TIDMAFRN

RNS Number : 8728K

Aferian PLC

31 August 2023

AFERIAN PLC

("Aferian", the "Company" or the "Group")

HALF YEAR RESULTS

- Improving quality of Group earnings and enhanced revenue visibility.

- Continued strong demand in 24i division in fast growing video streaming market.

- Amino division refocused on higher quality, higher margin streaming devices.

- Confident in full year outturn with high percentage of

contracted revenue and a well-developed pipeline.

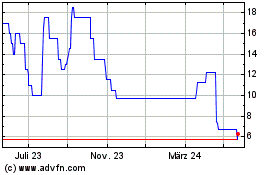

Aferian plc (LSE AIM: AFRN), the B2B video streaming solutions

company, announces its unaudited results for the six months ended

31 May 2023 ("H1 2023"), which demonstrate a performance in line

with the trading update announced on 28 June 2023.

Donald McGarva, Chief Executive Officer of Aferian plc,

said:

"This has been a very busy and challenging half for Aferian. The

restructuring of our cost base in 24i and Amino is generating

significant annualised cost savings and providing a stronger

platform on which to build and grow. Demand in our 24i division has

remained strong as we continue our strategic focus on growing

software and services revenue in the fast-growing video streaming

market.

To align ourselves better with our customers' changings needs,

our Amino business has been refocussed to concentrate on higher

quality, higher margin streaming and device management

opportunities and we have seen good initial customer engagement in

the Pay TV and digital signage markets. We have continued to

progress our strategy to improve the quality of our earnings and

enhance revenue visibility in the first half, against what is for

everyone, a challenging macroeconomic environment. Our higher

margin software and services revenue was up 17% year on year, and

we closed the period with exit run rate ARR up 19%.

Following the successful completion of our $4.0m equity raise in

July, we have the resources to focus on driving forward our

advantage and growth in the video streaming market. With 90% of

revenue contracted for the full year and a well-developed pipeline

of well qualified prospects, we remain confident in the full year

outcome and Aferian's positioning to capitalise on long-term

opportunities in the fast-growing video streaming market."

Financial Key Figures

Periods ended 31 May

US$m unless otherwise stated H1 2023 H1 2022 Change

Unaudited Unaudited

------------------------------------------------ ----------- ----------- -------

Total revenue 23.3 44.5 (48%)

* Devices 9.4 32.5 (71%)

* Software and services 14.0 12.0 17%

Exit run rate Annual Recurring Revenue ("ARR")

(1) 18.8 15.8 19%

Statutory operating loss (8.0) (0.6) N/A

Statutory operating cash flow before tax

- H1 2022 restated(5) (12.3) 4.9 N/A

Statutory basic earnings per share (US cents) (10.20) (1.76) (480%)

------------------------------------------------ ----------- ----------- -------

Adjusted operating (loss)/profit (2) (4.2) 2.4 N/A

Adjusted operating cash flow before tax(4) (7.0) 6.7 N/A

Adjusted basic earnings per share (US cents)

(3) (6.40) 1.50 N/A

------------------------------------------------ ----------- ----------- -------

Net (debt)/cash (12.9) 7.8 N/A

Interim dividend per share (GBP pence) - 1.0 N/A

Notes

1. Exit Annualised Recurring Revenue (ARR) is annual run-rate

recurring revenue as at 31 May 2023.

2. Adjusted operating profit is a non-GAAP measure and excludes

amortisation of acquired intangibles, exceptional items, and

share-based payment charges.

3. Adjusted basic earnings per share is a non-GAAP measure and

excludes amortisation of acquired intangibles, exceptional items,

share-based payment charges and non-recurring finance income and

expense.

4. Adjusted operating cash flow before tax is a non-GAAP measure

and excludes cash paid/received in respect of exceptional

items.

5. H1 2022 restated see note 8.

6. Constant currency basis calculated using the closing FX rate for H1 2022 in both years

Financial Highlights

-- Further momentum demonstrated in improving the quality of earnings

and enhancing Group revenue visibility:

o Higher margin software & services revenue of $14.0m, up 17% year-on-year.

o Recurring revenue of $9.5m, up 16% in H1 2023 compared to H1 2022.

o Exit run rate ARR of $18.8m, up 19% year-on-year (constant currency(6)

basis: 20%).

-- Adjusted operating loss of $4.2m, (H1 2022: profit $2.4m) is due

to the reduction in Amino device revenues.

-- Management actions taken in February and June 2023 have reduced

the Group's annualised cost base, including capital expenditure,

by a total of c$8m.

-- Additional cost reduction actions are underway and expected to be

completed in early September 2023.

-- The Group's inventory balance at 31 May 2023 was $8.6m (30 November

2022: $9.2m).

-- Net debt at 31 May 2023 was $12.9m (31 November 2022: $4.0m net

cash). This is expected to reduce over the remainder of the current

financial year as Amino inventory levels reduce further. The Group

remains in compliance with its loan facilities covenants.

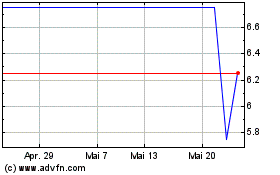

-- Post period end, on 25 July 2022, the Group successfully raised

$4.0m through an equity placing to be used for general working capital.

This replaced the need for further drawdown of the Group's existing

shareholder loan facility (currently GBP1.25m) from Kestrel. The

undrawn element GBP2.125m expired on 31 July 2023.

-- No interim dividend payment (H1 2022: 1.0 pence / 1.26 US cents).

Strategic & Operational Highlights

-- 24i - focussed on streaming video experiences.

o 24i continues to win new customers and grow recurring revenue

driven by continued strong demand for streaming video solutions.

The division is prioritising profitability and cash generation

over nominal growth.

o The business launched two significant platform enhancements

in March 2023:

-- 24i Broadcaster Studio, a new pre-packaged solution targeting

broadcasters who go direct-to-consumer with streaming

apps as part of a wider strategy to capitalise on growth

in ad-funded streaming.

-- Three new tiered packages of 24iQ, our data-driven SaaS

personalisation platform, enabling customers of all sizes

to drive greater engagement and end user churn.

o Partnership with global Free Ad-supported Streaming TV ('FAST')

experts, Amagi, announced in March 2023, is already delivering

results with the first joint Amagi and 24i customers launching

their 24i-based streaming apps post period end.

-- Amino - connecting Pay TV to streaming services.

o The poor trading conditions at Amino caused by customer de-stocking

at a time of rising interest rates has also resulted in a higher

than planned inventory balance of $8.6m as at 31 May 2023. The

Amino inventory balance is expected to reduce back towards November

FY21 levels (which were $2.6m) in H1 2024.

o We have refocused the division on higher quality, higher margin

Pay TV and digital signage streaming devices incorporating the

Group's software and Amino's SaaS device management platform.

o Digital signage devices were deployed into a number of international

airports in India during the period.

o Sports betting brand, Paddy Power, is now using Amino digital

signage devices throughout its shops in the UK and Ireland to

improve the customer experience and reduce costs.

Current Trading and Outlook

Trading remains in line with the trading and outlook

communicated in our trading statement on 28 June 2023. For the full

year ending 30 November 2023, 91% of expected revenues are

contracted. The remaining 9% is covered by a well-developed sales

pipeline. Combined with the cost reduction actions taken above,

this provides the Board with confidence in the expected outturn for

the full year in which the Group is expected to generate a positive

material EBITDA.

The Board anticipates full year software and services revenue

growth of c.10% to 15% in the current financial year. As we move in

to FY2024, the 24i business and management team is re-orientating

its focus to deliver enhanced profitability and cash

generation.

Devices revenue in H2 2023 is expected to be higher than H1 2023

and this recovery is expected to continue in FY 2024 as inventory

levels within the supply chain continue to normalise.

24i

Demand for 24i's video streaming platform remains strong.

