Groupe Casino : Third-quarter 2023 – France

Third-quarter 2023 – France

Sales:

- France

Retail sales were down -5.6% on a same-store basis,

reflecting:

- The effect of

price readjustment measures in Supermarkets/Hypermarkets taken in

Q1. The commercial turnaround in historic supermarkets is

confirmed, with customer traffic and volumes now positive1

at +8% and +3% respectively in 4H, while hypermarkets are seeing a

gradual improvement in customer traffic

- Growth

of +0.4% in Parisian and convenience banners, penalized by

unfavorable weather conditions which impacted non-food sales. Food

sales were up +1.3%

- At

Cdiscount, the deliberate reduction in

unprofitable direct sales is continuing, while GMV marketplace

sales are back on an upward trend at +1%, and service revenues are

up by 7%. All in all, sales were down -25%

- Overall,

sales in France were -8.3% on a reported basis and

-8.2% on a like-for-like basis

Financial indicators:

- France

EBITDA at €136m (-€12m after lease payments), impacted by

price-cutting measures. The year-on-year decline was smaller than

in Q2, driven by a sequential improvement in Supermarkets and

Hypermarkets

- France

net debt at €5.6bn at 30 September 2023, +€0.2bn higher

than at 30 June 2023

- At September 30,

2023, liquidity stood at €1.3 billion, including

€945 million in available cash (including proceeds from the ITM

disposal)

Asset disposals:

- Sale of

61 stores to ITM for at least €160m net and

collection of a further

€140m in deposits for the sale of around 70 stores

over the next three years

- Signing

of a preliminary agreement with Grupo Calleja for the

sale of Casino's direct stake in Grupo Éxito for

$400m, which is expected to close around the end of the

year

Restructuring plan

agreement

- Lock-up

agreement reached on 5 October and accelerated

safeguard proceedings opened on 25

October 2023

Updated 2023 outlook

- Given the price investments

required to continue driving the recovery in customer

traffic and volumes in hypermarkets and supermarkets in an

increasingly competitive environment, the Group now

estimates that full-year 2023 EBITDA after lease payments, which

was forecast at €214m last July2, will be lower

than the level achieved over the 12-month rolling period to

end-September 2023, i.e., €100m

France Retail

Same-store change in

sales3

|

|

Q3 2022 |

Q2 2023 |

Q3 2023 |

|

Franprix |

+8.4% |

+4.3% |

+2.2% |

|

Monoprix |

+4.1% |

+2.2% |

0.0% |

|

Monoprix City |

+4.5% |

+2.5% |

-0.2% |

|

Monop’ |

+12.4% |

+5.3% |

+1.6% |

|

Convenience |

+6.3% |

+2.7% |

+0.4% |

|

Parisian and convenience banners |

+5.2% |

+2.6% |

+0.4% |

|

Supermarkets |

+1.6% |

-13.9% |

-11.5% |

|

o/w long-standing supermarkets4 |

+2.1% |

-12.5% |

-10.0% |

|

Hypermarkets |

+2.2% |

-17.1% |

-18.6% |

|

Supermarkets/Hypermarkets |

+1.9% |

-15.3% |

-14.4% |

|

FRANCE RETAIL |

+3.9% |

-4.2% |

-5.6% |

In France Retail, sales for the quarter

came to €3,396m, down -5.6% on a same-store basis,

reflecting slight growth in Parisian and convenience banners

(+0.4%), with non-food sales adversely affected by the weather, and

a negative quarter in Supermarkets/Hypermarkets (-14.4%) due to the

implementation of price adjustment measures, nevertheless

demonstrating a sequential improvement, particularly in

long-standing Supermarkets, where customer traffic and volumes are

now positive.

The expansion strategy continued during the

quarter, with the opening of 91 stores in

convenience formats (Franprix, Spar, Vival, etc.), mainly

under franchise.

Casino Group has also stepped up

initiatives designed to support purchasing power,

including:

Monoprix:

- Price cuts on more than 760

products in all stores since May (on more than 3,100

products in total, particularly for the largest stores and

e-commerce)

- Price freeze

extended until the end of the year on more than 260

products

- Cost-price offers on fresh

produce since the beginning of September.

