Global X Planning U.S. Version of SuperDividend ETF - ETF News And Commentary

06 November 2012 - 3:01PM

Zacks

Global X, the New York-based ETF issuer best known for its

international and high yield products, appears to be back in the

product lab again with a brand new SEC filing. However, unlike many

of its other ETFs currently on the market, this proposed product

will focus in on American securities instead.

This marks a shift for Global X, as the company has a lineup of

Chinese and Brazilian funds, various commodity ETFs that have

international exposure, and a number of other specialized products

as well. Still, the company has been trending somewhat back to the

American market with a few of its recent launches such as

GURU or MLPA, so the latest

American-centric filing shouldn’t be much of a surprise.

This is especially true given the focus of the product on yield,

an area that is continuing to attract investors in droves. For this

reason, Global X’s filing for the U.S. SuperDividend ETF

(DIV) seems like a logical step for the quickly growing

issuer (See Inside The SuperDividend ETF).

This proposed fund, if ever approved, would mark the third

‘Super’ ETF in the company’s lineup, further rounding out the

firm’s list of income-focused products. Unfortunately, many details

were not yet available so little is known about the product at this

time besides the proposed ticker symbol of DIV (read 11 Great

Dividend ETFs).

However, we do know that the ETF looks to track the INDXX

SuperDividend U.S. Low Volatility Index, equally weighting a group

of common stocks, MLPs, and REITs that rank among the highest

dividend yielding securities in the American market. Components are

also required to have paid dividends consistently over the past two

years while the index provider also looks to focus in on lower

volatility securities in order to given the fund a beta of less

than 1.0.

Undoubtedly Global X is hoping that this proposed product, if

ever approved, will mirror in success its original

SuperDividend ETF (SDIV). This product currently

has a yield of over 7.7% in 30-Day SEC terms and over $160 million

in total AUM (read Can You Beat These High Dividend ETFs?).

This is a pretty solid level of interest for this ETF,

especially considering the global focus, expense ratio above 0.5%,

and how fresh the ETF is to the market having made its debut in

June of 2011. It should also be noted that the product also takes

an equal weighted approach and focuses in on the highest yielders

form around the world—including the U.S.—so there will definitely

be some similarities between SDIV and a future DIV product.

However, the global dividend ETF market is by no means as

competitive as the domestic one, with the main foes to Global X

coming in the form of LVL and

DWX. The American market, on the other hand, has a

host of competitors not just in the broad dividend space, but in

high yield segments as well such as mREITs, MLPs, and preferred

stock.

Among these funds, the biggest competition will likely be the

$10+ billion dollar dividend giants of VIG,

DVY, and SDY (ok SDY has a little

less than ten billion in AUM). Beyond that, there are plenty of

other products that also promise high yields either by weighting

based on payments, yield levels, or a combination of the two (see

Invest Like the One Percent with These Three ETFs).

Clearly, DIV, if ever approved, will face a much more difficult

road than what SDIV saw for its quest to build up a big following.

However, if DIV can pass the regulatory hurdles and provide 7%+

yields like its international-focused cousin, it could manage to

carve out a decent niche among the more diversified U.S. income

products out there.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

(DIV): ETF Research Reports

ISHARS-DJ DVD (DVY): ETF Research Reports

GLBL-X SUPERDIV (SDIV): ETF Research Reports

SPDR-SP DIV ETF (SDY): ETF Research Reports

VANGD-DIV APPRC (VIG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

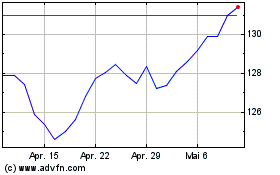

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

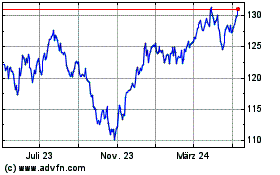

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Apr 2024 bis Apr 2025