Investments previously made in sales and marketing have delivered

results. The 24i management team, under its new leadership, is

focused on growing revenue and ARR at double digit percentages in

FY2023, whilst ensuring targeted R&D investment and improved

customer project scoping and pricing to increase profitability in

the second half of the financial year. This will ensure a better

balance between nominal revenue growth and profitability / cash

generation in the future.

Amino

The device market is forecast to continue to grow, however, the

market has evolved with low-cost manufacturers meeting the needs of

many pay TV operators who, whilst needing to upgrade their services

to incorporate video streaming, remain focused on cost reduction.

Therefore, to better align with these changing customer needs and

to target enhanced profitability, Amino's focus will be on

delivering value through:

-- delivering higher quality, higher margin pay TV streaming devices

which can also be bundled with the Group's Software-as-a-Service

("SaaS") device management platform, Engage. This SaaS device

management platform is also integrated with third party devices

and sold on a standalone basis; and

-- driving growth in its digital signage business selling into large

integrators and via distributors.

For further information please contact:

Aferian plc +44 (0)1223 598197

Donald McGarva, Chief Executive Officer

Mark Carlisle, Chief Financial Officer

+44 (0)20 7597

Investec plc (NOMAD and Broker) 5970

David Anderson / Patrick Robb / Nick Prowting

/ Cameron MacRitchie

+44 (0)20 3727

FTI Consulting LLP (Financial communications) 1000

Matt Dixon / Emma Hall / Tom Blundell / Aisha

Hamilton

About Aferian plc

Aferian plc (AIM: AFRN) is a B2B video streaming solutions

company. Our end-to-end solutions bring live and on-demand video to

every kind of screen. We create the forward-thinking solutions that

our customers need to drive subscriber engagement, audience

satisfaction, and revenue growth.

It is our belief that successful media companies and services

will be those that are most consumer-centric, data driven and

flexible to change. We focus on innovating technologies that enable

our customers stay ahead of evolving viewer demand by providing

smarter, more cost-effective ways of delivering end-to-end modern

TV and video experiences to consumers. By anticipating

technological and behavioural audience trends, our software

solutions empower our customers to heighten viewer enjoyment, drive

growth in audience share and ultimately, their profitability.

Aferian plc has two operating companies: 24i, which focusses on

streaming video experiences, and Amino, which connects Pay TV to

streaming services. Our two complementary companies combine their

products and services to create solutions which ensure that people

can consume TV and video how and when they want it. Our solutions

deliver modern TV and video experiences every day to millions of

viewers globally, via our growing global customer base of over 500

service providers.

Aferian plc is traded on the London Stock Exchange Alternative

Investment Market (AIM: symbol AFRN). Headquartered in Cambridge,

UK, the company has over 225 staff located in 11 offices, including

major European cities as Amsterdam, Helsinki, Copenhagen, and Brno,

as well as in San Francisco and Hong Kong. For more information,

please visit www.aferian.com .

Chief Executive Officer's Review

The Group has continued to make progress in improving the

quality of its earnings and enhancing revenue visibility as it

executes on its strategy to grow software and services revenue in

the fast-growing video streaming market. Exit run rate Annual

Recurring Revenue ("ARR") increased to $18.8m representing 19%

growth year-on-year. Software and services revenue for the period

also increased to $14.0m, an increase of 17% versus the prior

year.

Sales of streaming devices, however, were significantly lower

than the prior period at $9.4m, representing a decrease of 71%

year-on-year. Whilst the video streaming device market continues to

grow, the number of devices shipped in the period was impacted by

customers de-stocking in response to reduced lead-times after

building up stocks to weather post-COVID supply chain challenges.

This downturn in Amino revenues has had a significant impact on

Group results for the period.

Consequently, Group revenue in the period was $23.3m, a decrease

of 48% versus the prior year. As a result, we took proactive steps

to reduce the Group's cost base in both 24i and Amino in February

2023 and, post period end in June 2023, we took further action to

reduce costs in the Amino business. Together these actions have

generated c$8m of annualised cost savings for the Group. We have

also identified additional savings in 24i through a targeted

cost-reduction programme which is due to complete in early

September 2023.

On 31 May 2023, Aferian secured additional cash funding by way

of a shareholder loan facility of up to GBP3.25m from our largest

shareholder, Kestrel Partners LLP, of which GBP1.25m was drawn as

at 31 May 2023. On 25 July 2023, the Group successfully raised

$4.0m (before expenses) through an issue of equity share capital to

be used for general working capital purposes, replacing the need

for further drawdown of the full shareholder loan facility from

Kestrel, of which the undrawn element of GBP2.125m expired on 31

July 2023. These funds provide additional headroom in respect of

the covenants in the Group's existing bank facility.

We believe that the actions taken to reduce our cost base and

the additional cash funding provides the Group with a stronger

platform on which to build and grow. With adequate headroom already

secured over our banking covenants, we believe we now have the

resources to drive forward our advantage in the video streaming

market, which continues to grow at pace as streaming increasingly

becomes the most popular way to consume video.

As trading improves, we expect the Group's inventory levels to

reduce and cash generation to improve in the second half of the

year, reducing our net debt position.

H1 2023 Key Performance Indicators

Our key performance indicators demonstrate growth in software

& services revenue (up 17%) and exit ARR (up 19%).

H1 2023 H1 2022 Change

$m $m %

---------------------------------------- --------- -------- -------

Total revenue 23.3 44.5 (48%)

Software & services revenues 14.0 12.0 17%

Exit run rate Annual Recurring Revenue

("ARR") at 31 May 18.8 15.8 19%

Adjusted operating cashflow before tax (7.0) 6.7 N/A

Net customer revenue retention rate on

recurring revenue* 110% 113%

---------------------------------------- --------- -------- -------

*Net customer revenue retention rate on recurring revenue based

on a constant currency basis

The executive management team remain focused on reducing

inventory levels and improving cash flows whilst improving the

returns generated by investments already made in the 24i

division.

A fast-growing video streaming sector

The prospects for the video streaming sector in which both 24i

and Amino operate remain positive. The media and entertainment

sector is continuing its migration from traditional broadcast

distribution models such as cable and satellite to streaming as the

preferred mode of video delivery. Evidence of this trend can be

seen in the success of new services from traditional broadcasters

like ITV, which saw a 49% increase in overall streaming hours in

the first quarter of 2023* following the launch of its ITVX

service. It is also evident among Pay TV operators such as Sky

which signalled a significant shift away from expensive satellite

distribution with the launch in October 2022 of its first

"dish-less" product**. Sky Stream features around 150 TV channels

and on-demand content via the internet to a palm-sized streaming

device in the home.

Aferian has been at the forefront of this type of content

delivery for over 25 years and the continued transition to

streaming demonstrates a growing market opportunity for Amino's

devices and 24i's end-to-end video streaming solutions. Most

recently, post-period end, Virgin Media used its 24i integrated

solution to launch and monetise a new line-up of themed Free

Ad-supported Streaming TV ('FAST') channels on Virgin TV. 24i

worked in partnership with Amagi, the global leader in cloud-based

SaaS technology for broadcast and connected TV. An initial

selection of 14 channels have been rolled-out to Virgin Media's V6,

TV 360 and Stream set-top boxes (STBs), allowing subscribers to

instantly access an extended range of attractive content, monetised

through advertising.

While subscriber churn at household names such as Netflix and

Disney have driven some media headlines, the overall sector remains

buoyant. In April 2023, Statista forecast that revenue from

internet-based video services operating without the need for a

cable or satellite subscription (known in the industry as "over the

top TV" or "OTT") will reach 235 billion US dollars*** by 2028,

nearly double the figure reported in 2021.