Franprix:

- Price cuts on

150 essential products since the end of May,

price freeze on TLJ products in all Franprix

stores since Q2

- Development of the Leader

Price product range (257 additional SKUs and roll-out of

Leader Price shop-in-shops in 12 stores in Q3)

- Dedicated end-of-month

promotions, with immediate reductions on 50 SKUs on top of

standard offers.

Hypermarkets/Supermarkets/Convenience:

- Continuation of the

anti-inflation basket with prices frozen on 500

products (extended to 1,000 products at less than €2 from the

beginning of October)

- Introduction of cost-price

fuel at hypermarkets and some supermarkets at weekends

from the end of August and every day since 29 September

- Featured low prices with

the Leader Price range (7% share of volumes)

- Roll-out of the multiple

discount system on all Casino brand products

The partnership with Prosol is also

continuing to develop, with the roll-out of Fresh outlets

in Montpellier hypermarkets on 6 December 2023 and in Montpellier

supermarkets scheduled on 13 December 2023.

Consolidated net sales in France by

banner

|

|

Q2 2023/Q2 2022 change |

Q3 2023/Q3 2022 change |

|

Net sales by banner (in €m) |

Q2 2023 net sales |

Total growth |

Organic growth5 |

Same-store growth1 |

Q3 2023 net sales |

Total growth |

Organic growth1 |

Same-store growth1 |

|

Hypermarkets |

582 |

-24.9% |

-17.5% |

-17.1% |

636 |

-16.4% |

-20.0% |

-18.6% |

|

Supermarkets |

789 |

-8.0% |

-12.2% |

-13.9% |

873 |

-8.9% |

-10.7% |

-11.5% |

|

Convenience & Other6 |

461 |

+1.2% |

-0.8% |

+2.8% |

513 |

-1.9% |

-0.8% |

+0.7% |

|

o/w Convenience7 |

380 |

-1.9% |

-1.9% |

+2.7% |

437 |

-1.6% |

0.0% |

+0.4% |

|

Monoprix |

1,088 |

-2.1% |

+2.2% |

+2.2% |

1,012 |

-2.7% |

-1.1% |

0.0% |

|

Franprix |

396 |

+2.9% |

+3.9% |

+4.3% |

362 |

+2.9% |

+2.9% |

+2.2% |

|

FRANCE RETAIL |

3,316 |

-7.5% |

-4.8% |

-4.2% |

3,396 |

-6.5% |

-6.5% |

-5.6% |

- Monoprix

sales for the quarter were stable on a same-store basis,

reflecting satisfactory sales in Food (+1.6%)

compared with Non-Food (-3.8%), which was mainly impacted by

unfavourable weather conditions that weighed on sales in the

clothing segment and on customer traffic. Naturalia posted

another quarter of growth (+1.9% ) in a still difficult

organic market, confirming the positive momentum seen in recent

months. The banner further expanded its store network

during the quarter, with seven international store

openings. In addition, the Amazon Prime/Monoprix

partnership8 is bearing fruit, attracting and retaining new

customers for the Monopflix subscription (30% new

subscribers).

-

Franprix reported same-store sales growth

of +2.2% for the quarter, with a sequential slowdown due

to a difficult basis for comparison (very good performance in

July-August 2022) and a summer impacted by riots in early July and

unfavourable weather. September saw a clear upturn in the

trend, with same-store growth of +3.4% and customer

traffic up +4.2% (vs +0.5% for the quarter). Franprix posted

double-digit growth in e-commerce and continued

its expansion strategy, with 22 new stores opened during

the quarter, for a total of 98 stores opened since the

beginning of the year.

- The

Convenience business posted same-store

growth of +0.4% in net sales over the quarter. The

store network expansion and independent retailer absorption

strategy continued, with 65 new convenience store

openings recorded during the quarter.

- Casino

Supermarkets and Hypermarkets once again reported lower

sales (-14.4% on a same-store basis), due in particular to

significant price cuts (-10% on average).

Customer traffic and volume trends continue to

improve.

