false

0001650696

0001650696

2023-11-08

2023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2023

Laird Superfood, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-39537

|

|

81-1589788

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number

|

|

(IRS Employer Identification No.)

|

|

5303 Spine Road, Suite 204, Boulder, Colorado

|

|

80301

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (541) 588-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange

|

|

Common Stock

|

|

LSF

|

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On November 8, 2023, Laird Superfood, Inc. issued a press release announcing its financial results for the three and nine months ended September 30, 2023. The press release is being furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

The information contained in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filings under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

| |

|

|

|

Exhibit No.

|

|

Description

|

| |

|

|

99.1

|

|

|

| |

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

|

Date: November 8, 2023

|

|

|

|

Laird Superfood, Inc.

|

| |

|

|

|

| |

|

|

|

By:

|

|

/s/ Anya Hamill

|

| |

|

|

|

Name:

|

|

Anya Hamill

|

| |

|

|

|

Title:

|

|

Chief Financial Officer

|

Exhibit 99.1

Laird Superfood Reports Third Quarter 2023 Financial Results

Net sales returns to growth; gross margin exceeds 30%.

Boulder, Colorado – November 8, 2023 – Laird Superfood, Inc. (NYSE American: LSF) (“Laird Superfood,” the "Company", “we”, and “our”), today reported financial results for its third quarter ended September 30, 2023.

Third Quarter 2023 Highlights

| |

●

|

Net sales of $9.2 million compared to $7.7 million in the prior quarter, and $8.8 million in the prior year period.

|

| |

●

|

Wholesale contributed 47% of total net sales and increased by 42.8% year-over-year, driven by distribution gains in the natural and conventional channels, seasonal program expansion in club, pricing actions, as well as velocity improvements behind new packaging and the re-branding campaign launched earlier this year.

|

| |

●

|

E-commerce contributed 53% of total net sales and decreased 16.6% year-over-year driven by a planned 19% media spend reduction across the Amazon and direct-to-consumer ("DTC") channels. Amazon sales were negatively impacted by inventory out-of-stocks related to the previously discussed quality issue experienced in Q1. This out-of-stock issue was fully resolved by the end of the third quarter of 2023. The decline in DTC was due to media spend reduction, which was partially offset by an increase in our subscription sales which grew 21% sequentially as a percentage of DTC sales.

|

| |

●

|

Gross margin was 31.0%, compared to 24.3% in the second quarter of 2023 and 23.4% in the prior year period. This 758-basis point margin expansion from the prior year period was driven by the transition to a variable cost third-party co-manufacturing business model, partially offset by incremental trade spend intended to drive growth in the retail channel, specifically around innovation expansion, awareness, and trial.

|

| |

●

|

Net loss was $2.7 million, or $0.28 per diluted share compared to net loss of $3.5 million, or $0.38 per diluted share, in the second quarter of 2023 and net loss of $5.7 million, or $0.63 per diluted share, in the prior year period. The improvement is driven by gross margin expansion, lower marketing and general and administrative spend (G&A).

|

| |

●

|

Adjusted net loss, which is a non-GAAP financial measure, was $2.8 million, or $0.30 per diluted share in the third quarter of 2023, compared to $3.3 million, or $0.36 per diluted share in the second quarter of 2023 and $5.6 million, or $0.61 per diluted share in the prior year period. This sequential and prior year improvement was driven by significantly expanded gross margins and lower marketing and G&A spend. For more details on non-GAAP financial measures, refer to the information in the non-GAAP financial measures section of this press release.

|

Jason Vieth, Chief Executive Officer, commented, "Our significantly improved Q3 results are the natural outcome of continued progress against our strategic initiatives and toward our goal of breakeven profitability. Over the past year, we successfully completed a full reboot of our operations, moving us to a significantly more flexible, more profitable supply chain. As predicted, our gross margin exceeded 30% in the quarter and we don’t expect to look back. At the same time, we have executed the transition from an ecommerce business with a small amount of wholesale sales to a business that is nearly 50-50% split across those two channels. Our strong growth in wholesale is now outweighing the planned declines in the online business, which propelled us to positive year over year sales growth for the first time since the first quarter of 2022."

