Bitcoin Price Surge Threatened By Liquidity Crunch – What To Expect

27 März 2023 - 8:09AM

NEWSBTC

Bitcoin market liquidity is currently a major point of concern

within the cryptocurrency sphere. The lack of depth in the market

has led to significant price slippage when large orders are

executed, resulting in erratic price swings that can overwhelm even

the most experienced traders. The cryptocurrency market is

currently facing a liquidity crisis triggered by the shutdown of

Silvergate’s SEN and Signature’s Signet network in early March.

Despite a rebound in Bitcoin’s price since its March slump, which

reached a peak of around $28,900, the initial drop has raised

concerns among market participants. Lack of liquidity in an asset

can cause significant market inefficiencies, resulting in severe

price swings that can deter experienced investors from executing

trades. Bitcoin Poised For Consolidation Phase According to

CoinMarketCap data, Bitcoin has seen a slight increase of 0.77% on

Monday and is currently valued at $27,849. Despite its inability to

reach the $30,000 mark thus far, market trends suggest that Bitcoin

may be gearing up for a phase of consolidation. A

consolidation phase is a period of time where the market’s

volatility decreases, and prices remain relatively stable. It

typically follows a significant uptrend or downtrend, allowing the

asset to take a breather before continuing its trend. For Bitcoin,

a consolidation phase may signal a time of market indecision.

However, it could also be a positive sign for investors, as it may

lead to the formation of a base for future growth. Related Reading:

Bitcoin Price Barrels Past $28,000 – Can BTC Keep Pushing This

Week? It’s worth noting that while a consolidation phase may be a

positive sign for Bitcoin’s long-term growth, it’s not always

guaranteed to lead to an upward trend. Market conditions can change

quickly, and unexpected events can disrupt even the most stable of

assets. Bitcoin Liquidity Hits 10-Month Low Despite Bitcoin’s

impressive performance this year, investors may be concerned about

the lack of liquidity in cryptocurrency markets. Conor Ryder

from Kaiko told Bloomberg about a decline in the measure of

Bitcoin’s ease of buying and selling, which has reached a low point

not seen in 10 months. The calculation of this metric involves

evaluating the offers to buy and sell in the market maker’s order

books, limited to a 2% deviation from the cryptocurrency’s current

price on either side. BTCUSD currently remains in the $27K region

on the daily chart at TradingView.com Related Reading: Dogecoin

(DOGE) Makes Slight 6% Climb This Week – Here’s Why This liquidity

decline is attributed to firms that purchase and sell

cryptocurrency losing access to dollar-payment systems, resulting

in a drying up of liquidity in the market. The fate of Bitcoin has

left investors in the cryptocurrency industry on the edge of their

seats. Despite the market’s resilience in the past, the

current liquidity crisis presents a formidable challenge to its

stability. The future of Bitcoin’s rally hangs in the balance, and

it remains to be seen whether it will persevere or succumb to the

crisis. -Featured image from PublishOx

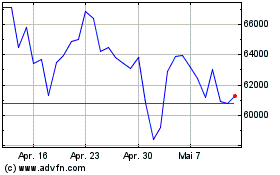

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024