- The recovery

trajectory for long-standing Supermarkets has been

confirmed over the quarter, and the last few weeks show an

increase in customer traffic of around +7% and

volumes that are now positive (+3%), consolidating

the stores' commercial turnaround.9

| |

|

|

Graph available in attached pdf |

Graph available in attached pdf |

- For Hypermarkets

and former hypermarkets operating under the Supermarkets banner,

the change in price adjustments remains more gradual than for

supermarkets, as hypermarkets require more time and advertising

effort in the face of increased competition since the start of the

school year. Customer traffic improved, standing at around -10%

over the quarter (roughly -4% over the last two weeks). Volumes

remain below market levels, but the gap is gradually closing.

|

Graph available in attached pdf |

Graph available in attached pdf |

Cdiscount10

In line with its strategy, Cdiscount

continued to reduce its direct sales this quarter, in favor of

developing services, notably related to the

marketplace,

Advertising11, B2C services and

B2B activities.

Improved mix in line with the

plan to transform to a more profitable model:

- 35%

decrease in direct sales

- Evolution of the

mix in favor of the marketplace: marketplace GMV

recorded a return to growth this quarter (+1%

year-on-year, +9% vs. 2019), with a share that reached a

new record level of 63% (+11 pts year-on-year, +23 pts vs.

2019)

- Good

performance by B2C Services GMV at €38 million (+12%

year-on-year), mainly driven by Travel activities in a favorable

market context.

Growth in services (+7%) led to a +7 pts

improvement in gross margin:

- Revenues from the

marketplace reached €46m (+1.4% year-on-year, +29.4% vs. 2019)

- Revenues

from Advertising Services were €18m for the quarter (up +8% year on

year, double the 2019 figure), still led by the

momentum of Retail Media (revenues up +11% year on

year) with a continued improvement in the GMV take rate12, to 4%

(up +1 pt year on year and up +2.5 pts vs. 2019)

- B2B

activities continued to develop, with Octopia's

B2B revenues up +54% and C-Logistics’

B2B revenues up four-fold over one

year.

- Octopia's momentum

was driven by its Merchants-as-a-Service and

Marketplace-as-a-Service activities, where revenues tripled over

the past year, driven by the successful launch of two marketplaces

in the third quarter, and also by its Fulfilment-as-a-Service

activities, with the number of parcels shipped up +28% year on

year;

- C-Logistics' B2B

growth benefited from the growing number of parcels

shipped to external customers (up six-fold year on year).

Cost savings plan:

The cost savings plan to

recalibrate the operating cost structure and level of capital

expenditure by end-2023 is ahead of the target to achieve

€90m in full-year savings vs 2021 (initial target of €75

million in full-year savings announced in July 2022, revised

upwards in April 2023 to include an additional €15 million).

|

Key figures |

Q3 2022 |

Q3 2023 |

Change |

|

Total GMV including tax13 |

772 |

668 |

-13.5% |

|

o/w direct sales |

304 |

198 |

-35.0% |

|

o/w marketplace sales |

333 |

336 |

+0.7% |

|

Marketplace contribution (%) |

52.3% |

62.9% |

+10.6 pts |

|

Services revenues |

66.9 |

71.5 |

+6.9% |

|

Marketplace revenues14 |

45.4 |

46.1 |

+1.4% |

|

Revenues from Advertising Services2 |

16.5 |

17.7 |

+7.8% |

|

Octopia B2B revenues2 |

5.0 |

7.7 |

+54.0% |

|

Net sales (in €m) |

373 |

281 |

-24.8% |

Cnova published its Q3 2023 sales figures

this morning.

Financial indicators – France

EBITDA: third-quarter

EBITDA15 was €136m, and -€12m

after lease payments, mainly due to margin investing in

Casino hypermarkets and supermarkets.

- Due to the

sequential improvement in volume trends at Distribution Casino

France, the year-on-year decline in France EBITDA was -€196m in Q3,

lower than in Q2, when it stood at -311 M€

On this basis, EBITDA for the last 12

months before lease payments was €694m and €100m after lease

payments.

Net debt: At

30 September 2023, net debt16 stood at €5.6bn (+€0.2bn higher than

at 30 June 2023).