Anya Hamill, Chief Financial Officer, commented, "I am pleased to report that in the third quarter we have achieved gross margin above 30%, representing a 758-basis point improvement over the same period during the prior year and a 671-basis point improvement sequentially versus Q2 2023. This margin expansion was driven by the continued optimization of our supply chain model based on the strategic actions we took last year as well as new and improved liquid creamer formulation implemented in the third quarter. Cost of goods sold improved by 21% as a percentage of gross sales which translates to nearly 15 points of gross margin in the third quarter versus the same period last year. This margin improvement was partially offset by stepped-up trade investment into promotional and product placement activities to drive growth in our wholesale channel. Beginning in Q4 of this year, we expect to begin pulling back the increased trade spend, which we expect to result in margin expansion as we see the benefit of our supply chain transformation and other planned margin-driving initiatives. Q3 net loss of $2.7 million was the lowest in the Company’s post-IPO history, driven by gross margin expansion and significant reductions in marketing and G&A spend. Our Q3 G&A spend was $2.2 million lower than the same quarter last year, demonstrating the strong progress that we have made in managing costs and pushing the business towards breakeven profitability in future quarters."

| |

|

Three Months Ended September 30,

|

| |

|

2023

|

|

2022

|

| |

|

$

|

|

% of Total

|

|

$

|

|

% of Total

|

|

Coffee creamers

|

|

$ 5,795,991

|

|

63%

|

|

$ 4,716,650

|

|

53%

|

|

Hydration and beverage enhancing supplements

|

|

1,726,512

|

|

19%

|

|

1,061,136

|

|

12%

|

|

Harvest snacks and other food items

|

|

1,747,873

|

|

19%

|

|

1,935,812

|

|

22%

|

|

Coffee, tea, and hot chocolate products

|

|

1,990,013

|

|

22%

|

|

1,455,888

|

|

16%

|

|

Other

|

|

132,319

|

|

1%

|

|

437,210

|

|

5%

|

|

Gross sales

|

|

11,392,708

|

|

124%

|

|

9,606,696

|

|

108%

|

|

Shipping income

|

|

214,982

|

|

2%

|

|

289,505

|

|

3%

|

|

Returns and discounts

|

|

(2,427,909)

|

|

(26)%

|

|

(1,051,356)

|

|

(11)%

|

|

Sales, net

|

|

$ 9,179,781

|

|

100%

|

|

$ 8,844,845

|

|

100%

|

| |

|

|

|

|

|

|

|

|

|

E-commerce

|

|

4,842,389

|

|

53%

|

|

5,808,186

|

|

66%

|

|

Wholesale

|

|

4,337,392

|

|

47%

|

|

3,036,659

|

|

34%

|

|

Sales, net

|

|

$ 9,179,781

|

|

100%

|

|

$ 8,844,845

|

|

100%

|

| |

|

Nine Months Ended September 30,

|

| |

|

2023

|

|

2022

|

| |

|

$

|

|

% of Total

|

|

$

|

|

% of Total

|

|

Coffee creamers

|

|

$ 15,550,157

|

|

62%

|

|

$ 14,866,032

|

|

55%

|

|

Hydration and beverage enhancing supplements

|

|

3,395,671

|

|

14%

|

|

3,815,346

|

|

14%

|

|

Harvest snacks and other food items

|

|

5,345,915

|

|

21%

|

|

5,336,043

|

|

20%

|

|

Coffee, tea, and hot chocolate products

|

|

5,932,745

|

|

24%

|

|

4,840,215

|

|

18%

|

|

Other

|

|

287,001

|

|

1%

|

|

1,094,924

|

|

4%

|

|

Gross sales

|

|

30,511,489

|

|

122%

|

|

29,952,560

|

|

111%

|

|

Shipping income

|

|

778,051

|

|

3%

|

|

829,107

|

|

3%

|

|

Returns and discounts

|

|

(6,272,730)

|

|

(25)%

|

|

(3,922,803)

|

|

(14)%

|

|

Sales, net

|

|

$ 25,016,810

|

|

100%

|

|

$ 26,858,864

|

|

100%

|

| |

|

|

|

|

|

|

|

|

|

E-commerce

|

|

13,409,443

|

|

54%

|

|

16,410,956

|

|

61%

|

|

Wholesale

|

|

11,607,367

|

|

46%

|

|

10,447,908

|

|

39%

|

|

Sales, net

|

|

$ 25,016,810

|

|

100%

|

|

$ 26,858,864

|

|

100%

|

Balance Sheet and Cash Flow Highlights

The Company had $7.4 million of cash, cash equivalents, and restricted cash as of September 30, 2023, and no outstanding debt.