Although cost-of-living pressures will inevitably make our

customers look harder at their cost base and the prices they charge

their consumers for subscriptions, we believe this presents an

opportunity for Aferian. Our cost-effective, off-the-shelf

solutions and managed services represent an excellent alternative

for video service providers who want to continue delivering great

consumer experiences but are re-assessing the value of their

current custom-built solutions and/or the cost of employing

in-house streaming expertise.

Many streaming service providers, including Netflix and Amazon

Prime Video, have diversified beyond subscription business models

into advertising-funded packages in response to rising competition

from the proliferation of smaller streaming services and worldwide

cost of living concerns. 24i has capitalised on this shift with the

addition of advertising-related capabilities to its end-to-end

video streaming platform****.

* https://www.digitaltveurope.com/2023/06/09/itv-measures-success-of-itvx-after-six-months/

** https://www.broadbandtvnews.com/2022/10/19/sky-stream-launches-in-the-uk/

*** https://www.statista.com/statistics/260179/over-the-top-revenue-worldwide/

**** https://www.24i.com/articles/24i-unveils-latest-advancements-to-expand-the-reach-of-fast-and-linear-channels-for-broadcasters-and-to-make-personalized-video-experiences-access

ible-to-everyone

Operational Review

24i

24i's robust, end-to-end SaaS video streaming platform enables

all kinds of video content owners and distributors to monetise

their content investments by quickly launching and efficiently

managing attractive streaming services on all consumer devices,

from mobile phones and tablets to Smart TVs and the managed devices

provided by pay TV operators. With 14 years of experience in the

market, 24i's customers include NPO, Telenor, Pure Flix and

Broadway HD.

In the first half of 2023, 24i's revenues were $11.1m, an

increase of $1.8m on H1 2022.

In March 2023, 24i unveiled two significant enhancements to its

streaming platform resulting from recent investment in research and

development. 24i Broadcaster Studio is a new pre-packaged solution

targeting the specific needs of broadcasters who want to go

direct-to-consumer (D2C) with streaming applications, rather than

relying on Pay TV operators for carriage.

At the same time, we announced three new tiered packages of

24iQ, our data-driven SaaS personalisation platform. Two tiers are

pre-integrated with the wider 24i streaming platform, enabling

companies of all sizes to rapidly take advantage of the

personalisation trend to drive user engagement and tackle churn. A

third, enterprise tier enables larger broadcasters, pay TV

operators and streaming services to get a more bespoke, managed

service tailored to their specific personalisation needs.

The launch of 24i Broadcaster Studio is part of a wider strategy

to capitalise on the growth in ad-funded streaming, and in

particular what's known as Free Ad supported Streaming TV ('FAST')

channels. Today, thousands of these streaming-only TV channels are

available on aggregation platforms worldwide. In March 2023, we

announced a partnership with global FAST experts, Amagi, in which

24i can support the owners of these channels to quickly launch

their own streaming apps, build a direct relationship with their

consumers and develop new monetisation strategies. Post period end,

the first joint Amagi and 24i customer, US food and travel video

streaming network Tastemade, launched their 24i-based apps followed

shortly thereafter by Virgin Media.

Other customer project wins in the period include Israeli Public

Broadcaster, KAN, which used 24i's application framework and SaaS

content management platform to launch a series of new Smart TV

streaming applications with sophisticated new features such as

personalisation in December 2022 to coincide with the FIFA World

Cup. The 24i-powered app was downloaded more than 380,000 times

during the tournament alone.

Demand for 24i's video streaming platform remains strong.

Investments previously made in sales and marketing have delivered

results. The 24i management team, under its new leadership, is

focused on growing revenue and ARR at double digit percentages in

FY2023, whilst ensuring targeted R&D investment and improved

customer project scoping and pricing to increase profitability in

the second half of the financial year. This will ensure a better

balance between nominal revenue growth and profitability / cash

generation in the future.

Amino

Amino's managed video streaming devices and SaaS management

platform enable Pay TV operators to bring their live and on-demand

content to every connected household with the quality of service

and level of support that consumers demand for their big-screen

viewing experience.

In the first half of 2023 Amino's revenues were $12.1m, a

reduction of $23.1m on H1 2022. This was due to customers delaying

device orders to temporarily reduce working capital and defer

capital expenditure. We expect this trend to continue in 2023,

albeit that we expect Amino's revenue to be higher in the second

half of the financial year. Having taken the decision in Q2 2022 to

invest in raw materials and finished goods to reduce supply chain

risks associate with the COVID pandemic, inventory in Amino at 31

May 2023 was $8.6m, $4.6m higher than at 31 May 2022. As lead times

reduce, we have taken the decision to also reduce inventory and we

expect inventory levels to reduce back towards November FY21 levels

(which were $2.6m) in H1 2024.

With Pay TV operators looking to maximise their own cost

efficiencies, Amino's SaaS device management platform continues to

gain traction in the market. This platform has now been deployed by

over 120 Pay TV operators who use it to remotely maintain and

upgrade devices located in consumer homes, ensuring they maintain a

high level of service quality whilst also reducing customer support

costs. Unlike previous generations of satellite and cable TV

set-top-boxes, streaming devices can be posted to customers,

self-installed and remotely managed, providing a major cost saving

compared to the old model of an engineer home visit installation

for every customer.

We have also continued to see progress in the deployment of our

digital signage devices. These are used to stream information and

entertainment content to digital displays in a wide range of

settings, from betting shops and stadiums to healthcare facilities,

retail outlets, transportation hubs and government facilities. Our

devices have now been deployed into a number of international

Airports in India. Paddy Power is also migrating its services from

legacy satellite delivery to next gen low latency IP video delivery

using Amino digital signage devices throughout its shops in the UK

and Ireland. Improved quality and reduced latency not only improve

the customer experience, but also reduces Paddy Power's costs with

Amino's platform providing secure remote device management and

control across their widely distributed network.

The video streaming device market is forecast to continue to

grow, however, the market has evolved with low-cost manufacturers

meeting the needs of many pay TV operators who, whilst needing to

upgrade their services to incorporate video streaming, remain

focused on cost reduction. Therefore, to enhance profitability,

Amino's focus will be on delivering value to its customers

through:

-- delivering higher quality, higher margin pay TV streaming devices

which can also be bundled with the Group's Software-as-a-Service

("SaaS") device management platform, Engage. This SaaS device management

platform is also integrated with third party devices and sold on

a standalone basis; and

-- driving growth in its digital signage business selling into large

integrators and via distributors.

Environmental, Social and Governance ("ESG")

Today, we have published an update to our ESG report. This can

be found on our website at https://aferian.com/esg . In April 2023,

we were delighted to be awarded a prestigious Sustainability

Leadership Award at the National Association of Broadcasters annual

conference in the US. Amino was honoured in the medium-sized

company category in recognition of the company's outstanding

innovations in media technology that promote conservation and

reusability of natural resources and foster economic and social

development. The award recognised Amino for taking critical steps

to transform its business in line with a sustainable future and

aligned with the UN's Sustainability Development Goals (SDG).

During the first half of the year, we have seen excellent

engagement from staff across both 24i and Amino in our "Do The

Right Thing" initiative which encourages staff to suggest new ways

in which we can promote sustainability, diversity and good

governance across the Group. Ideas that have been adopted include a

bike plan proposed by an employee in Amsterdam which will provide

funding to employees to help them buy a bicycle suitable for

commuting.

In May 2023, we commenced an Employee Wellbeing campaign that

challenges the teams in our global offices to devise activities

that promote better physical, mental, social and financial

wellbeing. Our first cohort of Mental Health First Aiders have

completed their training and we have begun a programme to promote

more inclusivity and diversity in our recruitment and onboarding

processes. A programme of activities focused on physical wellbeing

has included trials of walking meetings, charity run sponsorship,

guided stretching sessions and a 60-day walking challenge.

The 24i team have also continued their support of Czechitas, a

non-profit organisation in the Czech Republic which retrains women

for careers in IT. Several cohorts of students have now undertaken

workshops at our offices, and we have now expanded the partnership

to provide mentorship opportunities with some of our staff.