Liquidity: At 30

September 2023, the Group's liquidity in France was

€1.3bn, including €945m in available cash and €311m in

cash that is either not available or in transit.At 30 September

2023, the Group had received proceeds from the sale of the first

ITM stores and deposits on the sale of around 70 additional stores

to be completed within three years.

Updated 2023 outlook

Net sales and EBITDA for the first nine months

of 2023 continued to be impacted by price readjustment measures and

the more gradual than expected recovery of Hypermarkets and

Supermarkets.

Given the price investments required to continue

driving the recovery in customer traffic and volumes in today’s

increasingly competitive environment, the Group now estimates that

full-year EBITDA will be lower than the level achieved over the

12-month rolling period to end-September 2023 (€100m after lease

payments compared with the €214m forecast in July 2023).17

Asset disposals

France

At the end of September 2023, Groupement

Les Mousquetaires and Casino Group completed the sale of a set of

61 Casino France outlets (hypermarkets, supermarkets,

Franprix and convenience stores) with net store sales of €563m for

2022.

The sale was based on an enterprise value of

€209m, including service stations. After working capital

adjustments and provisions that will depend on the stores’ final

financial statements, the net sale price is expected to represent

at least €160m, with the Group having collected the

provisional sale proceeds at the end of September. Groupement Les

Mousquetaires has already taken possession of 58 of the 61 sales

outlets sold. At the same time, the Group received €140m in

deposits for the second wave of store disposals (to be

completed within three years).

Latam

Following the spin-off of GPA and Grupo Éxito at

the end of August 2023, Casino Group has also decided to

begin the process of selling Grupo Éxito. On Friday 13

October 2023, its Board of Directors approved the signing of a

preliminary agreement with Grupo Calleja, which

owns the leading food retail group in El Salvador, for the

sale of Casino's entire stake in Grupo Éxito, i.e.,

34.05% of Grupo Éxito's share capital. GPA, which

holds 13.31% of Grupo Éxito's shares, is also party to the

preliminary agreement and has agreed to sell its stake as

part of the takeover bid.The price, which will be paid in cash,

represents a total of $400m for Casino Group’s direct

stake and $156m for GPA’s stake. The

all-cash tender offer is expected to close around the end of the

year.(see press release dated 16 October 2023)

CSR commitments

In the third quarter, Casino Group pursued its

social, societal and environmental commitments in a number of

areas:

The fight against climate

change

- The Executive Committee reaffirmed

its commitment to the fight against climate change by taking part

in a Climate Fresk workshop.

- More than 180

employees are already familiar with the Fresk.

- In September,

Casino Group received two LSA “La conso s’engage” awards for its

climate-focused CSR initiatives.

More responsible trade

- On France’s national anti-food

waste day, a number of banners highlighted their commitments:

- Franprix has saved 2.4 million

meals since the beginning of the year, with 840 tonnes of products

donated to non-profits, 300,000 anti-waste baskets sold on the

Phenix and Too Good To Go platforms, and 47,000

anti-waste fruit and vegetable/pastry boxes sold in stores.

- Monoprix donates its unsold goods

to over 400 non-profits working to help vulnerable people through

its partners Banques Alimentaires, the French Red

Cross, and Secours populaire français (18.5 million meals were

distributed in 2022).

- Casino now offers 80 Max

Havelaar/Fairtrade-certified private-label products.

- Cdiscount supports responsible

products, which accounted for 18.6% of product GMV in third-quarter

2023 (+5 pts vs. 2022).

Workplace equality

- Launch of the first Fresque de

l’Equité (gender equality workshop) to continue raising employee

awareness of the issues surrounding gender inequality.

- The Group obtained

a score of 94/100 on the Equality Index in 2023.

Community outreach

- The Casino, Franprix, Monoprix and

Cdiscount banners raised €225,000 during Gustave Roussy’s

“Septembre en Or” campaign to fund medical research to help cure

childhood cancer in the 21st century.

Conciliation procedure

On 25 May 2023, the President of the Paris

Commercial Court opened a conciliation procedure for Casino Group

for an initial period of four months, which was extended by a

further month until 25 October 2023. The purpose of this procedure

was to enable the Group to engage in discussions with its financial

creditors within a legally secure framework.