Net cash used in operating activities was $3.5 million for the third quarter of 2023, compared to $1.4 million in the second quarter of 2023 and $3.6 million in the prior year period. The increase in cash burn in the third quarter of 2023 relative to the second quarter was due to planned inventory build to meet stepped up demand in the retail and club channels and the timing of accounts receivable collections.

Net cash used in operating activities was $10.9 million year to date in 2023, compared to $11.1 million year to date in 2022. The reduction in cash burn was driven by the realization of the operating efficiencies gained from the transition to the variable cost co-manufacturing model and the related reductions in overhead and administrative costs offset in part by our Sisters, Oregon exit and disposal costs incurred in the first quarter of 2023.

2023 Outlook

We expect fourth quarter net sales to be in the range of $8.5 million to $9.0 million, and gross margins in the mid-to-high thirties, excluding any one-time extraordinary charges.

Conference Call and Webcast Details

The Company will host a conference call and webcast at 5:00 p.m. ET today to discuss results. Participants may access the live webcast on the Laird Superfood Investor Relations website at https://investors.lairdsuperfood.com under “Events”.

About Laird Superfood

Laird Superfood, Inc. creates award-winning, plant-based superfood products that are both delicious and functional. The Company's products are designed to enhance your daily ritual and keep consumers fueled naturally throughout the day. The Company was co-founded in 2015 by the world's most prolific big-wave surfer, Laird Hamilton. Laird Superfood's offerings are environmentally conscientious, responsibly tested and made with real ingredients. Shop all products online at lairdsuperfood.com and join the Laird Superfood community on social media for the latest news and daily doses of inspiration.

Forward-Looking Statements

This press release and the conference call referencing this press release contain “forward-looking” statements, as that term is defined under the federal securities laws, including but not limited to statements regarding Laird Superfood’s future financial performance and growth. These forward-looking statements are based on Laird Superfood’s current assumptions, expectations and beliefs and are subject to substantial risks, uncertainties, assumptions and changes in circumstances that may cause Laird Superfood’s actual results, performance or achievements to differ materially from those expressed or implied in any forward-looking statement. We expressly disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

The risks and uncertainties referred to above include, but are not limited to: (1) the effects of global outbreaks of pandemics or contagious diseases or fear of such outbreaks, including on our supply chain, the demand for our products, and on overall economic conditions and consumer confidence and spending levels; (2) volatility regarding our revenue, expenses, including shipping expenses, and other operating results; (3) our ability to acquire new direct and wholesale customers and successfully retain existing customers; (4) our ability to attract and retain our suppliers, distributors and co-manufacturers, and effectively manage their costs and performance; (5) effects of real or perceived quality or health issues with our products or other issues that adversely affect our brand and reputation; (6) our ability to innovate on a timely and cost-effective basis, predict changes in consumer preferences and develop successful new products, or updates to existing products, and develop innovative Marketing strategies; (7) adverse developments regarding prices and availability of raw materials and other inputs, a substantial amount of which come from a limited number of suppliers outside the United States, including in areas which may be adversely affected by climate change; (8) effects of changes in the tastes and preferences of our consumers and consumer preferences for natural and organic food products; (9) the financial condition of, and our relationships with, our suppliers, co-manufacturers, distributors, retailers and food service customers, as well as the health of the food service industry generally; (10) the ability of ourselves, our suppliers and co-manufacturers to comply with food safety, environmental or other laws or regulations; (11) our plans for future investments in our business, our anticipated capital expenditures and our estimates regarding our capital requirements, including our ability to continue as a going concern; (12) the costs and success of our Marketing efforts, and our ability to promote our brand; (13) our reliance on our executive team and other key personnel and our ability to identify, recruit and retain skilled and general working personnel; (14) our ability to effectively manage our growth; (15) our ability to compete effectively with existing competitors and new market entrants; (16) the impact of adverse economic conditions; (17) the growth rates of the markets in which we compete, and (18) the other risks described in our Annual Report on Form 10-K for the year ended December 31, 2022 and other filings we make with the Securities and Exchange Commission.