Current Trading and Outlook

Trading remains in line with the trading and outlook

communicated in our trading statement on 28 June 2023. For the full

year ended 30 November 2023, 91% of management's forecast Group

revenues are contracted. The remaining 9% is covered by a

well-developed sales pipeline. Combined with the cost reduction

actions taken above, this provides the Board with confidence in the

expected outturn for the full year in which the Group is expected

to generate a positive material EBITDA.

Chief Financial Officer's review

As indicated in the trading update of 28 June 2023, the interim

results reflect management's strategic focus on profitable software

and services revenue growth in the 24i division and on higher

quality, higher margin streaming devices and device management

software in the Amino division.

High margin software & services revenues increased by 17% to

$14.0m (H1 2022: $12.0m). In addition, exit run rate ARR increased

to $18.8m (H1 2022: $15.8m), representing growth of 19%. As

forecast, device revenues in the first half are $9.4m (H1 2022:

$32.5m), representing a decrease of 71% year-on-year. Consequently,

Group revenue for the period is $23.3m (H1 2022: $44.5m).

Adjusted operating cashflow before tax was a $7.0m outflow (H1

2022: $6.7m inflow), primarily driven by the reduction in EBITDA as

a result of the significant decrease in device revenue as well as a

working capital outflow of $6.9m primarily relating to payments for

inventory built up in H2 2022. The Group's inventory balance at 31

May 2023 was $8.6m (31 May 2022: $4.0m). After $4.1m payments for

professional fees associated with the previously communicated

aborted acquisition incurred in 2022 as well as $1.1m restructuring

costs resulting from the cost reduction actions taken by management

in February 2023, operating cash flow before tax was a $12.3m

outflow (H1 2022: $4.9m inflow).

As a result of these operating cash outflows, the Group had net

debt of $12.9m as at 31 May 2023 (30 November 2022: $4.0m net

cash).

The Group has a loan facility with Barclays Bank plc, Silicon

Valley Bank, and Bank of Ireland, which has a committed term to 23

December 2024 with options to extend by a further one or two years.

On 31 May 2023 the Group agreed to reduce the total amounts

available under this facility from $50 million to $25.4 million.

The Group had drawn $17.5m of this facility at 31 May 2023 (30

November 2022: $7.5m).

In addition, on 31 May 2023, the Group secured a shareholder

loan facility of up to GBP3.25 million arranged by its largest

shareholder, Kestrel Partners LLP, of which GBP1.25m was drawn as

at 31 May 2023.

On 25 July 2023, the Group successfully raised $4.0m (before

expenses) through an equity placing to be used for general working

capital purposes, replacing the need for further drawdown of the

shareholder loan from Kestrel, of which the undrawn element

GBP2.125m expired on 31 July 2023. These funds provide additional

headroom in respect of the covenants in the Group's existing bank

facility.

Net debt is expected to reduce over the remainder of the current

financial year as inventory levels reduce.

Revenue

H1 2023 H1 2022 Change

$m $m

------------------------------ -------------- -------------- ---------------

Software and services

Revenue

Recurring 9.5 8.2 16%

Non-recurring 4.5 3.8 18%

Total revenue 14.0 12.0 17%

Devices including integrated

software

Revenue

Non-recurring 9.4 32.5 (71%)

Total

Revenue

Recurring 9.5 8.2 16%

Non-recurring 13.8 36.3 (62%)

Total revenue 23.3 44.5 (48%)

------------------------------ -------------- -------------- ---------------

At 31 May 2023, exit run rate ARR increased to $18.8m (H1 2022:

$15.8m). On a constant currency basis exit run rate ARR at 31 May

2023 would have been $18.9m. The increase in exit run rate ARR

provides enhanced revenue visibility as the Group moves

forward.

Higher margin software & services revenue increased by 17%

to $14.0m (H1 2022: $12.0m), representing 60% of total revenues for

the period (H1 2022: 27%), of which 68% was recurring (H1 2022:

68%). This demonstrates that the Group continues to make

encouraging progress in executing on its strategy to grow software

and services revenue in the fast-growing video streaming

market.

Devices revenues, however, were significantly lower than the

prior period at $9.4m (H1 2022: $32.5m), representing a decrease of

71% year on year. Whilst the video streaming device market

continues to grow, the number of devices shipped in the period

significantly reduced due to wider macro-economic impact, and

customers de-stocking in response to reduced lead-times after

building up stocks to weather post-COVID supply chain

challenges.

Revenue and adjusted EBITDA

Revenue Adjusted EBITDA

H1 2023 H1 2022 H1 2023 H1 2022

$m $m $m $m

------------------------- ---------- ----------- ------- ------------ ----------

24i 11.3 9.3 1.4 0.6

Amino 12.1 35.2 (0.5) 6.5

Central costs - - (1.0) (1.3)

------------------------- ---------- ----------- ------- ------------ ----------

Total 23.3 44.5 (0.1) 5.8

------------------------- ---------- ----------- ------- ------------ ----------

Adjusted EBITDA for the six months to 31 May 2023 was a loss of

$0.1m (H1 2022: $5.8m profit). Adjusted EBITDA is reconciled below,

and is calculated as operating profit before depreciation,

interest, tax, amortisation, impairment of goodwill, exceptional

items and employee share-based payment charges. This is consistent

with the way the financial performance of the Group is presented to

the Board. The Directors believe that this provides a more

meaningful comparison of how the business is managed and measured

on a day-to-day basis.

24i segment

H1 2023 H1 2022

$m $m

-------------------------------- --------- --------

Software & services 11.1 9.3

Device revenues 0.2 -

Revenue 11.3 9.3

Adjusted cost of sales (3.2) (2.6)

-------------------------------- --------- --------

Adjusted gross profit margin 8.1 6.7

Adjusted gross profit margin % 72% 72%

Adjusted operating costs (6.7) (6.1)

-------------------------------- --------- --------

Adjusted EBITDA* 1.4 0.6

Adjusted EBITDA margin % 12% 6%

Capitalised development costs 2.6 3.2

-------------------------------- --------- --------

*Adjusted EBITDA is a non-GAAP measure and excludes

depreciation, amortisation, interest, tax, exceptional items and

share based payment charges.

With the increased focus on improving visibility, ARR has grown

from $11.3m to $14.2m in the last 12 months. This represents

year-on-year growth of 26% (constant currency basis: 26%). The

increased focus on exit run rate ARR aligns with the Group's

software-led strategy.

The gross profit margin for the 24i segment has remained

consistent with H1 2022 at 72%.

Furthermore, adjusted operating costs increased by $0.6m during

the period, mainly driven by investment made in additional

resources for customer-onboarding as the business is growing. The

24i management team are focused on accelerating profitability in

the second half of the financial year and beyond.

Amino segment

H1 2023 H1 2022

$m $m

---------------------------------------

Software & services 2.9 2.7

Devices including integrated software 9.2 32.5

Revenue 12.1 35.2

Adjusted cost of sales (7.1) (22.5)

--------------------------------------- ------------ -----------

Adjusted gross profit 5.0 12.7

Adjusted gross profit margin % 40% 36%

Adjusted operating costs (5.5) (6.2)

--------------------------------------- ------------ -----------

Adjusted EBITDA* (0.5) 6.5

Adjusted EBITDA margin % (4%) 18%

Capitalised development costs 0.7 1.0

--------------------------------------- ------------ -----------

*Adjusted EBITDA is a non-GAAP measure and excludes

depreciation, amortisation, interest, tax, exceptional items and

share based payment charges.

Devices revenues were significantly lower than the prior period

at $9.2m (H1 2022: $32.5m), representing a decrease of 72%

year-on-year. Whilst the video streaming device market continues to

grow, the number of devices shipped decreased significantly in the

period due to wider macro-economic impact, and customers

de-stocking in response to reduced lead-times after building up

stocks to weather post-COVID supply chain challenges.

