Torqx launches recommended all-cash offer for Beter Bed Holding Shares - Acceptance Period starts on 5 October 2023

04 Oktober 2023 - 6:00PM

Torqx launches recommended all-cash offer for Beter Bed Holding

Shares - Acceptance Period starts on 5 October 2023

UPDATE - JOINT PRESS RELEASE

This is a joint press release by Beter Bed

Holding N.V. ("Beter Bed Holding" or the

"Company") and 959 B.V. (the

"Offeror"), a company controlled by Torqx Capital

Partners B.V. ("Torqx"). This joint press release

is issued pursuant to the provisions of Section 4, paragraph 1,

Section 10, paragraphs 1 and 3 and Section 18, paragraph 3 of the

Dutch Decree on public takeover bids (Besluit openbare biedingen

Wft) (the "Decree") in connection with the

recommended public offer by the Offeror for all the issued and

outstanding shares in the capital of the Company (the

"Offer"). This press release does not constitute

an offer, or any solicitation of any offer, to buy or subscribe for

any securities in the Company. Any offer will be made only by means

of the offer memorandum ("Offer Memorandum")

approved by the Dutch Authority for the Financial Markets

(Autoriteit Financiële Markten, the "AFM") which

is available as of today. Terms not defined in this press release

will have the meaning as set forth in the Offer Memorandum. This

press release is not for release, publication or distribution, in

whole or in part, in or into, directly or indirectly, in any

jurisdiction in which such release, publication or distribution

would be unlawful, including the United States.

Transaction Highlights

- Offer Price of EUR 6.10 (cum dividend) per Share reflects a

significant premium of approximately 107%.

- Acceptance Period runs from 5 October 2023 to 29 November 2023.

Completion of the Offer is expected before year-end.

- Boards of Beter Bed Holding unanimously recommend the

Shareholders to tender their Shares.

- Beter Bed Holding will hold the EGM at 10:00 hours CET on 15

November 2023.

- Navitas, Teslin and De Engh have irrevocably committed to offer

their Shares, representing 44.32% of the Shares.

- The joint works council of Beter Bed Holding provided its

positive advice.

- The ACM (Autoriteit Consument & Markt) issued a positive

clearance decision.

- Offer is subject to certain conditions, including Acceptance

Threshold of 80%.

- If the Offeror obtains 95% or more of the Shares, it will

initiate Statutory Buy-Out Proceedings and may elect to implement

the Post-Closing Demerger prior to initiating the Statutory Buy-Out

Proceedings. If the Offeror obtains between 80% and 95% it expects

to implement the Post-Closing Merger. The Offeror may only

implement the Post-Closing Demerger or Post-Closing Merger if

approved at the EGM.

- More information on the Offer can be found on the dedicated

webpage: www.beterbedholding.com/public-offer/.

Uden, the Netherlands, 4 October

2023, with reference to the publication of the

Offer Memorandum today, Beter Bed Holding, the

Netherlands’ largest sleep specialist in retail, wholesale and B2B,

and Torqx are pleased to jointly announce that

Torqx, through the Offeror, is making a recommended public cash

offer to all holders of issued ordinary shares in the capital of

Beter Bed Holding (the "Shares", and each holder of such Shares a

"Shareholder") at an offer price of EUR 6.10 (cum dividend) per

Share. Shareholders can tender their Shares

between 5 October 2023 and 29 November 2023. Completion of the

Offer is expected before year end.

For the full PDF of the press release, please click on the link

under attachment.

Press photos can be downloaded here.

Beter Bed Holding NV (EU:BBED)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

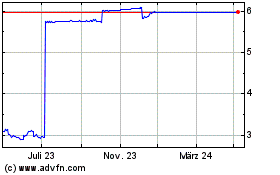

Beter Bed Holding NV (EU:BBED)

Historical Stock Chart

Von Apr 2023 bis Apr 2024