With a view to strengthening the Group’s equity

and restructuring its debt, on 27 July 2023, the Group entered into

an agreement in principle with EP Global Commerce a.s., Fimalac and

Attestor (“the Consortium”) and certain secured creditors, and then

on 18 September 2023, with the ad hoc group of holders of the notes

issued by Quatrim representing a majority of the noteholders.

On 5 October 2023, a lock-up agreement was

signed with the Consortium and the creditors. As of 17 October

2023, the following creditors had acceded to the agreement:

- creditors

economically holding 98.6% of Term Loan B;

- principal

commercial banking groups and some of the above-mentioned creditors

economically holding 90.0% of the RCF;

- holders of notes

issued by Quatrim representing 78.0% of these notes;

- 51.0% of unsecured

financial creditors (high yield bonds, EMTN notes and NEU CP);

and

- 44.3% of perpetual

subordinated noteholders.

On 25 October 2023, the Casino group announced

the opening of accelerated safeguard procedures for Casino,

Guichard-Perrachon and certain of its subsidiaries18 in order to

implement the Group's restructuring plan in accordance with the

terms of the lock-up agreement concluded on October 5, 2023 as part

of the conciliation procedures.

All of the information regarding the

conciliation procedure and the accelerated safeguard proceedings is

available on the Company’s website: Link

The Group will publish its Q3 2023

consolidated net sales figures on 31 October 2023, before the start

of trading.

APPENDICES – OTHER

INFORMATION

Main changes in scope in

France

- Sale of Sarenza on 1

October 2022 (Monoprix)

- Disposal of CChezVous

on 31 December 2022 (Cdiscount)

