program

Purchases and sales of the Company’s shares may be made, by

decision of the Board, to:

|

Authorized objectives |

|

a) ensure liquidity and boost the market for the

Company’s stock through an investment service provider acting

independently within the context of a liquidity agreement, in

compliance with the market practice accepted by the Autorité

des marchés financiers on 2 July 2018, |

b) allocate shares to the corporate officers and

employees of the Company and of other Group entities, in particular

within the context of:

(i) employee profit sharing;

(ii) any stock option plan of the Company,

pursuant to Article L.225-177 et seq. of the French Commercial

Code;

(iii) any savings plan in compliance with

Article L.3331-1 et seq. of the French Labour Code;

(iv) any allocation of bonus shares pursuant to

the provisions of Article L.225‑197-1 et seq. of the French

Commercial Code;

as well as performing all hedging operations relating to these

operations, under the conditions provided for by the market

authorities, and at the times to be determined by the Board of

Directors or the person acting by delegation thereof |

|

c) transfer the Company’s shares upon exercise of

the rights attached to securities entitling their bearers, directly

or indirectly, through reimbursement, conversion, exchange,

presentation of a warrant or in any other manner, to the allocation

of the Company’s shares pursuant to current regulations;

additionally, perform all hedge operations relating to these

transactions, under the conditions provided for by the market

authorities and at the times to be determined by the Board of

Directors or the person acting by delegation of the Board of

Directors |

|

d) keep the Company’s shares and subsequently

remit them as payment or trade within the context of any external

growth operations |

|

e) cancel all or part of the stock purchased |

|

f) implement any market practice that may be

authorised by the French Financial Markets Authority and, more

generally, perform all operations in compliance with applicable

regulations in particular with Regulation (EU) No 596/2014 of

the European Parliament and of the Council of 16 April 2014 on

market abuse (market abuse regulation) |

2.4 Maximum percentage of the share capital, maximum

number of shares, maximum purchase price and characteristics of the

shares that COFACE SA intends to buyback

2.4.1 Characteristics of the shares that COFACE SA

intends to buyback

Common shares of the Company traded on Euronext Paris:

|

STOCK MARKET PROFILE |

|

Trading |

Euronext Paris (compartment A), eligible for

deferred settlement service (SRD) |

|

ISIN code |

FR0010667147 |

|

Reuters code |

COFA.PA |

|

Bloomberg code |

COFA FP |

|

Stock market indexes |

SBF 120, CAC All Shares, CAC All-Tradable,

CAC Financials, CAC Mid & Small, CAC Mid 60, Next 150 |

2.4.2 Maximum percentage of the share

capital

The Board of Directors can authorise, with the

power to sub-delegate under the legal and regulatory conditions, in

compliance with the provisions of Articles L.22-10-62 et seq and

L.225-210 et seq. of the French Commercial Code, the purchase

of –in one or more instances and at the times to be determined by

it - a number of shares of the Company not to exceed:

(i) 10% the total number of shares composing

the share capital, at any time whatsoever; or,

(ii) 5% of the total number of shares

subsequently composing the share capital if it concerns shares

acquired by the Company in view of keeping them and transferring

them as payment or exchange under a merger, spin-off or

contribution operation.

These percentages apply to a number of shares

adjusted, where appropriate, according to the operations that could

affect the share capital subsequent to the Shareholders’ Meeting of

16 May 2024.

2.4.3 Maximum number of shares

COFACE SA is committed, by law, not to exceed

the holding limit of 10% of its capital, such 10% limit being, for

information purposes, 15,017,979 shares as at 31 July 2024.

2.4.4 Maximum purchase price

According to the fourth (4th)

resolution proposed and accepted by the Shareholder’s Combined

General Meeting of 16 May 2024, the maximum purchase

price per unit may not exceed €18, excluding costs.

The Board of Directors may nevertheless, for

operations involving the Company’s capital, in particular a

modification of the par value of the share, a capital increase by

incorporation of reserves following the creation and allocation of

bonus shares, a stock split or reverse stock split, adjust the

aforementioned maximum purchase price in order to take into account

the impact of these operations on the value of the Company’s

stock.

2.4.5 Other information

The acquisition, disposal or transfer of these

shares may be completed and paid for by all methods authorised by

the current regulations, on a regulated market, multilateral

trading system, a systematic internaliser, or over the counter, in

particular through the acquisition or disposal of blocks of shares,

using options or other derivative financial instruments, or

warrants or, more generally, securities entitling their bearers to

shares of the Company, at the times that the Board of Directors

will determine.

