- Details regarding the terms for setting the price of the

planned capital increase of between €5.5M and €6.4M to take place

in January 2024, to be submitted to a vote at the Annuel General

Meeting on November 16, 2023

- Signing of an amendment to Sanyou Medical’s commitment to

participate in the planned capital increase

- Sanyou Medical has been granted an exemption from the

obligation to file a draft public offering by the AMF

Regulatory News:

IMPLANET (Euronext Growth: ALIMP, FR0013470168, eligible for

PEA-PME equity savings plans), a medical technology company

specializing in implants for orthopedic surgery and the

distribution of technological medical equipment, hereby specifies

the terms for setting the price of its upcoming capital

increase.

As announced in the press release of September 28, 2023, in the

coming months the Company is planning to launch an operation to

raise between €5.5 million and €6.6 million (excluding the possible

exercise of a maximum 15 % extension option).

This operation would take the form of a capital increase by

issue with preferential subscription rights open to all

shareholders within the framework of the granting of a new

authorization to be sought from shareholders at a General Meeting

to be held on November 16, 2023, which will take place in January

2024, once the various conditions precedent have been met.

As a reminder, Shanghai Sanyou Medical Co., Ltd, which holds a

41.03% stake in IMPLANET’s capital via its subsidiary Sanyou (HK)

International Medical Holding Co., Ltd (together: “Sanyou Medical”)

had pledged, should such an operation be implemented, to subscribe

to the capital increase in cash on an irreducible and reducible

basis to the tune of €5 million subject to (i) the approval of

Sanyou Medical’s Board of Directors, (ii) obtaining a prior waiver

from the AMF French stock market authority of the obligation to

file a public tender offer (in accordance with the provisions of

articles 234-8 and 234-9, 2° of the AMF’s General Regulations) in

the event of a post-transaction crossing of the 50% capital or

voting rights threshold and (iii) the approval of the relevant

Chinese government authorities1.

Sanyou Medical has also asked to be granted the majority of

directorships on the Company's Board of Directors as from the

completion of its subscription.

At its meeting of October 27, 2023, IMPLANET’s Board of

Directors specified the terms for setting the price of the capital

increase. The issue price will thus be defined on the basis of a

market value that is the lowest of:

- IMPLANET’s closing share price during the

trading session immediately preceding the date of the Company’s

Board Meeting held to approve the launch the operation; and - the

volume weighted average price (VWAP) over the 20 trading sessions

immediately preceding the date of the Company’s Board Meeting held

to approve the launch the operation.

Moreover, the issue price will be in the following range2:

- a maximum of €0.07 per share; and - a

minimum of €0.04 per share.

Within the framework of an amendment signed on October 27, 2023,

Sanyou Medical has confirmed its commitment to participate in the

capital increase to the tune of €5.0 million under the

price-setting conditions defined above and subject to the same

reservations as before, i.e. (i) the approval of Sanyou Medical’s

Board of Directors, (ii) obtaining a prior waiver from the AMF

French stock market authority of the obligation to file a public

tender offer (in accordance with the provisions of articles 234-8

and 234-9, 2° of the AMF’s General Regulations) in the event of a

post-transaction crossing of the 50% capital threshold and (iii)

the approval of the relevant Chinese government authorities.

Under these conditions:

- at the top of the range, i.e. €0.07 per

share, in the case of a €5.0 million subscription by Sanyou Medical

and no public subscription, Sanyou

Medical’s capital stake could increase to 78.48%. A historical

shareholder holding 1% of the undiluted capital would then see his

stake diluted to 0.36% of the undiluted capital.

- at the bottom of the range, i.e. €0.04 per

share, in the case of a €5.0 million subscription by Sanyou Medical

and no public subscription, Sanyou

Medical’s capital stake could increase to 85.42%. A historical

shareholder holding 1% of undiluted capital would then see his or

her stake diluted to 0.25% of undiluted capital.

Lastly, on October 31, 2023, the AMF granted Sanyou Medical a

waiver of the obligation to file a public tender offer in the event

of a post-transaction crossing of the 50% capital threshold under

article 234-9, 2° of the AMF’s General Regulations “Subscription to

a capital increase by a company in recognised financial difficulty,

subject to the approval of a general meeting of its

shareholders”.

Documents and information relating to this Extraordinary General

Meeting are available to shareholders and accessible on the

Company’s website, in accordance with applicable legal and

regulatory provisions.

Moreover, the Company would like to remind readers that, based

on current cashflow assumptions and in the absence of any new

sources of funding being obtained (i.e. excluding the financing

that will be received from the capital increase), the Company has a

cash runway to December 31, 2023 following the drawdown of the

first €0.5 million tranche of the short-term financing the Company

benefited from in October 20233.

Based on current assumptions regarding activity and anticipated

commercial developments with Sanyou Medical, the Company estimates

that this capital increase – which is subject to its shareholders’

approval at the General Meeting of November 16, 2023 – for a

minimum of €5 million would, once implemented, give it financial

visibility of over 12 months.