The Group has a core customer base in respect of device

revenues, whereby repeat orders are placed by the same customers

over multiple financial years. Taking the last three financial

years, repeat orders from existing customers over that period has

accounted for 93% (H1 2022: 91%) of total device revenue.

Devices revenue in H2 2023 is expected to be higher than H1 2023

and this recovery is expected to continue in FY 2024 as inventory

levels continue to normalise within the supply chain. The Amino

division will now focus on higher quality, higher margin streaming

devices which can also be bundled with its SaaS device management

platform. This SaaS device management platform is also integrated

with third party devices and sold on a standalone basis. With

encouraging initial traction, the Amino division will also look to

continue to grow its digital signage business.

Central costs

H1 2023 H1 2022

$m $m

Adjusted operating costs and adjusted EBITDA (1.0) (1.3)

---------------------------------------------- --------- --------

Central costs comprise the costs of the Board, including

executive directors, as well as costs associated with the Company's

listing on the London Stock Exchange.

Adjusted EBITDA

H1 2023 H1 2022

$m $m

--------------------------------------------

Revenue 23.3 44.5

Adjusted cost of sales (10.3) (25.1)

-------------------------------------------- ------------ -----------

Adjusted gross profit 13.0 19.4

Adjusted gross profit margin % 56% 44%

Customer support and professional services (2.8) (2.9)

Research and development expenses (2.6) (2.9)

SG&A (7.7) (7.8)

Total adjusted operating expenses (13.1) (13.6)

Adjusted EBITDA (0.1) 5.8

-------------------------------------------- ------------ -----------

Research & development ('R&D') costs

The Group continues to invest in research and in the development

of new products and spent $5.9m on R&D activities (H1 2022:

$7.1m), of which $3.2m (H1 2022: $4.2m) was capitalised.

H1 2023 % of revenue H1 2022

$m $m % of

revenue

-------------------------------- --------- -------------- -------- ---------

Core engineering expenses 4.9 21% 6.1 14%

Product management - H1 2022

restated* 0.5 3% 0.6* 1%

R&D senior management 0.4 2% 0.4 1%

-------------------------------- --------- -------------- -------- ---------

Total research and development

costs 5.8 25% 7.1 16%

-------------------------------- --------- -------------- -------- ---------

Less Capitalised development

costs (3.2) - (4.2) -

-------------------------------- --------- -------------- -------- ---------

Net research and development

expense 2.6 - 2.9 -

-------------------------------- --------- -------------- -------- ---------

*Product management costs of $0.3m in H1 2022 have been

reclassified from core engineering expenses to be consistent with

the classification methodology used in H1 2023.

Selling, general and administrative (SG&A) expenses have

remained consistent with prior period at $7.8m. The Group's spend

on core engineering activities has decreased by $1.2m in the period

to $4.9m (H1 2022: $6.1m) with capitalised development costs also

down $1.0m to $3.2m (H1 2022: $4.2m). This is due to the actions

taken by management in February 2023 which has reduced the Group's

annualised operating cost base by c.$2.9m and in turn the capital

research and development spend by c.$1.8m.

A reconciliation of Adjusted EBITDA to operating (loss)/profit

is provided as follows:

H1 2023 H1 2022

$m $m

--------------------------------------------- --------- --------

Adjusted EBITDA (0.1) 5.8

Exceptional items within operating expenses (1.2) (0.5)

Employee share-based payment charge (0.3) (0.3)

Depreciation and amortisation (6.4) (5.6)

--------------------------------------------- --------- --------

Operating loss (8.0) (0.6)

--------------------------------------------- --------- --------

Exceptional items

Exceptional items for the period comprised:

-- $1.2m (H1 2022: $0.3m) redundancy and associated restructuring costs; and

-- $nil (H1 2022: $0.2m) acquisition and associated one-off legal costs.

Depreciation and amortisation

Excluding amortisation of intangibles recognised on acquisition,

depreciation and amortisation was $4.1m (H1 2022: $3.3m).

Amortisation of intangibles recognised on acquisitions was $2.4m

(H1 2022: $2.2m). The increase of $0.2m in the period relates to

the acquisition of The Filter in April 2022.

Taxation

The tax charge of $0.0m (H1 2022: $0.7m) comprises:

-- $0.3m (H1 2022: $0.9m) current tax charge; and

-- $0.2m (H1 2022: $0.2m) credit relating to the unwinding of

deferred tax assets and liabilities recognised on acquisitions.

Loss after tax was $8.7m loss (H1 2022: $1.5m loss).

Cash flow

A reconciliation of adjusted operating cash flow before tax to

cash generated from operations before tax is provided as

follows:

H1 2023 H1 2022

$m $m

----------------------------------------------- --------- --------

Adjusted operating cashflow before tax (7.0) 6.7

Post-acquisition integration and associated

restructuring costs (1.2) (0.3)

Acquisition and associated one-off legal

costs - (0.2)

One-off refinancing costs - H1 2022 restated* - (1.3)

Acquisition costs for the aborted acquisition (4.1) -

in prior year

Cash generated from operations before tax (12.3) 4.9

----------------------------------------------- --------- --------

*Restated as a result of bank loan facility set up costs of

$1.3m being reclassified from interest paid within cash used in

financing activities to movements on trade and other receivables

within cash generated from operations before tax see note 8.

Adjusted cash flow from operations before tax was a $7.0m

outflow (H1 2022: $6.7m inflow - restated), a decrease of 204% due

to the reduction in EBITDA as a result of the significant decrease

in device revenues, together with a working capital outflow of

$6.9m primarily relating to payments for inventory built up in H2

2022.

Cash generated from operations before tax was $12.3m outflow (H1

2022: $4.9m inflow), $4.1m payments for professional fees

associated with the aborted acquisition incurred in 2022 as well as

$1m restructuring and legal costs associated with the cost

reduction actions taken by management in February 2023.

Tax payments, principally in respect of corporation tax,

totalled $0.3m during the period (H1 2022: $1.9m), after $0.2m tax

rebate received for FY2021.

During the period, the Group spent $nil (H1 2022: $0.1m) on

capital expenditure in respect of tangible fixed assets and

capitalised $3.3m of research and development costs (H1 2022:

$4.2m). The decrease of $0.9m was mainly driven by the cost

reduction actions taken in February 2023.

Interest paid in the period of $0.5m (H1 2022: $0.2m) includes

bank loan and overdraft interest.

Financial position

The Group had net debt of $12.9m as at 31 May 2023 (30 November

2022: $4.0m cash). On 31 May 2023 the Group agreed with its

existing banking facility providers to reduce the total available

loan facility from $50 million to $25.4 million. Of the total

available loan facility of $25.4m, $17.5m was drawn at 31 May 2023

(30 November 2022: $7.5m) , $0.1m is committed performance bond

facilities, and the remaining $7.8m loan facility is undrawn

including $5m undrawn overdraft facility. The bank loan facility

has a committed term to 23 December 2024 with options to extend by

a further one or two years. In addition, on 31 May 2023, the Group

has secured a shareholder loan facility of up to GBP3.25 million

arranged by its largest shareholder, Kestrel Partners LLP, of which

GBP2.125m was un-drawn at 31 May 2023. Amounts drawn under this

shareholder loan facility (including accrued interest) are (if not

prepaid) repayable on 31 March 2025, unless extended at the

Company's option to 31 March 2026 and 31 March 2027.

Net debt is expected to reduce over the remainder of the current

financial year as inventory levels reduce. The Group remains in

compliance with its loan facilities covenants.

At 31 May 2023, the Group had total equity of $71.9m (30

November 2022: $78.9m) and net current liabilities of $8.5m (30

November 2022: $1.4m).