- Sale of stores to ITM

on 30 September 2023

- Sale of Sudeco on 31

March 2023

|

Gross sales under banner in

France

|

TOTAL ESTIMATED GROSS SALES UNDER BANNER (in €m, including

fuel) |

Q3 2023 |

Change (incl. calendar

effects) |

|

|

|

|

Monoprix |

|

1,076 |

-1.8% |

|

Franprix |

|

438 |

+4.6% |

|

Supermarkets |

|

905 |

-9.9% |

|

Hypermarkets |

|

713 |

-14.1% |

|

Convenience & Other |

|

804 |

+2.5% |

|

o/w Convenience |

|

727 |

+3.2% |

|

TOTAL FRANCE RETAIL |

|

3,935 |

-4.8% |

|

Cdiscount |

|

553 |

-14.5% |

|

TOTAL FRANCE RETAIL AND CDISCOUNT |

|

4,488 |

-6.1% |

Store network

|

France |

30 Sept. 2022 |

31 Dec. 2022 |

31 March 2023 |

30 June 2023 |

30 Sept. 2023 |

|

Géant Casino/Hyper Frais HM |

77 |

77 |

78 |

78 |

67 |

|

o/w French franchised |

3 |

3 |

3 |

3 |

3 |

|

International affiliates |

9 |

9 |

10 |

10 |

9 |

|

Casino Supermarkets |

461 |

474 |

476 |

478 |

441 |

|

o/w Franchised / LG France |

63 |

63 |

62 |

60 |

60 |

|

International affiliates |

23 |

24 |

26 |

29 |

33 |

|

Monoprix (Monop’, Naturalia, etc.) |

849 |

858 |

852 |

855 |

862 |

|

o/w Affiliates / LG France ex Naturalia |

235 |

255 |

265 |

271 |

285 |

|

Naturalia

integrated stores France |

183 |

181 |

177 |

175 |

170 |

|

Naturalia

franchises / LG France |

63 |

65 |

66 |

63 |

65 |

|

Franprix |

1,069 |

1,098 |

1,123 |

1,155 |

1,159 |

|

o/w franchises / LG France |

747 |

775 |

795 |

831 |

840 |

|

Franprix banner |

836 |

864 |

876 |

888 |

881 |

|

Other banners (Marché d’à côté, etc.) |

233 |

234 |

247 |

267 |

278 |

|

Convenience o/w Vival o/w

Spar o/w Petit Casino and

similar o/w oil companies o/w affiliates o/w other convenience

outlets19 |

6,0601,7869131,0431,41494810 |

6,3131,9789511,0481,422100814 |

6,4342,0029511,0471,478100856 |

6,4482,0079511,0481,464102876 |

6,3921,9839471,0301,485103844 |

|

Leader Price20 |

63 |

66 |

66 |

63 |

40 |

|

Other businesses21 |

218 |

221 |

202 |

200 |

179 |

|

Total France |

8,797 |

9,107 |

9,231 |

9,277 |

9,14022 |

Analyst and investor

contacts-

Christopher Welton+33 (0)1 53 65

64 17 – cwelton.exterieur@groupe-casino.fror+33 (0)1 53 65 24 17 –

IR_Casino@groupe-casino.fr

Press

contacts-

Casino Group – Communications

Department

Nicolas Boudot+33 (0)6 79 61 40

99 – nboudot@groupe-casino.frBéatrice MANDINE+ 33

(0)6 48 48 10 10 - bmandine@groupe-casino.fror+33(0)1 53 65 24 78 –

directiondelacommunication@groupe-casino.fr

-

Agence IMAGE 7

Karine Allouis +33 (0)6 11 59 23

26 – kallouis@image7.frLaurent Poinsot +33(0)6 80

11 73 52 – lpoinsot@image7.frFranck Pasquier

+33(0)6 73 62 57 99 – fpasquier@image7.fr

Disclaimer

This press release was prepared solely for

information purposes, and should not be construed as a solicitation

or an offer to buy or sell securities or related financial

instruments. Likewise, it does not provide and should not be

treated as providing investment advice. It has no connection with

the specific investment objectives, financial situation or needs of

any receiver. No representation or warranty, either express or

implied, is provided in relation to the accuracy, completeness or

reliability of the information contained herein. Recipients should

not consider it as a substitute for the exercise of their own

judgement. All the opinions expressed herein are subject to change

without notice.

1 Data for the past 4 weeks2 Cf. press releases of

27 July and 20 September3 Excluding fuel and calendar effects4

Long-standing SM (excluding ex-HM), including Corsican SM5

Excluding fuel and calendar effects6 Miscellaneous: mainly Geimex7

Convenience segment net sales on a same-store basis include the

same-store performance of franchised stores8 -10% discount at

Monoprix for 6 months, in store and online, for all Amazon Prime

subscribers in France9 Data presented over four weeks with the

exception of the last week (data for the current week)10 Unaudited

data published by Cnova NV. The reported figures present all

revenues generated by Cdiscount.11 Advertising and digital

marketing12 Calculated as revenues excluding tax divided by product

GMV excluding tax13 Gross merchandise volume (GMV) includes,

including tax, sales of merchandise, other revenues and the

marketplace’s sales volume based on confirmed and shipped orders

and the sales volume of B2C services and the Octopia and

C-Logistics activities14 Excluding tax15 Scope as defined in bond

refinancing documentation, with mainly Segisor and Wilkes accounted

for within the France Retail + E-commerce scope (including

GreenYellow)16 France Retail + E-commerce scope (including Segisor,

excluding GreenYellow); gross financial debt at 30/09/23: €6.9 bn

of which unsecured bonds for €2.2 bn, RCF for €2.1 bn, Term Loan B

for €1.4 bn and Quatrim for €0.6 bn17 See press releases dated 27

July and 20 September18 Casino Finance, Distribution Casino France,

Casino Participations France, Quatrim, Ségisor, et Monoprix

19 Outlets under specific banners with a Casino

supply contract20 Leader Price stores in France. Leader Price

international franchises are recorded in “Other businesses”21 Other

businesses include Leader Price international franchises and 3C

Cameroon stores22 The number of stores in France at 30 September

2023 has been restated to account for the outlets sold to

Intermarché

- 2023 10 26 - PR - Q3 2023

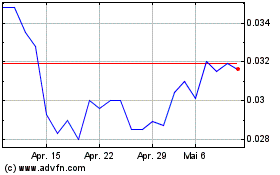

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024