74% Of Bitcoin Holders Are In The Money As Price Explodes Above $26,000

17 März 2023 - 12:30PM

NEWSBTC

IntoTheBlock data on March 17 shows that 74% of Bitcoin

holders are in the money at spot prices. 23% are out of the money,

meaning they are holding to losing positions. When writing, only 4%

are at break even, at parity with when they bought their bags. 74%

Of Bitcoin Holders In Profits Bitcoin is a volatile asset, and

prices have been moving strongly in the last few weeks, dropping to

as low as $15,300 in Q4 2022. However, the coin has

maintained a sharp uptrend in the past week, rising from last

week’s depths and soaring above $26,000, printing a new Q1 2023

high. When writing, trackers show that BTC is trading above

$26,200, adding six percent in the last 24 hours and roughly 32% in

the previous week. At current prices, most BTC holders are

profitable. Related Reading: Bitcoin Price Restarts Rally As The

Bulls Target New Monthly High A notable development amid this

expansion is the high participation levels. The current leg up on

the Bitcoin daily chart has been with rising trading volumes.

In trading and technical analysis, price expansions or contractions

with a spike in trading volumes indicate participation or

interest. As BTC rallied from around $19,500 last week, there

has been a notable expansion in volumes, an indicator that this

rally is supported. Banking Crisis And Binance Folding The Industry

Recovery Fund Behind the reversion to crypto assets, an asset class

that Jerome Powell, the Federal Reserve chairman, said is risky,

could be due to several reasons. The placement of Silicon

Valley Bank into receivership and under the custody of the FDIC

triggered a bank run. This development was at the back of the

collapse of Silvergate. After Silicon Valley Bank fell, Signature

Bank was closed. The United States government, through Janet

Yellen and the Treasury Department, fearing contagion, said it

would intervene and ensure depositors won’t be affected. The Fed

also created a fund and a credit line for distressed banks.

Related Reading: The US Fed adds $297 Billion In A Week, Fanning

Bitcoin Rally This intervention has seen the Fed’s asset portfolio

increase. It is despite a decline in the number of Treasuries and

Mortgage-Backed Securities (MBS) being purchased. QE is Back!

About $300 billion in assets added to Fed balance sheet in the last

week pic.twitter.com/a46TLAkFwr — Genevieve Roch-Decter, CFA

(@GRDecter) March 16, 2023 Subsequently, analysts now say the Fed

is technically back to quantitative easing. This is also increasing

the odds of the central bank slashing interest rates in the next

few months. The emergence of cracks in the banking system and

the announcement that Binance, one of the largest cryptocurrency

exchanges, would buy several coins, including Bitcoin, from their

$1 billion Industry Recovery Fund, also fanned an uptrend.

Given the changes in stable coins and banks, #Binance will convert

the remaining of the $1 billion Industry Recovery Initiative funds

from BUSD to native crypto, including #BTC, #BNB and ETH. Some fund

movements will occur on-chain. Transparency. — CZ 🔶 Binance

(@cz_binance) March 13, 2023 Binance announced the Recovery Fund in

November following the collapse of FTX. The goal was to support

promising crypto projects under liquidity pressure. Although

there was news that some projects had been vetted to receive

funding, Binance is now folding this initiative and diversifying

into crypto assets, away from stablecoins. Feature Image From

Canva, Chart From TradingView

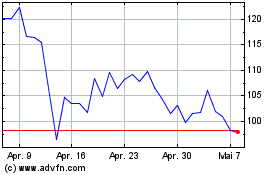

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

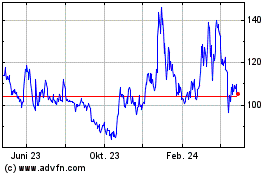

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024