As indicated in its press release of September 28, 2023, this

financing will strengthen the Company's financial position, enable

it to meet its financial commitments and ensure the commercial

development of its medical devices based on three main areas:

- roll out the commercial and technological

partnership with Sanyou Medical for the joint development of a new

European range of hybrid posterior fixation systems; - initiate

distribution of the JAZZ® platform in China (the world's leading

spine market in terms of volume) with Sanyou Medical; - distribute

high-tech medical equipment in Europe, such as the ultrasonic

medical scalpel from SMTP Technology Co.

The final terms of the transaction and its timetable will be

announced in a forthcoming press release.

Risk factors

The Company draws attention to the other risk factors related to

the Company and its activity presented in the Chapter 4 "Risk

factors" of the Company's 2017 Reference Document filed with the

AMF on April 16, 2018 under number D.18-0337, in the annual

financial report of December 31, 2022 and in the half-yearly

financial report of June 30, 2023.

At the date of this press release, the share price for the 2023

financial year reached its highest level on April 11, 2023 at

€0.2925, and its lowest level on October 19, 2023 at €0.0461. Given

the high volatility of the Company's share price on the launch date

of this capital increase, this price could be lower than the

minimum issue price, i.e. €0.04. In this situation, without

prejudging the value of the preferential subscription right ("DPS")

during the DPS listing period, the theoretical value of the DPS

would be negative and would therefore have to be recorded at

zero.

Other main risk factors related to the forthcoming capital

increase are presented below:

- the market for preferential subscription

rights may offer only limited liquidity and be subject to high

volatility; - shareholders who do not exercise their preferential

subscription rights will see their stake in the Company's capital

diluted; - the market price of the Company's shares could fluctuate

and fall below the subscription price of the shares issued on

exercise of the preferential subscription rights; - in the event of

a fall in the market price of the Company's shares, preferential

subscription rights could lose their value; - the Company's

shareholders could suffer potentially significant dilution as a

result of any future capital increases.

Upcoming financial

publication

- 2023 Full-Year Revenue, on January 23, 2024, after

market close

About IMPLANET Founded in 2007, IMPLANET is a medical

technology company that manufactures high-quality implants for

orthopedic surgery and distributing medical technology equipment.

Its activity revolves around a comprehensive innovative solution

for improving the treatment of spinal pathologies (JAZZ®)

complemented by the product range offered by Orthopaedic &

Spine Development (OSD), acquired in May 2021 (thoraco-lumbar

screws, cages and cervical plates). Implanet’s tried-and-tested

orthopedic platform is based on the traceability of its products.

Protected by four families of international patents, JAZZ® has

obtained 510(k) regulatory clearance from the Food and Drug

Administration (FDA) in the United States, the CE mark in Europe

and ANVISA approval in Brazil. In 2022, IMPLANET entered into a

commercial, technological and financial partnership with SANYOU

MEDICAL, China's second largest medical device manufacturer.

IMPLANET employs 43 staff and recorded a consolidated revenue of

€8.0 million in 2022. Based near Bordeaux in France, IMPLANET

opened a US subsidiary in Boston in 2013. IMPLANET is listed on the

Euronext Growth market in Paris. For further information, please

visit www.Implanet.com.

Disclaimer

This press release contains forward-looking statements about

Implanet and its business. Implanet believes that these

forward-looking statements are based on reasonable assumptions.

However, no assurance can be given that the forecasts expressed in

these forward-looking statements will materialize, as they are

subject to risks, including those described in Implanet's reference

document filed with the Autorité des marchés financiers (AMF) on

April 16, 2018 under number D.18-0337, in the annual financial

report for December 31, 2022 and in the half-year report for June

30, 2023, which are available on the Company's website

(www.implanet-invest.com), and to changes in economic conditions,

financial markets and the markets in which Implanet operates. The

forward-looking statements contained in this press release are also

subject to risks that are unknown to Implanet or that Implanet does

not currently consider material. The occurrence of some or all of

these risks could cause Implanet's actual results, financial

condition, performance or achievements to differ materially from

those expressed in the forward-looking statements. This press

release is for information purposes only and does not and shall not

under any circumstances constitute an offer to sell or subscribe,

or the solicitation of an order to buy or subscribe, Implanet

securities in any country.

1 See press release of September 28, 2023 2 This range replaces

the maximum price of €0.13 indicated previously. 3 See press

release of October 11, 2023

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231031229138/en/

IMPLANET Ludovic Lastennet, CEO David Dieumegard, CFO

Tél. : +33 (0)5 57 99 55 55 investors@Implanet.com

NewCap Investor Relations Mathilde Bohin Nicolas Fossiez

Tél.: +33 (0)1 44 71 94 94 Implanet@newcap.eu

NewCap Media Relations Arthur Rouillé Tél.: +33 (0)1 44

71 94 94 Implanet@newcap.eu

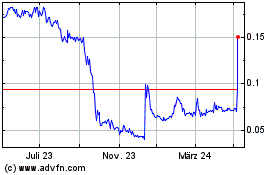

Implanet (EU:ALIMP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

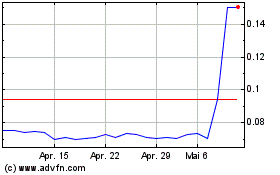

Implanet (EU:ALIMP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024