Crypto Predictions 2025: Dragonfly’s Managing Partner Unveils What’s Ahead

02 Januar 2025 - 12:30PM

NEWSBTC

Haseeb Qureshi, managing partner at Dragonfly Capital, outlined his

crypto predictions 2025 via X, forecasting transformative trends

that could significantly alter the crypto landscape. Here are the

detailed insights from each of the key areas Qureshi covered:

Crypto Predictions 2025 By Haseeb Qureshi #1 A Blurring Line

Between L1s/L2s: In his crypto predictions 2025, Qureshi forecasts

the diminishing distinctions between Layer 1 and Layer 2 networks,

forecasting a major consolidation within the blockchain industry.

“The era of differentiating L1s from L2s based on technical

capabilities is over. It’s now about carving out niches and

enhancing user stickiness,” he declares. Related Reading: Crypto

Trader Capitalizes On Elon Musk’s X Name Change For 17,000% Return

This shift implies a future where strategic market positioning and

user experience outweigh pure technological innovation. “EVM will

not only retain its dominance but expand, driven by platforms like

Base, Monad, and Berachain,” he further asserts. Qureshi credits

this growth to the vast repositories of Solidity training data,

which will empower language models to write advanced application

code in 2025, marking a significant transition towards AI-driven

development within blockchain ecosystems. #2 Better Token Launches:

Qureshi’s crypto predictions 2025 also foresee a revolution in

token distribution mechanisms. He sees the industry moving away

from large-scale airdrops, which often prioritize quantity over

quality of engagement. “We’ll see a more strategic approach, where

token distribution is aligned with long-term user engagement and

project viability,” he notes. For projects with clear metrics and

defined goals, tokens will be used as tools to enhance user

retention and incentivize meaningful interactions. Meanwhile,

projects lacking concrete metrics will likely pivot towards

structured crowdsales to build and maintain a dedicated user base.

Furthermore, he predicts that “memecoins will continue to lose

market share to AI agent coins. I consider this a migration from

financial nihilism to financial over-optimism. (Yep I’m coining

that.).” #3 Accelerated Stablecoin Adoption: Stablecoins are set to

become a cornerstone of business transactions for small and

medium-sized businesses (SMBs) seeking reliable and instant

financial settlements. “We’re on the brink of seeing SMBs broadly

adopt stablecoins, driven not just by their efficiency but by

increasing institutional trust and involvement,” Qureshi noted. He

anticipates significant movements from banks, including new

stablecoin launches as financial institutions seek to capture part

of this burgeoning market. Moreover, he remarks, “With Howard

Lutnick as Secretary of Commerce, institutional hesitance will

decrease, securing Tether’s top position amidst growing

competition.” He adds, “Expect Ethena to gobble up even more

capital, especially as treasury yields continue to decline over the

coming year. When the opportunity cost of capital declines, it

makes basis trade yields even more attractive.” #4 A Cautious

Regulatory Advance: The regulatory outlook within Qureshi’s crypto

predictions 2025 suggests a mixed bag of advancements and setbacks.

According to him, 2025 will witness evolving regulations, with

specific legislation around stablecoins likely to pass in the US.

Related Reading: Top Crypto Assets For Q1 2025: Grayscale Reveals

The Best Altcoins However, comprehensive market reforms such as the

Financial Innovation Technology of the 21st Century Act (FIT21)

might face delays. “While we see the regulatory framework for

stablecoins strengthening, broader financial technology reforms

will lag, creating a piecemeal regulatory environment,” he

predicts. Additionally, Qureshi foresees that Fortune 100 companies

will become more willing to offer crypto to consumers under the

Trump administration. “Trump’s inauguration will create a perceived

regulatory jubilee until clear rules and enforcement priorities are

set. During this window, expect to see aggressive expansion of

crypto integration into Web2 platforms,” he remarks. #5 AI Agents

Will Evolve Beyond The Hype: A significant portion of Qureshi’s

crypto predictions 2025 involves the role of AI agents in reshaping

the crypto landscape. He criticizes the current state of AI agents,

suggesting, “Today’s AI agents are essentially sophisticated

chatbots linked to cryptocurrencies. They lack true agency and are

primarily designed for interactions rather than autonomous

operation.” Despite these limitations, he believes the role of AI

in crypto will grow significantly, moving from novelty to

necessity. “AI’s capability to automate and enhance blockchain

operations will lead to a software development renaissance,

drastically lowering the barriers to entry for blockchain

applications,” he forecasts. #6 Crypto x AI: Looking beyond 2025,

Qureshi envisions a deeper integration between crypto and AI

technologies. “As we refine AI capabilities and regulatory

frameworks, crypto will increasingly facilitate AI operations,

leading to autonomous agents conducting transactions and managing

their own economies on blockchain networks,” he stated. This

interplay is expected to revolutionize user experiences and

operational efficiencies, paving the way for a new era of

decentralized and autonomous digital ecosystems. At press time, the

total crypto market cap stood at $3.31 trillion. Featured image

from YouTube, chart from TradingView.com

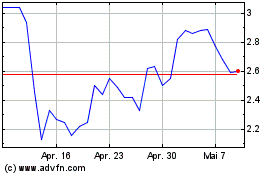

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Optimism (COIN:OPUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025