Dividend

The Board is not proposing an interim dividend (H1 2022: 1.0 GBP

pence).

Going concern

The Directors have considered it appropriate to prepare these

consolidated interim financial statements on a going concern basis.

The Directors assessment of going concern including is set out in

note 2.

Principal risks and uncertainties

The principal risks and uncertainties facing the Group remain

consistent with the principal risks and uncertainties reported in

Aferian's 2022 Annual Report.

Mark Carlisle

Chief Financial Officer

31 August 2023

Consolidated income statement

For the six months ended 31 May 2023

Six months Six months ended

ended 31 May 2022

31 May 2023 Unaudited

Unaudited

Notes $000s $000s

------------------------------------ ----- ------------- ------------------

Revenue 3 23,348 44,517

Cost of sales (10,332) (25,106)

------------------------------------ ----- ------------- ------------------

Gross profit 13,016 19,411

Operating expenses (21,000) (20,010)

Operating loss (7,984) (599)

Adjusted operating (loss)/profit (4,172) 2,378

Share based payment charge (286) (310)

Exceptional items 6 (1,151) (516)

Amortisation of acquired intangible

assets (2,375) (2,151)

------------------------------------ ----- ------------- ------------------

Operating loss (7,984) (599)

------------------

Finance expense (1,199) (223)

Finance income 534 11

------------------------------------ ----- ------------- ------------------

Net finance expense (665) (212)

------------------------------------ ----- ------------- ------------------

Loss before tax (8,649) (811)

Tax charge (43) (659)

------------------------------------ ----- ------------- ------------------

Loss after tax (8,692) (1,470)

------------------------------------ ----- ------------- ------------------

Basic earnings per 1p ordinary

share 7 (10.20c) (1.76c)

Diluted earnings per 1p ordinary

share 7 (10.20c) (1.78c)

------------------------------------ ----- ------------- ------------------

Consolidated statement of comprehensive income

For the six months ended 31 May 2023

Six months Six months ended

ended 31 May 2022

31 May 2023 Unaudited

Unaudited

$000s $000s

---------------------------------------- ------------ ----------------

Loss for the period (8,692) (1,470)

---------------------------------------- ------------ ----------------

Foreign exchange difference arising on

consolidation 1,960 (4,232)

---------------------------------------- ------------ ----------------

Other comprehensive income/(loss) 1,960 (4,232)

---------------------------------------- ------------ ----------------

Total comprehensive loss for the period (6,732) (5,702)

---------------------------------------- ------------ ----------------

Consolidated balance sheet

As at 31 May 2023 As at As at

31 May 2023 30 November

Unaudited 2022

Assets Notes $000s $000s

----------------------------------- ----- ------------ ------------

Non-current assets

Property, plant and equipment 388 496

Right of use assets 1,818 2,276

Intangible assets 80,430 81,021

Other receivables 183 183

----------------------------------- ----- ------------ ------------

82,819 83,976

----------------------------------- ----- ------------ ------------

Current assets

Inventories 8,607 9,222

Trade and other receivables 13,457 19,846

Corporation tax receivable 205 654

Cash and cash equivalents 6,072 11,524

----------------------------------- ----- ------------ ------------

28,341 41,246

----------------------------------- ----- ------------ ------------

Total assets 111,160 125,222

----------------------------------- ----- ------------ ------------

Capital and reserves attributable

to equity holders of the business

Called-up share capital 1,488 1,488

Share premium 39,870 39,768

Capital redemption reserve 12 12

Foreign exchange reserves (6,762) (8,722)

Merger reserve 42,750 42,750

Retained earnings (4,952) 3,587

----------------------------------- ----- ------------ ------------

Total equity 72,406 78,883

----------------------------------- ----- ------------ ------------

Liabilities

Current liabilities

Trade and other payables 16,347 33,534

Lease liabilities 797 1,121

Corporation tax payable - 505

Loans and borrowings 5 17,764 7,531

34,908 42,691

----------------------------------- ----- ------------ ------------

Non-current liabilities

----------------------------------- ----- ------------ ------------

Trade and other payables 355 1,070

Lease liabilities 1,034 1,177

Loans and borrowings 5 1,227 -

Provisions 289 288

Deferred tax liability 941 1,113

----------------------------------- ----- ------------ ------------

3,846 3,648

----------------------------------- ----- ------------ ------------

Total liabilities 38,754 46,339

----------------------------------- ----- ------------ ------------

Total equity and liabilities 111,160 125,222

----------------------------------- ----- ------------ ------------

Consolidated Cash Flow Statement

For the six months ended 31 May 2023

Six months Six months

ended 31 May ended 31 May

2023 2022

Unaudited Unaudited

Restated

Notes $000s $000s

-------------------------------------------- ----- ------------- -------------

Cash flows from operating activities

Cash generated from operations 8 (12,254) 6,229

Net corporation tax paid (268) (1,864)

-------------------------------------------- ----- ------------- -------------

Net cash (used in)/generated from operating

activities (12,522) 4,365

-------------------------------------------- ----- ------------- -------------

Cash flows from investing activities

Expenditure on intangible assets (3,288) (4,156)

Payment of deferred consideration on

acquisition - (503)

Purchase of property, plant and equipment (36) (124)

Interest received 3 -

Acquisition of subsidiary, net of cash

acquired - (1,545)

-------------------------------------------- ----- ------------- -------------

Net cash used in investing activities (3,321) (6,328)

-------------------------------------------- ----- ------------- -------------

Cash flows from financing activities

Interest paid (464) (1,531)

Lease liability repayments (639) (629)

Proceeds from borrowings 15,813 -

Repayment of borrowings (4,500) -

Dividends paid - (2,297)

-------------------------------------------- ----- ------------- -------------

Net cash generated from/(used in) financing

activities 10,210 (4,457)

-------------------------------------------- ----- ------------- -------------

Net decrease in cash and cash equivalents (5,633) (6,420)

Cash and cash equivalents at start of

the period 11,524 14,182

Effects of exchange rate fluctuations

on cash held 181 -

-------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at end of

period 6,072 7,762

-------------------------------------------- ----- ------------- -------------

Notes to the interim condensed consolidated unaudited financial

information

Six months ended 31 May 2023

1 General information

Aferian plc ('the Company') and its subsidiaries (together 'the

Group') specialise in the delivery of next generation video

experiences over IP using its end-to-end solution. This comprises

the 24i online video solution and Amino video streaming devices and

associated operating and device management software.

The Company is a public limited company which is listed on the

AIM market of the London Stock Exchange and is incorporated and

domiciled in England and Wales.

2 Basis of preparation

These interim consolidated financial statements have been

prepared using accounting policies based on United Kingdom adopted

international accounting standards ('IFRS') . They do not include

all disclosures that would otherwise be required in a complete set

of financial statements and should be read in conjunction with the

30 November 2022 Annual Report. The financial information for the

six months ended 31 May 2023 and 31 May 2022 does not constitute

statutory accounts within the meaning of Section 434 (3) of the

Companies Act 2006 and both periods are unaudited.

The annual financial statements of Aferian Plc ('the Group')

were prepared in accordance with United Kingdom adopted

international accounting standards ('IFRS'). The statutory Annual

Report and Financial Statements for 2022 have been filed with the

Registrar of Companies. The Independent Auditors' Report on the

Annual Report and Financial Statements for the year ended 30

November 2022 was unmodified, drew attention to a material

uncertainty related to going concern and did not contain a

statement under 498(2) - (3) of the Companies Act 2006.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2022 annual financial statements, except for those that

relate to new standards and interpretations effective for the first

time for periods beginning on (or after) 1 January 2022 and will be

adopted in the 2023 financial statements. There are deemed to be no

new and amended standards and/or interpretations that will apply

for the first time in the next annual financial statements that are

expected to have a material impact on the Group.