Investor Relations Contact

Trevor Rousseau

trousseau@lairdsuperfood.com

|

LAIRD SUPERFOOD, INC.

|

|

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

|

|

(Unaudited)

|

| |

|

Three Months Ended September 30,

|

|

Nine Months Ended September 30,

|

| |

|

2023

|

|

2022

|

|

2023

|

|

2022

|

|

Sales, net

|

|

$ 9,179,781

|

|

$ 8,844,845

|

|

$ 25,016,810

|

|

$ 26,858,864

|

|

Cost of goods sold

|

|

(6,332,624)

|

|

(6,773,029)

|

|

(18,419,709)

|

|

(21,259,300)

|

|

Gross profit

|

|

2,847,157

|

|

2,071,816

|

|

6,597,101

|

|

5,599,564

|

|

General and administrative

|

|

|

|

|

|

|

|

|

|

Impairment of goodwill and long-lived assets

|

|

—

|

|

—

|

|

—

|

|

8,126,426

|

|

Other expense

|

|

2,208,213

|

|

4,383,868

|

|

7,822,834

|

|

10,721,611

|

|

Total general and administrative expenses

|

|

2,208,213

|

|

4,383,868

|

|

7,822,834

|

|

18,848,037

|

|

Research and product development

|

|

40,123

|

|

115,077

|

|

206,313

|

|

335,377

|

|

Sales and marketing

|

|

|

|

|

|

|

|

|

|

Advertising

|

|

1,137,488

|

|

1,832,172

|

|

3,454,485

|

|

5,191,374

|

|

Related party marketing agreements

|

|

141,712

|

|

19,500

|

|

435,084

|

|

52,750

|

|

Other expense

|

|

2,106,690

|

|

1,539,185

|

|

5,423,541

|

|

5,871,375

|

|

Total sales and marketing expenses

|

|

3,385,890

|

|

3,390,857

|

|

9,313,110

|

|

11,115,499

|

|

Total operating expenses

|

|

5,634,226

|

|

7,889,802

|

|

17,342,257

|

|

30,298,913

|

|

Operating loss

|

|

(2,787,069)

|

|

(5,817,986)

|

|

(10,745,156)

|

|

(24,699,349)

|

|

Other income (expense)

|

|

132,185

|

|

79,777

|

|

452,288

|

|

(77,008)

|

|

Loss before income taxes

|

|

(2,654,884)

|

|

(5,738,209)

|

|

(10,292,868)

|

|

(24,776,357)

|

|

Income tax expense

|

|

—

|

|

—

|

|

(13,172)

|

|

(5,774)

|

|

Net loss

|

|

$ (2,654,884)

|

|

$ (5,738,209)

|

|

$ (10,306,040)

|

|

$ (24,782,131)

|

|

Net loss per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ (0.28)

|

|

$ (0.63)

|

|

$ (1.11)

|

|

$ (2.71)

|

|

Diluted

|

|

$ (0.28)

|

|

$ (0.63)

|

|

$ (1.11)

|

|

$ (2.71)

|

|

Weighted-average shares of common stock outstanding used in computing net loss per share of common stock, basic and diluted

|

|

9,337,789

|

|

9,178,533

|

|

9,279,541

|

|

9,136,071

|

|

LAIRD SUPERFOOD, INC.

|

|

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

|

|

(Unaudited)

|

| |

|

Nine Months Ended September 30,

|

| |

|

2023

|

|

2022

|

|

Cash flows from operating activities

|

|

|

|

|

|

Net loss

|

|

$ (10,306,040)

|

|

$ (24,782,131)

|

|

Adjustments to reconcile net loss to net cash from operating activities:

|

|

|

|

|

|

Depreciation and amortization

|

|

235,025

|

|

846,356

|

|

Stock-based compensation

|

|

818,647

|

|

284,980

|

|

Provision for inventory obsolescence

|

|

1,260,580

|

|

342,178

|

|

Impairment of goodwill and other long-lived assets

|

|

—

|

|

8,126,426

|

|

Other operating activities, net

|

|

398,052

|

|

527,740

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

Accounts receivable

|

|

(937,876)

|

|

(417,670)

|

|

Inventory

|

|

(1,958,157)

|

|

1,061,152

|

|

Prepaid expenses and other current assets

|

|

1,061,879

|

|

2,242,703

|

|

Operating lease liability

|

|

(94,679)

|

|

(556,597)

|

|

Accounts payable

|

|

810,908

|

|

(62,080)

|

|

Accrued expenses

|

|

(2,217,484)

|

|

1,253,566

|

|

Net cash from operating activities

|

|

(10,929,145)

|

|

(11,133,377)

