Solana Price Reverses Its Green Start, What’s The Next Target?

29 September 2022 - 3:00AM

NEWSBTC

Solana price was off to a good start this week despite choppy

market conditions. The bulls have tired out over the last 24 hours.

In the past day, the altcoin fell by 3%. Solana prices have risen

by nearly 6% in the last week. The technical indicator continued to

demonstrate that the bears were in control at press time. If buying

strength continues to head in the same direction, then most of the

coin’s weekly gains would be nullified. The technical outlook for

the coin was negative as the sellers took over at the time of

writing. The current support zone for the coin is between $33 and

$26. If SOL falls below its current price level, then the bears

will gain momentum on the chart. With Bitcoin consistently wavering

near the $19,000 mark, most altcoins also started to wobble on

their respective charts and moved closer to their immediate support

levels. For Solana price to reach its next price ceiling, the

demand for the coin has to increase on its chart. Solana Price

Analysis: One Day Chart SOL was trading at $33 at the time of

writing. The coin had registered recent gains over the past few

days, but the bulls faced resistance and it fell on its chart. The

immediate resistance for the coin stood at $38 and then another

price ceiling was at $41. If Solana price decides to move above the

$41 level, then bulls could come around on the chart. On the other

hand, the closest support line was at $29, and a fall from that

level would cause the altcoin to trade at $26. The volume of

altcoin traded decreased in the previous session, indicating that

buying strength has decreased on the chart. Technical Analysis The

altcoin showed more selling strength on its one-day chart. Solana,

despite gains in the last few days, has not witnessed a surge of

buyers. This also meant that demand was present at the lower

levels. The Relative Strength Index displayed an uptick and the

indicator was on the half-line, which meant that there was an even

number of buyers and sellers. Other indicators, however, aligned

with the selling strength on the chart. The Solana price was below

the 20-SMA line, which also indicated that the sellers were driving

the price momentum in the market. With a slight appreciation in

demand, SOL could travel above the 20-SMA line. Related Reading:

Solana Clears 100 Billion Transaction Count As NFTs Gain Prominence

SOL’s other technical indicators were yet to turn entirely bearish,

although the indicators depicted the onset of bearish pressure. The

Moving Average Convergence Divergence indicates the price momentum

and overall price direction. The MACD continued to display green

histograms, which were buy signal for the coin. The green signal

bars were declining, which also meant that the positive price

momentum was on a decline. The Directional Movement Index showed

the price momentum and it was positive as the +DI line was above

the -DI line. Average Directional Index was below the 20-mark,

showing that the current market action had less strength. Related

Reading: Cardano Price Fails To Pierce Through $0.48 As Bears

Continue To Dominate Featured image from Tecxpla, charts from

TradingView.com

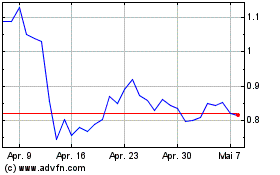

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024