Going Concern

The interim consolidated financial statements have been prepared

on a going concern basis. The ability of the Group to continue as a

going concern is contingent of the ongoing working capital

facilities and wider viability of the Group. The Group meets its

day-to-day working capital requirements through its cash balances,

working capital facilities and wider working capital

management.

The Group had net debt of $12.9m as at 31 May 2023 (30 November

2022: $4.0m cash) and a multicurrency working capital facility of

$25.4m, of which $17.5m was drawn at 31 May 2023 (30 November 2022:

$7.5m). On 31 May 2023 the Group agreed with its existing banking

facility providers to reduce the total available loan facility from

$50 million to $25.4 million. At 31 May 2023, of the remaining

$7.9m facility $0.1m is committed performance bond facilities with

the remaining $7.8m undrawn including $5m undrawn overdraft. In

addition, on 31 May 2023, the Group secured additional cash funding

by way of a shareholder loan of up to GBP1.125 million from our

largest shareholder, Kestrel Partners LLP.

On 25 July 2023, the Group successfully raised $4.0m through an

issue of equity share capital to be used for general working

capital, replacing the need for further drawdown of the shareholder

loan from Kestrel, of which the undrawn element GBP2.125m expired

on 31 July 2023. These funds provide additional headroom in respect

of the covenants in the Group's existing bank facility.

The Directors have reviewed the Group's going concern position

taking account of its current business activities and forecast

performance. The factors likely to affect its future development

are set out in these consolidated interim financial statements. In

carrying out the going concern assessment, the Directors have

prepared a base case cash flow forecast for the next 12 months

which includes 91% of forecast revenue being contracted for FY23.

In addition, they have prepared a downside scenario, where lower

forecast sales are achieved in addition to a significantly higher

working capital requirement.

Overall, if the base case forecast is achieved, the Group will

be able to operate within its existing working capital facilities.

However, the recovery of Amino's revenues, continued growth in 24i

and reduction in working capital expected in the second half of

FY23 are key. The material cost reduction management actions taken

since February 2023 mean that the Group is expected to generate a

material positive EBITDA in the second half of FY23 even in the

forecast downside scenario. However, failure to achieve the base

case view of forecast sales and reduction in working capital could

result in the Group failing to comply with financial covenants

associated with its existing bank facility, potentially resulting

in the facilities being withdrawn.

In reaching their going concern assessment, the Directors have

considered the foreseeable future, a period extending at least 12

months from the date of approval of these consolidated interim

financial statements. Taking account of these matters, the

Directors have concluded that the circumstances set forth above

indicates the existence of a material uncertainty that may cast

significant doubt on the Group's ability to continue as a going

concern. However, given the Group's current performance, the

Directors have considered it appropriate to prepare these

consolidated interim financial statements on a going concern basis

and they do not include the adjustments that would be required if

the Group were unable to continue as a going concern.

The Board of Directors approved this interim report on 31 August

2023.

3 Revenue

The geographical analysis of revenue from external customers

generated by the identified operating segment is:

Six months Six months

ended ended

31 May 2023 31 May 2022

Unaudited Unaudited

$000s $000s

------------------ ------------ ------------

North America 7,961 16,019

Latin America 1,652 6,027

------------------ ------------ ------------

Netherlands 6,449 13,540

Rest of EMEA 6,505 7,829

------------------ ------------ ------------

EMEA 12,954 21,369

Rest of the World 781 1,102

------------------ ------------ ------------

23,348 44,517

------------------ ------------ ------------

The Group's revenue disaggregated by product is as follows:

Six months Six months

ended ended

31 May 2023 31 May 2022

Unaudited Unaudited

$000s $000s

------------------------------------------ ------------ ------------

Devices incorporating integrated software

and associated accessories 9,393 32,457

Software and services 13,955 12,060

------------------------------------------ ------------ ------------

23,348 44,517

------------------------------------------ ------------ ------------

4 Segmental analysis

Operating segments are reported in a manner consistent with the

internal reporting provided to the Aferian plc Chief Operating

Decision Maker ("CODM") for the use in strategic decision making

and monitoring of performance. The CODM has been identified as the

Group Chief Executive and the Chief Financial Officer. The CODM

reviews the Group's internal reporting in order to assess

performance and allocate resources. Performance of the operating

segments is based on adjusted EBITDA. Information provided to the

CODM is measured in a manner consistent with that in the Financial

Statements.

The Group reports three operating segments to the CODM:

-- the development and sale of video streaming devices and solutions,

including licensing and support services ("Amino");

-- development and sale of the 24i end-to-end streaming platform

and associated services. This includes the results of 24iQ (formerly

called the Filter) and FokusOnTV (formerly called Nordija A/S);

and

-- central costs which comprise the costs of the Board, including

the executive directors as well as costs associated with the Company's

listing on the London Stock Exchange.

Revenues and costs by segment are shown below.

Central

Amino 24i costs Total

2023 $000s $000s $000s $000s

Software and

Revenue services 2,884 11,071 - 13,955

Devices * 9,185 208 - 9,393

---------------------- ------------- -------- -------- -------- ---------

Total 12,069 11,279 - 23,348

% Recurring 20% 63% - 41%

Adjusted cost

of sales (7,162) (3,170) - (10,332)

---------------------- ------------- -------- -------- -------- ---------

Adjusted gross

profit 4,907 8,109 - 13,016

Adjusted operating expenses (5,477) (6,693) (957) (13,127)

------------------------------------- -------- -------- -------- ---------

Adjusted EBITDA (570) 1,416 (957) (111)

Exceptional items within operating

expenses (1,151)

Share based payment charge (286)

Depreciation, amortisation,

and loss on disposal of fixed

assets (6,436)

------------------------------------- -------- -------- -------- ---------

Operating loss (7,984)

Net finance expense (665)

---------------------- ------------- -------- -------- -------- ---------

Loss before

tax (8,649)

---------------------- ------------- -------- -------- -------- ---------

Additions to non-current assets:

Capitalised development costs 675 2,571 - 3,246

------------------------------------- -------- -------- -------- ---------

* incorporating integrated Amino software and associated

accessories.

4 Segmental analysis (continued)

Central

Amino 24i costs Total

2022 $000s $000s $000s $000s

Software and

Revenue services 2,723 9,311 - 12,034

Devices * 32,483 - - 32,483

---------------------- ------------- --------- -------- -------- ---------

Total 35,206 9,311 - 44,517

% Recurring 7% 62% - 19%

Adjusted cost

of sales (22,484) (2,622) - (25,106)

---------------------- ------------- --------- -------- -------- ---------

Adjusted gross

profit 12,722 6,689 - 19,411

Adjusted operating expenses (6,237) (6,046) (1,346) (13,629)

------------------------------------- --------- -------- -------- ---------

Adjusted EBITDA 6,485 643 (1,346) 5,782

Exceptional items within operating

expenses (516)

Share based payment charge (310)

Depreciation, amortisation,

and loss on disposal of fixed

assets (5,555)

------------------------------------- --------- -------- -------- ---------

Operating loss (599)

Net finance expense (212)

---------------------- ------------- --------- -------- -------- ---------

Loss before

tax (811)

---------------------- ------------- --------- -------- -------- ---------

Additions to non-current assets:

Capitalised development costs 998 3,158 - 4,156

------------------------------------- --------- -------- -------- ---------

* incorporating integrated Amino software and associated

accessories.

5 Loans and borrowings

As at As at 30 November

31 May 2023 2022

Unaudited

$000s $000s

------------------------------- ------------ -----------------

Current

Bank loans (secured)

17,764 7,531

Non-current

Shareholder loans (unsecured) 1,227 -

Total borrowings 18,991 7,531

------------------------------- ------------ -----------------

There is no difference between the book value and the fair value

of the bank loan. The bank loan is denominated in USD and the rate

at which the loan interest is payable is between 2.1% and 2.75%

above bank reference rate depending on the gross leverage cover

ratio. The bank loan is secured by a fixed and floating charge over

all assets of the Group. On 31 May 2023 the Group agreed to reduce

the total amounts available under the bank loan facility from $50

million to $25.4 million. The Group had drawn $17.5m of this

facility at 31 May 2023 (30 November 2022: $7.5m), which is

included in current liabilities together with the accrual interests

on the loan.