|

|

Cash flows from investing activities

|

|

|

|

|

|

Proceeds from sale of investment securities available-for-sale

|

|

—

|

|

8,513,783

|

|

Other investing activities, net

|

|

567,459

|

|

467,373

|

|

Net cash from investing activities

|

|

567,459

|

|

8,981,156

|

|

Cash flows from financing activities

|

|

(23,066)

|

|

121,090

|

|

Net change in cash and cash equivalents

|

|

(10,384,752)

|

|

(2,031,131)

|

|

Cash, cash equivalents, and restricted cash, beginning of period

|

|

17,809,802

|

|

23,049,234

|

|

Cash, cash equivalents, and restricted cash, end of period

|

|

$ 7,425,050

|

|

$ 21,018,103

|

|

Supplemental disclosures of cash flow information

|

|

|

|

|

|

Right-of-use assets obtained in exchange for operating lease liabilities

|

|

$ 344,382

|

|

$ 5,285,330

|

|

Supplemental disclosures of non-cash investing activities

|

|

|

|

|

|

Receivable from sale of assets held-for-sale included in other current assets at the end of the period

|

|

$ 126,268

|

|

$ —

|

|

Receivable from sale of assets held-for-sale included in accrued expenses at the end of the period

|

|

$ —

|

|

$ 28,240

|

| Settlement recovery from business interruption claims included in other current assets |

|

$ 158,429 |

|

$ — |

|

Amounts reclassified from accumulated other comprehensive loss

|

|

$ —

|

|

$ 61,016

|

|

Amounts reclassified from property, plant, and equipment to fixed assets held-for-sale

|

|

$ —

|

|

$ 947,394

|

|

Amounts reclassified from property, plant, and equipment to intangible assets

|

|

$ —

|

|

$ 153,691

|

|

Purchases of equipment included in deposits at the beginning of the period

|

|

$ —

|

|

$ 372,507

|

|

LAIRD SUPERFOOD, INC.

|

|

CONSOLIDATED CONDENSED BALANCE SHEETS

|

| (Unaudited) |

| |

|

As of

|

| |

|

September 30, 2023

|

|

December 31, 2022

|

|

Assets

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

Cash, cash equivalents, and restricted cash

|

|

$ 7,425,050

|

|

$ 17,809,802

|

|

Accounts receivable, net

|

|

2,186,645

|

|

1,494,469

|

|

Inventory, net

|

|

6,552,571

|

|

5,696,565

|

|

Prepaid expenses and other current assets, net

|

|

1,436,035

|

|

2,530,075

|

|

Total current assets

|

|

17,600,301

|

|

27,530,911

|

|

Noncurrent assets

|

|

|

|

|

|

Property and equipment, net

|

|

138,604

|

|

150,289

|

|

Fixed assets held-for-sale

|

|

—

|

|

800,000

|

|

Intangible assets, net

|

|

1,136,953

|

|

1,292,118

|

|

Related party license agreements

|

|

132,100

|

|

132,100

|

|

Right-of-use assets

|

|

386,118

|

|

133,922

|

|

Total noncurrent assets

|

|

1,793,775

|

|

2,508,429

|

|

Total assets

|

|

$ 19,394,076

|

|

$ 30,039,340

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

Accounts payable

|

|

$ 1,869,458

|

|

$ 1,080,267

|

|

Accrued expenses

|

|

4,059,799

|

|

6,295,640

|

|

Related party liabilities

|

|

56,574

|

|

16,500

|

|

Lease liabilities, current portion

|

|

129,274

|

|

59,845

|

|

Total current liabilities

|

|

6,115,105

|

|

7,452,252

|

|

Long-term liabilities

|

|

|

|

|

|

Lease liabilities

|

|

278,418

|

|

76,076

|

|

Total long-term liabilities

|

|

278,418

|

|

76,076

|

|

Total liabilities

|

|

6,393,523

|

|

7,528,328

|

|

Stockholders’ equity

|

|

|

|

|

|

Common stock, $0.001 par value, 100,000,000 shares authorized as of September 30, 2023 and December 31, 2022; 9,709,347 and 9,343,643 issued and outstanding at September 30, 2023, respectively; and 9,576,117 and 9,210,414 issued and outstanding at December 31, 2022, respectively.