The Board of Directors shall have all powers,

with the power to sub delegate in compliance with legislative and

regulatory conditions, in order to, in accordance with applicable

legislative and regulatory provisions, proceed with the permitted

reallocation of repurchased shares in view of one of the objectives

of the programme, to one or more of its other objectives, or even

their disposal, on or off the market.

2.5 Term of the 2024-2025 Share Buyback

Program

According to the fourth (4th)

resolution proposed and accepted by the Shareholders’ Combined

General Meeting of 16 May 2024, this Program will have a

maximum period of eighteen (18) months from the date of said

Combined General Meeting and will therefore continue no later than

15 November 2025 (including) or until the date of its renewal by a

Shareholders’ General Meeting, the one occurring first.

This authorisation concludes the authorisation

granted by the fourth (4th) resolution that was adopted

by the Shareholders’ Combined Meeting of 16 May 2023.

- LEGAL FRAMEWORK

Legal Framework

The legal framework used for this document shall be that in

force on 31 July 2024.

It shall be noted that regulation may evolve during time and its

updates shall be taken into consideration.

- Regulation (EU) No 596/2014 of

the European Parliament and of the Council of 16 April 2014 on

market abuse (market abuse regulation) and repealing Directive

2003/6/EC of the European Parliament and of the Council and

Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC;

- Commission Delegated Regulation

(EU) 2016/1052 of 8 March 2016 supplementing Regulation (EU) No

596/2014 of the European Parliament and of the Council with regard

to regulatory technical standards for the conditions applicable to

buy-back programs and stabilisation measures;

- Article L.225-206 and following of

the French Commercial Code (and updates);

- General Regulation of the French

Market Authority: Article L.221-1 and seq. and Article L.241-1 and

seq.;

- AMF Policy Documents.

Historical figures

The main features of the Share Buyback Programs

have been published on the website of the Company

(http://www.coface.com/Investors) and are also described in the

Universal Registration Documents.

Share Buyback Program

|

General Assembly authorizing the Program

|

Decision to implement the Program by the Board of

Directors

|

Transactions framework |

|

Liquidity Agreement |

LTIP |

Cancellation of shares |

|

2020 – 2021 |

14 May 2020 (Res. 5) |

29 July 2020 |

Yes |

No |

Yes1 |

|

2021 – 2022 |

12 May 2021 (Res. 17) |

28 July 2021 |

Yes |

No |

No |

|

2022 – 2023 |

17 May 2022 (Res. 8) |

28 July 2022 |

Yes |

Yes2 |

No |

|

2023 – 2024 |

16 May 2023 (Res. 4) |

10 August 2023 |

Yes |

Yes3 |

No |

|

2024 – 2025 |

16 May 2024 (Res. 4) |

5 August 2024 |

Yes |

No |

No |

(1) Own shares transactions

Agreement, signed with Kepler Cheuvreux, from 27 October 2020 to 29

January 2021, to buy Coface’s shares for their cancellation. For

more information, the reader should refer to the Universal

Registration Document published in 2021 on the 2020 financial

statements.

(2) Own shares transactions Agreement, signed with

BNP Paribas Exane, from 13 September 2022 to 15 November 2022, to

buy Coface’s shares for their allocation under the LTIP. For more

information, the reader should refer to the Universal Registration

Document published in 2023 on the 2022 financial statements.

(3) Own shares transactions Agreement, signed with

Kepler Cheuvreux, from 11 September 2023 to 29 September 2023, to

buy Coface’s shares for their allocation under the LTIP. For more

information, the reader should refer to the Universal Registration

Document published in 2024 on the 2023 financial statements.

|

Wiztrust |

Regulated

documents posted by COFACE SA have been secured and authenticated

with the blockchain technology by Wiztrust. You can check the

authenticity on the website

www.wiztrust.com. |

- 2024 08 05 Share Buyback Program vDEF

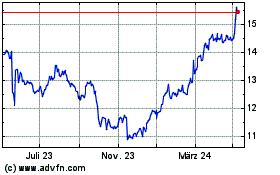

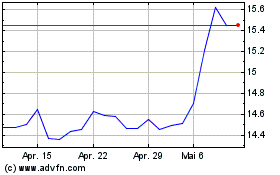

Coface (EU:COFA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Coface (EU:COFA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024