On 31 May 2023, the Group secured a shareholder loan facility of

up to GBP3.25 million arranged by its largest shareholder, Kestrel

Partners LLP, of which GBP1.25m was drawn as at 31 May 2023. The

Group has the option, until 31 July 2023, to draw the remaining

GBP2.125 million. Amounts drawn under this facility (including

accrued interest) are (if not prepaid) repayable on 31 March 2025,

unless extended at the Group's option to 31 March 2026 and 31 March

2027. Following the initial drawing of GBP1.125 million of the

Shareholder Loan, Warrants over 4.5 million ordinary shares are

issuable to the Lender, Kestrel Partners LLP, representing

approximately 5.2% of Group's issued share capital. Full exercise

of the Warrants over 4.5 million ordinary shares issuable in

connection with the initial GBP1.125 million drawing of the

shareholder loan would result in cash proceeds of GBP765,000

payable to Aferian and full exercise of all Warrants issuable in

connection with the shareholder loan if it were fully drawn would

result in cash proceeds of GBP2.21 million payable to the

Group.

The Shareholder loan constitutes a form of convertible debt

which is accounted for as a compound instrument under IAS 32. The

fair value of the shareholder loan liability component is

recognised as non-current liability as the loan is repayable on 31

March 2025, and calculated based on the present value of the

contractual stream of future cash flows discounted at the market

rate of interest that would have been applied to an instrument of

comparable credit quality with substantially the same cash flows,

on the same terms, but without the conversion option. The residual

shareholder loan book value is recognised as the equity

component.

6 Exceptional items

Exceptional items included in operating (loss)/profit comprise

the following charges:

Six months ended Six months ended

31 May 2023 31 May 2022

Unaudited Unaudited

$000s $000s

-------------------------------------------- ---------------- ----------------

Post-acquisition integration and associated

restructuring costs 1,151 289

Acquisition and associated one-off legal

costs - 227

Subtotal operating expenses 1,151 516

-------------------------------------------- ---------------- ----------------

Total exceptional items 1,151 516

-------------------------------------------- ---------------- ----------------

Exceptional items within net finance expense comprise the

following charges/(credits):

Six months ended Six months ended

31 May 2023 31 May 2022

Unaudited Unaudited

$000s $000s

----------------------------------------------- ---------------- ----------------

Credit in relation to movement in contingent (530) -

consideration

----------------------------------------------- ---------------- ----------------

Subtotal finance income (530) -

----------------------------------------------- ---------------- ----------------

Unwinding discount on contingent consideration 198 -

Subtotal finance expense 198 -

----------------------------------------------- ---------------- ----------------

Total exceptional items (332) -

----------------------------------------------- ---------------- ----------------

Exceptional items are items which are material or non-recurring

in nature and which are therefore presented separately from

underlying operating expenses and income. Material costs may

include: release of contingent consideration no longer payable,

release of royalty costs recognised in prior years and subsequent

renegotiated, redundancy and associated costs, legal and

professional advisor fees in respect of acquisitions costs,

contingent post acquisition remuneration payable and additions,

aborted acquisition costs or releases to the provision for

uncertain tax provisions. Material income comprises amounts outside

the course of normal trading activities.

Furthermore, the Group considers the fair value movement in

contingent consideration and the unwinding of the discount on

contingent consideration to be adjusting items within net finance

expenses because they are non-cash and they do not relate to the

day-to-day trading activities of the Group. They are treated as

adjusting items below adjusted operating profit but not presented

on the face of the consolidated income statement.

7 Earnings per share

Six months ended Six months ended

31 May 2023 31 May 2022

Unaudited Unaudited

Restated

$000s $000s

---------------------------------------------- ---------------- ----------------

Loss attributable to shareholders (8,692) (1,470)

---------------------------------------------- ---------------- ----------------

Exceptional items 1,151 516

Share-based payment charges 286 310

Finance income (see note 5) (530) -

Finance expense (see note 5) 198 -

Amortisation of acquired intangible assets 2,375 2,151

---------------------------------------------- ---------------- ----------------

Tax effect thereon (243) (256)

---------------------------------------------- ---------------- ----------------

Profit attributable to shareholders excluding

exceptional items, share-based payments

and amortisation of acquired intangibles

and associated taxation (5,455) 1,251

---------------------------------------------- ---------------- ----------------

Number Number

Weighted average number of shares (Basic) 85,211,865 83,439,943

---------------------------------------------- ---------------- ----------------

Weighted average number of shares (Diluted) 86,340,346 84,890,085

---------------------------------------------- ---------------- ----------------

Basic earnings per share (cents) (10.20) (1.76)

Diluted earnings per share (cents) (10.20) (1.76)

---------------------------------------------- ---------------- ----------------

Adjusted basic earnings per share (cents) (6.40) 1.50

Adjusted diluted earnings per share (cents) (6.40) 1.47

---------------------------------------------- ---------------- ----------------

The weighted average number of shares (Diluted) has been

restated from 82,832,009 to 84,890,085 for 31 May 2022 due to the

calculation previously including proceeds from options which were

deemed to not be dilutive as at 31 May 2022. As a result, adjusted

diluted earnings per share has been restated for the period 6

months period ending 31 May 2022 from $1.51 to $1.47.

The calculation of basic earnings per share is based on profit

after taxation and the weighted average number of ordinary shares

of 1p each in issue during the period. The Company holds 1,482,502

(H1 2022: 1,488,254) of its own shares in treasury and these are

excluded from the weighted average above. The basic weighted

average number of shares also excludes 242 (H1 2022: 242) being the

weighted average shares held by the EBT in the year.

The number of dilutive share options above represents the share

options where the market price is greater than the exercise price

of the Company's ordinary shares.

8 Cash generated from operations

Six months Six months ended

ended 31 May 2022

31 May 2023 Unaudited

Unaudited

Restated

$000s $000s

------------------------------------------------ ------------ ----------------

Loss for the period (8,692) (1,470)

Tax expense 43 659

Net finance expense 665 212

Amortisation charge 5,658 4,768

Depreciation charge 778 787

Loss on disposal of property, plant & equipment - 5

Share based payment charge 286 310

Exchange differences 10 848

Decrease/(increase) in inventories 615 (1,429)

Decrease in trade and other receivables 6,307 628

Decrease in provisions - (5)

Decrease in trade and other payables (17,924) (457)

Cash (used in)/generated from operations

before tax (12,254) 4,856

------------------------------------------------ ------------ ----------------

The movement in trade and other receivables has been restated

for H1 2022 to now include a $1.3m cash outflow relating to bank

loan set-up costs that was previously classified as interest paid

within cash used in financing activities. As a result, cash

generated from operations before tax has been restated from $6.2m

to $4.9m.

Adjusted operating cash flow before tax was $7.0m outflow (H1

2022: $6.7m inflow) and is reconciled to cash generated from

operations before tax as follows:

Six months Six months ended

ended 31 May 2022

31 May 2023 Unaudited

Unaudited Restated

$000s $000s

--------------------------------------- ------------ ----------------

Adjusted operating cashflow before tax (7,003) 6,745

--------------------------------------- ------------ ----------------

Redundancy and associated costs (1,151) (289)

Acquisition and one-off legal costs - (227)

Bank loan facility set up costs - (1,373)*

Aborted acquisition costs (4,100) -

Cash generated from operations before

tax (12,254) 4,856

--------------------------------------- ------------ ----------------

*Restated as a result of bank loan facility set up costs of

$1.3m being reclassified from interest paid within cash used in