|

|

9,344

|

|

9,210

|

|

Additional paid-in capital

|

|

119,432,281

|

|

118,636,834

|

|

Accumulated deficit

|

|

(106,441,072)

|

|

(96,135,032)

|

|

Total stockholders’ equity

|

|

13,000,553

|

|

22,511,012

|

|

Total liabilities and stockholders’ equity

|

|

$ 19,394,076

|

|

$ 30,039,340

|

Non-GAAP Financial Measures

In this press release, we report adjusted net loss, and adjusted net loss per diluted share, which are financial measures not required by, or presented in accordance with, accounting principles generally accepted in the United States of America (“GAAP”). Management uses these adjusted metrics to evaluate financial performance because they allow for period-over-period comparisons of the Company’s ongoing operations before the impact of certain items described below. Management believes this information may also be useful to investors to compare the Company’s results period-over-period. We define adjusted net loss and adjusted net loss per diluted share to exclude certain one-time costs defined in detail in the tables to follow. We define adjusted gross margin to exclude the net sales and cost of goods sold components of one-time costs defined in the tables to follow. Please be aware that adjusted gross margin, adjusted net loss, and adjusted net loss per diluted share have limitations and should not be considered in isolation or as a substitute for gross margin, net loss, or net loss per diluted share. In addition, we may calculate and/or present adjusted gross margin, adjusted net loss, and adjusted net loss per diluted share differently than measures with the same or similar names that other companies report, and as a result, the non-GAAP measures we report may not be comparable to those reported by others.

These non-GAAP measures are reconciled to the most directly comparable GAAP measures in the table that follows.

|

LAIRD SUPERFOOD, INC.

|

|

NON-GAAP FINANCIAL MEASURES

|

|

(Unaudited)

|

| |

|

Three Months Ended

|

Nine Months Ended

|

| |

|

March 31, 2023

|

|

June 30, 2023

|

|

September 30, 2023

|

|

September 30, 2023

|

|

Net loss

|

|

$ (4,143,910)

|

|

$ (3,507,246)

|

|

$ (2,654,884)

|

|

$ (10,306,040)

|

|

Adjusted for:

|

|

|

|

|

|

|

|

|

|

Strategic organizational shifts

|

(a)

|

(135,380)

|

|

74,690

|

|

5,342

|

|

(55,348)

|

|

Product quality issue

|

(b)

|

491,861

|

|

—

|

|

(140,019)

|

|

351,842

|

|

Company-wide rebranding costs

|

(c)

|

61,451

|

|

102,355

|

|

—

|

|

163,806

|

|

Adjusted net loss

|

|

$ (3,725,978)

|

|

$ (3,330,201)

|

|

$ (2,789,561)

|

|

$ (9,845,740)

|

|

Adjusted net loss per share, diluted:

|

|

(0.40)

|

|

(0.36)

|

|

(0.30)

|

|

(1.06)

|

|

Weighted-average shares of common stock outstanding used in computing adjusted net loss per share of common stock, diluted

|

|

9,213,723

|

|

9,284,585

|

|

9,337,789

|

|

9,279,541

|

|

(a) Costs incurred as part of the strategic downsizing of the Company's operations, including severances, forfeitures of stock-based compensation, and other personnel costs, IT integration costs, and freight costs to move inventory to third-party facilities.

|

|

(b) In the first month of the first quarter of 2023, we identified a product quality issue with raw material from one vendor and we voluntarily withdrew any affected finished goods. We incurred costs associated with product testing, discounts for replacement orders, and inventory obsolescence costs. We reached settlement with a supplier and recorded recoveries in the third quarter of 2023.

|

|

(c) Costs incurred as part of the company-wide rebranding efforts that launched in Q1 2023.

|

| |

|

Three Months Ended

|

Nine Months Ended

|

| |

|

March 31,

2022

|

|

June 30,

2022

|

|

September 30,

2022

|

|

September 30,

2022

|

|

Net loss

|

|

$(14,139,402)

|

|

$ (4,904,520)

|

|

$ (5,738,209)

|

|

$(24,782,131)

|

|

Adjusted for:

|

|

|

|

|

|

|

|

|

|

Impairment of goodwill and long-lived assets

|

(a)

|

8,026,000

|

|

100,426

|

|

—

|

|

8,126,426

|

|

Strategic organizational shifts

|

(b)

|

(581,351)

|

|

(803,405)

|

|

112,974

|

|

(1,271,782)

|

|

Gain on sale of land held-for-sale

|

(c)

|

—

|

|

(573,818)

|

|

—

|

|

(573,818)

|

|

Other, net

|

(d)

|

(22,296)

