Ackermans & van Haaren realised a net profit of 170.7 million euros over the first half of 2023 and is well on track to deliver another strong set of results for the whole year of 2023

31 August 2023 - 7:00AM

Ackermans & van Haaren realised a net profit of 170.7 million

euros over the first half of 2023 and is well on track to deliver

another strong set of results for the whole year of 2023

Dear shareholder,

Dear Madam, Dear Sir,

- In spite of a more challenging economic environment, the

contribution of the core segments of 149.6 million euros is down

only 4% from H1 2022.

- Delen Private Bank and Bank Van Breda have further reinforced

their leading market position and posted stellar performances.

- As expected, capital gains contributed less than in the record

year 2022. The capital gain on the exit of Telemond in H1 2023

illustrates the potential of AvH’s diversified portfolio.

- AvH’s net financial position grew further to 511 million euros

at June 30, 2023.

"The diversification of our portfolio has once again proven its

relevance in an environment which remains challenging, with a

result of our core segments very close to our strong H1 2022

results.

Our banks reported a strong performance on the back of continued

increases in assets entrusted by our customers and the positive

effects of the improved interest environment, compensating somewhat

the negative effects of the more challenging market context on

other participations. Our focus on installation of offshore wind

farms and investments in offshore wind capacity through DEME and

Green Offshore, have also contributed to our group’s overall

resilience in a period of high energy prices.

We are proud of our selection as one of the 20 companies forming

the new BEL ESG Index, launched by Euronext in January. It

constitutes a recognition of our group’s efforts to position itself

as 'partners for sustainable growth' with respect for people and

for the environment. The sale of our 50% participation in Telemond

in February, following a successful collaboration of more than 30

years with the German family Maas, is another example of AvH’s

strategy to support family businesses as a long-term partner.

The recently announced investments in IQIP and Camlin Fine

Sciences (CFS) also fit with our ambition to be 'part of the

solution' in these turbulent markets and to put the ~520 million

euros cash of the recent divestments to work in market leaders with

sustainable business models. IQIP is a specialist in foundation

techniques for offshore wind turbines and as such contributes to

the energy transition. CFS for its part plays a significant role,

as one of the world’s important producers of vanillin and

shelf-life solutions, in addressing the global challenge of feeding

more than 8 billion people in a cost-efficient way whilst

minimising food wastage. We look forward to building out these

companies, together with our current portfolio companies,

successfully over the longer term with their family shareholders

and management teams."

John-Eric Bertrand (co-CEO) and Piet Dejonghe

(co-CEO)

You can read our press release via the link

below.

Best regards

Ackermans & van Haaren

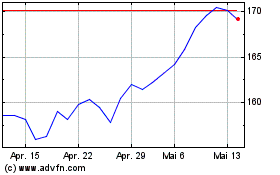

Ackermans and Van Haaren... (EU:ACKB)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

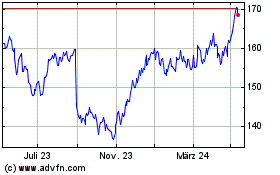

Ackermans and Van Haaren... (EU:ACKB)

Historical Stock Chart

Von Dez 2023 bis Dez 2024