|

|

—

|

|

51,400

|

|

29,104

|

|

Adjusted net loss

|

|

$ (6,717,049)

|

|

$ (6,181,317)

|

|

$ (5,573,835)

|

|

$(18,472,201)

|

|

Adjusted net loss per share, diluted:

|

|

(0.74)

|

|

(0.68)

|

|

(0.61)

|

|

(2.02)

|

|

Weighted-average shares of common stock outstanding used in computing adjusted net loss per share of common stock, diluted

|

|

9,095,441

|

|

9,132,632

|

|

9,178,533

|

|

9,136,071

|

|

(a) Impairment charges to goodwill and long-lived intangible assets assumed in the acquisition of Picky Bars which occurred Q2 2021, in the amounts of $6.5 million and $1.5 million, respectively, and of assets held-for-sale of $0.1 million in Q2 2022.

|

|

(b) Costs incurred as part of the strategic downsizing of the Company's operations, including severances, forfeitures of stock-based compensation, early termination of service contracts, and other personnel costs arising from the resignations of certain members of executive leadership.

|

|

(c) Gains on the sale of unused plots of land in Sisters, Oregon.

|

|

(d) Realized losses on the liquidation of all of the Company's available-for-sale securities included in other income in Q1 2022. Recovery of costs incurred in connection with an insurance claim following loss of product during handling by a third party included in cost of goods sold in Q1 2022. Losses incurred on prepaid inventories which were not recoverable following the bankruptcy of the supplier in the Q3 2022.

|

|

LAIRD SUPERFOOD, INC.

|

|

NON-GAAP FINANCIAL MEASURES

|

|

(Unaudited)

|

| |

|

Three Months Ended

|

Nine Months Ended

|

| |

|

March 31, 2023

|

|

June 30, 2023

|

|

September 30, 2023

|

|

September 30, 2023

|

|

Gross margin

|

|

23.1%

|

|

24.3%

|

|

31.0%

|

|

26.4%

|

|

Adjusted for:

|

|

|

|

|

|

|

|

|

|

Strategic organizational shifts

|

(a)

|

-0.2%

|

|

—

|

|

—

|

|

-0.1%

|

|

Product quality issue

|

(b)

|

4.1%

|

|

—

|

|

-1.5%

|

|

0.4%

|

|

Adjusted gross margin

|

|

27.0%

|

|

24.3%

|

|

29.5%

|

|

27.1%

|

|

(a) Costs incurred as part of the strategic downsizing of the Company's operations, including severances, forfeitures of stock-based compensation, and other personnel costs, and freight costs to move inventory to third-party facilities.

|

|

(b) In the first month of the first quarter of 2023, we identified a product quality issue with raw material from one vendor and we voluntarily withdrew any affected finished goods. We incurred costs associated with discounts for replacement orders and inventory obsolescence costs. We reached settlement with a supplier and recorded recoveries in the third quarter of 2023.

|

| |

|

Three Months Ended

|

Nine Months Ended

|

| |

|

March 31, 2022

|

|

June 30, 2022

|

|

September 30, 2022

|

|

September 30, 2022

|

|

Gross margin

|

|

20.9%

|

|

18.2%

|

|

23.4%

|

|

20.8%

|

|

Adjusted for:

|

|

|

|

|

|

|

|

|

|

Other

|

(a)

|

-2.2%

|

|

—

|

|

—

|

|

-0.8%

|

|

Adjusted gross margin

|

|

18.7%

|

|

18.2%

|

|

23.4%

|

|

20.1%

|

|

(a) Recovery of costs incurred in connection with an insurance claim following loss of product during handling by a third party included in cost of goods sold in Q1 2022.

|

v3.23.3

Document And Entity Information

|

Nov. 08, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Laird Superfood, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 08, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

1-39537

|

| Entity, Tax Identification Number |

81-1589788

|

| Entity, Address, Address Line One |

5303 Spine Road, Suite 204

|

| Entity, Address, City or Town |

Boulder

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

80301

|

| City Area Code |

541

|

| Local Phone Number |

588-3600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

LSF

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001650696

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

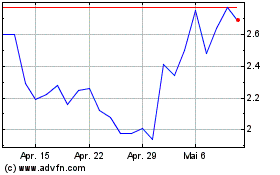

Laird Superfood (AMEX:LSF)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Laird Superfood (AMEX:LSF)

Historical Stock Chart

Von Mai 2023 bis Mai 2024